CompTIA research provides critical insight and analysis on technology topics, trends, and business intelligence, allowing our members to keep their finger on the pulse of the industry, plan growth strategies, and build high-impact technology solutions. CompTIA Quick Stats allows you to easily identify and utilize key facts and statistics for presentations, strategic documents and market research.

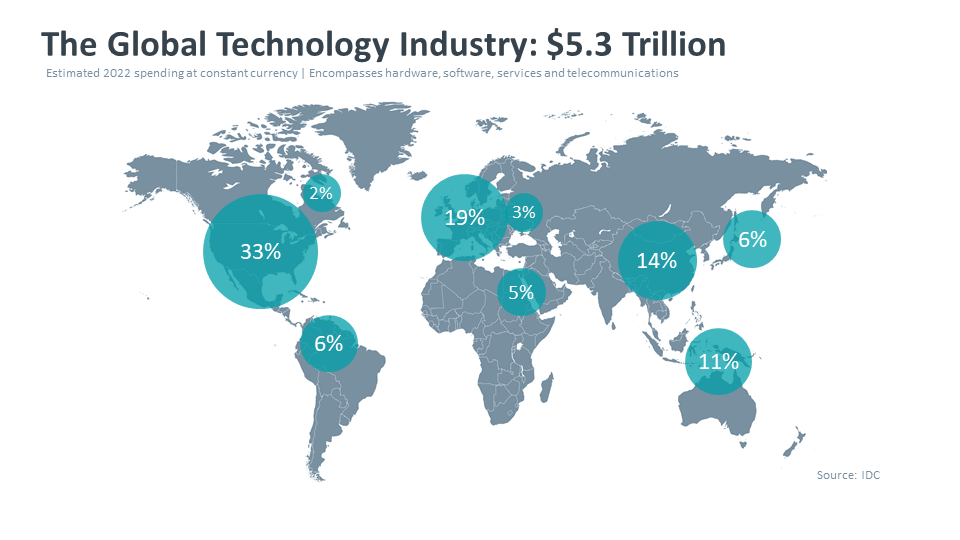

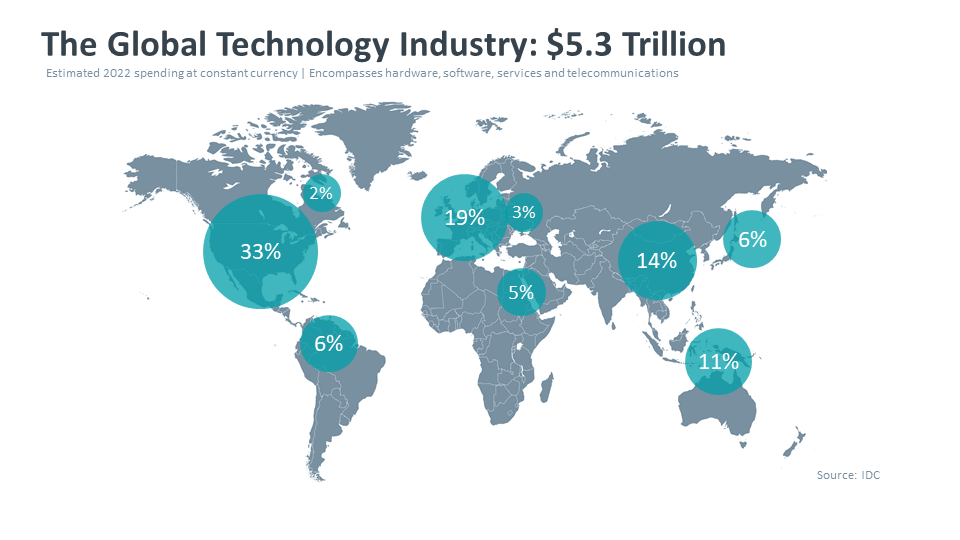

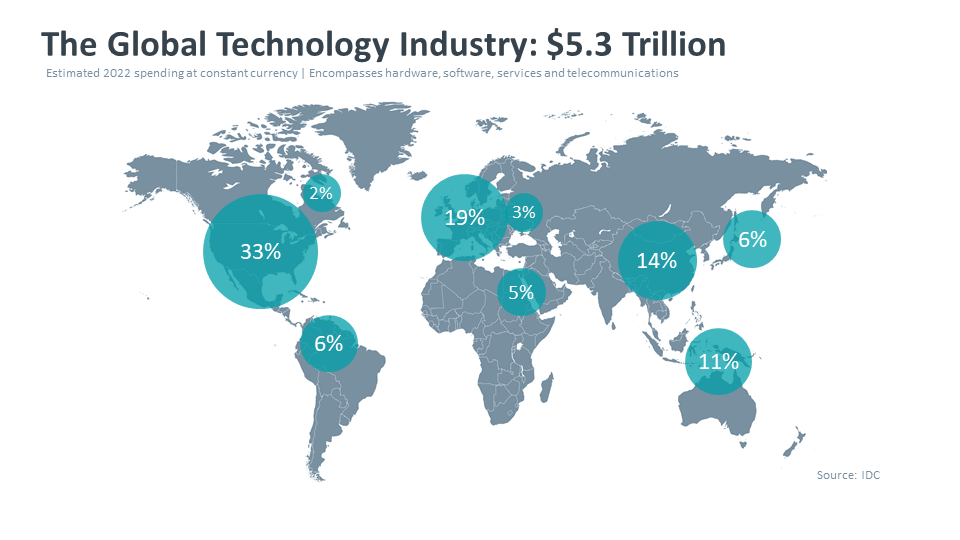

IDC projects that the technology industry is on pace to exceed $5.3 trillion in 2022. After the speed bump of 2020, the industry is returning to its previous growth pattern of 5%-6% growth year over year.

The United States is the largest tech market in the world, representing 33% of the total, or approximately $1.8 trillion for 2022. Among global regions, western Europe remains a significant contributor, accounting for approximately one of every five technology dollars spent worldwide. As far as individual countries go, China has clearly established itself as a major player in the global tech market.

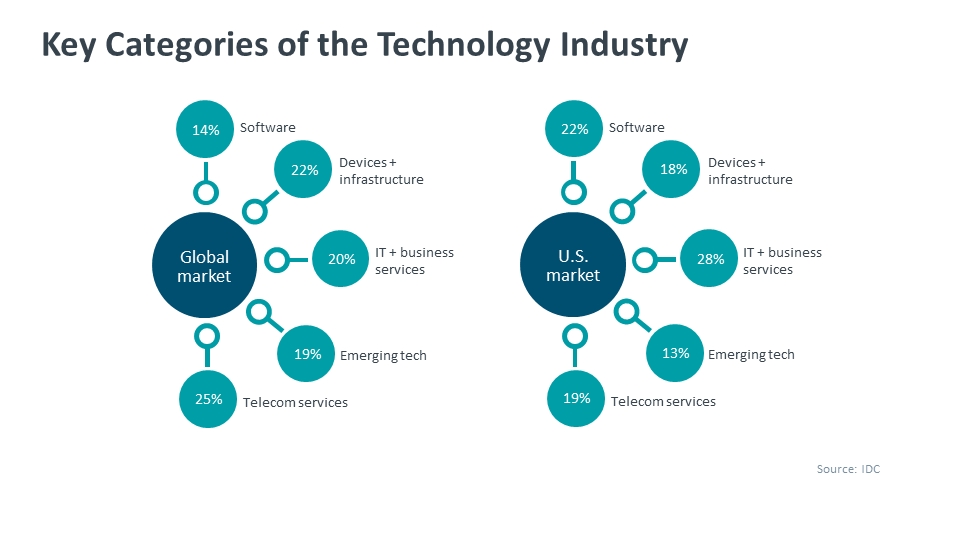

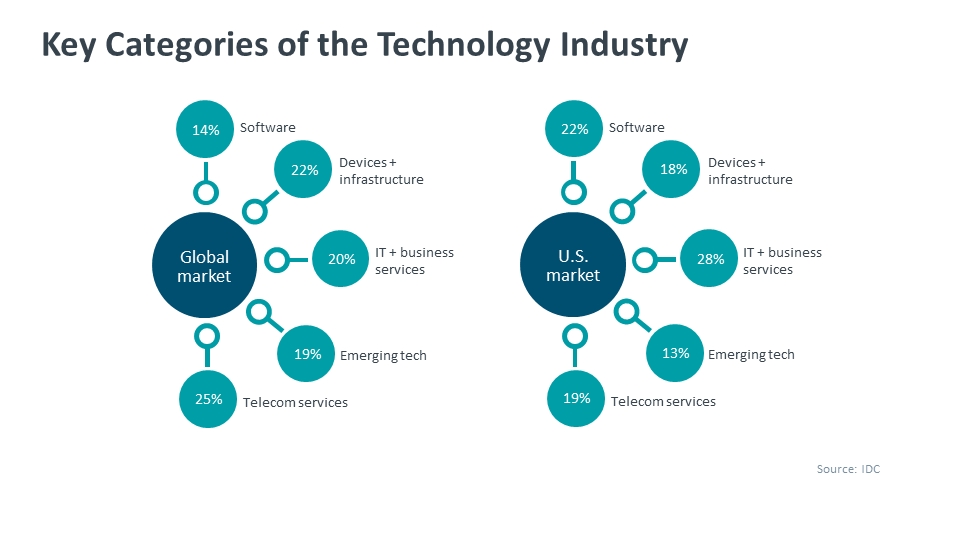

The allocation of spending will vary from country to country based on a number of factors. In the mature U.S. market, for example, there is robust infrastructure, a large installed base of users equipped with connected devices and abundant bandwidth for these devices to communicate. This paves the way for investments in the software applications and technology services that sit on top of this foundation.

The traditional categories of hardware, software and services account for 56% of the global total. The other core category, telecom services, accounts for 25%. The remaining 19% covers various emerging technologies that either don’t fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software and service, such as IoT, drones and many automating technologies.

The traditional categories of hardware, software and services account for 56% of the global total. The other core category, telecom services, accounts for 25%. The remaining 19% covers various emerging technologies that either don’t fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software and service, such as IoT, drones and many automating technologies.

The traditional categories of hardware, software and services account for 56% of the global total. The other core category, telecom services, accounts for 25%. The remaining 19% covers various emerging technologies that either don’t fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software and service, such as IoT, drones and many automating technologies.

Ranging from large vendors and telcos to small MSPs and IT services firm, they generated $2 trillion in direct economic impact to the U.S. economy combined, or over 10% of the overall U.S. economy.

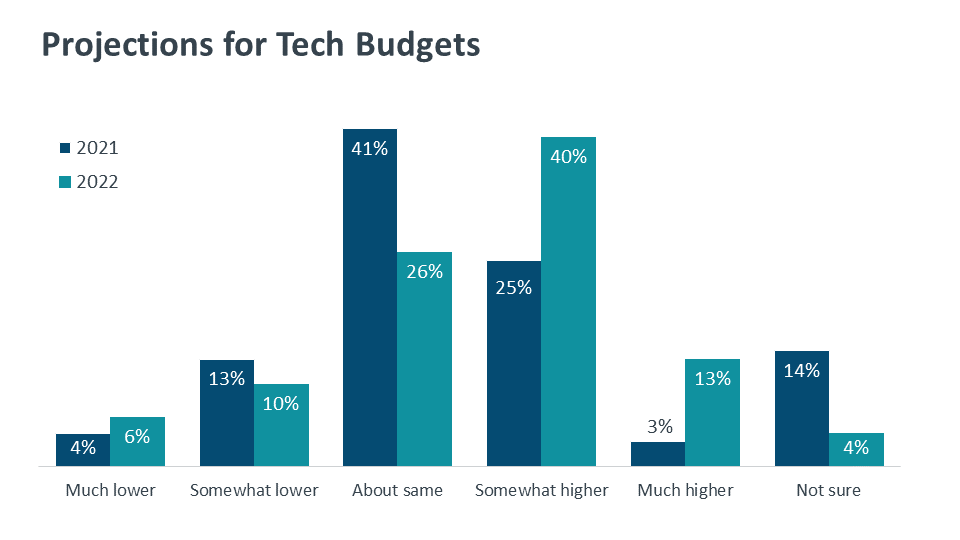

Of all the indicators of a return to strategy by channel firms, budget forecasts for 2022 are the most demonstrable—especially when compared with projections made a year ago. Looking ahead to next year, a majority (53%) of channel companies expect to have higher tech budgets, while only 28% did so in the same timeframe last year. Even the number of companies that expect the same budget allocation in 2022 as 2021 declined significantly from 41% to 26%.

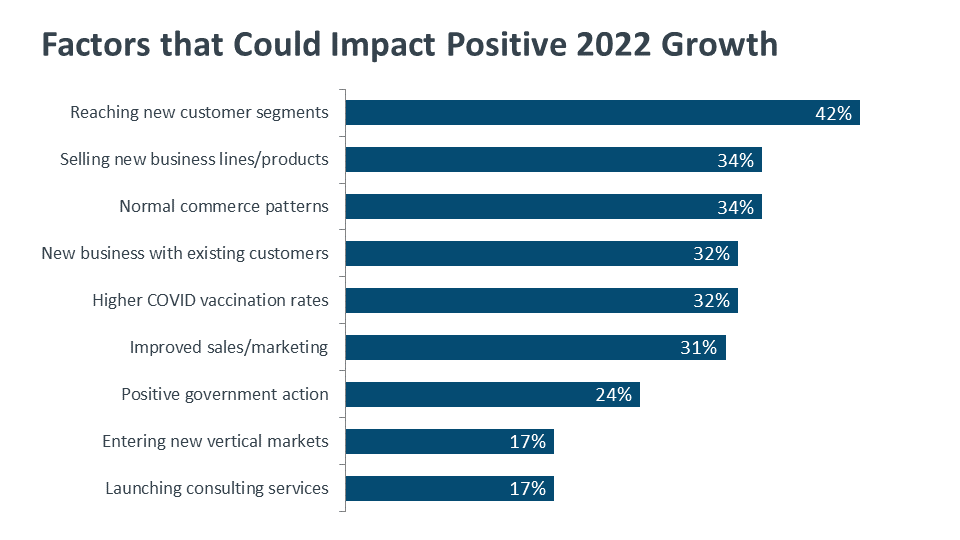

In 2021, respondents said growth was predicated on picking up business from existing clients, which made sense in the pandemic-drenched economic climate that made finding new customers challenging and budgets tight. But looking ahead to next year, respondents now say reaching new clients is the No. 1 factor to drive growth. No one’s forgetting their current customers, of course, but the hunt is on for new ones to fill the pipeline.

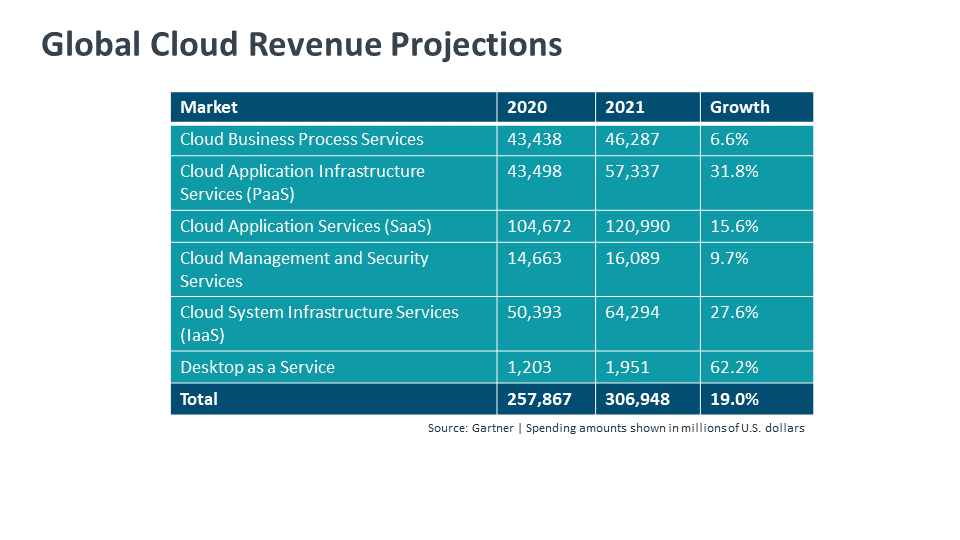

In November 2019, Gartner projected worldwide revenue in cloud services to grow by 17% in 2020, moving from $227.8 billion across all cloud offerings to $266.4 billion. These numbers will almost certainly be revised in the wake of increased cloud activity. A recent survey by O’Reilly Media found that 25% of IT managers were planning to move all their business applications to cloud systems over the next 12 months, and the ripple effects from the COVID-19 crisis are still being calculated.

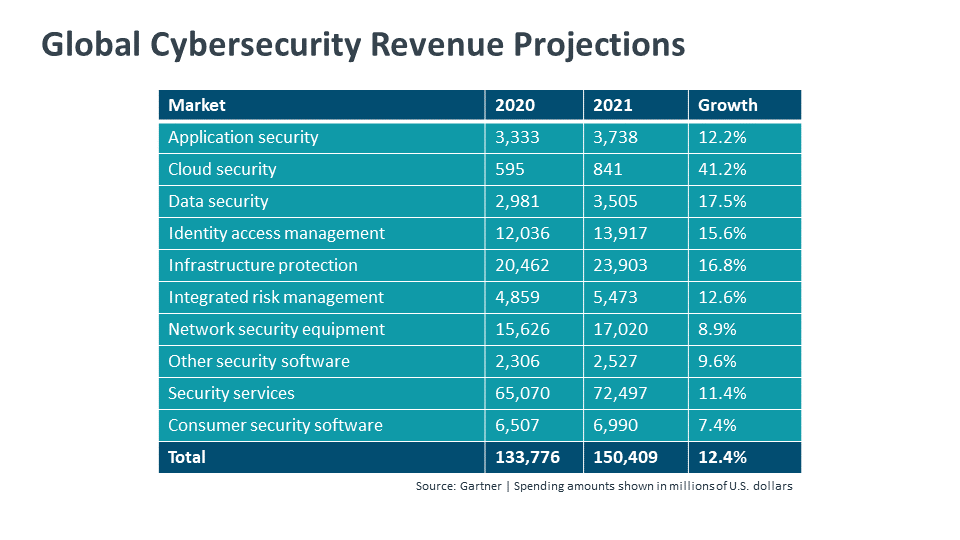

For 2020, Gartner originally projected that cybersecurity spending across a range of topics would reach nearly $124 billion by the end of the year, representing a 2.4% increase over 2019. In reality, cybersecurity spending surpassed $133 million, representing a 10.6% increase. For 2021, Gartner clearly expects that momentum to continue.

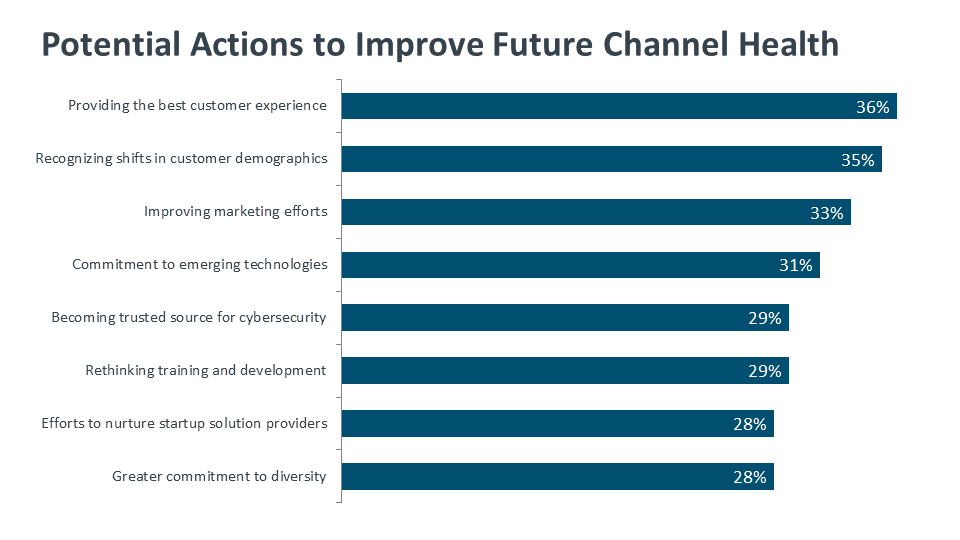

The IT channel is morphing rapidly as new companies beyond transactional resellers (influencers, consultants, as-a-service, retention specialists etc.) emerge. Many customers are now sourcing in new ways too.

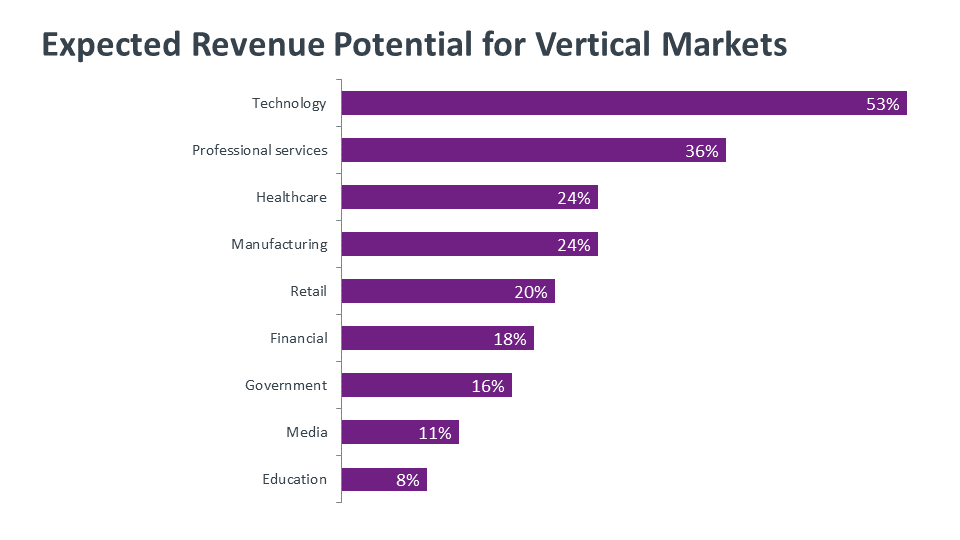

Other verticals that channel firms say are the best revenue-generators, in order, are professional services, manufacturing, healthcare, and retail/wholesale

The market follows a classic pyramid shape with a substantial base of micro businesses (the vast majority of business entities at the base, and a very narrow peak of large enterprises, accounting for less than 1% of the total.) Analysis of industry sectors reveals the top four verticals to be healthcare, professional services such as accounting, retail, and construction across business establishments in the SMB space.

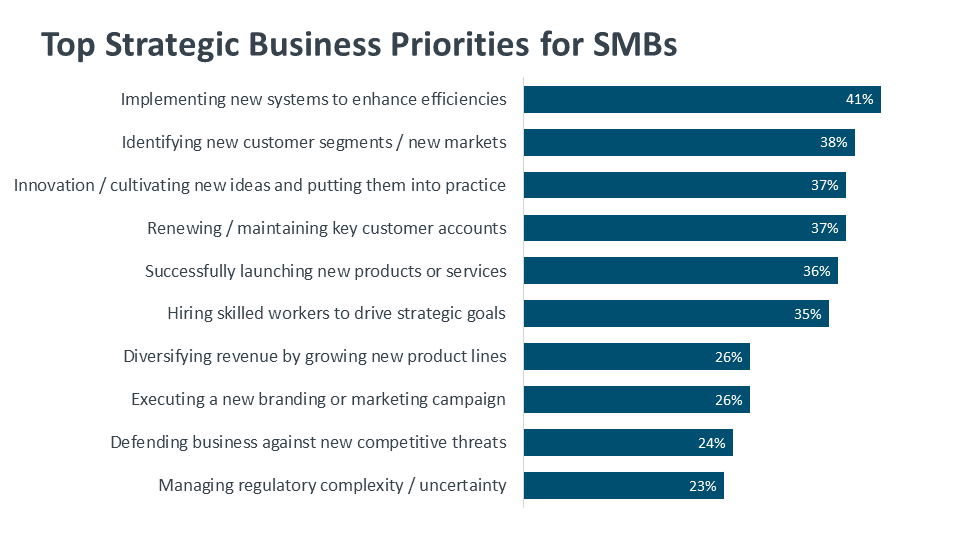

For more, see Tech Buying Trends among Small & Medium-Sized Businesses

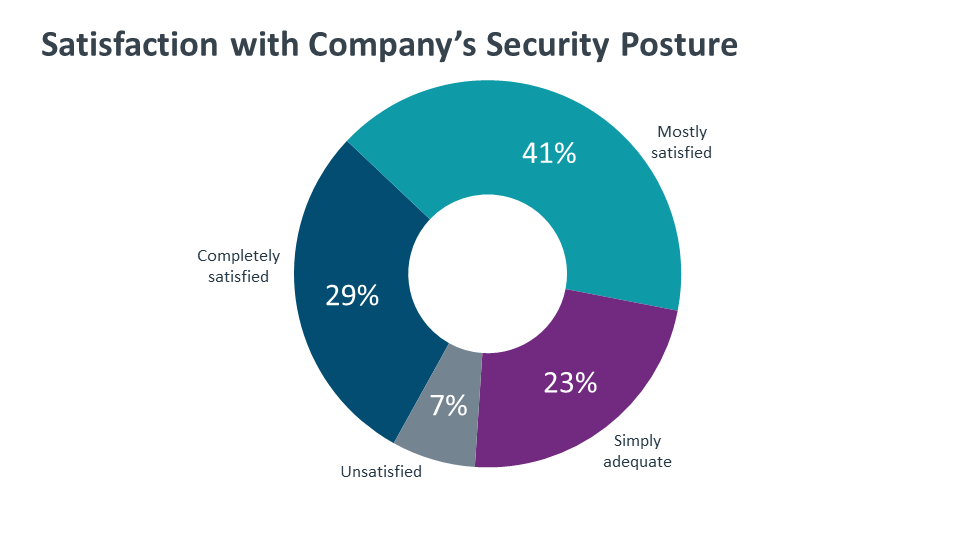

In 2020, 82% of employees felt satisfied with their company’s approach to cybersecurity. In 2021, that number dropped to 70%. Given everything happening on the world stage, practices that were previously considered good enough might not be cutting it anymore.

Even for large companies, maintaining both breadth and depth in cybersecurity processes is a major challenge. The old method of a static, secure perimeter was a relatively simple one to maintain, often being treated as a side component of the general IT function. Today’s processes require specialization in the technical workforce and security-first thinking in the overall workforce. Unless there is buy-in throughout the organization, the process of security will break down, leaving the business exposed.

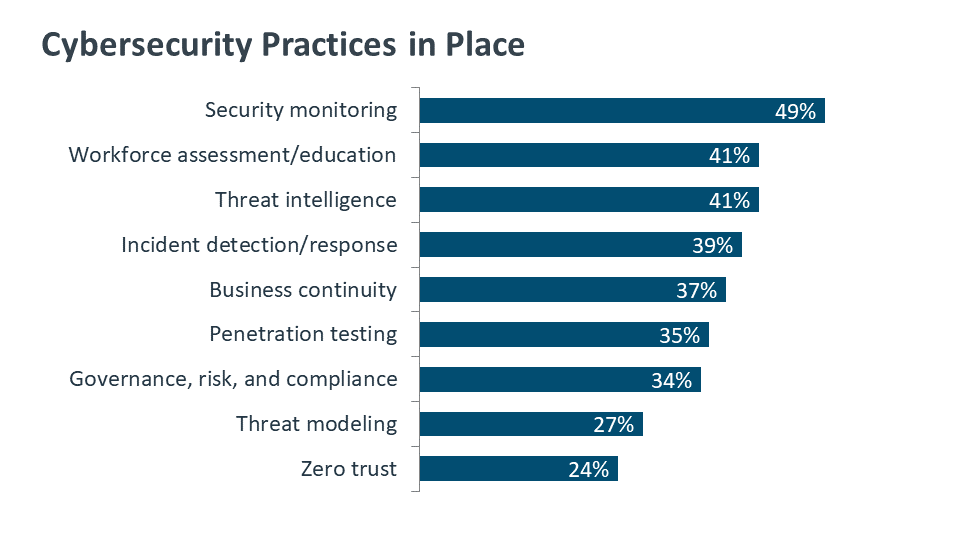

The most common cybersecurity practice is monitoring for cybersecurity incidents, which seems self-explanatory. However, this practice also includes analysis of network traffic attack patterns, which is where things get interesting. Analysis is a more advanced, more proactive initiative. It requires both an understanding of typical network behavior and also an understanding of attack methodology, so that any anomalies can be investigated as potential infections.

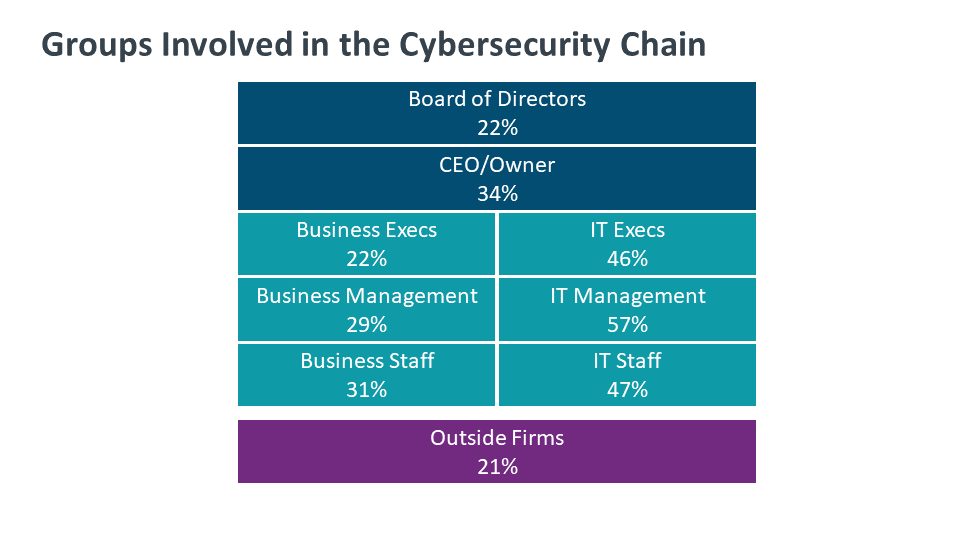

The notion of cybersecurity personnel has expanded along with the processes used for implementation. Just as the process was once a simplistic secure perimeter and now touches every part of the organization, cybersecurity responsibility has grown from isolated skills into company-wide awareness. Obviously not every employee within an organization needs to have deep expertise, but there are key points to consider since so many groups are involved.

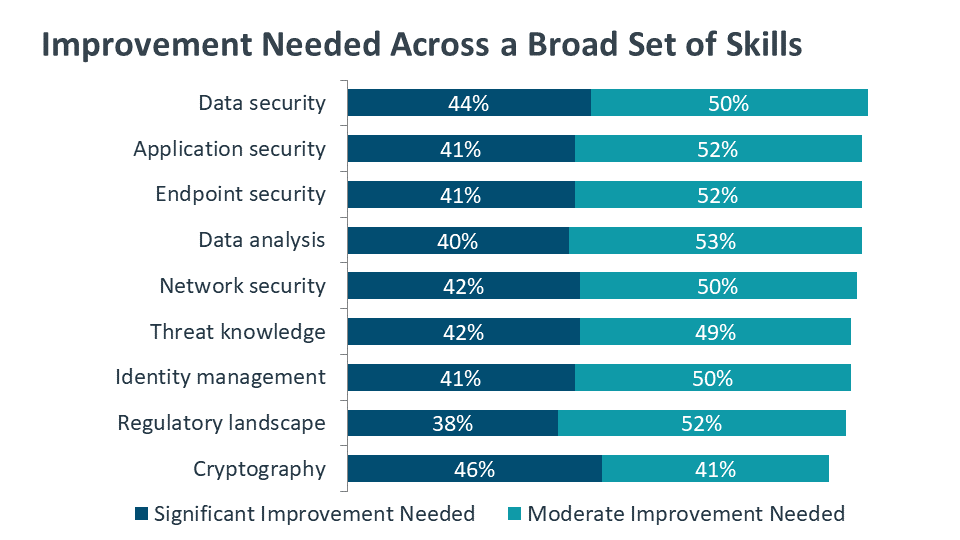

Regardless of how cybersecurity resources are distributed, companies are keenly aware of the need to keep their skills current and relevant. This starts with skill assessment. Like other metrics around security, assessing skill level does not have a long history and is open for interpretation. IT professionals are likely aware of which areas are personal strengths and weaknesses, but there may be no correlation to which skills are critical based on business goals and policy.

52% of MSPs said that gaining more skills in cybersecurity will be the No. 1 action to help ensure solid market performance over the next two years

Nearly 3 in 10 MSSPs said they expect significant growth in the MSSP part of their business in the next two years, with just over half predicting modest growth.

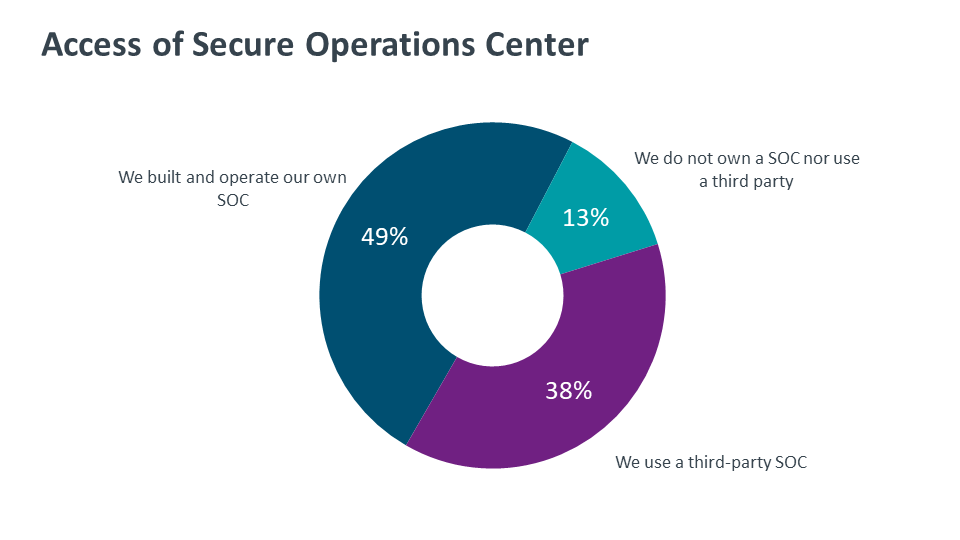

A SOC is one of the must-haves in order to call your business an MSSP. Other than building your own, 38% use a third party.

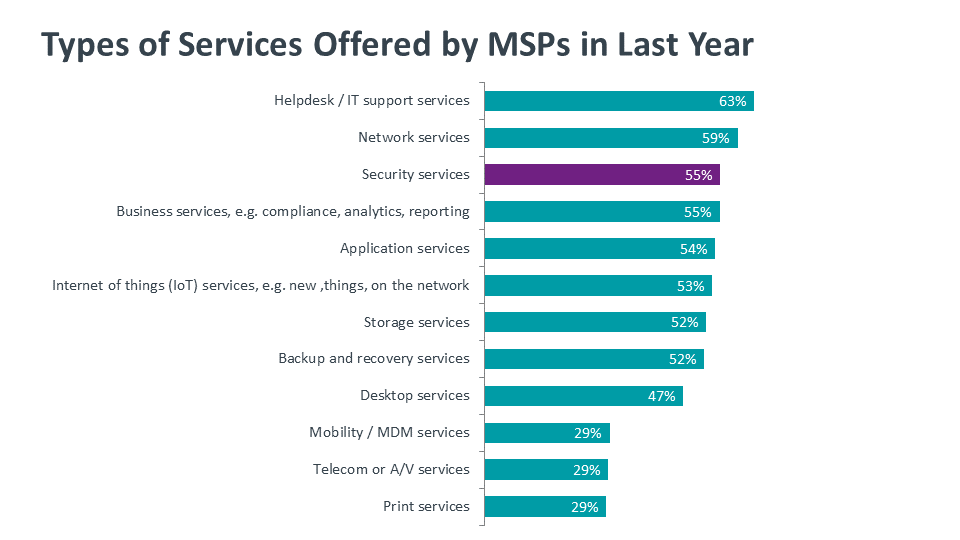

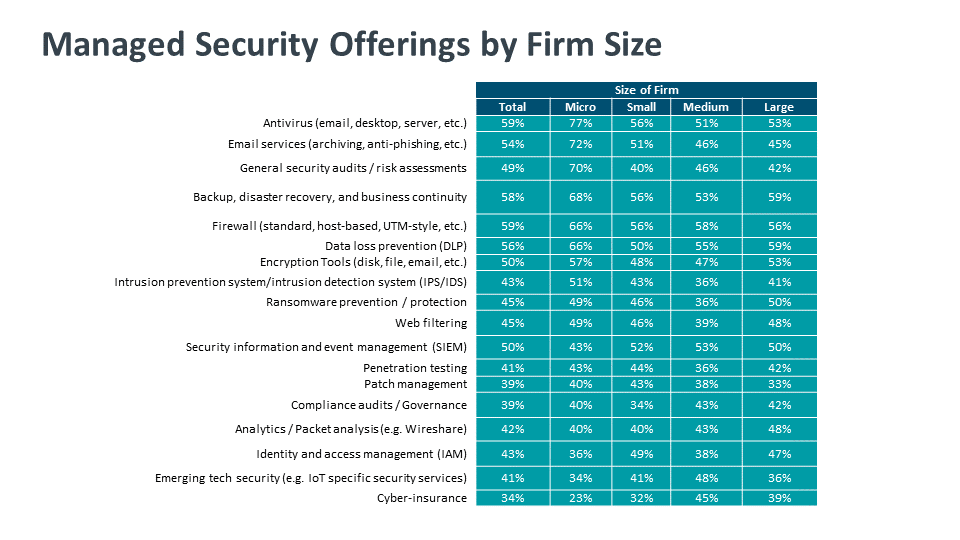

Beyond the table stakes security offerings, many MSSPs are offering more sophisticated services. Compliance audits, penetration testing, SIEM, ransomware protection and more are what make an MSSP no longer an MSP.

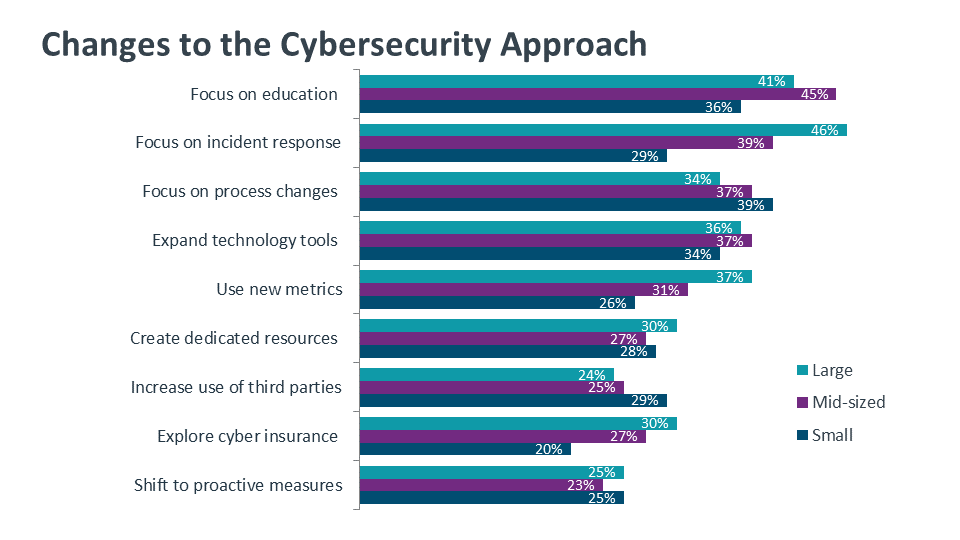

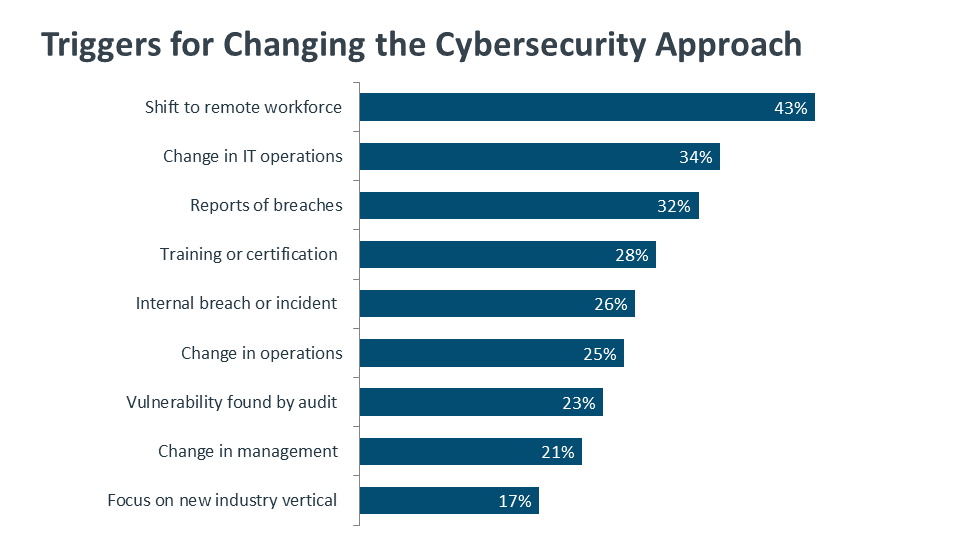

As expected, the recent shift to a remote workforce during the COVID-19 pandemic has been the primary trigger for revisiting security. While there are real security issues to consider with a remote workforce, those are only the starting point for issues created by a change in IT operations. After companies begin evaluating cybersecurity based on a remote workforce, they should be sure to continue the work by evaluating broader changes needed for expanded cloud adoption or exploration of emerging technology.

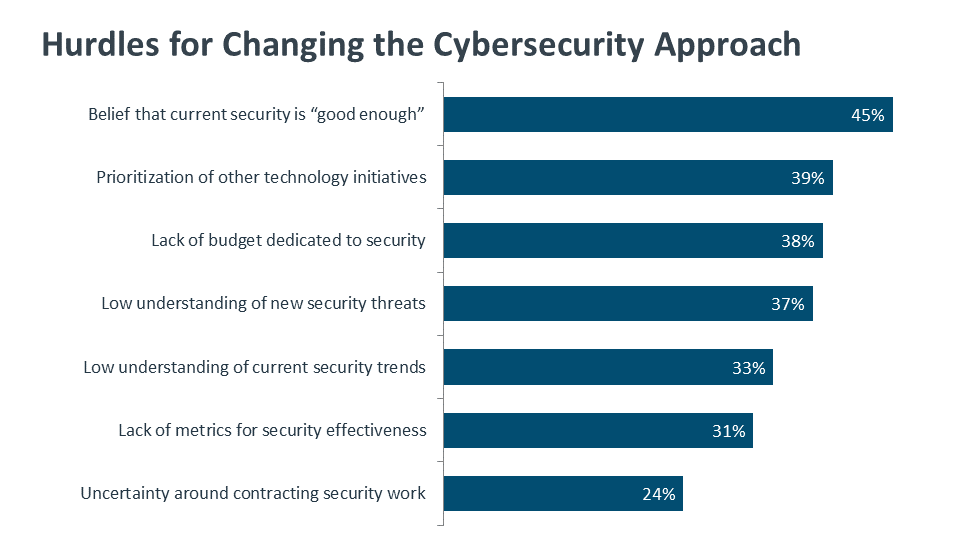

As with any shift in thinking, there are barriers in the way of adopting a new mindset around cybersecurity. The top two hurdles are the belief that current cybersecurity efforts are sufficient and the prioritization of other technology initiatives. Whether by using metrics or by collaborative discussion, the goal is to get decision makers to recognize that a modern cybersecurity approach is needed in order to secure a business for the future.

As the relationship dynamics change within the IT channel, solution providers are looking to vendors for a wider variety of services and benefits. Cybersecurity education is a key value that vendors can deliver.

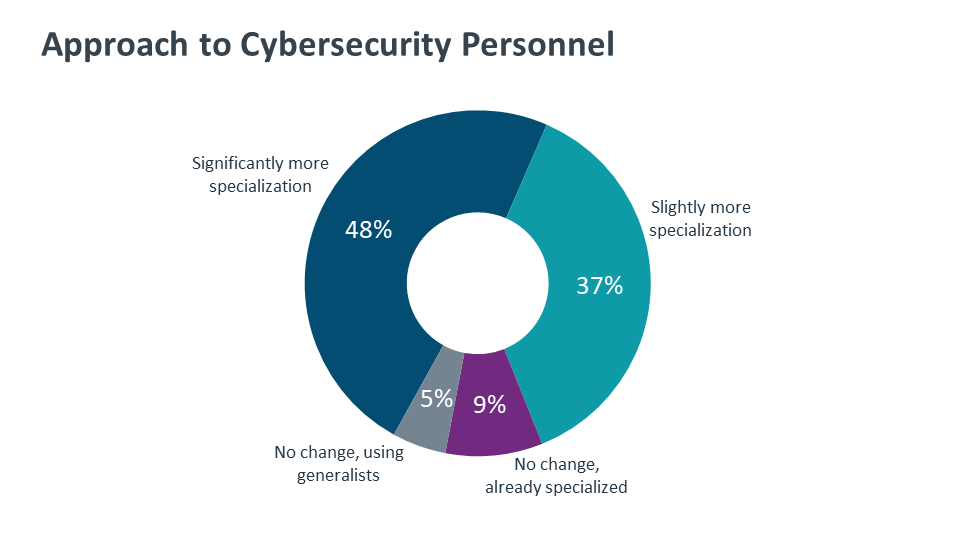

Continuing a trend that has been in place since businesses started installing CISOs, there is a major push for specialization in the field of cybersecurity. Whether companies are focusing on internal resources or outside partnerships, there is much more demand for targeted skill in threat management, proactive testing, and regulatory compliance.

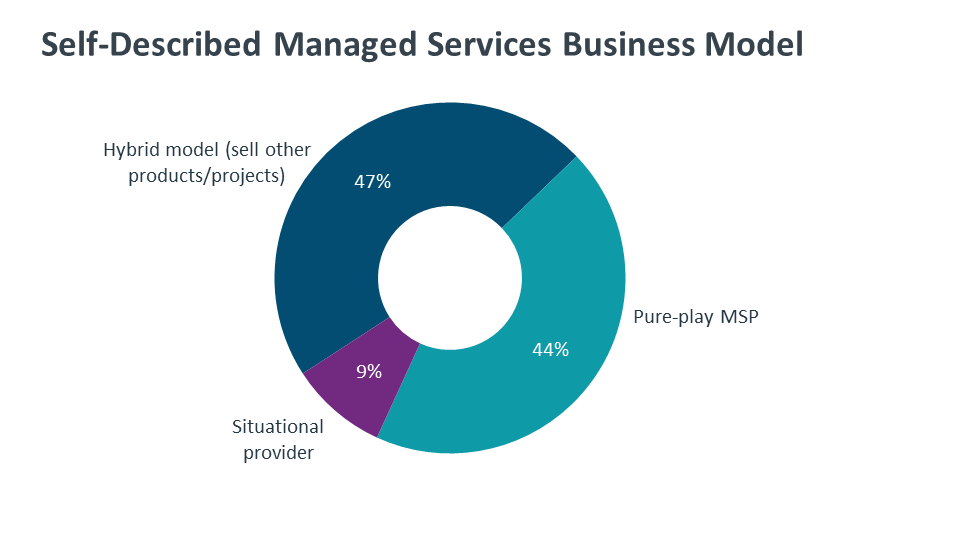

What is hybrid? It amounts to a business model that, which leading with managed services, also includes the sale of traditional hardware and software, as well as doing project work. Conversely, 44% of MSPs are pure plays. It's all they do.

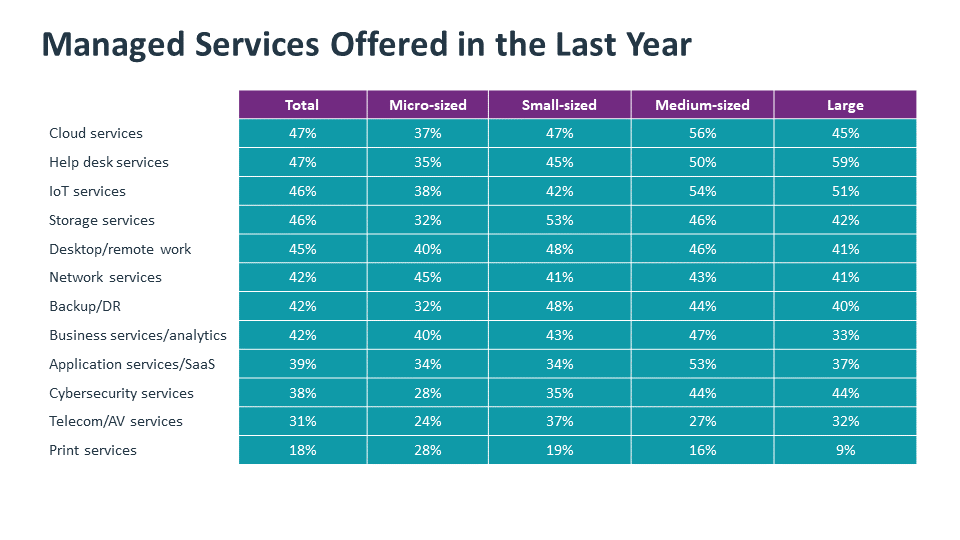

While cloud services and help desk led MSP portfolios this year, overall it's a blend of newer and traditional. What's most surprising is that 46% said they are now offering IoT as a managed services. This represents a decent climb up the ladder from previous studies, and indicates that MSPs are realizing the potential in managing IoT systems.

Likewise, up to 2/3rds of MSPs say they plan to mix up their offerings in the next couple years to include higher-end consulting services and other emerging technologies

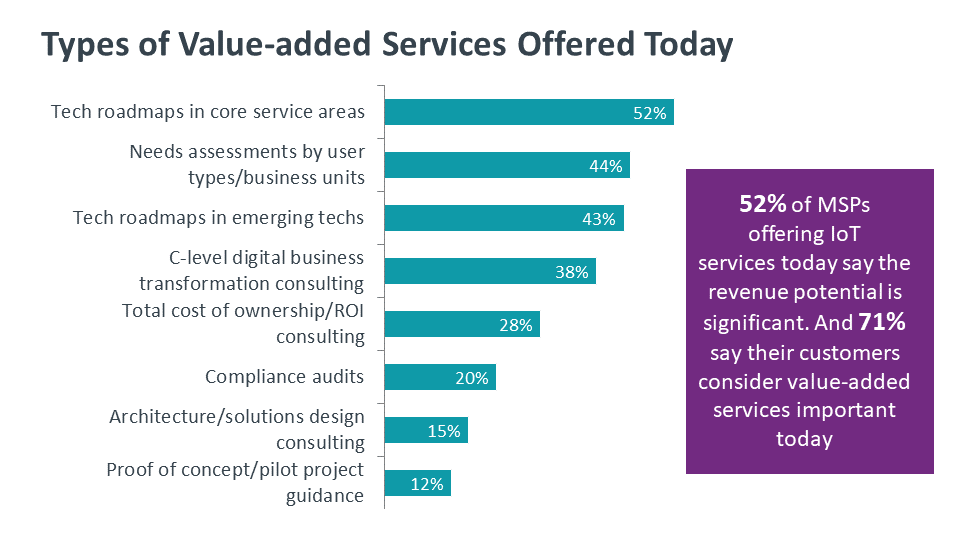

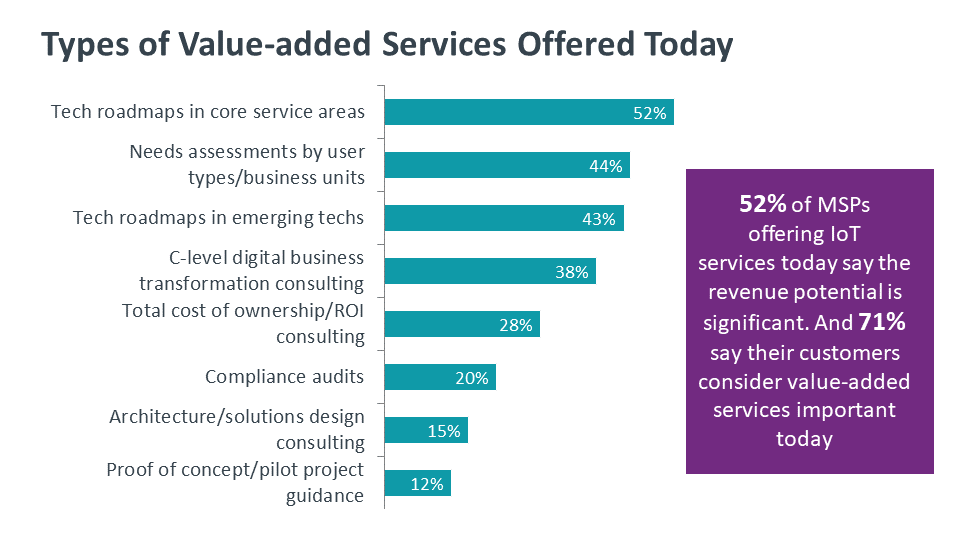

Tech roadmaps based on customer business unit/role, needs assessments for emerging tech, C-level digital transformation consulting, and compliance audits are among the newer, lucrative services offered

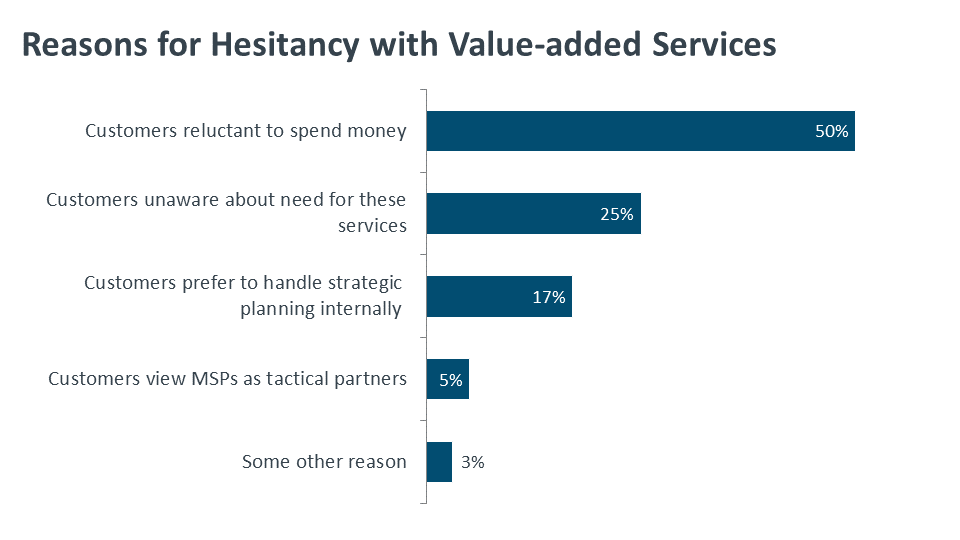

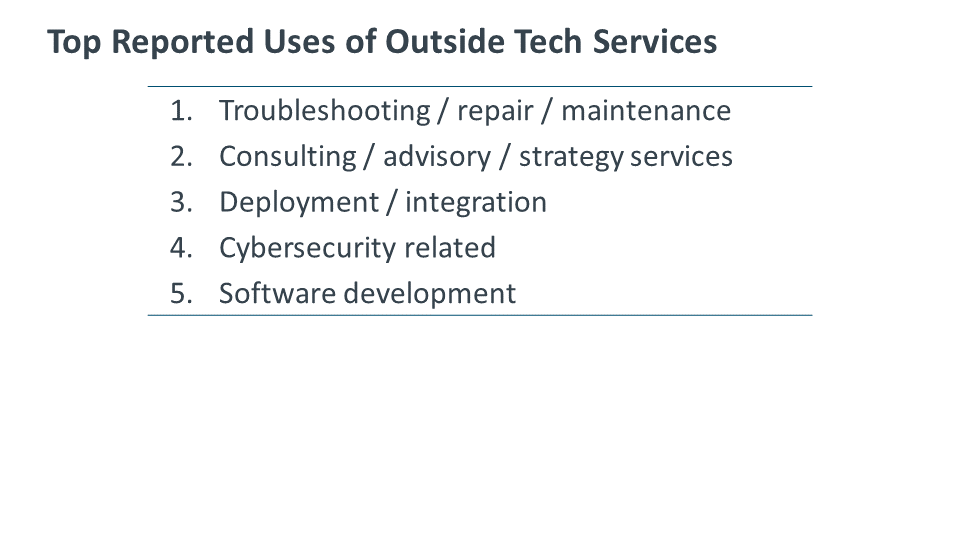

But of those that do not value these services, cost is the No. reason, along with lack of perceived need, desire to handle strategic projects in-house, and the view that MSPs are to be used tactically only

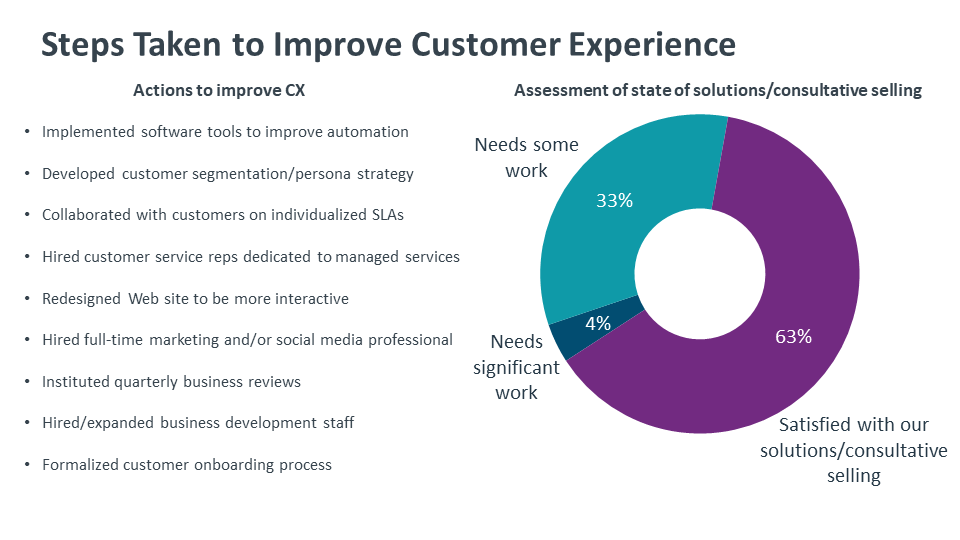

The balance, however, believes they need to do some work – some significantly – in this area

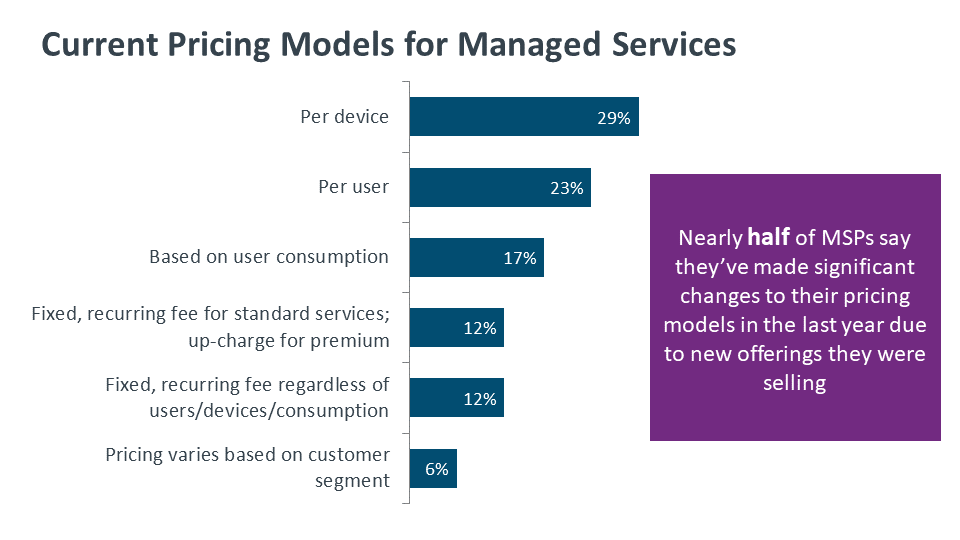

Nearly half of MSPs say they’ve made significant changes to their pricing models. Most attribute this to selling new types of offerings in the past two years

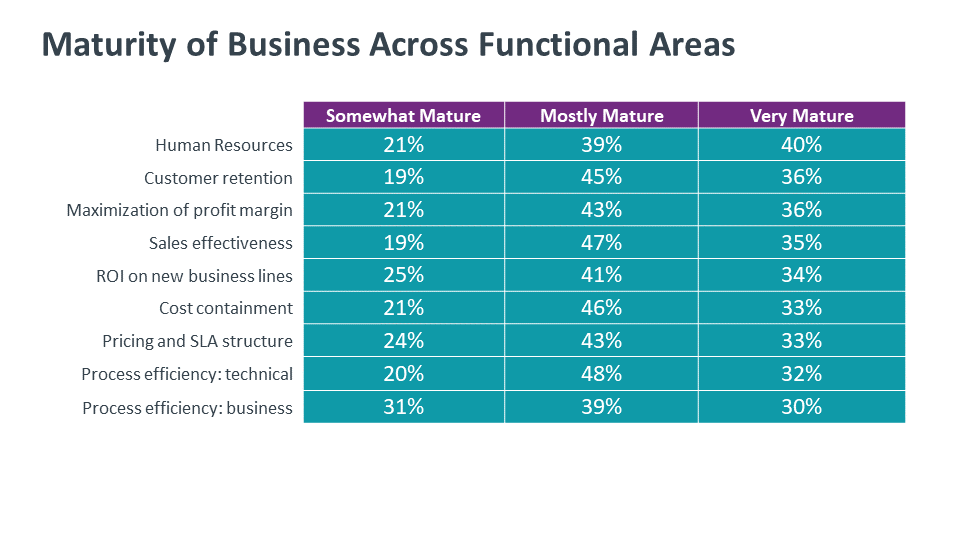

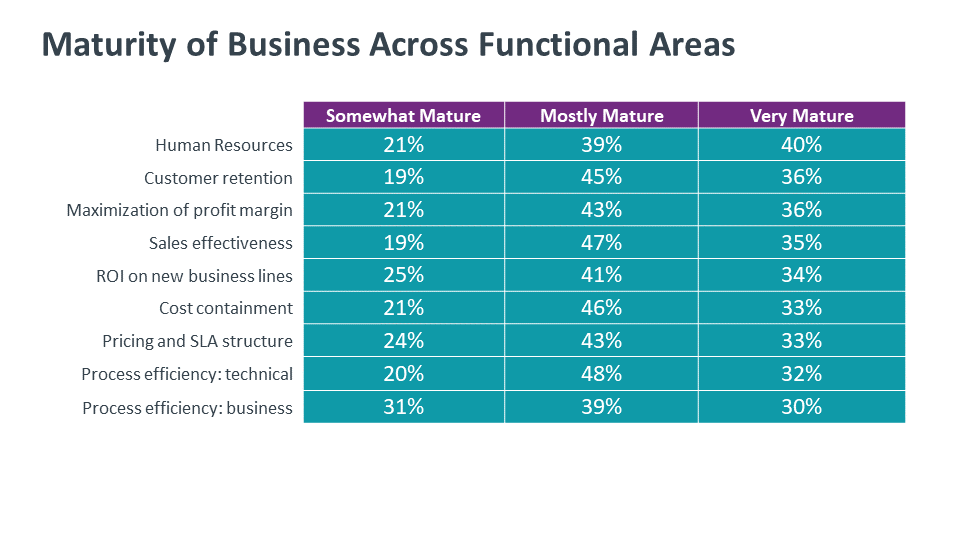

Operational maturity lags however in the areas of process efficiency (both technical and business) and pricing structure/SLA management

For those MSPs that either kept marketing efforts the same, or curtailed them, half attributed this to uncertainty around Covid

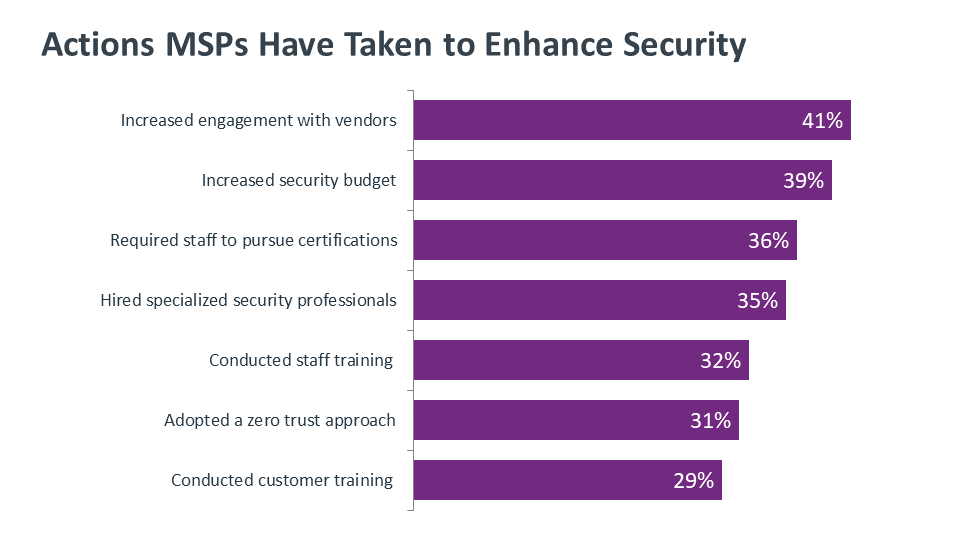

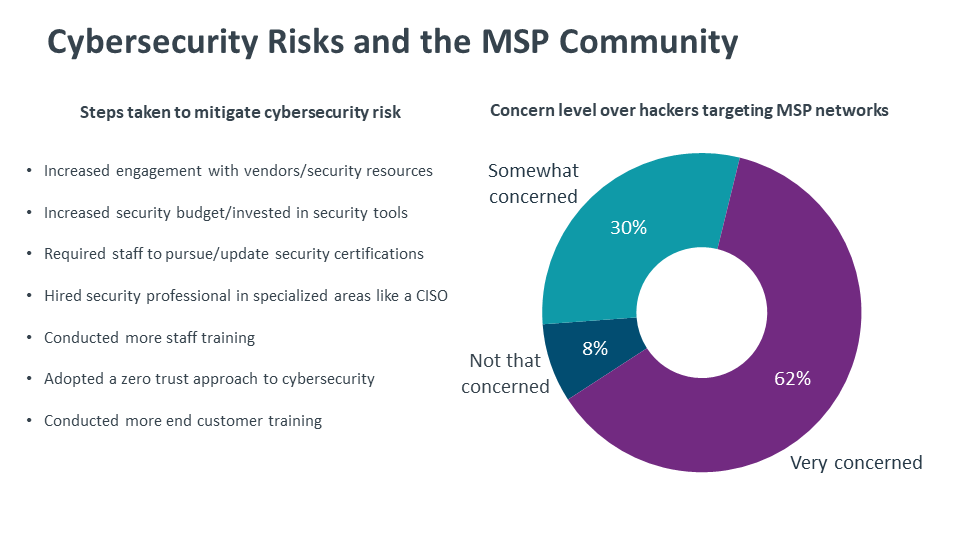

Steps taken to mitigate this risk include increased engagement with vendor/security resources, expanded investment in cybersecurity tools, and adopting a zero trust posture

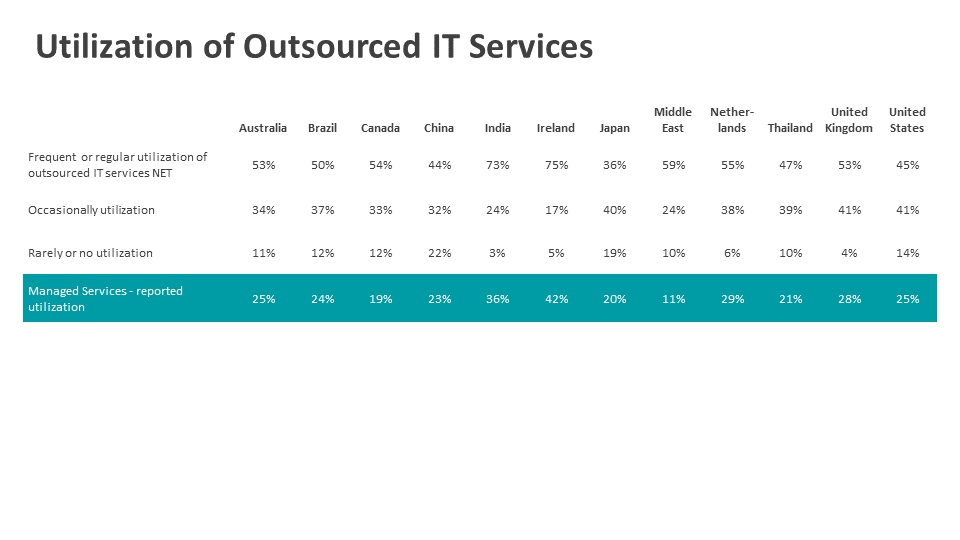

Businesses using an MSP report doing so for ongoing IT operations and typically have higher perceptions of the ROI benefits

For more, see International Trends in Technology and Workforce

This includes more than half of those that outsource/use third-party tech firms either regularly (34%) or frequently (19%)

For more, see International Trends in Technology and Workforce

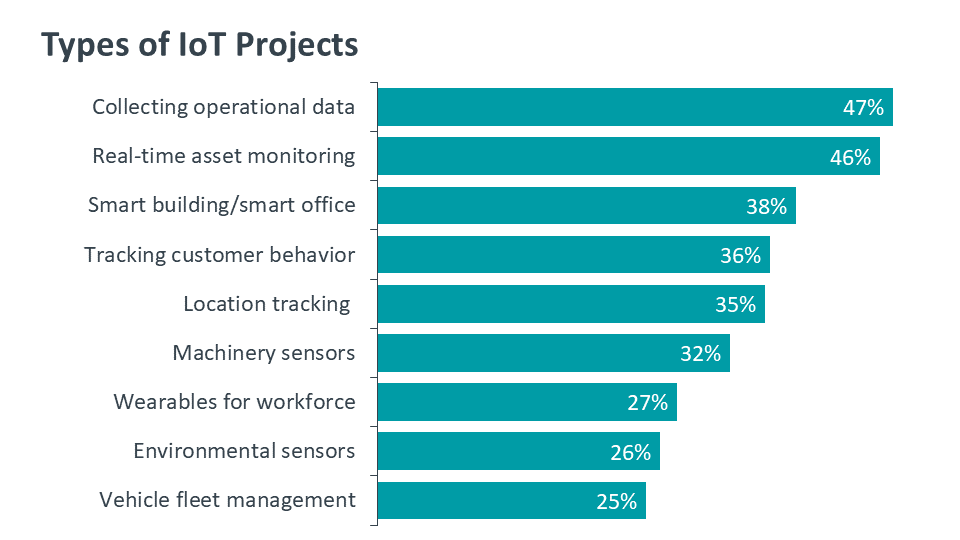

Monitoring business operations, managing the physical office environment, and tracking the behavior of customers are all activities owned by non-IT departments. Adding IoT components to these activities creates more opportunity for collaboration with the IT department, but that does not necessarily mean that they are IT projects. Those executives that connect IoT with IT may not be fully embracing a holistic view of digital transformation, where technology permeates every part of the business and new working models are needed to fully digitize operations

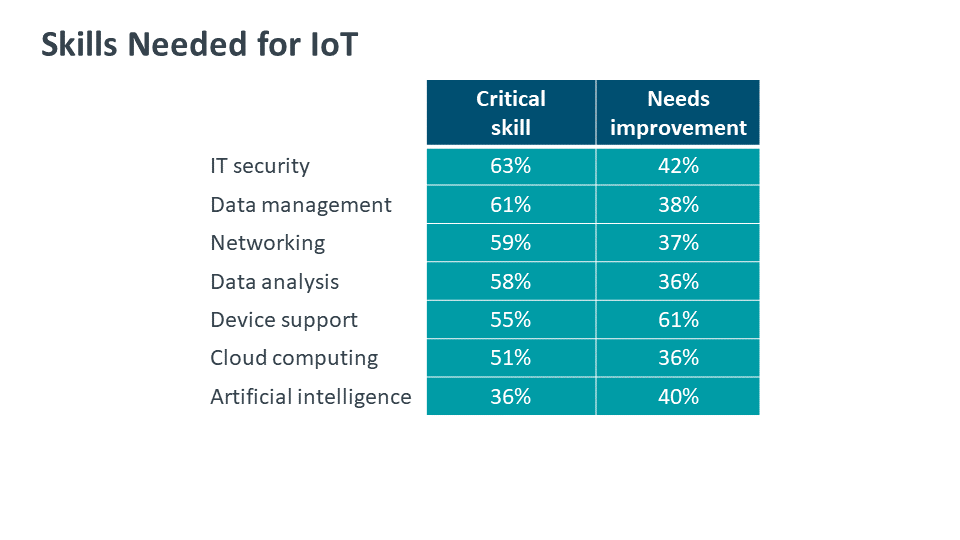

As with many emerging technologies, the tendency is to focus on ”IoT-specific” skills. Businesses might search for an IoT Architect or an IoT Security Specialist. These positions might make sense for companies that are heavily investing in IoT strategies, but these specialized roles can mask the fact that IoT support is more likely to be a combination of existing skills that are augmented to some degree with IoT expertise.

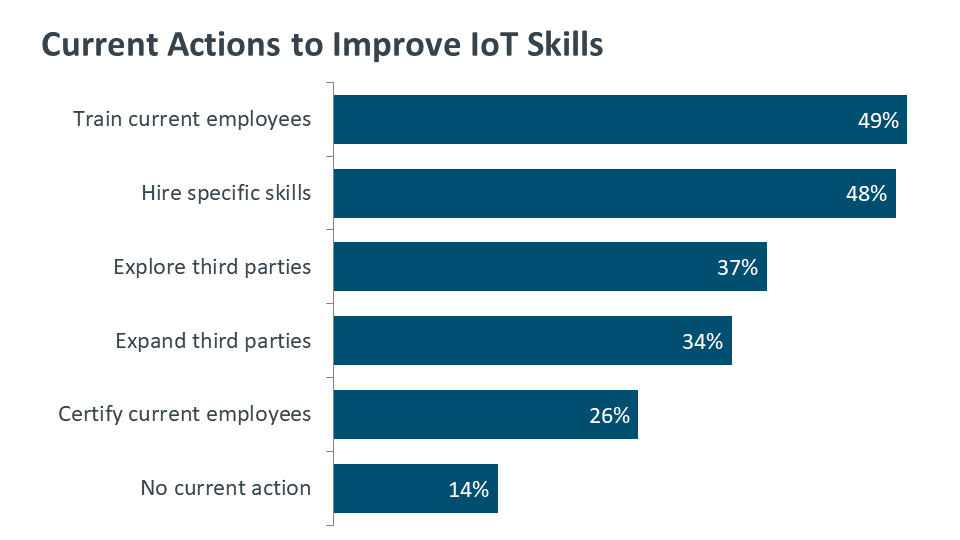

When current internal resources are scarce or hiring is challenging due to a competitive environment, third parties can provide a supplement or even take the lead on IoT activity. As with other technology trends, medium-sized firms are most likely to explore new third-party relationships or expand the partnerships they already have

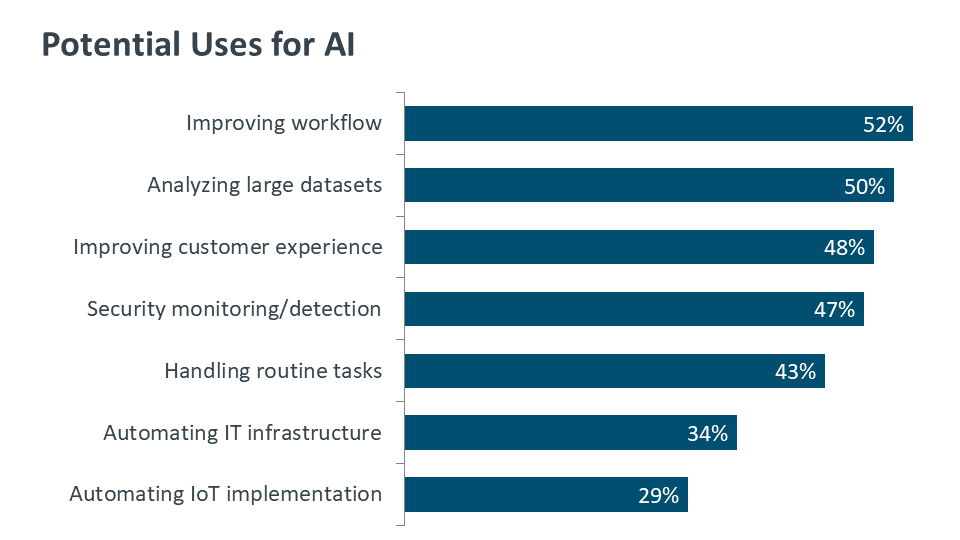

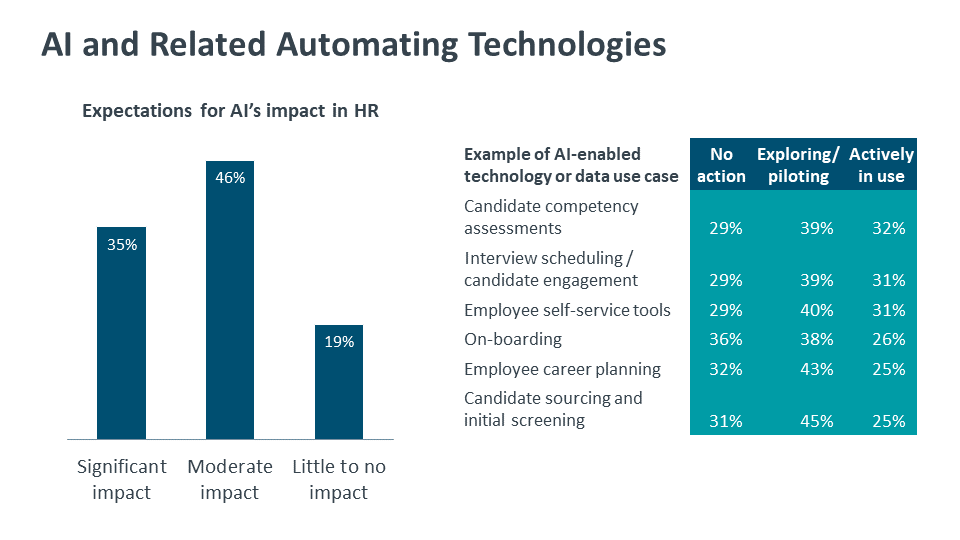

The potential use cases are high-level where the examples are more specific. However, AI is not a single development effort or third-party product that can be brought in to drive an objective. Especially given its nature as a tool that produces results based on probabilities, companies need to carefully consider how AI will integrate with their existing systems, along with the cost of a fully-functioning AI in terms of supporting hardware and robust datasets.

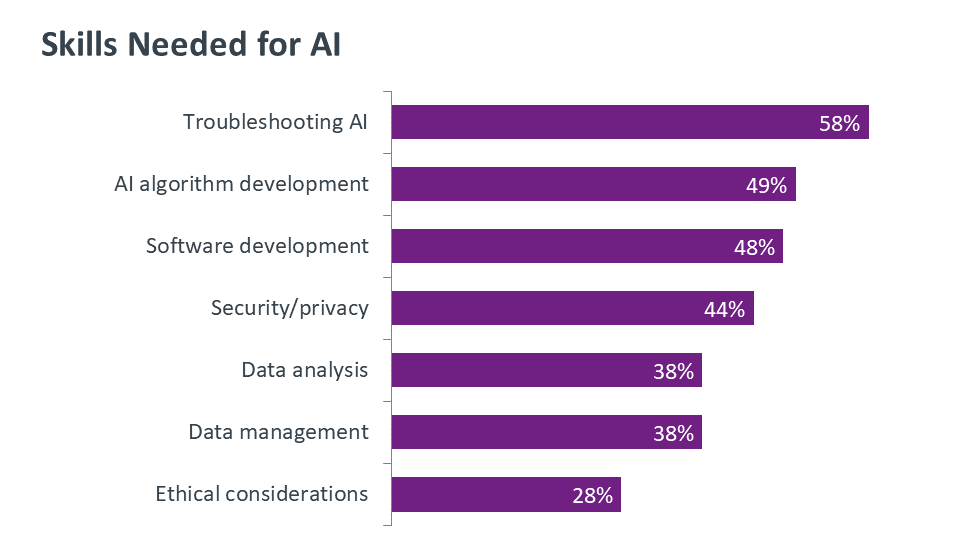

The top skill in demand is troubleshooting AI components, followed by AI algorithm development. In order to perform these tasks, though, there must be sufficient skills in software development, security, data management—skills that rank lower on the wish list. Companies should also be focusing on ethical ramifications of AI, given the possibility of AI following training with inherent bias.

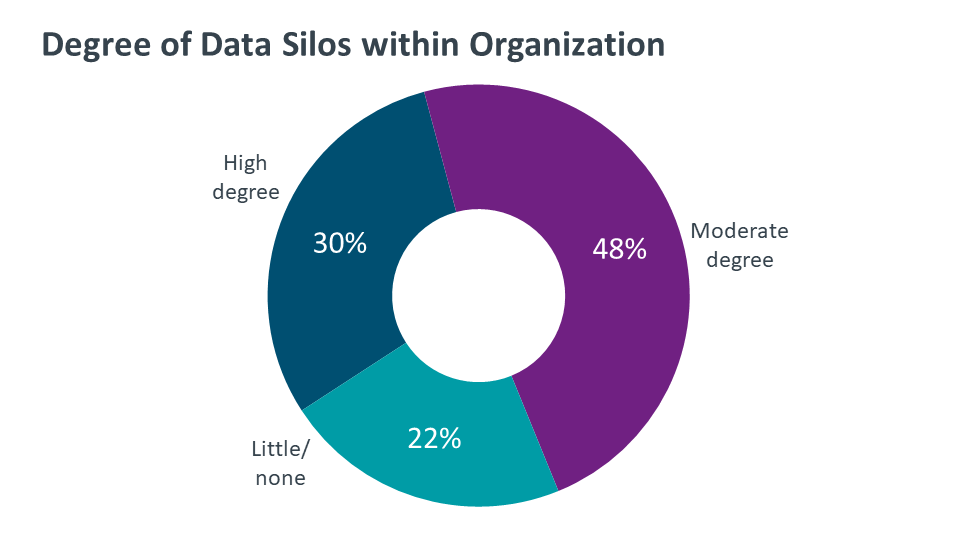

The starting point for building an organizational data plan is simply understanding the full extent of the organization’s data. Over three-fourths of companies recognize that they have data silos, pockets of data specific to a business function that are not visible to data owned by other business units. These data silos limit the abilities of AI, especially in the area of discovering patterns or correlations.

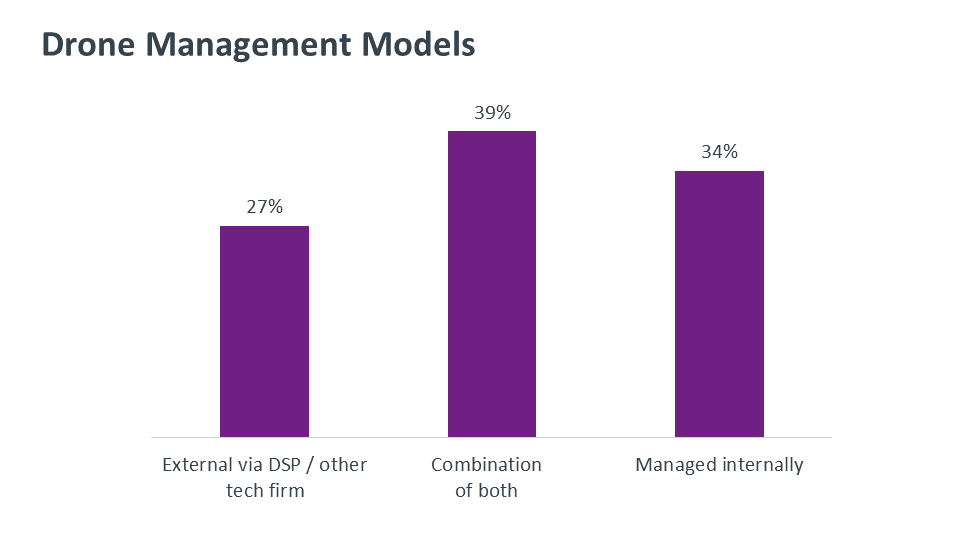

Currently, more than one-third (34%) of organizations manage their drone projects internally, while more than one-fourth (27%) rely on the expertise of DSPs (Drone Solution Providers) and other tech firms for these initiatives. A significant number of companies (39%) leverage both in house and outsourced resources for these projects. Drone-related collaborations allow IT services firms to expand their technology footprint and drive new recurring revenue streams

For more, see The Drone Market: Insights from Customers and Providers

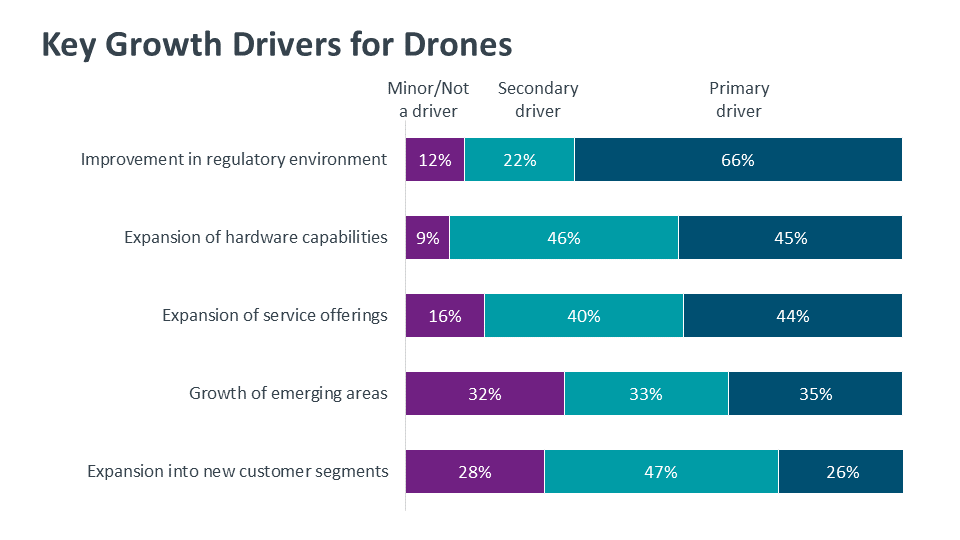

Several issues affect the outlook of the companies and individuals who deliver drone-related technologies and services. Providers are generally optimistic that an improved regulatory environment will lead to increased opportunities for their offerings, with 88% citing that situation as a primary (66%) or secondary factor (22%) driving their growth in the coming year.

For more, see The Drone Market: Insights from Customers and Providers

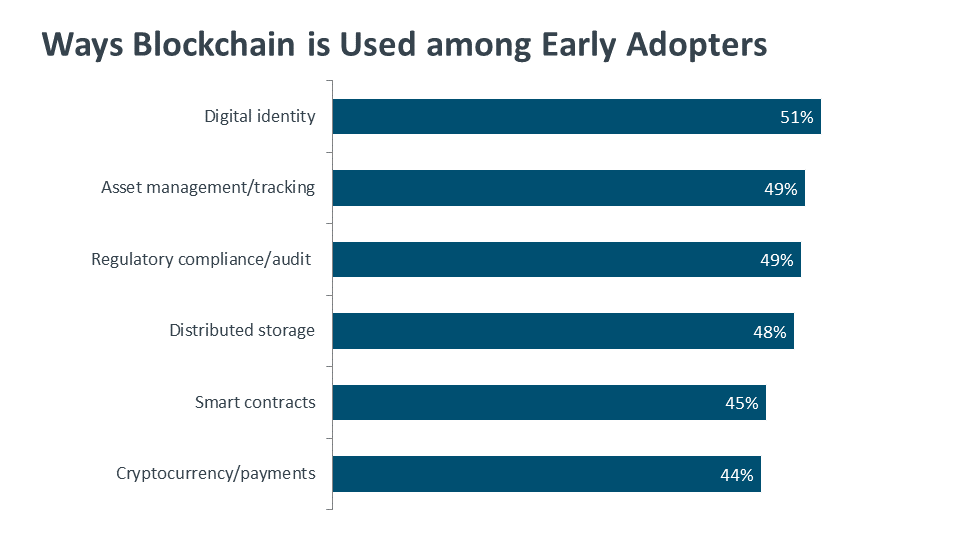

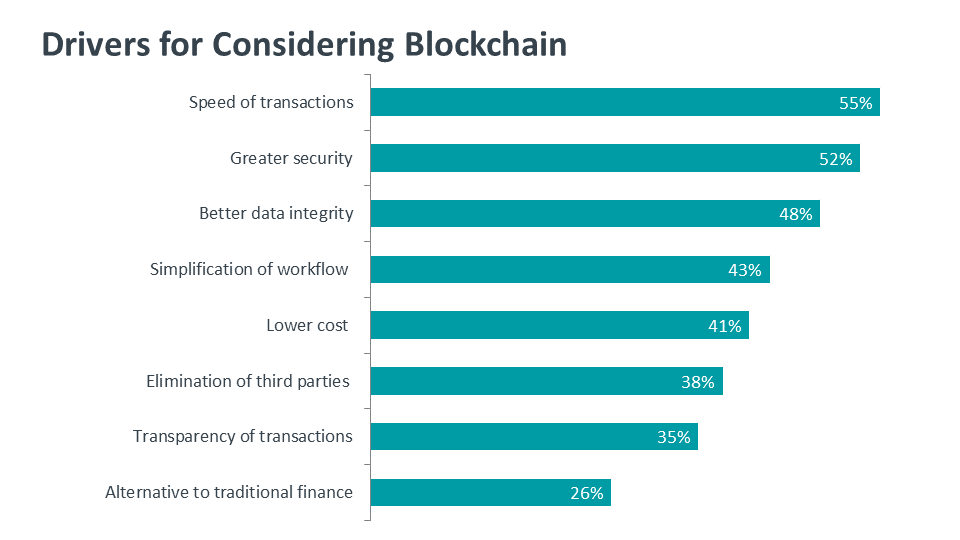

As is often the case with early-stage technologies, there is a tight clustering of potential use cases for blockchain. Security in general is experiencing disruption as companies re-evaluate their approach, so it is no surprise to see that firms are exploring blockchain as a way of confirming digital identity or keeping an audit trail for compliance. Of course, new blockchain vulnerabilities will likely be discovered as it becomes a more significant platform for attackers, but it still holds the potential to provide enhanced security around digital operations.

Transaction speed is related to the size of the blocks in the chain, which is a scalability issue impacting applications like storage. These scalability problems obviously occur at high volume, but they are important considerations given that improved speed is a top driver for blockchain adoption. Companies are talking about the speed of a single transaction, hoping that cutting out a middleman will improve turnaround times, but average transaction speed could become a hidden cost for a production system.

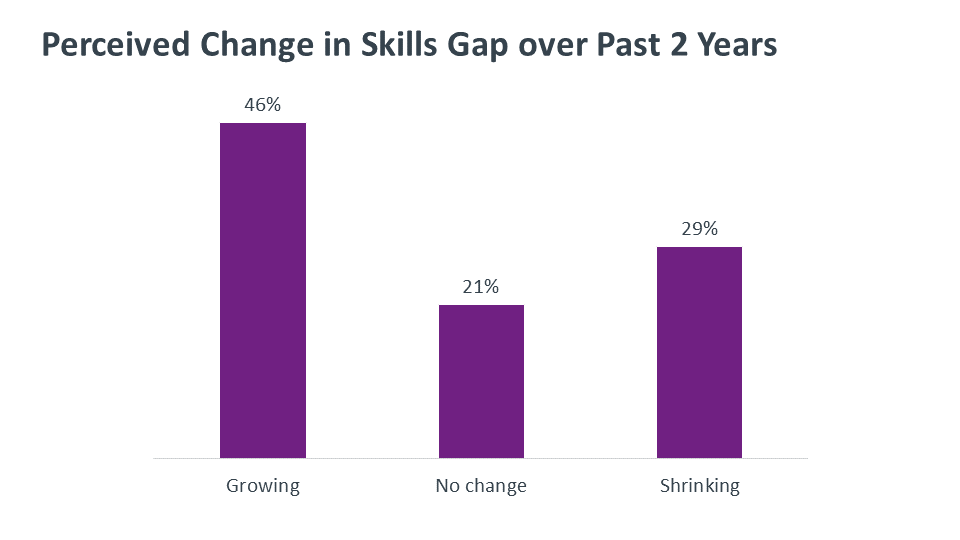

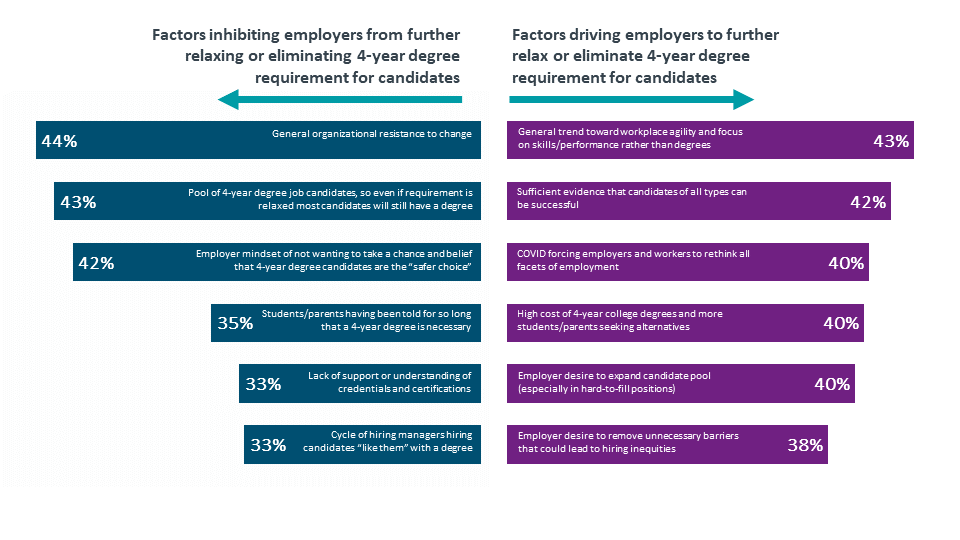

Much too often “skills gaps” are used as a term to generalize a host of other workforce issues. Skills gaps primarily meaning employee performance falling short of employer expectations or desires is far different from what could be described as a location or a pay gap. When breaking down some of the various types of gaps, the top ones the research identified as barriers in hiring and maintaining a robust tech workforce include innovation, soft skills, and wage gaps.

For more, see International Trends in Technology and Workforce

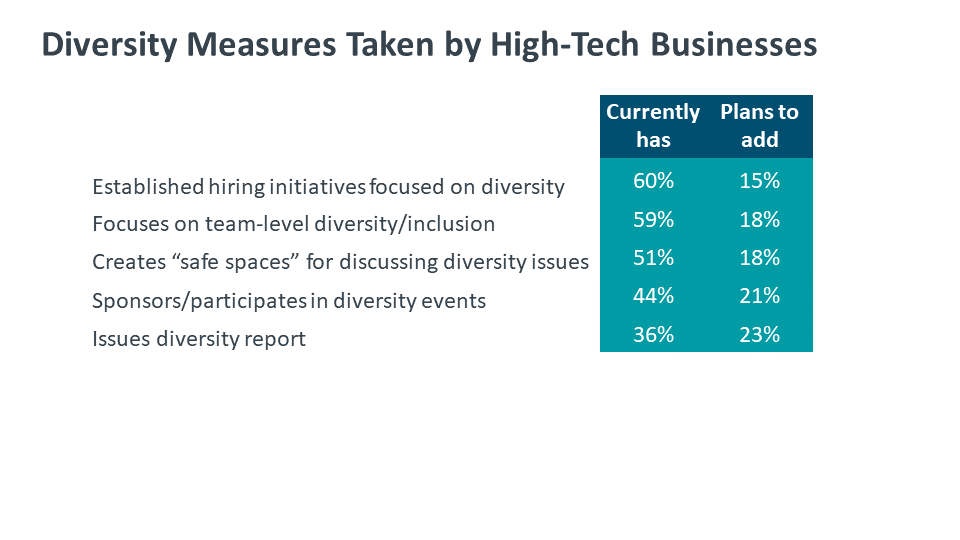

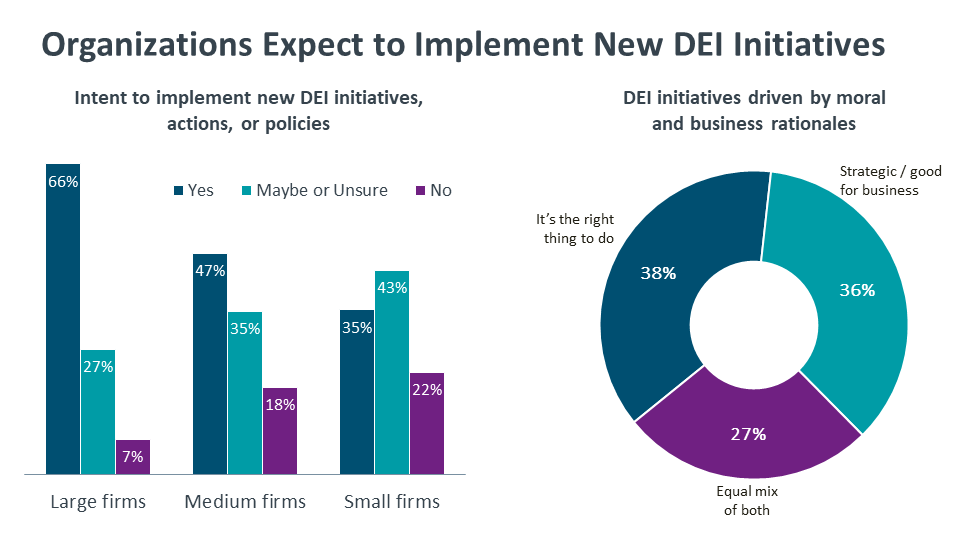

When it comes to whether the high-tech industry as a whole lags other industries in having a diverse workforce, 45% of respondents say yes, while another third at least partially agree. A quarter of respondents do not agree. Within this premise, there is a divide between white and non-white workers. Fifty-four percent of non-white workers say diversity in the high-tech world falls behind other industries, compared with 39% of white workers who feel similarly.

As the diversity conversation around the high-tech industry has swelled in the past few years, executives and business owners have been under pressure to enact change in the form of more inclusive policies and hiring practices, and more. As the leaders of their organizations, they are also expected to promote a diverse workplace as a strategic goal, which likely explains the high percentage of them that believe the effort to be critical.

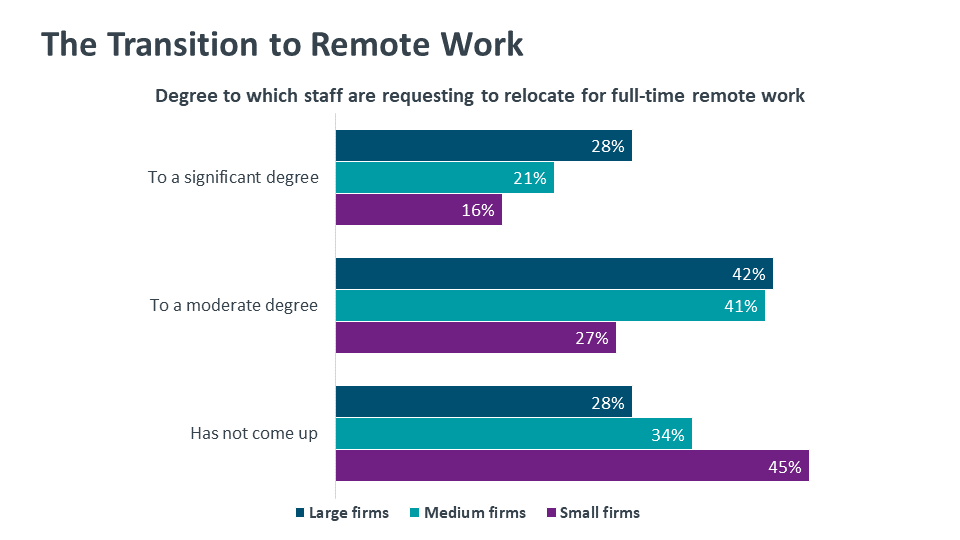

For all the anxiety about needing resilient and agile organizations in recent years, the pandemic response demonstrated that those qualities may have been available all along. Under very difficult circumstances, and in a matter of weeks, workers at many companies stood up entirely new operating models. This came at enormous cost for many subsegments of workers. But having survived that difficult period together could be the basis of a relationship reset between employer and employee.

New initiatives around diversity, equity and inclusion are more likely to be intentional and accountable. For example, the Nasdaq plans to require listed companies to disclose their diversity efforts, and 80% of corporate boards are planning to tie executive pay to environmental, social and governance metrics including DEI.25

A continuous, personalized learning approach aligns with making learning a strategic initiative instead of a check-the-box operation. It turns learning into a business advantage by operationalizing a learning culture in concrete ways. It can enable learning at a greater scale and, not incidentally, it can support DEI initiatives by accommodating the diverse ways individuals access career development opportunities.

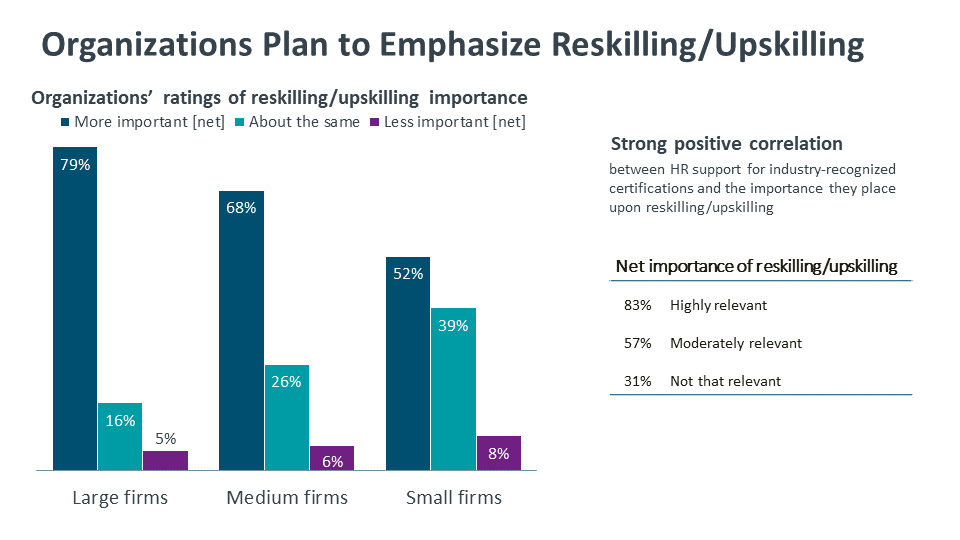

Asked what could influence this trend, culture change is one of the biggest factors: 44% say it will happen if organizations are more agile in general, and the same percentage say a significant obstacle is organizational resistance to change. The trend toward retaining and advancing incumbent employees to fill critical roles may be clearer, with 50% of people from large organizations saying they plan new efforts to reskill or upskill technology staff in response to the pandemic.

A majority of companies are either piloting or actively using AI in candidate screening, onboarding, competency assessment and career planning,

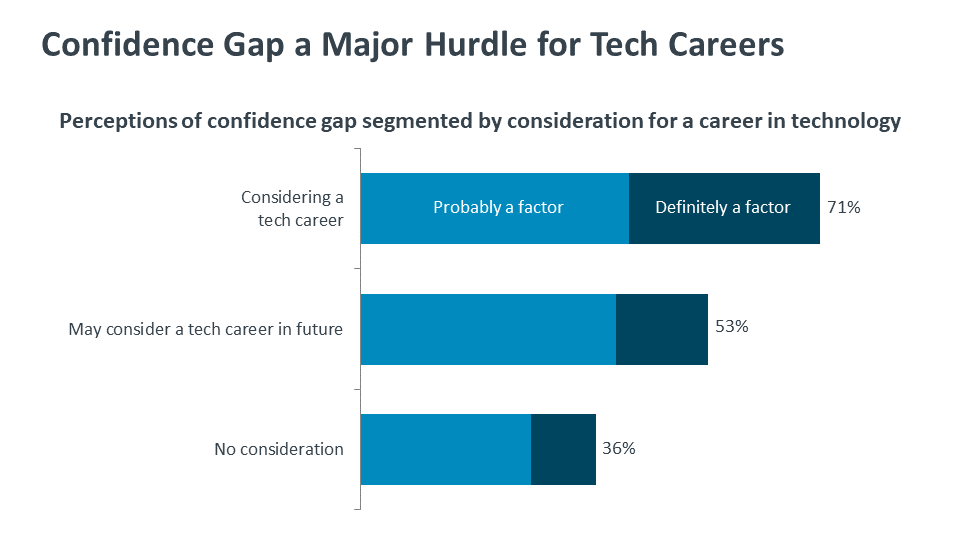

Among young adults considering a career in technology, 42% express concern over feeling ill-prepared because of insufficient exposure to technology in high school. A similar percentage cite lack of mentors and guidance in how to go about pursuing a career in technology as a factor. Among those living in small cities, towns, or rural areas, 1 in 3 report being discouraged by the perceived lack of tech job opportunities should they complete their training.

For more, see Role of Confidence Gap in Tech Career Development

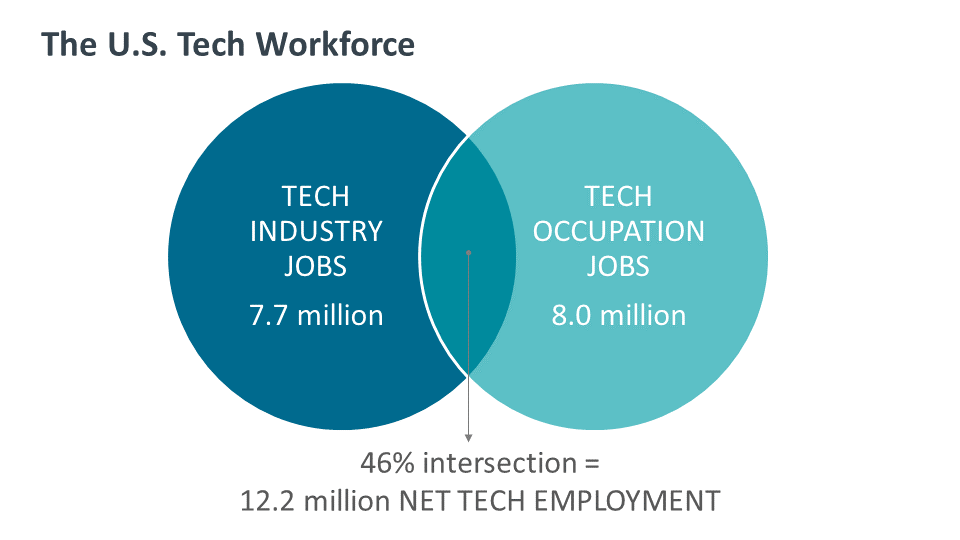

The tech workforce consists of two primary components, represented as a single figure by the ‘net tech employment’ designation. The foundation is the set of technology professionals working in technical positions, such as IT support, network engineering, software development, data scientist, and related roles. Many of these professionals work for technology companies (47 percent), but many others are employed by organizations across every industry sector in the U.S. economy (53 percent)

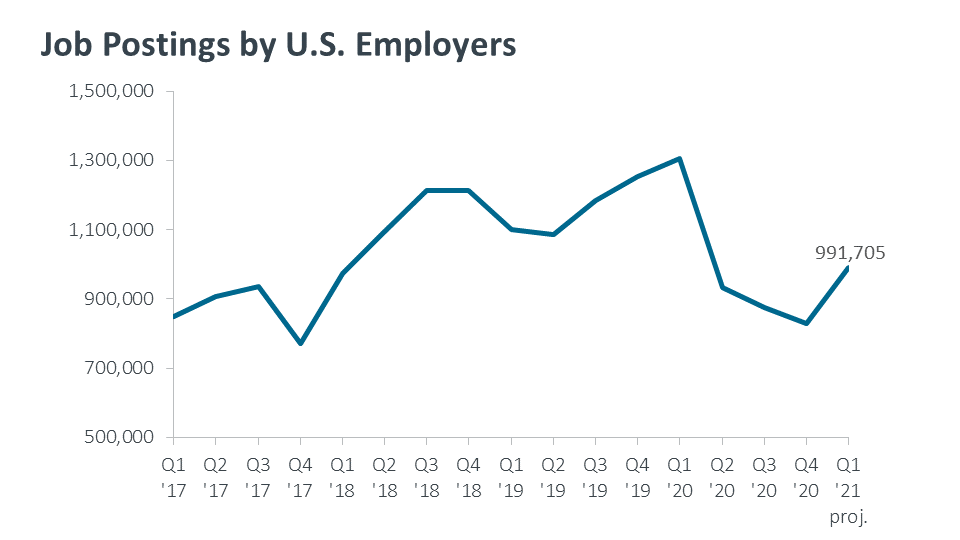

Overall quarterly tech job postings among U.S. employers dipped during 2020 due to the pandemic slowdown. Postings rebounded in Q1 2021 with employers playing catch-up with pent-up demand.

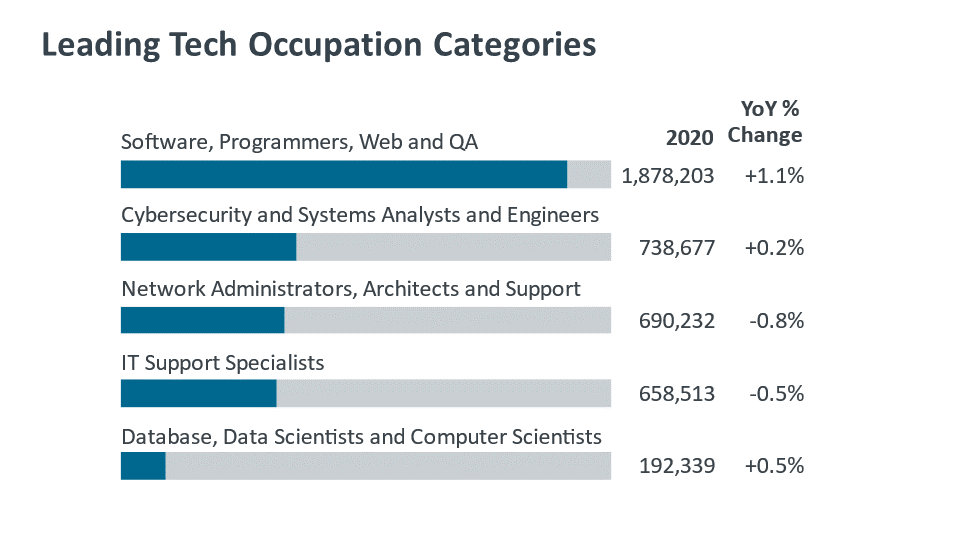

Cybersecurity occuptations are expected to grow 4.4% in 2021 and 31% by 2030.

IT support occuptations are expected to grow 2.2% in 2021 and 13% by 2030.

For questions or more information, contact [email protected]