Section 1: Background

Section 1 - Key Points

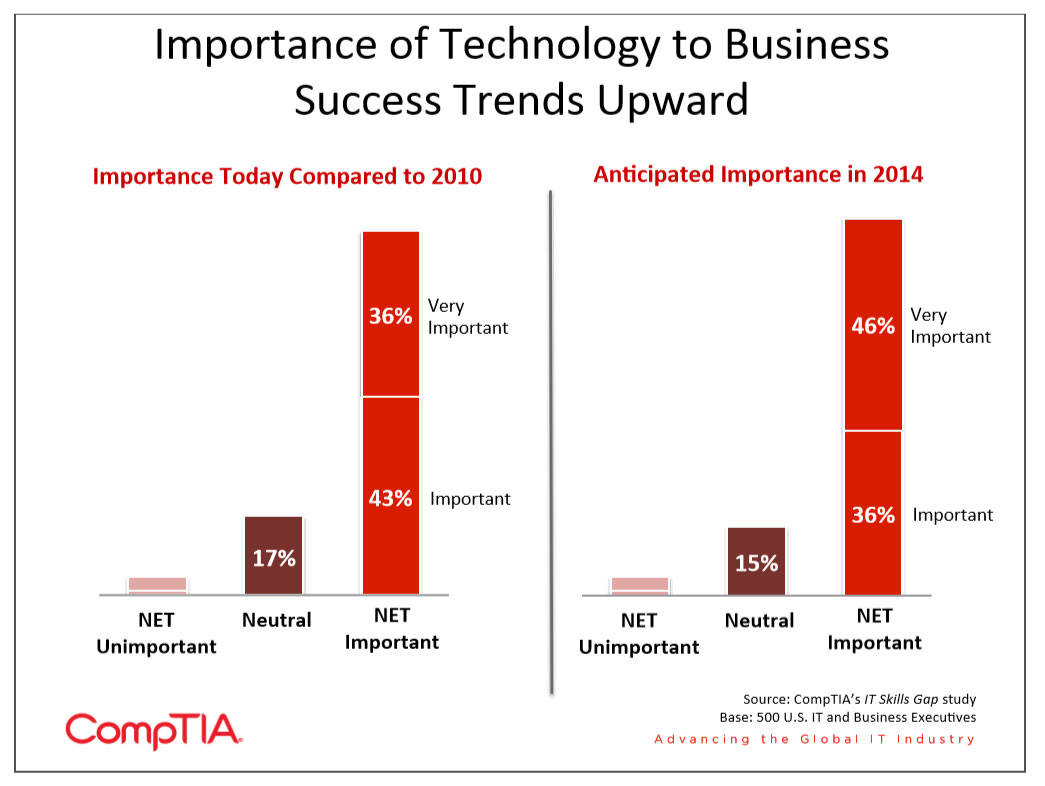

- The importance of information technology to the success of companies is growing.

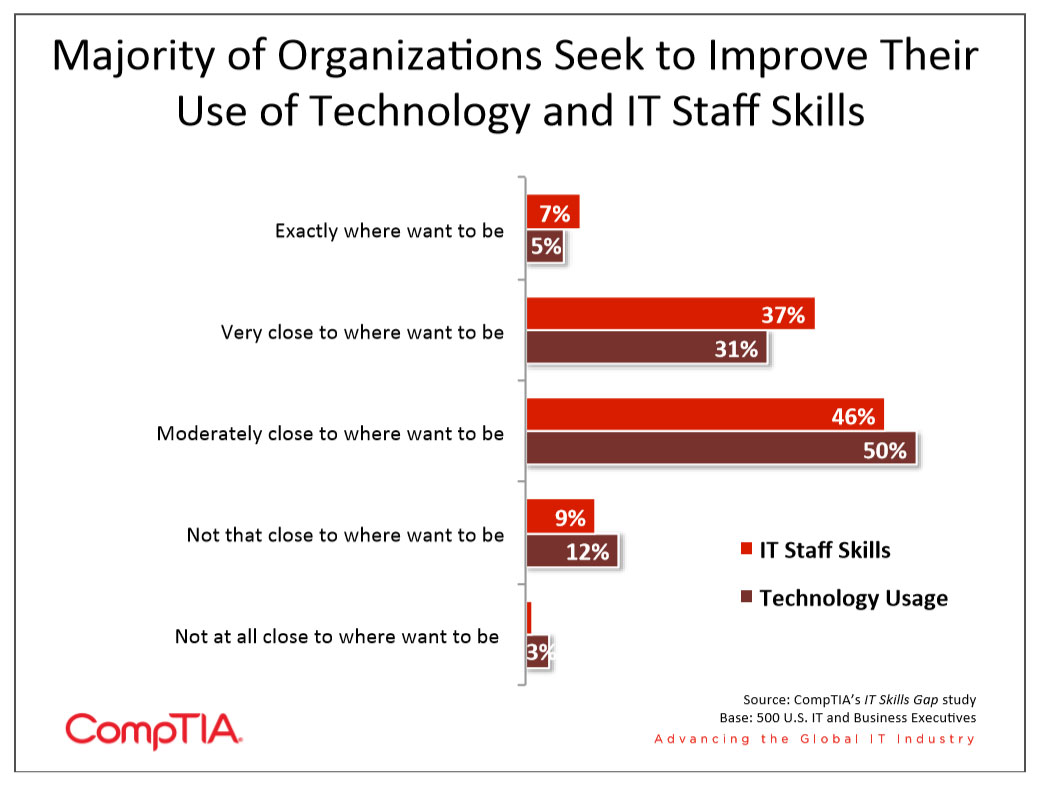

- Relatively few organizations report being exactly or even very close to where they want to be with technology utilization and staff skill levels.

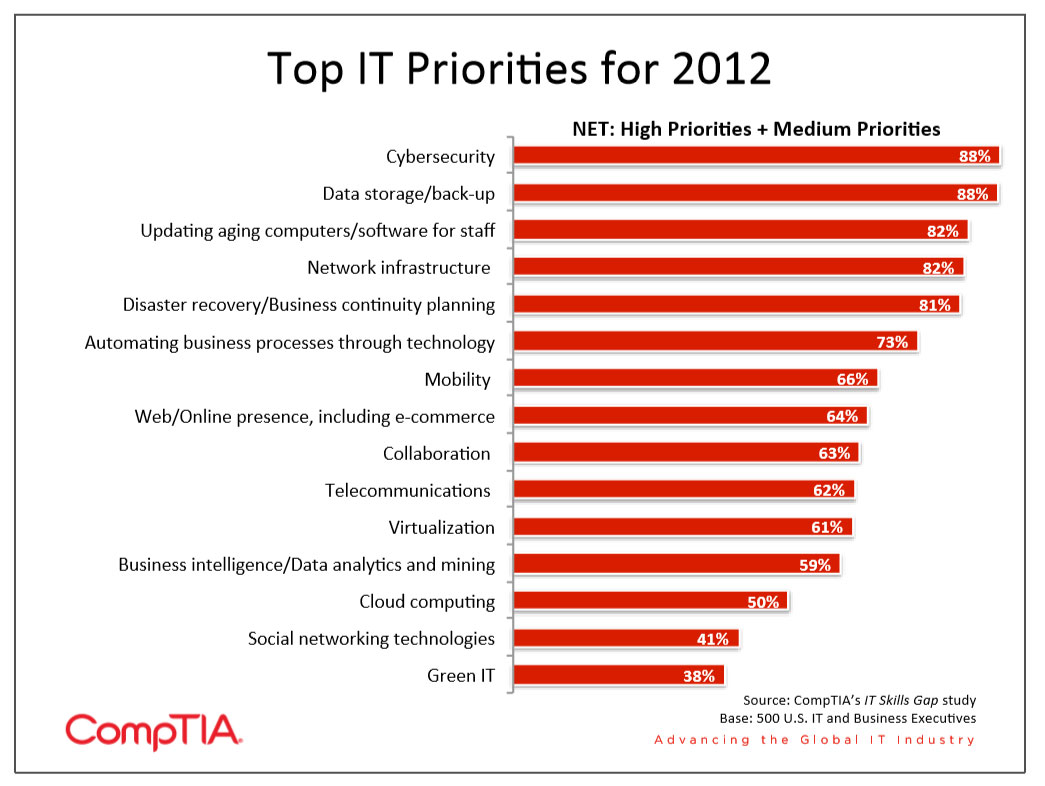

- The top IT priorities for U.S. companies still include security, data storage, refreshing aging equipment, improving network infrastructure, and disaster recovery/business continuity. Consequently, even with the core areas of technologies, new options translate to the need for new skills.

- Beyond core IT, the emerging areas of business process automation, mobility, collaboration, virtualization and a host of other technologies will be priorities for segments of companies. Again, each of these emerging areas will require both IT staff and end users have sufficient knowledge bases and skill sets to maximize the return on technology investment.

Technology Drives Business Success

The past few years have been an incredible period in innovation. Increasingly powerful and affordable computing, inexpensive mass storage, more expansive broadband coverage, new form factors and greater know-how to put it all together have had a significant impact on the economy and society.

Technology now affects more businesses in more ways than ever before. From SMBs to large enterprises and capital-intense industries to labor-intense industries, technology routinely sits at the center of business strategy.

The data reveals a few nuances to the technology importance ratings. Large firms place higher levels of importance on technology compared to smaller firms: 44% very important rating for large firms (500+ employees) vs. 33% for small firms (25-99 employees) and 30% for micro firms (5-24 employees). And, as expected, companies in the IT industry vertical place more importance on technology than companies in other verticals. But even in the case of the latter, a super majority rate technology as very important or important to their success.

Many Organizations Not Where They Want to Be with Technology / Staff Skills

Despite the acknowledgment of technology's importance to business success, relatively few organizations are where they want to be in their use of technology. Some of this can certainly be attributable to the resource constraints facing just about every organization. Even in good times, there is never enough budget to buy every sought after piece of hardware or software.

Beyond the investment itself, challenges in execution is the other major reason many organizations are not where they want to be in their use of technology. Failure to execute can take many forms. It could be a poor purchase decision — buying the wrong technology for the wrong job. It could be a poorly executed deployment, where new technology does not optimally integrate with legacy technology. Or, it could be a failure to adapt management, business processes or company culture. Few organizations are truly agile; most must overcome hefty inertial forces to change directions. Lastly, it could be a function of knowledge and the ability to apply that knowledge to business needs.

According to the research, relatively few organizations report being exactly or even very close to where they want to be with technology utilization and staff skill levels. To put this in perceptive, according to the U.S. Economic Census there are approximately 27 million businesses in the United States (employer + non-employer businesses). The 65% of organizations rating their technologically utilization at moderately close or lower represents nearly 18 million businesses. Additionally, it translates to over 15 million businesses that rate the aggregate skill level of their IT staff as less than optimal. Even modest improvements in these two areas could yield tremendous economic benefits.

IT Priorities Provide Clues to Knowledge and Skill Needs

The top five IT priorities for U.S. companies today probably look a lot like priorities that may have been published five or even ten years ago. Core issues of security, data storage, refreshing aging equipment and networks have been mainstays of IT departments since the advent of IT departments. Of course, there are now new variables that make decisions regarding core elements slightly more complicated. On-premise or cloud? In-house staff or outsource? Open source or proprietary technology? And the list goes on. Consequently, even with the core areas of technologies, new options translate to the need for new skills.

Beyond core IT, the emerging areas of business process automation, mobility, collaboration, virtualization and a host of other technologies will be priorities for segments of companies (see chart on accompanying page). Again, each of these emerging areas will require both IT staff and end users have sufficient knowledge bases and skill sets to maximize the return on technology investment.

Note: given the hype surrounding cloud computing, it may seem inconsistent for it to be rated a relatively low priority in this study. Keep in mind, that many of the top-tier priorities may involve a cloud element. For example, a company needing data storage and disaster recovery may evaluate the options and settle on a cloud-based solution. Others seeking business process automation may implement a cloud-based software-as-a-service option such as SuccessFactors for HR employee management. The take-away: many CIOs and business executives first think about the problem/needs and then the solution, which in some cases will inevitably involve a cloud element.

Section 2: IT SKILLS GAP CAUSES AND TRENDS

Section 2 — Key Points

- The great majority of employers (93%) indicate there is an overall skills gap, the difference between existing and desired skill levels, among their IT staff.

- Nearly 6 in 10 (56%) companies report being only moderately close or not even close to where they want to be with IT skills.

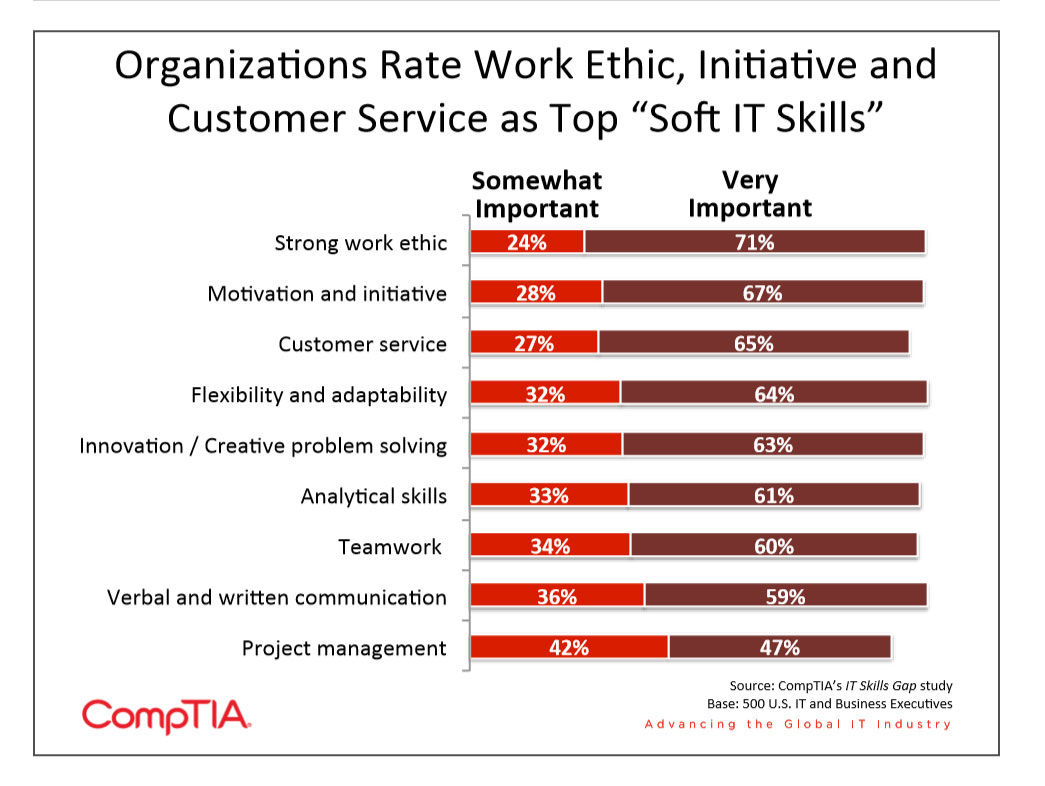

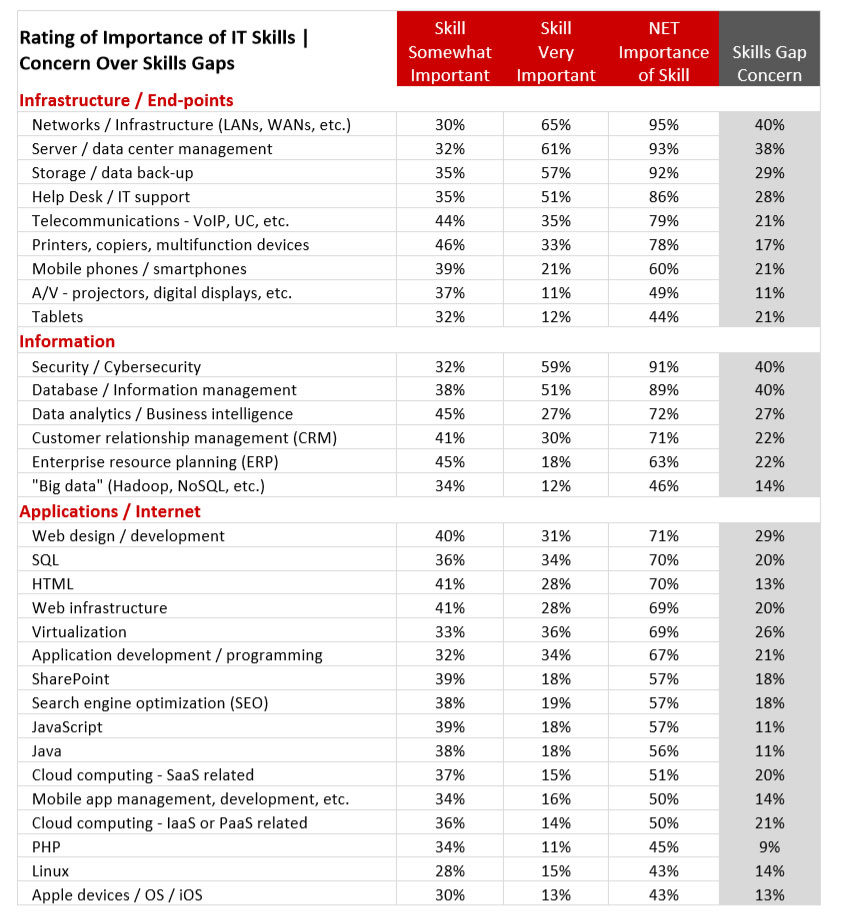

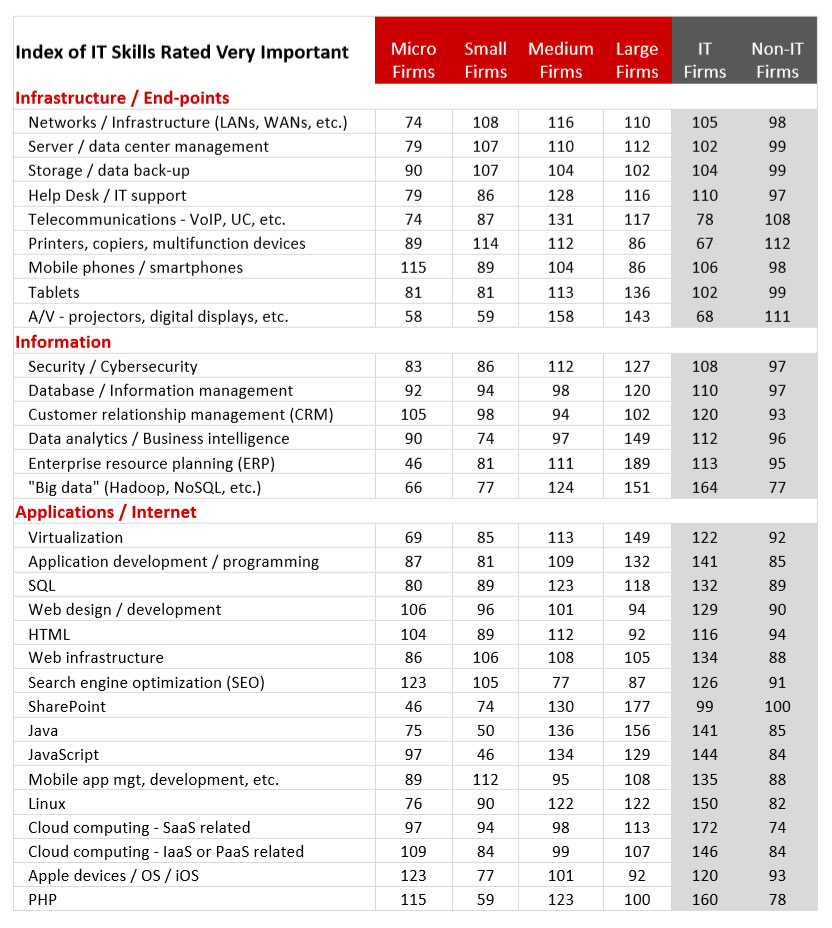

- Respondents place the highest levels of importance on skills associated with what could be described as the IT foundation such as networks, servers, storage, security, database management, and IT support.

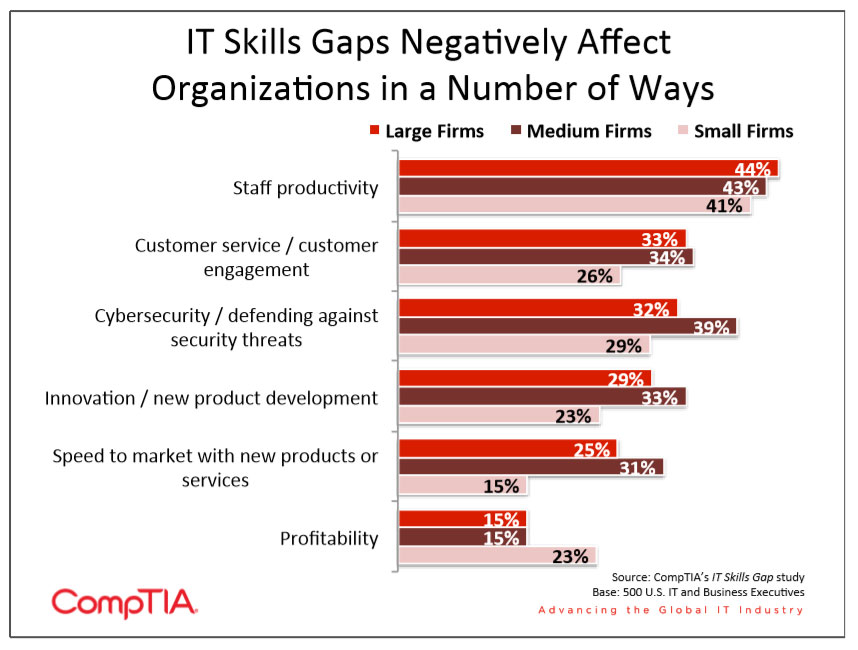

- Most (80%) organizations indicate their IT skills gap affects at least one business area such as staff productivity (41%), customer service / customer engagement (32%), and security (31%).

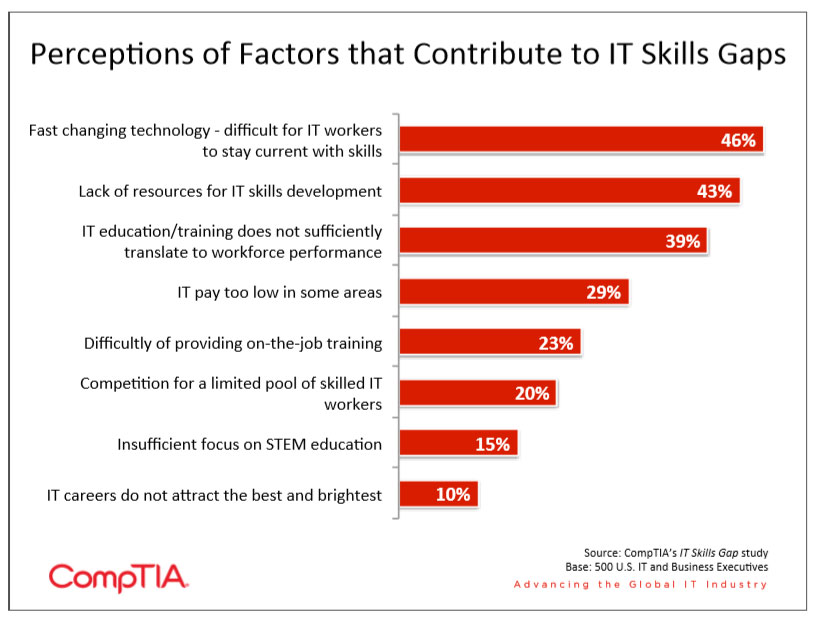

- Nearly half of respondents cite the dynamic nature of the tech space as a primary cause of skills gaps. Another top cause is the lack of resources for professional development.

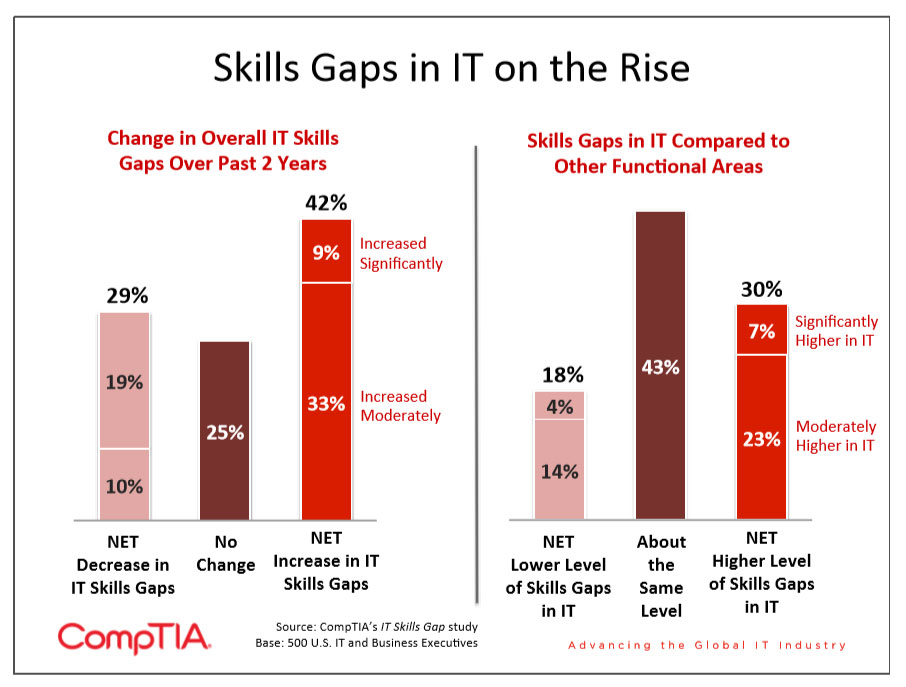

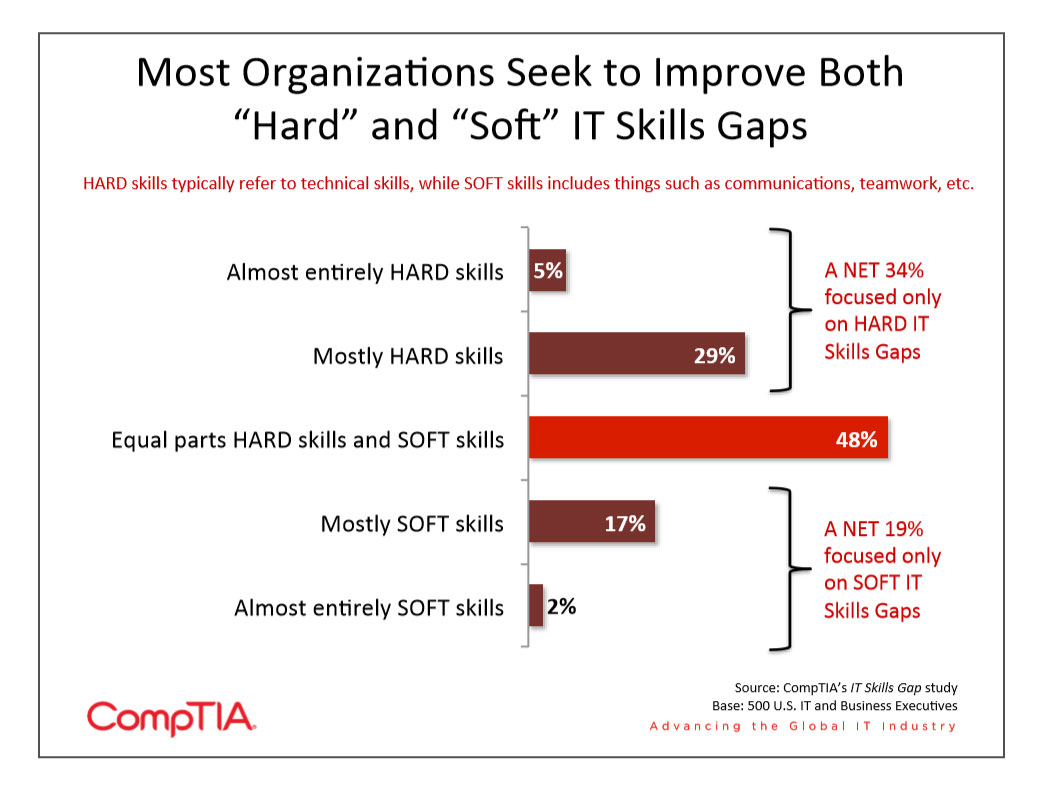

IT Skills Gaps Trend Upwards

It would be challenging, and somewhat troublesome, to find an organization that is perfectly content with the level of skills and expertise their employees possess. Couple that with today's unforgiving competitive environment and the skills needed to effectively support ever-changing technology, an overarching gap in IT skills is no surprise. As the data in CompTIA's State of the IT Skills Gap study echoes, a vast majority of employers (93%) indicate there is an overall skills gap, the difference between existing and desired skill levels, among their IT staff. Unfortunately, nearly 6 in 10 companies report being not close or only moderately close to where they want to be with IT skills. The distribution of results aligns with where the organization lies on the technology usage curve (see Section 1). In other words, gaps in IT skills are likely hindering companies' optimal utilization of technology and presumably hampering business success.

On a more positive note, at least some companies are making headway with their gaps in IT skills as 3 in 10 employers feel the IT skills gap at their organization has decreased over the past two years, which may be a function of their industry vertical, their IT needs or even the effectiveness of their internal training initiatives. Alternatively, it could be a situation of "not knowing what you don't know." Some organizations could be unaware of their IT skill needs, especially in emerging areas.

Nonetheless, few differences exist in comparisons of the data by company size, industry vertical or job role. This suggests widespread self-awareness and recognition of the issue.

Compared to other functional areas, such as marketing, finance, operations and so forth, 30% of executives believe skills gaps are more prevalent in IT. Validating the importance of industry-specialization skills, this percentage is considerably higher for those in the IT industry (40%) versus organizations outside IT such as government, education, finance, retail, healthcare, manufacturing (non-IT products), and other sectors (26%).

Analysis of IT Skills Needs and Gaps

In most organizations, strategic priorities align with and influence IT skills needs. Core IT priorities, as well as longer-term priorities in emerging areas (see Section 1), are reflected in skills ranking. Respondents place the highest levels of importance on skills associated with what could be described as the IT foundation —the fundamental elements of hardware, software and IT support required to exist in today's digital economy.

Top Tier IT Skills Priorities (NET rating of >70%)

- Networks / Infrastructure

- Server / data center management

- Storage / data back-up

- Cybersecurity

- Database / Information management

- Help desk / IT support

- Telecommunications / Unified communications

- Printers, copiers, multifunction devices

- Data analytics / Business intelligence

- Web design and development

- Customer relationship management (CRM)

Beyond core IT skills, needs vary based on a number of factors. For example, skills associated with mobile device management received an overall net rating of 60%, which places it as a mid-level need. Given the eye-popping adoption figures of mobile devices, a mid-tier skills need rating may seem questionable. However, there are a lot of variables at play. A company with a customer base in a limited geographic range that relies heavily on internal sales and third party fulfillment may need only the very basics from mobile devices, such as voice communication and email.

In many disciplines, importance ratings are similar across firm type, such as small vs. large or IT industry vs. non-IT industry. Notable differences do exist though (see tables on subsequent pages).

Summary of Notable Differences in IT Skills Importance Ratings:

Larger Firms

- Place relatively more importance on IT skills associated with virtualization, SharePoint, ERP, big data, cybersecurity, telecom and A/V

Smaller Firms

- Place relatively more importance on IT skills associated with search engine optimization

IT industry Firms

- Place relatively more importance on IT skills associated with big data, application development/programming, web design/development, mobile app development, Linux and cloud computing

Non-IT industry Firms

- Place relatively more importance on IT skills associated with telecom, printers/copiers and A/V

How to Read an Index:

An index is a way to compare relative differences among different segments of data. 100 = Overall rating. >100 =

Represents interest greater than the overall. The higher the number, the greater the interest relative to the overall score. <100 = Represents interest lower than the overall. The lower the number, the lower the interest relative to the overall score. A score of 90 means the respondent is 10% less likely than the average to rate the IT skill as

important. Conversely, a score of 110 means the respondent is 10% more likely than average to rate the IT skill as important. It's important to note, a high score only means there is a strong rating relative to the other segments. A score could be relatively high, but overall importance could be relatively low.

IT Skills Gaps Concerns

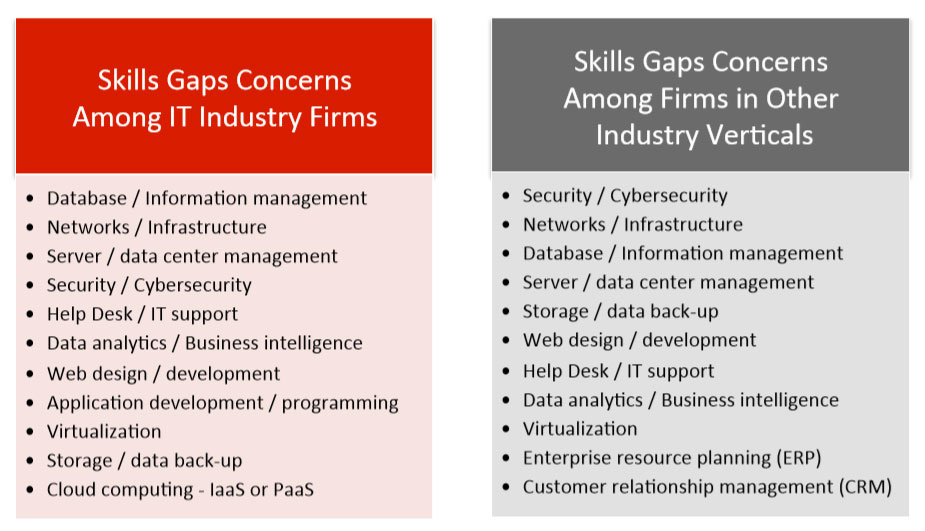

In many areas, firms operating in the IT industry vertical and firms operating in all other industry verticals share many of the same concerns over IT skills gaps. The core functions of information management, network infrastructure, security and data storage rate as top level areas of concern, where current or future skill sets are not at desired levels.

Help desk and IT support also rate as concerns. While the methods of providing IT support have evolved (think remote maintenance and monitoring) and the range of devices, locations and workers using technology have expanded, there continues to be a fundamental need for IT support services. For IT companies this may entail providing support to customers, while for companies in other verticals it may be the help desk function within the IT department.

The results indicate IT industry firms express slightly more concern over cloud computing skills gaps in the areas of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS). This is likely driven by competitive pressures — many IT firms are scrambling to build and promote their cloud-based service offerings. Obviously, inadequate levels of expertise will hamper those efforts.

Again, it's worth noting, low concern over a skills gap doesn't automatically mean the skill is unimportant or there is already an optimal pool of workers with the desired levels of knowledge and skill sets. Rather, it may be a reflection of where the technology is in its lifecycle. For example, the reason relatively few respondents express concern over skills gaps in big data or mobile app development may be because relatively few firms are far enough along in to have an understanding of skills needs.

As implied earlier, a company's shortfall in IT skills is likely to impede on other areas of the business. While it would be difficult to measure direct costs or opportunity costs, a large majority (80%) of employers point to at least one specific business area potentially affected by their organization's IT skills gap.

Top areas influenced by shortcomings in IT skills are staff productivity (41%), customer service / customer engagement (32%), and security (31%). It especially affects speed to market for IT businesses (34%) versus those in other industries (20%). Also interesting to note, smaller companies feel the punch in profitability more so than larger firms.

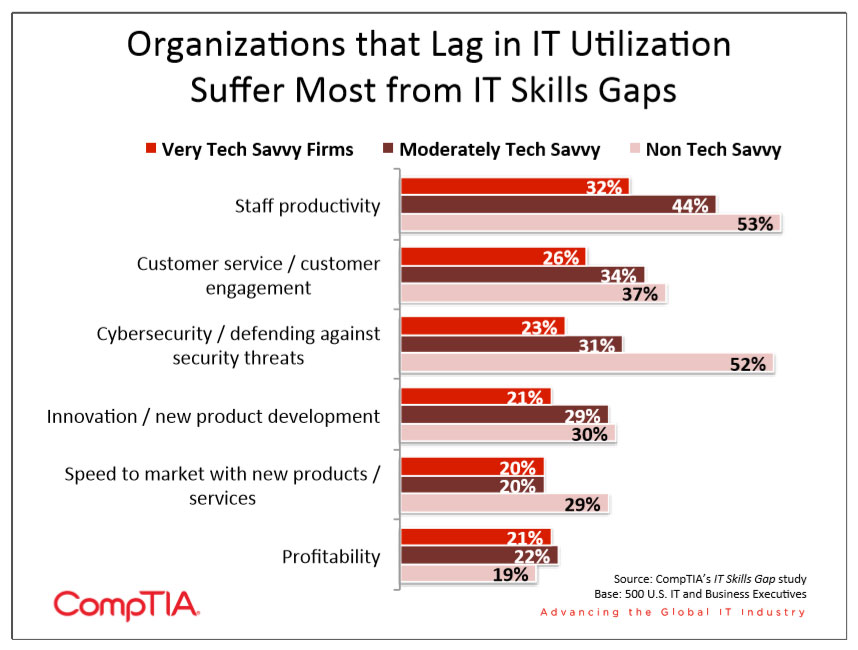

Additionally, the data validates that the companies significantly more likely to be negatively impacted by their IT skills gaps are the ones not close to where they want to be in using technology, i.e. "non tech savvy." As the chart below shows, the more "tech savvy" a firm is, the less of an impact their IT skills gaps have on business areas such as productivity, customer service, and security. This also holds true for the level of IT skills. The further away a firm's staff IT skills are from their organization's ideal, the larger the negative impact on other business areas. Hence, to reiterate the point made in Section 1, even modest improvements in the two areas of technology utilization and staff skill levels would likely yield massive economic benefits.

Many Factors Contribute to IT Skills Gaps

The research confirms most organizations recognize the presence of IT skills gaps and their potential harm to the bottom line, and yet, a plurality of firms acknowledge the need for improvement. The research helps explain this apparent disconnect. Simply put, there are many factors driving IT skills gap and few easy answers.

Overall, the greatest percentage of respondents cite the dynamic nature of the tech space as a primary cause of skills gaps. Innovation occurs faster and on more fronts, product lifecycles are now measured in months instead of years and market competition has never been greater. Consequently, organizations and IT staff are put in the difficult position of having to decide where to invest their limited time. A hedging approach whereby IT teams seek basic knowledge about a lot of technologies prevents organizations from becoming true experts in any one domain. Conversely, a focused approach exposes organizations to the risk of picking the wrong technologies and/or strategies.

The two other prominent factors are resource constraints and a perceived lack of workplace improvement following education or training. There are unique elements to these two issues, but also areas of overlap. Lack of resources is another way of saying the expenditure is a low priority or the perceived ROI is low. Similarly, concerns that IT education and training does not sufficiently translate to workplace performance is really another way of saying the ROI of education and training is too low.

While these concerns are certainly valid in some cases, more often than not, organizations struggle to measure and understand staff productivity, the value of time and the ROI of training. Without the proper metrics in place and the knowledge to use them, organizations will be ill-equipped to strategically overcome IT skills gaps (more on this topic in Section 3 of this report).

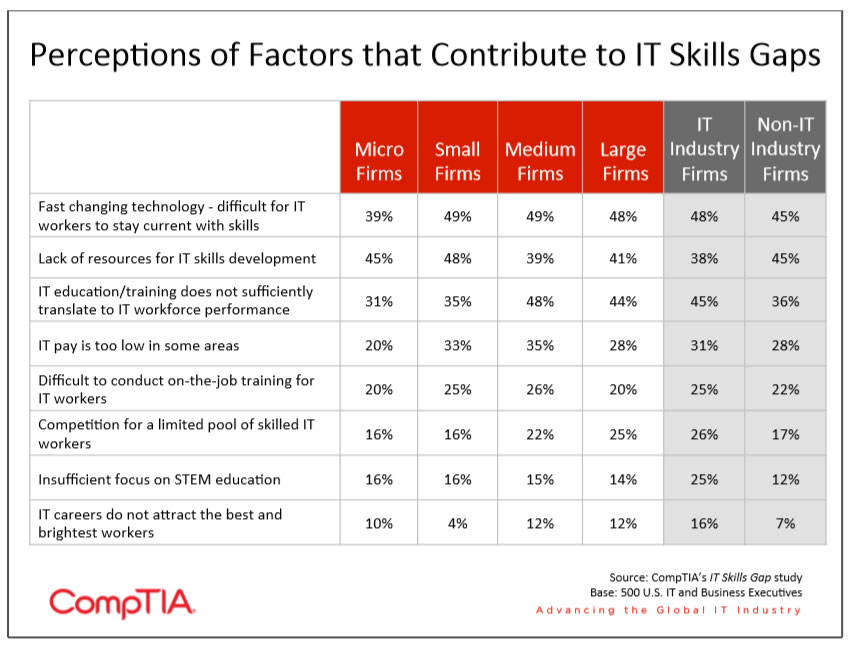

Summary Points of Contributing Factors to IT Skills Gaps by Segment:

Larger Firms

- Relatively more concerned about fast changing technology, insufficient transfer of education/training to workplace performance, competition for a limited pool of skilled IT workers

Smaller Firms

- Relatively more concerned about lack of resources for education/training

IT industry Firms

- Relatively more concerned about insufficient transfer of education/training to workplace performance, competition for a limited pool of skilled IT workers, insufficient focus on STEM education and IT careers not attracting the best and brightest

Non-IT industry Firms

- Relatively more concerned about lack of resources for education/training

Section 3: ADDRESSING IT SKILLS GAPS

Section 3 — Key Points

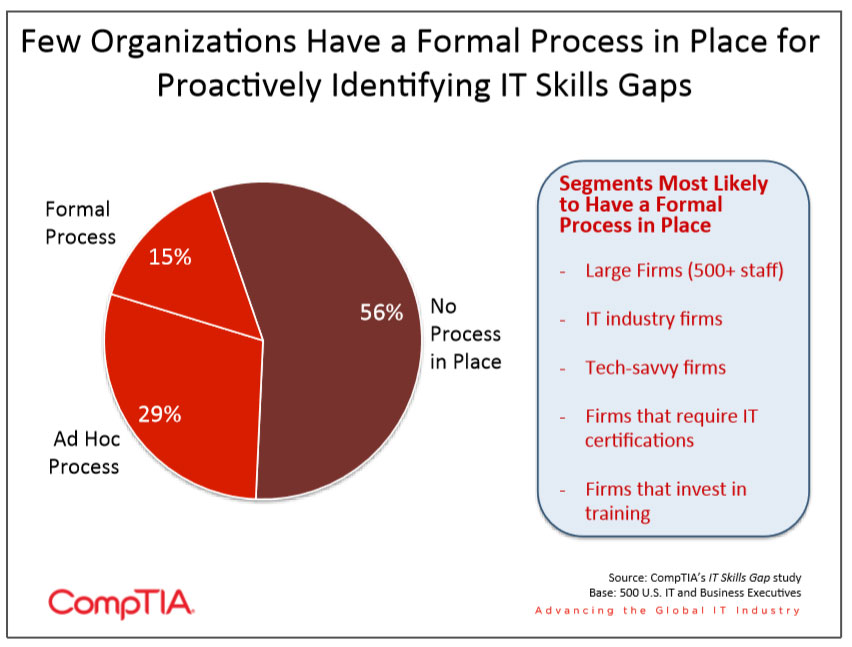

- More than half (56%) of employers do not have a process or method for identifying possible IT skills gaps among employees.

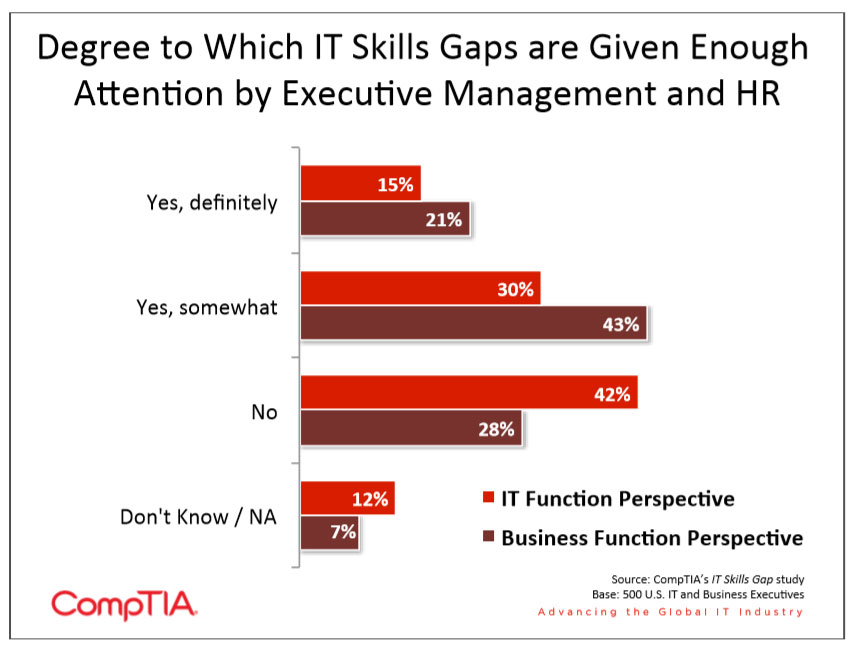

- About 4 in 10 (39%) IT and business managers believe that their executive management and HR do not give enough attention to IT skills gap issues.

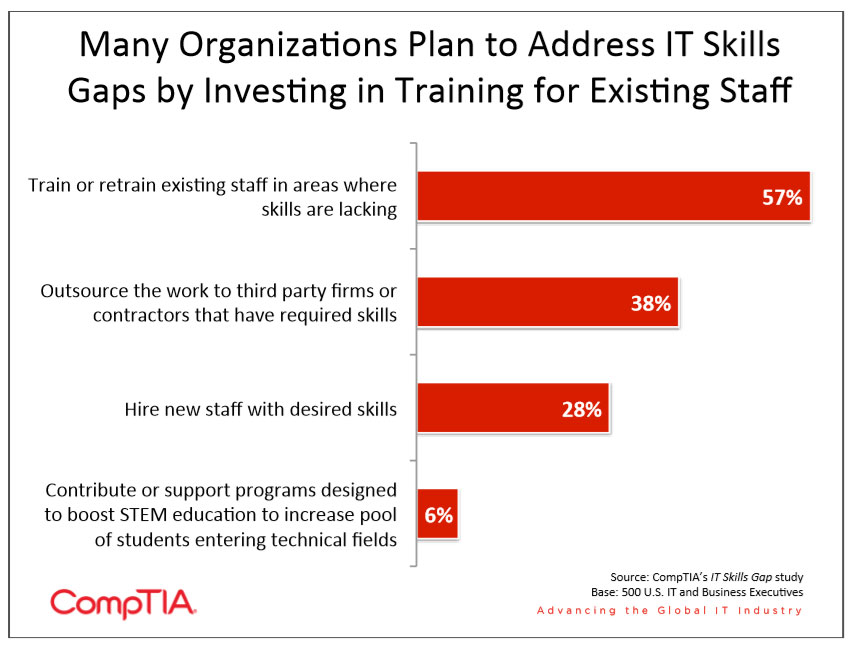

- Nearly 6 in 10 (57%) organizations address IT skills gap challenges via training or retraining existing staff in areas where skills are lacking.

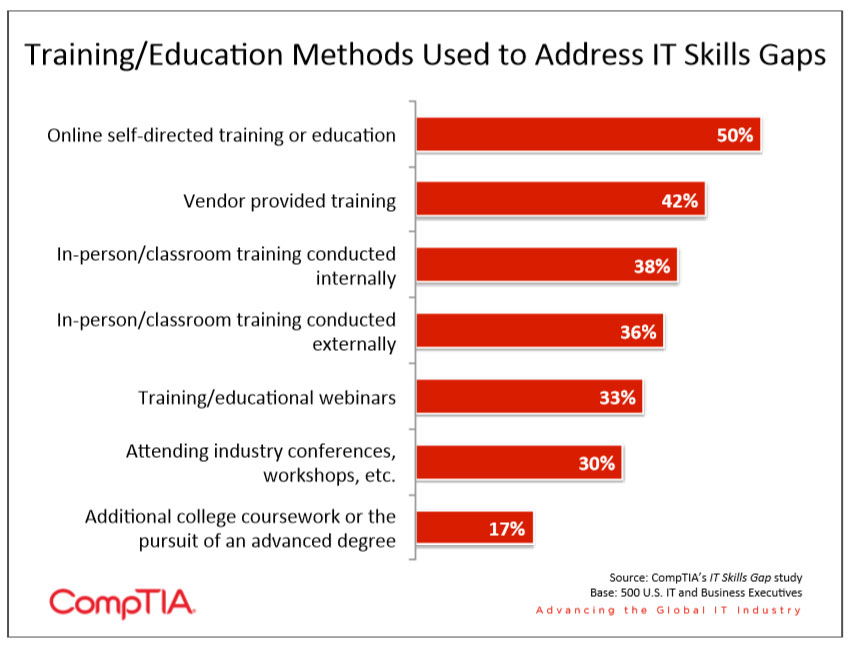

- The most common training method companies use for IT staff professional development is online self-study.

Most Organizations Reactive in Their IT Skills Gaps Strategies

Given the apparent scope of IT skills gaps and the impact on other areas of business, it's somewhat surprising that most organizations do not have a process or method for identifying possible IT skills gaps among employees. Related to findings in Section 2, companies struggle with a lack of resources for IT skills development.

Additionally, employers likely find it challenging to implement the framework to shift to a more proactive or formal process for at least discovering skills gaps. Or they may simply be unaware of the possible human capital or workforce management type of resources they could use. This points to an opportunity for IT firms to work with these organizations on appropriate solutions, showcasing the ROI of employee training as well.

Even if a firm recognizes IT skills gaps among its employees, not much can be resolved without the necessary support from executives and expertise from human resources. According to the data recently collected, clearly efforts are concentrated elsewhere when employers should try to focus more on their employees; their most valuable asset after all. Those in IT management roles are especially feeling the neglect. On the other hand, findings suggest that executives and HR professionals in IT firms are more attentive to IT skills gaps than companies outside of the IT industry.

Respondents cite a variety of reasons for why executive management and HR do not give IT skills gap issues enough attention. Common themes emerge around IT not being a priority (until something breaks), lack of budget/resources, the "cost" of training, and the lack of technical knowledge. Sampling of verbatim comments:

- "Their priority is with other areas. They don't recognize the importance of IT as it relates to overall strategy."

- "Funding and resources. Budget restraints are the number one issue!"

- "They do not understand the amount of time necessary to stay abreast of current IT trends and learning new skills."

- "Most do not realize or accept all the background challenges and maintenance actions that occur. They only see the finished product or higher level and higher visibility results without realizing all the background actions that were needed to have it occur."

Training Existing Staff Key

The primary way organizations address IT skills gaps challenges is via training existing staff versus turning elsewhere for new workers. Most professionals in executive or HR roles should already recognize that investing in staff training is typically a cheaper option than hiring new employees or outsourcing.

As CompTIA's Employer Perceptions of IT Training and Certification study highlights, there is a wide spectrum of professional development support organizations actually provide to employees. Nevertheless, nearly two-thirds view professional development as either extremely important (20%) or very important (45%). Another 28% declare it is moderately important. Interestingly, perhaps because of available resources or advancement opportunities, large-size companies place significantly higher importance on professional development than small-size firms.

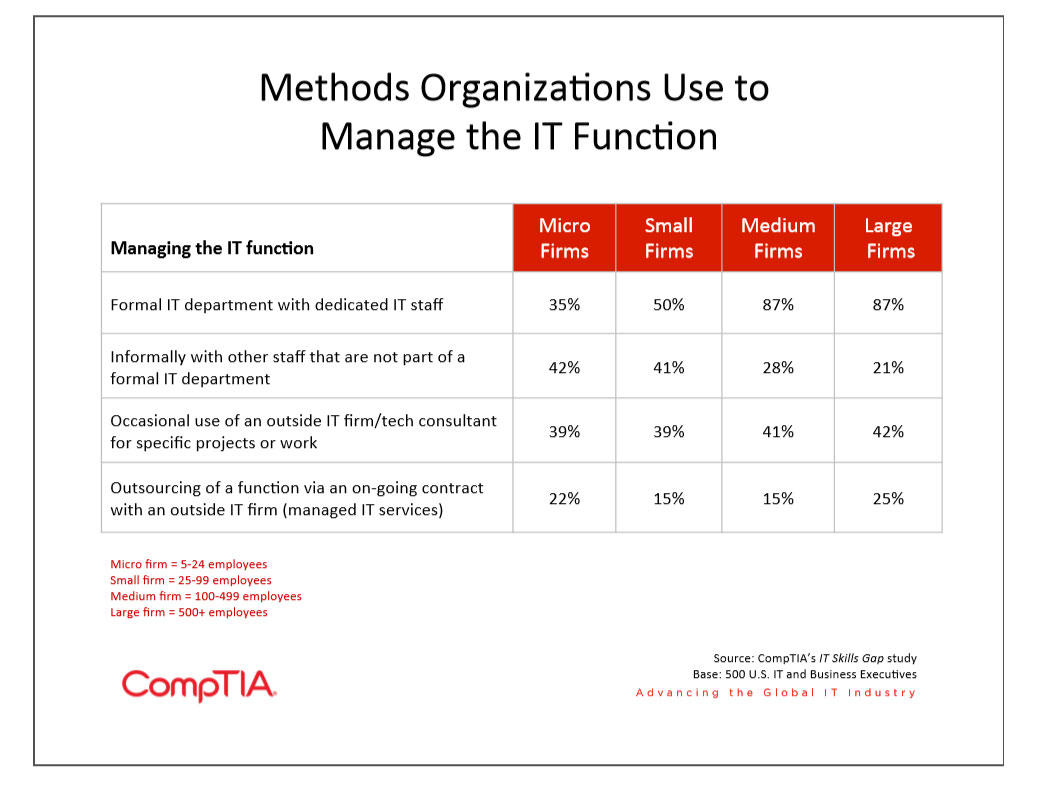

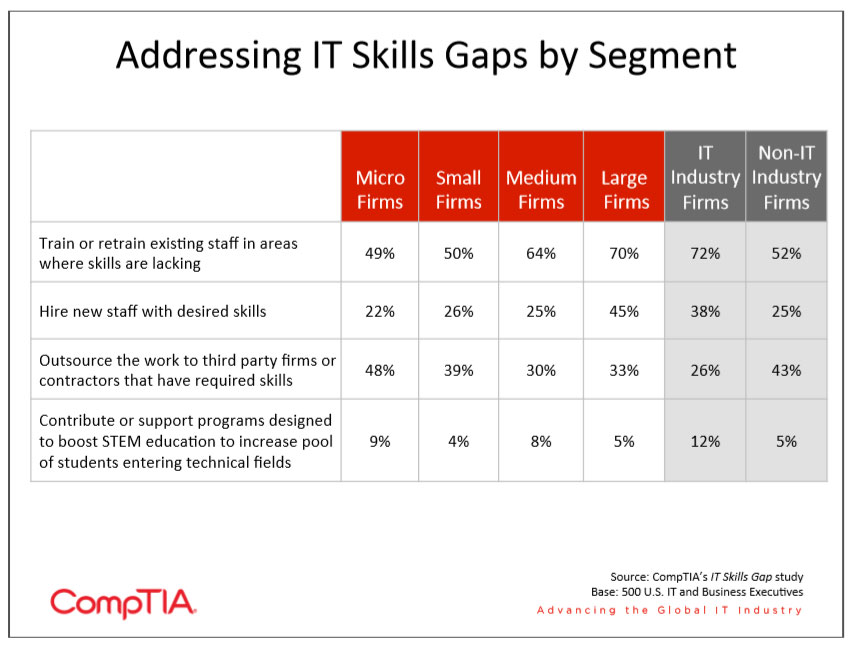

It makes sense that the firms more likely to train current employees are larger or in the IT industry. Conversely, the organizations more likely to outsource are micro-size. Therefore, as companies increasingly adopt emerging technologies and look to advance their skills support, IT service providers may want to first target selling to organizations with just 5-24 employees.

The American Society for Training and Development (ASTD) estimates U.S. organizations spent $125.88 billion on employee learning and development in 2009. Note: this figure includes expenditures on things such as operations, trainer salaries, and administrative costs. Nearly two-thirds of the US total ($78.6 billion) was spent on the internal learning function, such as staff salaries and internal development costs, with the remainder ($47.3 billion) allocated to external services such as workshops, vendors and external training sessions.

A growing piece of the training/education market is eLearning. As reflected in CompTIA's recent study, online self-study is the primary method companies use for addressing IT skills gap challenges. However, other types of training such as vendor-provided and instructor-led classroom are popular as well.

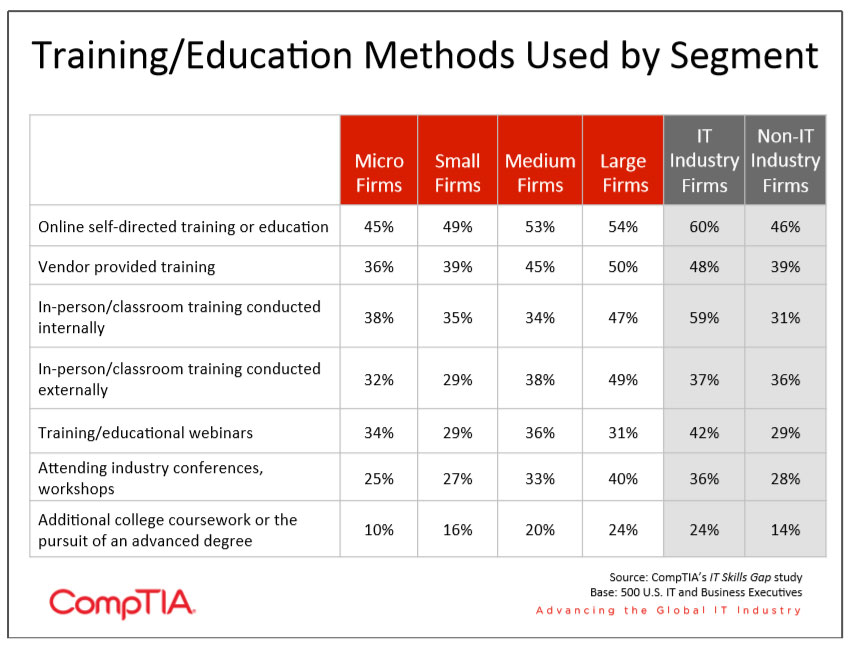

Factors such as company size and type of business may affect an organization's likelihood to use one type of training method over another. For example, large-size organizations are more likely to utilize nearly all the different methods covered in this study versus their smaller counterparts. IT workforce training providers may do well to primarily target the larger firms (500 or more employees), especially for vendor-provided training, classroom training, or industry conferences/workshops.

About this Research

CornpTIA's State of the IT Skills Gap study was conducted to gain a better understanding of the IT skills in demand and identify any existing or forthcoming IT skills shortages. The objectives of this research include:

- Identify which IT skills are and will be most important to employers

- Determine how well IT staff skills align with current/future needs of employers

- Examine professional development practices

The study consists of three sections, which can be viewed independently or together as chapters of a comprehensive report.

Section 1: Background

Section 2: IT Skills Gap Causes and Trends

Section 3: Addressing IT Skills Gaps

The data for this study was collected via a quantitative online survey conducted December 15, 2011 to January 23, 2012 among 1,061 IT and business managers involved in managing IT or IT staff within their organizations. The countries covered in this study include: Canada (n=125), Japan (n=109), South Africa (n=75), United Kingdom (n=250), and the United States (n=502).

The enclosed material covers the U.S. portion of the results ONLY. The international results are presented in a separate report.

The margin of sampling error at 95% confidence for aggregate results is +/- 2.9 percentage points. For the U.S. segment of the survey, margin of sampling error is +/- 4.3 percentage points. Sampling error is larger for subgroups of the data. As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence. CompTIA is responsible for all content contained in this series. Any questions regarding the study should be directed to CompTIA Market Research staff at [email protected].

CompTIA is a member of the Marketing Research Association (MRA) and adheres to the MRA's Code of Marketing Research Standards.

Download Full PDF

Download Full PDF