S trategy and tactics. In 2024, these two main ingredients to success will feature heavily on the minds of business owners, IT pros and the tech industry at large.

CompTIA’s IT Industry Outlook 2024 explores various aspects of the strategic and tactical sides of the technology industry, workplace and society today. Companies and individuals in the tech sector will have to decide for themselves which focus areas make most sense for the goals they are trying to accomplish, whether that’s revenue growth potential, professional development, product innovation or more. The tools and the knowledge, however, are there for the taking. Let’s look at the top 10 tech industry trends for 2024.

#1 AI Hype Fades, but Workflows Continue Evolving

Last year’s report was released just weeks before the launch of ChatGPT, and the hype cycle has been intense ever since. However, the initial hype around generative AI will likely wane in 2024 for a variety of reasons. Most companies will have to take a step back to build the proper prerequisites for modern artificial intelligence operations, but that doesn’t mean that exploration and pilot programs will grind to a halt. Along with new standalone products, a wide range of business applications will begin to incorporate AI as a feature.

In fact, just over 20% of technology companies surveyed are aggressively pursuing integration of AI across a wide variety of technology products and business workflows. Hesitation in adoption may stem from the challenges being encountered by early adopters. The top challenge for AI, whether that challenge comes from early experience or simply expectations around implementation, is around cost.

#2 Tech Providers Use AI to Run Better Businesses

Even those channel firms that choose not to sell AI solutions as part of their business can nonetheless boost profitability and reap positives by deploying AI functionality across their internal operations.

A net 56% of respondents say they are either experimenting with today’s AI solutions in some way or they have begun researching and evaluating the tools for potential future adoption. Top use cases for AI today include customer service and e-commerce.

Automation aims have always been a part of an MSP’s quest, but today’s AI will only accelerate and improve those efforts. That doesn’t necessarily mean massive job losses, though. Two thirds of MSP respondents said that use of AI by their company would either result in no change to their staffing levels – or a net gain.

As for the challenges? Issues with data quality and acquisition top the list. As has been copiously reported, generative AI outputs are only as good as the data the tool has at its disposal, which holds true in all uses.

#3 Governance Becomes a Focal Point for Cybersecurity and Data Operations

There is a growing demand for governance to ensure that implementation is following best practices. An emphasis on governance in the dynamic areas of cybersecurity and data will help align technology initiatives with organizational objectives.

When it comes to cybersecurity, traditionally governance doesn’t rank very high as a priority among companies. In fact, governance is at the bottom of the list when it comes to current focal points for cybersecurity initiatives, with only 5% of individuals citing governance as a driving factor. This low priority reflects a view of governance being centered on regulatory compliance. That aspect of governance will be growing more important, and there is also the need for more structured processes.

In the area of data, organizations are discovering the need to establish foundational data practices, consolidating and classifying data from various silos into a comprehensive picture that can be used for advanced analytics. Structured processes are needed here as well, along with the need to measure progress.

Although 44% of companies surveyed currently have well-defined governance processes for cybersecurity and data covering a wide range of topics, that number needs to be much higher to ensure that these critical domains are following best practices.

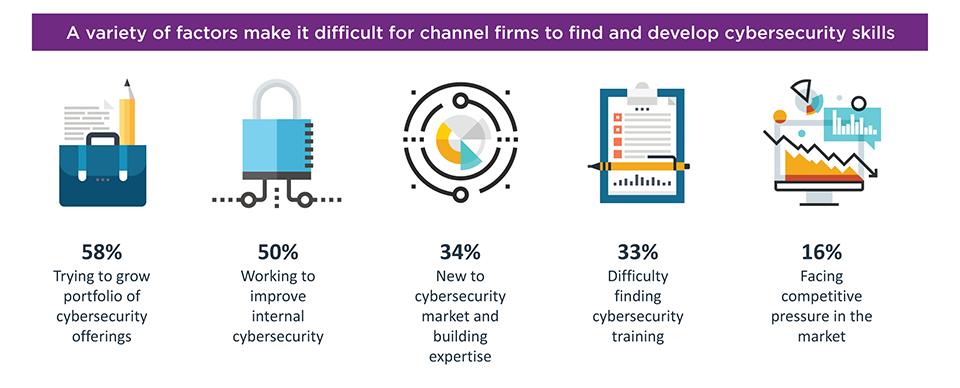

#4 Beyond-the-Basics Cybersecurity Becomes a Channel Skills Imperative

More than half (52%) of the channel companies surveyed say they are experiencing a shortage of workers and have a challenge finding job candidates with the cybersecurity skills their organization currently needs. The competition for talent is fierce, as companies in the IT channel must also vie for cybersecurity expertise across the economy at large.

CompTIA’s Cyberseek tool shows that there were over 660,000 cybersecurity-related job openings in the United States between May 2022 and April 2023, representing a 28% increase from the same time period in 2020. Meanwhile, CompTIA’s State of Cybersecurity 2024 study cited internal skills gaps as the top challenge to end user organization’s cybersecurity initiatives.

How channel firms plan to address their skills shortages and desire to move up the cybersecurity food chain is multipronged. Nearly half (45%) are taking a holistic approach and increasing overall spending in 2024 on all cybersecurity-related areas in the company. Others are taking the worker piece head on, with 43% providing training to existing employees to upskill them and another 38% looking outside to hire cybersecurity specialists.

#5 Cloud Architecture Accelerates Solution Complexity

Most emerging technologies, from internet of things (IoT) to blockchain to all the different variations of AI, are typically parts of a comprehensive solution instead of being individual products. With the lion’s share of the focus being placed on building these intricate solutions, it can be easy to overlook the importance of the foundation – computing infrastructure.

The majority of organizations have moved past the first stage of cloud adoption. The second stage will involve more depth, as companies build best practices around multi-cloud systems, financial operations (FinOps) and resilient architecture – paving the way to craft custom applications.

Most tech companies already view cloud systems as a necessity in their digital endeavors and more than one third feel that cloud computing is more of an accelerator. There is a fine line between the two camps—in today’s fast-paced environment, accelerating productivity or time to market could be its own form of necessity. Aside from enabling a corporate vision around technology, the availability of cloud systems also broadens the horizon in terms of vendor choice. The majority of companies surveyed say they are more willing to consider a variety of vendors, with 42% saying they are far more willing to explore new tech providers.

#6 IT Distributors Burnish Role as Online Marketplace for B2B

IT distributors, long the hardware fulfillment middle piece in the technology go-to-market chain, have been evolving their own business models to meet the cloud wave of computing. These companies are using their ample resources, scale and tech aggregator status to build marketplaces that serve channel firms (and vendors) in a variety of ways. Use of these digital engines is on the rise among MSPs, solution providers and others building complex multivendor cloud-based offerings.

In fact, 47% of channel firms said they are using distribution’s marketplace capabilities to aggregate multivendor cloud services to build solutions for customers.

Among the benefits of these partnerships? The capacity to mix and match multivendor products, tools and software subscriptions into a unified solution for customers; the right to choose who handles management of customer billing and payments; and finally, the ability to use distribution’s digital platform to white label their own e-commerce site.

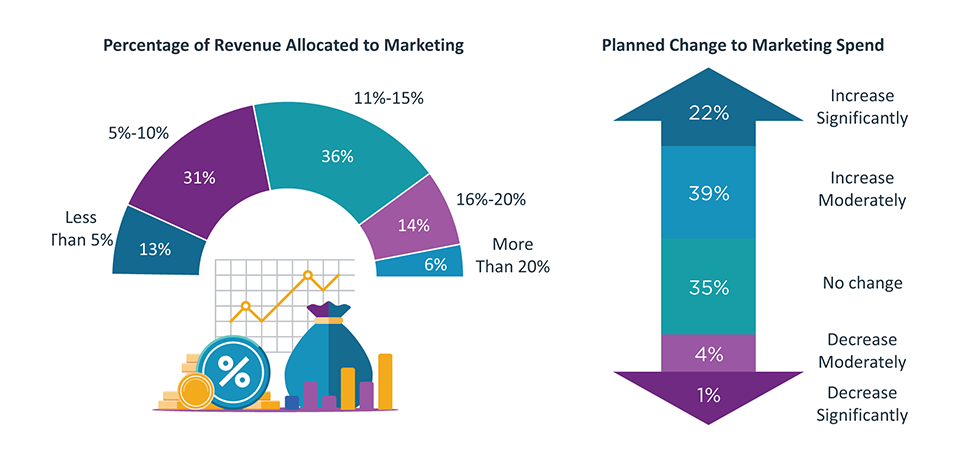

#7 Marketing Has Its Moment as an IT Business Differentiator

Companies are allocating more dedicated budget and other resources to marketing activities, hiring full-time marketing and generally demonstrating far more awareness about the significance of branding. Social media, influencer clout, content marketing, subscription models, decreased reliance on vendor and product as the brand and development of their own IP all factor into this awakening.

Channel spending on marketing activities is trending up with 61% of respondents planning an increase in their marketing spend in 2024.

Beyond spending increases, respondents reveal additional momentum behind marketing when asked to identify their organization’s general approach to the discipline. Four in 10 describe their marketing efforts as strategic, with a well-defined game plan consisting of key metrics and dedicated staff. Another 30% said marketing as a function is more tactical, comprised of mostly ad hoc campaigns and activities with limited or no dedicated staff.

#8 Productivity is the Driver for Digital Transformation

At the end of the day, digital transformation efforts are geared toward building a more productive workforce. Along with the implementation of new technologies, there must be a matching strategy around building skills, including upskilling current workers or pursuing new hiring.

Considering that work arrangements are tightly tied with productivity, the top two workforce priorities for organizations in 2024 are centered on making their employees as productive as possible. Many technology initiatives under the umbrella of digital transformation address this goal of productivity.

From a skills perspective, enabling employees to make the best use of new technology requires a multi-pronged approach. Internal training continues to be the most popular choice for building expertise, with 59% of companies expecting to pursue training options compared to 41% expecting to explore new hiring. As a capstone to training efforts, 41% of companies expect to pursue certifications for their technical staff.

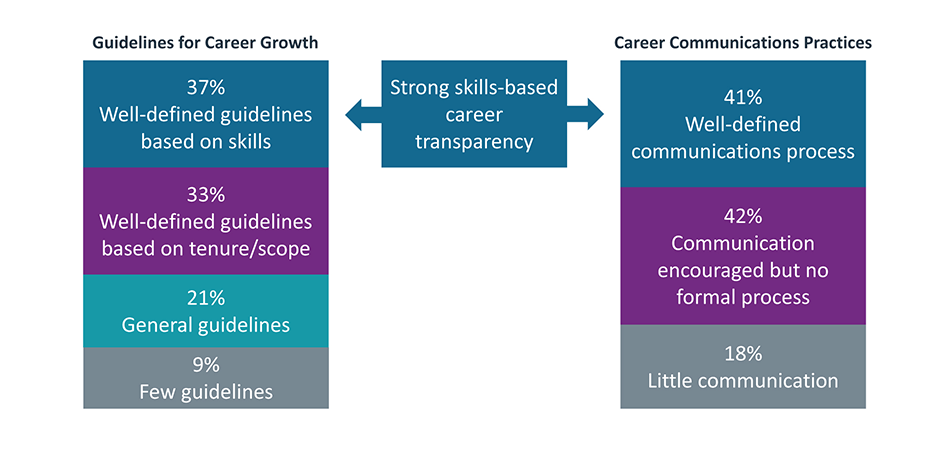

#9 Organizations Practice Skills-Based Career Transparency

When it comes to careers in technology, HR departments and hiring managers have moved toward a skills-based hiring approach, where individual skills are clearly defined for job roles and candidates are evaluated on their expertise in those skills.

Getting someone in the door is only the first step, though. Retention is also a major challenge in such a tight labor economy. As companies search for ways to keep the people they already have, extending the skills-based approach from hiring into career development is the next natural step. Adoption of skills-based career transparency requires two main components. First, there must be established guidelines for job roles and levels within roles based on the skills needed to perform the job. Second, there must be a culture of management focused on consistent and open communication.

#10 Companies Pursue Every Age Cohort for Staff, Customers

In discussions around the demographics of today’s technology sector, the popular refrain goes that a majority of business owners in the space are eyeing retirement and that the information technology industry desperately needs younger entrepreneurial talent to keep the segment relevant and vibrant.

Fear not. Respondents report that the changing of the guard is well underway, alongside what they describe as an already balanced mix of early-, mid- and late-career practitioners working in the channel.

A similar trend is playing out in the broader tech industry and its efforts to target certain customers. The 50-year-old-plus cohort has money to spend and is far more tech-savvy than the stereotypes depict. Whether it’s filling the need for tech talent or innovating the latest tech product, an openness to multigeneration thinking makes good business sense.

These technology industry trends will play out over the next twelve months as new chapters in the ongoing story of technology evolution. The best way to predict the future is to create it, and the firms that thrive in the coming years will be the ones leveraging technology to create new opportunities.

Methodology

This quantitative study consisted of two online surveys fielded to IT professionals and IT industry professionals during October 2023. A total of 513 professionals based in the United States participated in each survey, yielding an overall margin of sampling error at 95% confidence of +/- 4.4 percentage points. This survey was also fielded in ANZ, ASEAN, Benelux, DACH and UK/Ireland. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected Code of Standards and Ethics.

About CompTIA

The Computing Technology Industry Association (CompTIA) is a leading voice and advocate for the $5 trillion global information technology ecosystem and the estimated 75 million industry and tech professionals who design, implement, manage and safeguard the technology that powers the world’s economy. Through education, training, certifications, advocacy, philanthropy and market research, CompTIA is the hub for advancing the tech industry and its workforce.

CompTIA is the world’s leading vendor-neutral IT certifying body with more than 3 million certifications awarded based on the passage of rigorous, performance-based exams. CompTIA sets the standard for preparing entry-level candidates through expert-level professionals to succeed at all stages of their career in technology. Through CompTIA’s philanthropic arm, CompTIA develops innovative on-ramps and career pathways to expand opportunities to populations that traditionally have been under-represented in the information technology workforce.

Read more about Industry Trends.

Download Full PDF

Download Full PDF