IT Industry Outlook 2019

CompTIA’s annual forecast for the global IT industry provides insight and analysis about 12 key trends that are impacting our lives in business and at home.

U ntil recently, use cases for drones have been closely tied to military and recreational applications, with little consideration of the way these technologies could be utilized in the business community. The public perception of these devices as toys or weapons, rather than as viable commercial vehicles, limited the market potential to an extent - until recently. Strong global investment, new business use cases, and potential regulatory changes are increasing the revenue and profit opportunities for manufacturers, solution providers, distributors, operators, and other drone-related professionals.

This research report explores the latest adoption and usage trends, as well as key business challenges and prospects, for these pioneering technologies.

Business Value on the Rise

Appreciation for drone technologies is increasing, as are their real-world benefits for a growing number of vertical markets. In the survey, business leaders gave these devices and applications high ratings for ease of use, capabilities, content, and efficiency. User needs are continuing to shift, and engagement demands and support requirements for third-party providers is rising as organizations look for larger partners with higher capabilities, including data analytics, broad-based IT expertise, software development proficiencies, and cybersecurity skills.

A Tech Segment Ripe for Partnerships

Approximately 80% of organizations work with outside professionals to provide, design, build, manage, or secure their drone platforms and related activities ̶ with the balance expressing some level of interest in outsourcing options. Drone providers may also team up with other professionals to fulfill specific customer requirements, including pilots, software developers, and data analytics specialists.

Watch for Market Growth Obstacles

Limitations imposed by government regulations are a major concern for drone operators and those who develop and support these emerging technologies. Other potential inhibitors to growth include conflicts with hobbyists and unlicensed operators, shrinking margins, automation, and organizations hiring and developing in-house staff to replace pilots, solution providers, and other drone experts.

The Skills Gap Presents Challenges and Opportunities

As with any thriving market, it can difficult finding talent to fill drone-related jobs. Innovation is rapidly outpacing training, and the lack of qualified personnel can stifle growth opportunities for providers as well as suppliers. That skills gap is rising, leaving an estimated 90% of drone service providers and related organizations scrambling to fill drone-related positions. Companies that succeed in recruitment and training in this area have a greater chance of growing sales and profits.

Data source: CompTIA Drone Market Study, unless otherwise specified. See Methodology for details.

After years of advances, beginning with the decades-old military and hobby-purposed aircraft which preceded the latest commercial applications, drone technologies are finally gaining solid traction in the business community. This emerging market with a historically sound foundation is currently creating opportunities for a rapidly expanding ecosystem of developers, pilots, manufacturers, solution providers, distributors, and other support personnel.

Demand is strong. Drone Industry Insights projects the global market for drone technologies will reach $43.1 billion by 2024, up from $14.1 billion in 2018i. That equates to a compound annual growth rate of 20.5%, easily outpacing CompTIA projectionsii for the overall information technology industry (3-6% increases).

IDCiii predicts that the U.S. market for robotic/drone hardware will reach $9.2 billion in 2019, yielding a year over year growth rate of 15.6%, with robotics OT (operational technology) services reaching $3.4 billion in 2019, a year over year increase of 13%. For robotics/drone hardware, the U.S. represents about 14% of the global market.

Opportunities abound in the drone community. As with other emerging technology fields, engagement models can be quite complex and involve a variety of professionals and firms. CompTIA research identified a wide range of people and organizations involved in procuring, preparing, operating, and supporting these technologies.

Organizations and individuals entering this market segment must have a solid understanding of the engagement models and customer needs. The value proposition for drone technologies varies by industry, usage requirements, and internal capabilities.

As with other emerging technology markets, the engagement model for drones is somewhat complex and in transition. Organizations are continually evaluating projects and skill requirements and developing and altering long-range plans based on earlier results and industry research.

Engagement models tend to shift due to a variety of factors, including employment and technological investment requirements as well as workforce availability.

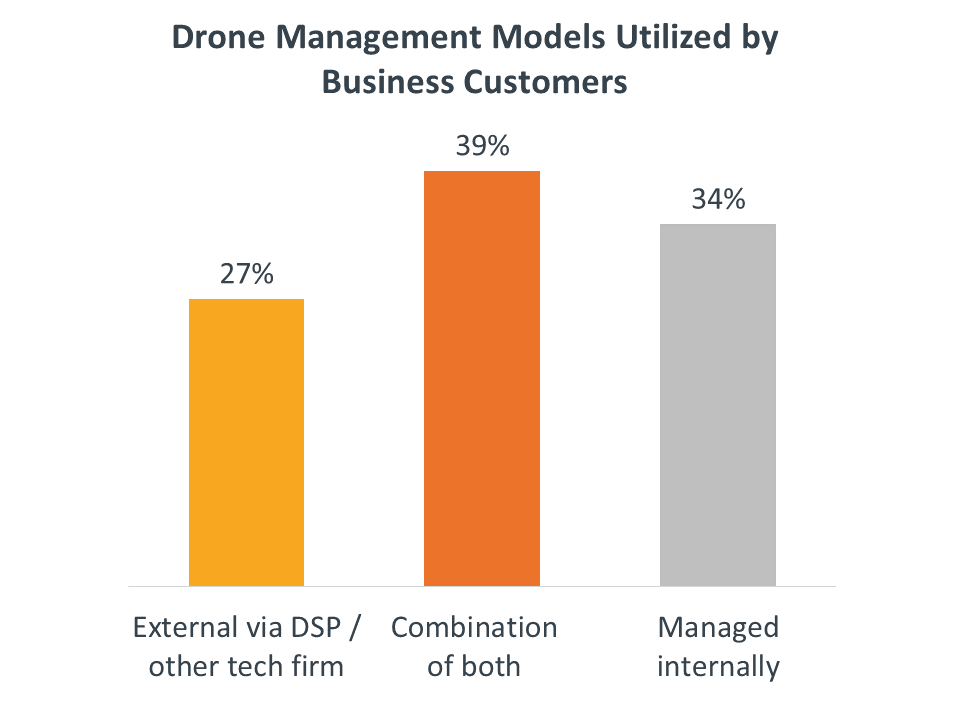

Currently, more than one-third (34%) of organizations manage their drone projects internally, while more than one-fourth (27%) rely on the expertise of DSPs (Drone Solution Providers) and other tech firms for these initiatives. A significant number of companies (39%) leverage both in house and outsourced resources for these projects. Drone-related collaborations allow IT services firms to expand their technology footprint and drive new recurring revenue streams.

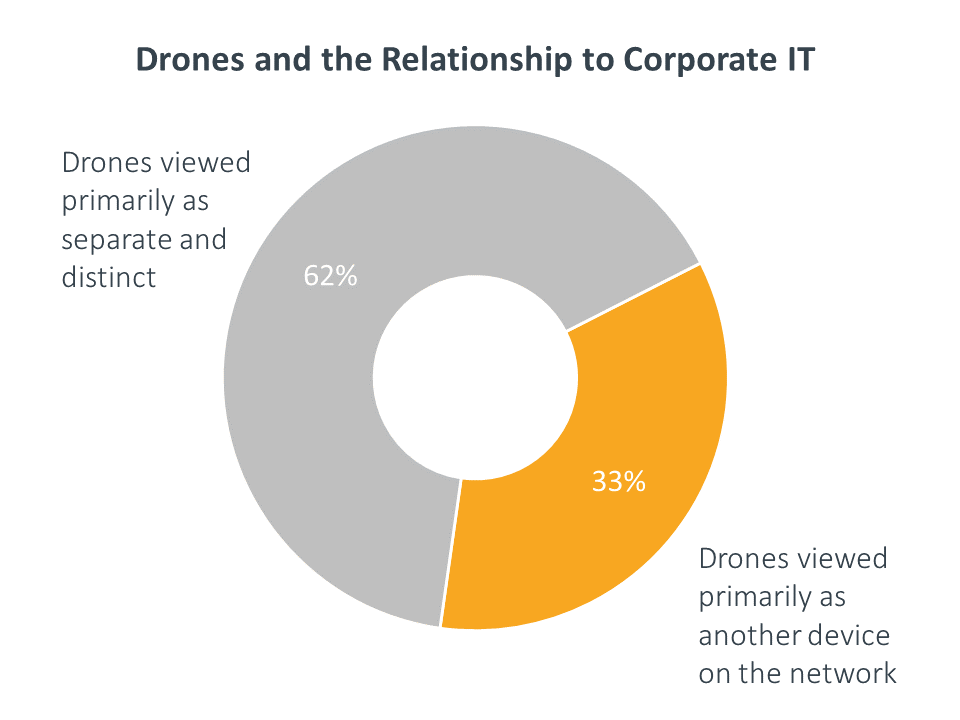

Neary half of the survey respondents characterize their drone engagements as “new,” meaning the organization or individual is leveraging the technology to accomplish something that was not previously possible. Others consider drones as an enhancement to existing practices. Approximately one-third of customers view these technologies as part of their overall corporate technology ecosystem, while the remainder of businesses sees drones as something other than “another device on the network.”

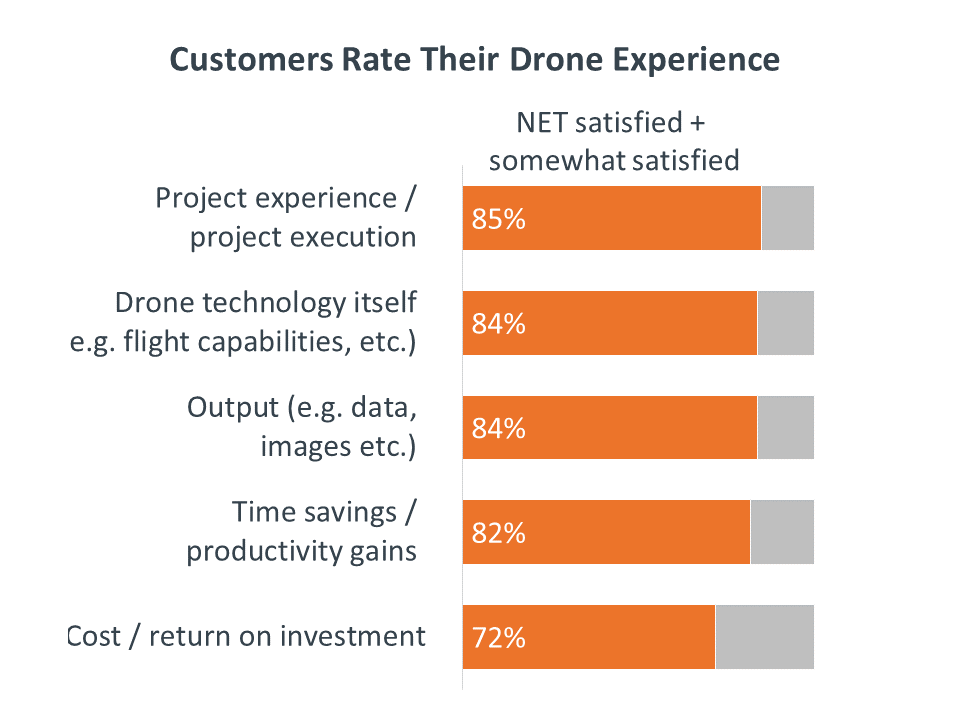

The business uses case for drones may have taken years to develop and validate, but the overall impression of these technologies has been very favorable. More than three-quarters of customers are satisfied with the ease of use/project execution (86%), capabilities (85%), output (85%), and time savings/productivity (82%) of these devices and solutions.

Even the two lowest rated customer satisfaction factors assessed in the study, cost/ return on investment and improvement to safety/ mitigation of risk, received relatively high grades (71% to 71%). Providers, operators, and other drone-related professionals can leverage those statistics to secure new projects with prospective clients. With such a positive overall experience, from the ease of implementation and use to an increasingly favorable ROI, it’s easy to see why experts expect the demand for drone technologies to rise steadily.

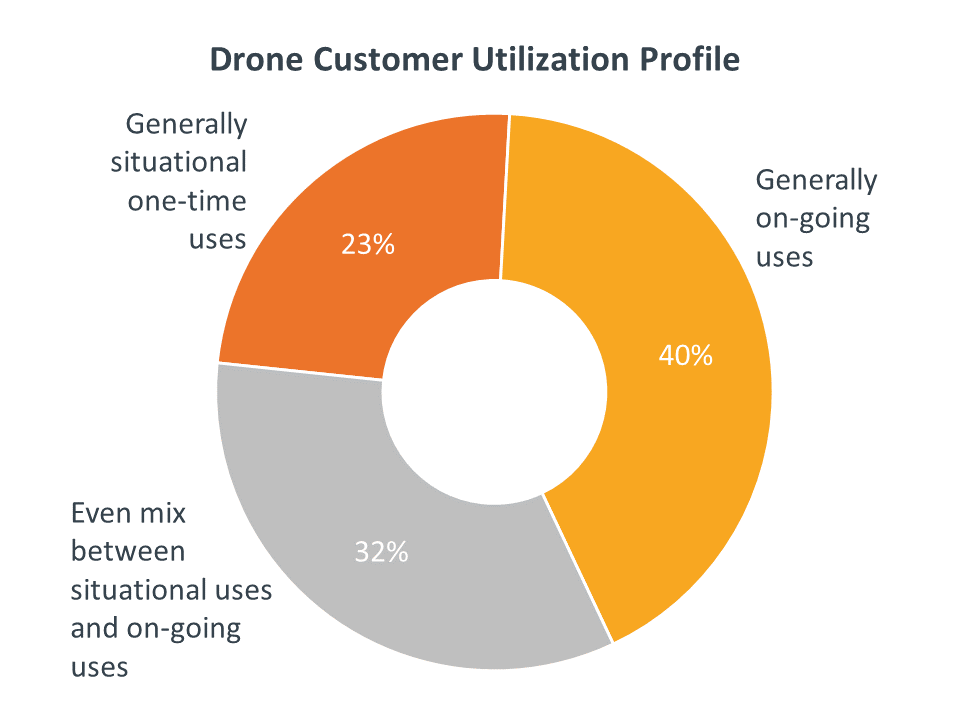

Not every company will need a full-time fleet of drones. In the survey, approximately 40% of respondents reported general on-going uses for these technologies, while less than one-fourth (23%) described their engagements as situational, one time uses.

The remainder of respondents describe their utilization as “about an even mix between situational uses and on-going uses.”

Due to investment requirements, organizations that employ these technologies on a part-time or occasional use basis may benefit from working with drone solution providers and other outsource companies.

Approximately half of the respondents also reported experiencing some degree of change in their utilization profile, which is not uncommon with new technologies. As drones mature and move beyond the early adopter stage, organizations may increase or decrease their investments and deployment options based on the results of previous projects. Drone professionals can help businesses test and evaluate various options or design more cost-effective solutions that meet their specific operational needs.

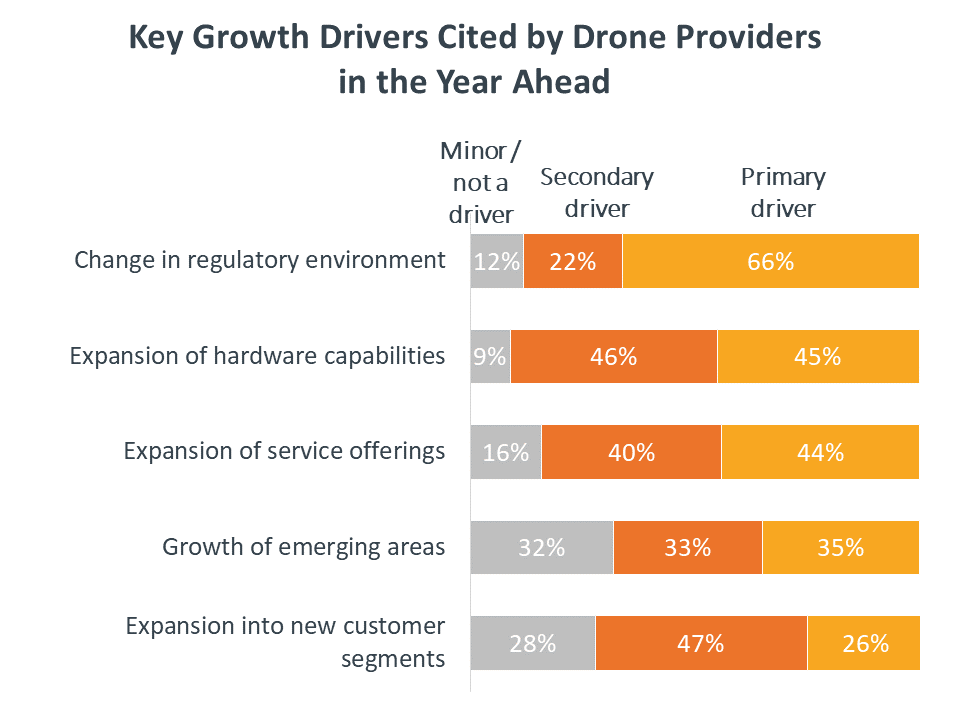

Several issues affect the outlook of the companies and individuals who deliver drone-related technologies and services. Providers are generally optimistic that an improved regulatory environment will lead to increased opportunities for their offerings, with 88% citing that situation as a primary (66%) or secondary factor (22%) driving their growth in the coming year.

Respondents rated the expansion of hardware capabilities higher overall (91%), but less than half (45%) cited it as a primary factor. Responses for the expansion of service offerings were similar, with 44% listing that situation as a primary factor in their future growth and 40% identifying it as a secondary consideration.

Other key business accelerators for drone providers include the growth of emerging areas such as AI (artificial intelligence), drone swarms, and autonomous systems; and expansion into new customer segments, including the SMB and international markets. Innovation, governmental rules changes, and new use case opportunities could significantly affect any or all of the studied business accelerators in the coming years.

Business use cases for drones have grown significantly over the past few years. Users, as well as the manufacturers, solution providers, operators, and pilots who support these technologies, have been actively engaged in designing, testing, and perfecting solutions for various markets.

Those efforts are paying off, with customer engagements reported across an increasing number of industries involving a variety of new and existing applications. More traditional use cases for drones such as business security, surveillance, and monitoring continue to expand, especially in areas where labor costs and crime are on the rise.

Aerial capabilities are also expanding the options for photographers and building inspectors (i.e., zoning officials, contractors, and insurance adjusters), as well as for those who conduct overhead land surveys and mapping.

Anticipated growth opportunities*

*According to drone service provider survey respondents

Emerging markets for drone technologies include agriculture, oil/gas, real estate, government, transportation, entertainment and media, telecommunications, and mining. Adoption in the SMB community is also rising due to the competitive advantages and cost efficiencies of drones. The opportunities for solution providers, operators, and pilots are plentiful, and the only restriction will be the number of applications developers and other inventive professionals can create.

The safety, security, and energy markets are great examples. Drones are increasingly being used to perform tasks that endanger people, including search and rescue activities and surveys of elevated infrastructure such as potentially unstable roofs and damaged power lines. Organizations can easily justify investments in drone technologies if they can reduce or eliminate safety risks for employees and others.

Delivery is another opportunity area, and competition among vendors in that space is driving innovation. Companies like Amazon, Google, Zipline, Flirtey, and Flytrex are rapidly increasing the technological capabilities of drones. The early adopters are also streamlining the delivery processes and forcing communities to redefine, clarify, and in some cases, relax regulatory restrictions. Those actions reduce the cost of entry to the drone delivery market for new developers, solution providers, and operators.

The key to succeeding in any new market is satisfying unmet needs. Drones are merely a platform from which organizations can perform a variety of different activities, and one of the initial roles of solution providers, operators, and pilots is to identify and prioritize the opportunities for each of their clients.

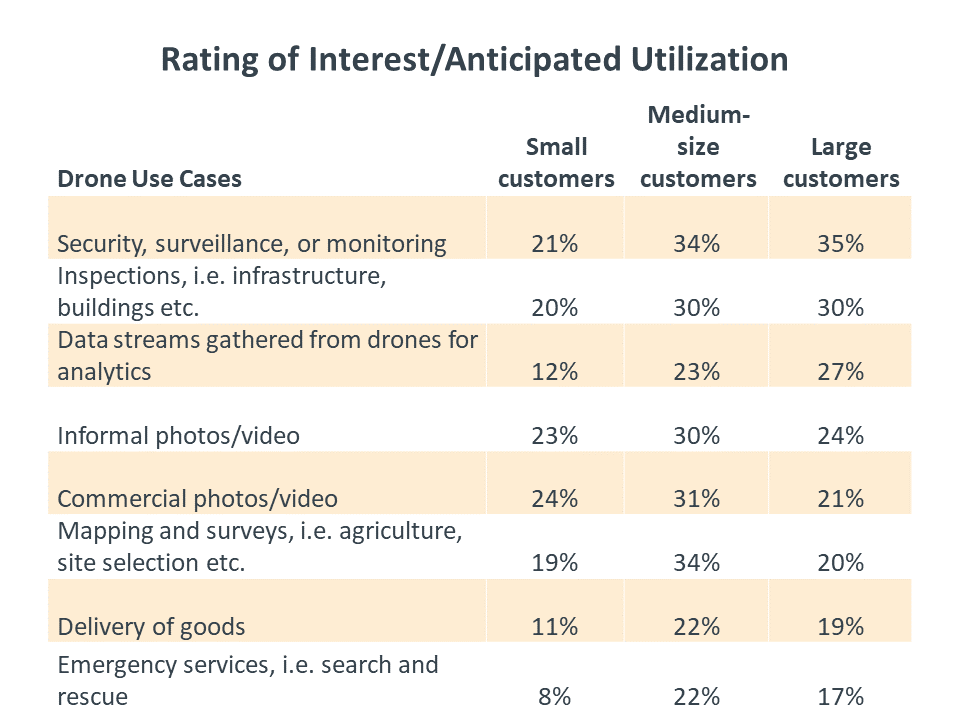

What are their primary and secondary goals? CompTIA asked prospective drone users (those not yet utilizing the platforms but investigating the options) their areas of interest during the survey and found a variety of answers.

Responses varied from more established uses (security, photography, inspections, etc.) to delivery and mapping services. Prospects also expressed interest in the management of data streams, including analysis of information gathered by drones and related business intelligence support.

Each of these areas presents a potential revenue opportunity for drone specialists, whether developed in house or through collaboration with peers, vendors, or other partners.

Nearly half of respondents rate their drone engagement as meeting or exceeding expectations, while the rest report a mixed experience: many positive benefits with room for improvement. Customers gave high ratings for ease of use, technology capabilities, output (images and collected data), and productivity.

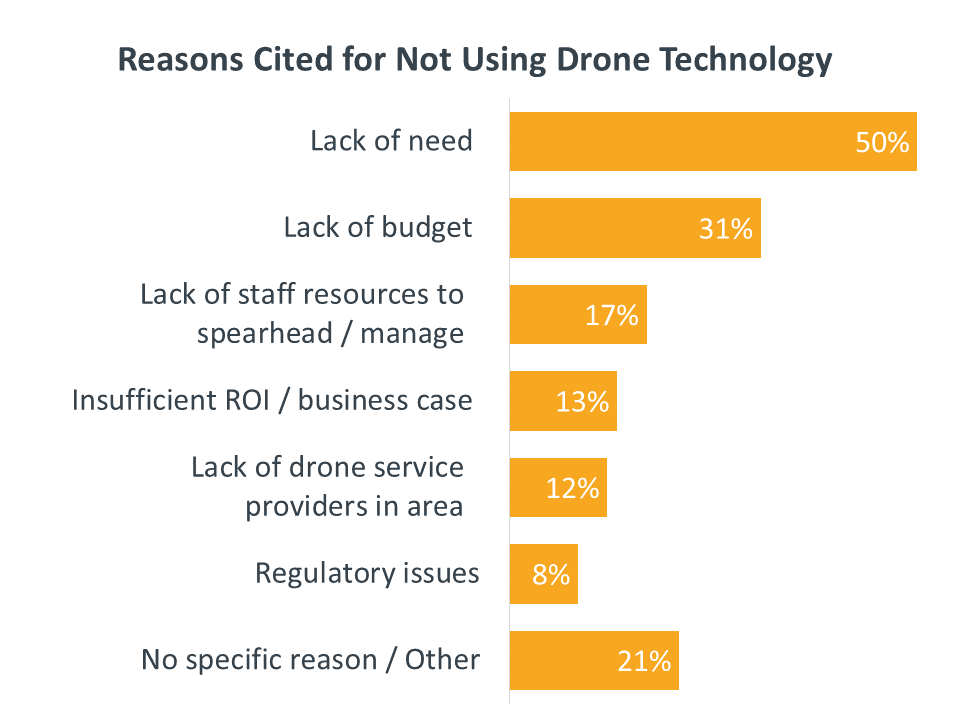

Of course, as with any new technology, there are some areas where the drone business model could use improvement or may not be a good organizational fit. In fact, half (50%) of the companies surveyed indicated no need for these technologies, at least at this time. There was never and may not ever be a use case that fulfills a specific need or addresses one of their key pain points.

The other major objection to drones is cost (31%). While competition may drive down price points on the vehicles and solutions over time, some organizations may never realize a return on investment with these technologies.

Other reasons for not utilizing drones could be potential sales opportunities for solution providers, operators, and pilots, including the objections of having too few resources (17%) and a lack of local providers (12%). Regulatory issues are not so easy to overcome, but efforts by the drone industry and business community to lessen some of those restrictions are already having a positive impact.

Among drone providers and technology firms with these types of specialized practices, a large majority (approximately 8 in 10) work with partners in some capacity, and the remainder indicate they are moving in that direction. Those relationships can be quite different from traditional channel/ vendor alliances.

IT firms may collaborate with several experts from various professions on different client engagements, including independent pilots, software developers, and data analytics experts. Commitments may vary based on project requirements and individual customer preferences and needs.

Types of firms customers report working with on their drone initiative

Drone technology partners should pay close attention to the shifting wants and needs of their customers. Nearly half of respondents who work with outside companies on their drone initiatives expect to continue working with their existing partners, but almost one-third indicated interest in seeking support from larger, more capable firms.

Expertise and competencies that business customers increasingly seek in drone providers

Emerging technology communities can be quite dynamic. As drones and the related solutions and services become more advanced, organizations may transition to new platforms and exit existing partner ecosystems. The early adopter stage can be frustrating for providers as they refine and redefine customer engagement models.

The survey results also illustrate a potential threat for smaller drone firms. Those providers may need to increase their commitment to avoid the status quo, boosting their portfolio of services and solutions to meet the increasing and changing needs of existing and potential clients.

While drone opportunities are increasing, technology firms cited several possible inhibitors that could limit growth, including government regulations and usage restrictions, diminishing professionalism, hobbyists operating without licenses, and their customers developing internal expertise.

Uncertainty makes planning and investment a challenge for drone solution providers. The lack of clarity around regulations and customers’ workforce aspirations could slow expansion plans, with many businesses moving from outsourcing to in-house management with emerging technologies. However, some customers will inherently miscalculate cost savings and complexities involved in that approach and shift some or all of their drone investments to outside firms.

Drone provider concerns about government regulation involve changes and uncertainty in the governing landscape. Top cited concerns include public nuisance/restrictions in usage, safety, security, and privacy.

Somewhat surprising, a little more than half of drone providers reported that they actively monitor regulatory developments, engage with lawmakers, or conduct other research-related activities.

CompTIA’s Drone Standards and Best Practices provides guidance in core operational, management, and delivery functions of an Unmanned Aerial Vehicle (UAV) services firm. Those controls cover these areas and more:

Learn more about the CompTIA Drone Standard at www.comptia.org/resources/comptia-standards-best-practices-drone

One of the major challenges in the drone market is finding, training, and retaining the skilled professionals who can fill various positions in this emerging technology segment. As mentioned previously, there are significant skills gaps across the community, which could have a considerable impact on industry growth predictions.

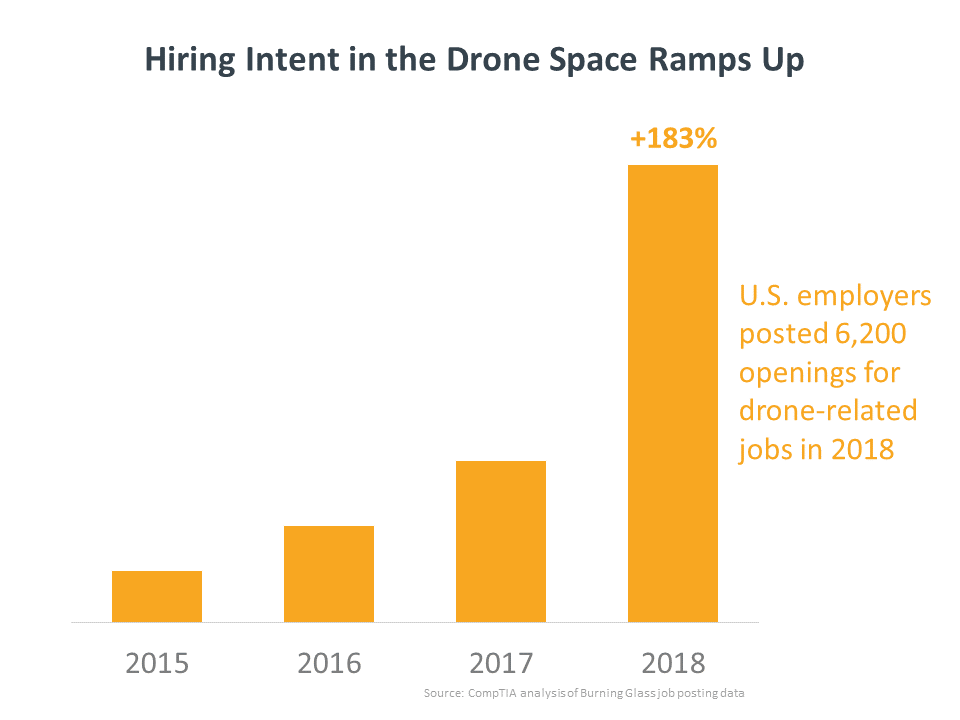

Let’s start with the demand; hiring intent increased 183% between 2017 and 2018, according to CompTIA’s analysis of research conducted by Burning Glass Technologies. The top industries actively recruiting drone talent include manufacturing, professional/technical services, real estate, and transportation, as well as other information gathering businesses and organizations. Those employment numbers are projected to continue rising at a steady rate as more organizations realize the benefits of aerial imagery, data collection, and transport.

Like many of today’s innovations, drones sit at the intersection of technology and business. That presents an opportunity for organizations with strong competencies in both areas that can create and deliver the types of aerial solutions that today’s businesses demand. Employment needs are greatest for key positions, including software developers, photographers/videographers, hardware engineers, systems engineers, and operators/pilots.

Study respondents suggest there is also increased demand for training options beyond the current IT/ technical and pilot certification programs, and global regulatory standards to stimulate worldwide adoption.

A growing number of institutions are expanding educational curriculums for these technologies, from traditional flight schools and aeronautical- and technology-focused colleges and universities to online pilot test preparation programs. While there are many options for pilot certification training, applicants should carefully evaluate course offerings, materials, and expectations upon graduation. The lack of standardized training requirements makes that process more difficult.

On the technology side, the curriculum for developers is more structured, with colleges and universities offering a variety of new and expanding programs. Some two-year colleges and technical schools also provide specific courses for those interested in developing drone solutions and building related support and services businesses. Educational and training options are expected to increase to meet the rising demand for skills in this rapidly growing market.

Top hiring industries

DSP staff skill development priorities

Drone technologies are being adopted by businesses of every size, from 2-3 employee real estate firms to Fortune 500 companies offering everything from delivery to surveying services. Not every organization will need a full-time staff of pilots and developers, or a technical team to support their activities. Third-party solution providers, operators, and independent pilots can be an attractive option for prospective clients who want to limit their investments and focus their scarce technical resources on more mission-critical activities.

SMB and enterprise organizations express similar thoughts about outsourcing drone-related activities when asked if these projects should be handled by internal staff members, an outside firm or individual, or some combination of both. According to MarketSight research, 18% of businesses prefer to outsource, 29% would employ their own resources, and more than half (52%) favor a mixed approachv.

Surprisingly, the largest deviation was with medium-sized organizations, which favored outsourcing (24% vs. 18%) or using internal staff (31% vs. 29%) over a combination (45% vs. 52%). These abnormalities may be the result of complications that can occur when employees are asked to work with third parties.

While enterprise organizations often have established best practices and policies for managing those relationships, mid-size companies may lack some of those resources. Solution providers, operators, and pilots should pay attention to potential conflicts with their clients and develop engagement strategies that will create positive work environments.

Most everyone who operates small unmanned aircraft systems in the United States must obtain a remote pilot certificate from the FAA, including hobbyists who may perform various types of freelance work. As a subset of the drone research project, CompTIA surveyed a number of these individuals about their future business prospects. Nearly two-thirds of the respondents (63%) hope to grow their hobby into a full-time business, and half are already involved in some form of commercial activities including shooting videos and images and performing inspections, mapping, and surveys.

With business use cases and drone utilization on the rise, that experience is in high demand. The hobbyist community is a great recruitment pool for organizations, including solution providers, operators, and other entities looking to expand their drone skill set.

This quantitative study consisted of three online surveys spanning 1). Current drone customers, 2). Prospective drone customers, and 3). Drone services providers and related technology firms. A total of 669 U.S. respondents completed the survey. CompTIA is responsible for the research design, data analysis, and output associated with this study. Any questions can be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA wishes to acknowledge and thank The Association for Unmanned Vehicle Systems International (AUVSI) for their input and support of this research initiative.

The Computing Technology Industry Association (CompTIA) is a leading voice and advocate for the $5 trillion global information technology ecosystem; and the more than 50 million industry and tech professionals who design, implement, manage, and safeguard the technology that powers the world’s economy. Through education, training, certifications, advocacy, philanthropy, and market research, CompTIA is the hub for advancing the tech industry and its workforce.

For the latest on the CompTIA Drone Advisory Council: https://www.comptia.org/councils/industry-advisory-councils/drone-advisory-council

ihttps://www.droneii.com/drone-investment-trends-update

iihttps://www.comptia.org/resources/it-industry-trends-analysis

iiihttps://www.idc.com/getdoc.jsp?containerId=IDC_P37304

ivhttps://www.pwc.pl/clarityfromabove

vhttps://www.marketsight.com/