Section 1:

Market Overview

Key Points

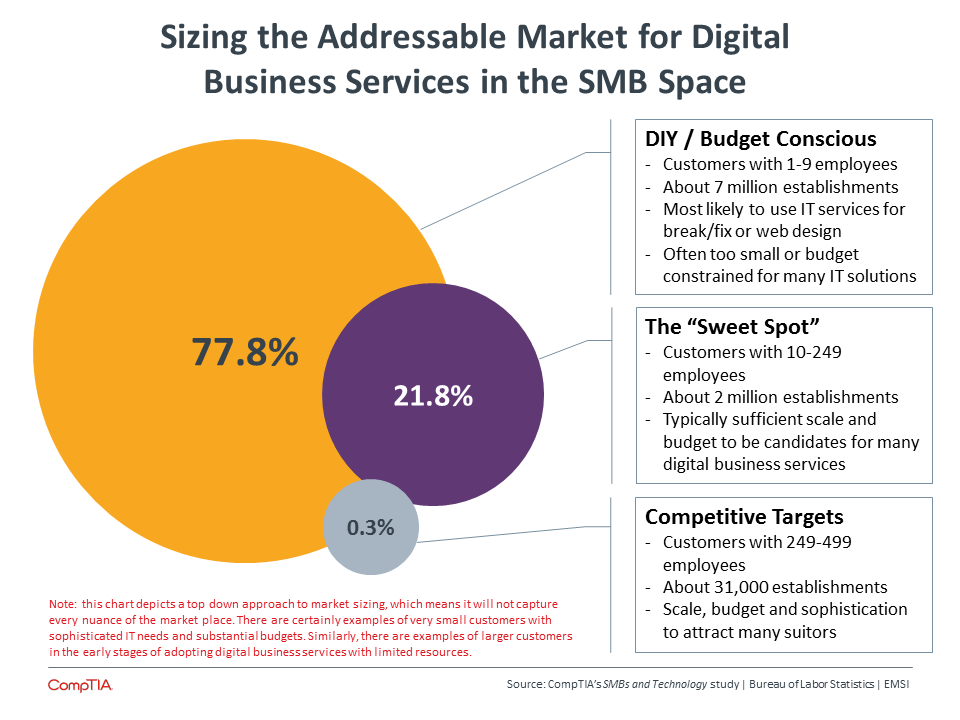

- Small and medium businesses (SMBs), typically defined as having fewer than 500 employees, are a major part of the U.S. economy. These firms represent 99.7% of the six million total U.S. employer firms, and have generated 63% of net new jobs over the past 15 years.

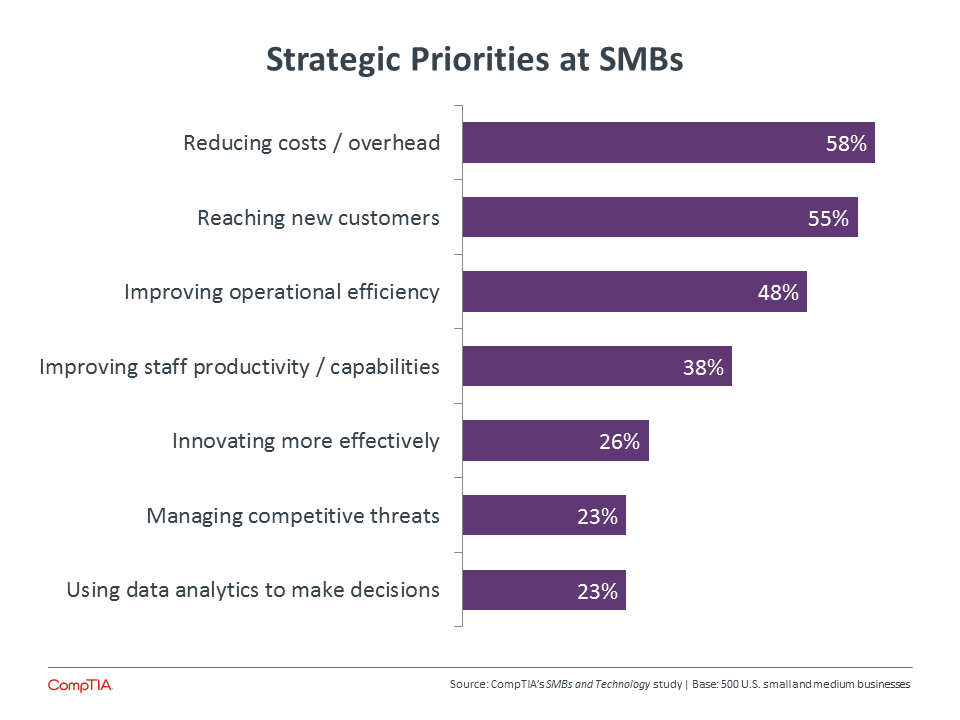

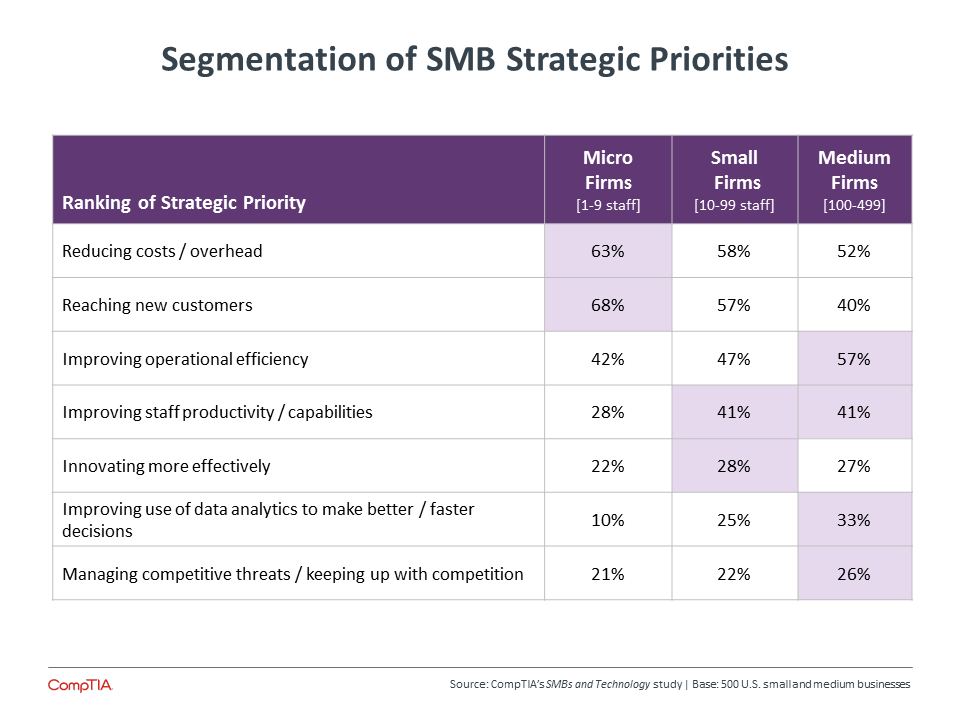

- As companies of all sizes begin to view technology as a strategic imperative, SMBs are also changing their unique relationship with IT. While reducing costs or overhead is still the prime strategic driver (cited by 58% of firms), reaching new customers implies a desire for growth and diversification (cited by 55% of firms).

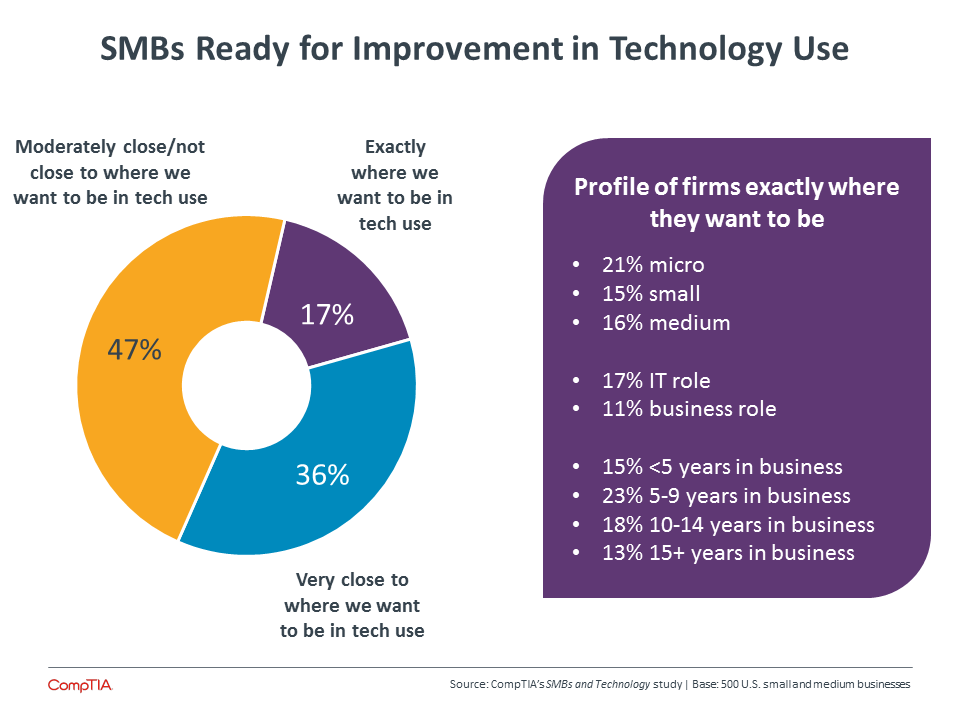

- SMBs may want technology to drive new business for them, but many are not currently in an ideal position. Only 17% of SMBs say that they are exactly where they want to be with technology, with medium-‐sized businesses and lines of business appearing to be a sweet spot for pushing new technology usage.

The Small and Medium Business Market

Although large companies tend to dominate the headlines and have a greater effect on the shape of business due to their size and scope, small and medium businesses account for the vast majority of American organizations and drive significant economic activity. Consider the following statistics from the Office of Advocacy of the U.S. Small Business Administration (SBA):

Small businesses (defined by SBA as fewer than 500 employees):

CompTIA uses the following definitions for

different segments of the SMB market:

- Micro firms: 1-9 employees

- Small firms: 10-99 employees

- Medium-sized firms: 100-499 employees

Note: these are firms with employees and payroll. Following Bureau of Labor Statistics categorization practices, self-employed workers are counted separately.

- Represent 99.7% of the six million U.S. employer firms. (In addition, there are over 21 million non-‐ employer firms, many of which are businesses run by a single owner.)

- On an establishment basis, there were a total of 9 million in 2014. An establishment is defined as a business entity; a single company may have multiple establishments (aka offices or locations).

- Have generated 63% of net new jobs over the past 15 years (driven primarily by startups).

- Employ 48.5% of all private sector employees.

- Pay 42% of total U.S. private payroll.

- Account for 37% of high-‐tech employment.

- Generate 33% of export value.

- Using IDC’s slightly broader definition of SMB (1-‐999 employees), IDC estimates this segment of U.S. customers spent more than $152 billion on IT hardware, software and services in 2014.

- Gartner estimates SMBs account for approximately 44% of IT spending globally (note: Gartner also defines SMB as 1-‐999 employees).

The small and medium business market is also very dynamic. According to the SBA Office of Advocacy, the most recent Census data showed approximately 409,000 employer firms beginning operations in 2011 and approximately 471,000 firms closing that same year. About half of all new firms last five years, and one-‐third reach their ten-‐year anniversary.

In times of economic uncertainty, the small and medium business market is keenly watched as an indicator of employment and spending trends. According to the quarterly Wells Fargo/Gallup Small Business Index from December 2014, 71% of small businesses expect their financial situation to be very good or somewhat good over the next 12 months, and 26% plan to increase the number of jobs at their company. Both of these numbers represent increases from index scores earlier in 2014. This sentiment is also mirrored in CompTIA’s 2015 Outlook numbers, where small and medium businesses expect industry growth of 5% or greater, in part due to optimism about their firms’ prospects.

Thanks to the impact on the economy of small business, the U.S. government takes special note of this segment. Both the House and Senate have committees focused on small business. These committees were created in the 1940s and have been permanent standing committees for at least three decades. Their purpose is to evaluate all legislation passing though Congress for effects on small business, giving weight to the concept that small businesses have distinctive needs yet substantial economic bearing.

SMBs and Technology

Small and medium businesses have a unique relationship with technology, and that relationship is growing more critical. Without an abundance of capital to invest on technology initiatives, many firms seek the best value or the minimum requirement investment. On the other hand, there is an increasing sense of urgency since many technologies available today can significantly increase the abilities of a smaller business and create capabilities on par with a larger enterprise.

Companies of all sizes are beginning to view technology more as the primary vehicle for achieving objectives instead of simply a support mechanism for day-‐to-‐day operations. For small and medium businesses, the strategic goals that can be met through technology reflect both the current realities these firms face and the future possibilities they envision.

Across a broad range of companies, cost reductions have started to drop in priority as many firms have been cutting costs for several years and are now pursuing expansion or innovation. However, smaller businesses still feel financial pressures, especially as resources become more limited. Reducing costs is cited as a top priority among 63% of micro-‐sized companies, 58% of small companies, and 52% of medium-‐sized companies.

Other top priorities—such as improving operational efficiency and improving staff productivity—also highlight the desire to reduce overhead burdens and make the business more productive. SMBs understand that technology can deliver these benefits, and it is the primary motivation behind most technology decisions.

There is another strategic imperative that drives the approach to technology. Fifty-‐five percent of SMBs cite reaching new customers as a top priority. These companies, just like larger firms, recognize that business environments and customer behaviors are changing drastically. Since those changes are largely driven by technology, it makes sense that this objective will create new thinking among SMBs about the role of technology in their organizations.

This dual role of technology, with operational efficiency on one side and innovative goals on the other, is not exclusive to SMBs, but it is encouraging to see that they recognize this dynamic. The innovative side of business technology is forcing new practices, new policies, and new partnering; and business growth and even sustainability are dependent on embracing these new areas.

With this perspective in mind, are SMBs in a good position with their current technology? For the most part, the answer is no. Only a small percentage of firms feel that they are exactly where they want to be, and the profile of those firms suggests that their self-‐assessment may be somewhat optimistic.

Looking at firm size, the very smallest firms are most likely to say that they are exactly where they want to be. These firms have the fewest resources to spend on technology or even to explore new options. It is reasonable to assume that these firms simply cannot envision being in a place to use technology any differently than they are today, but new models of technology management may open their eyes to new possibilities.

Considering job role, the gap between employees in an IT function and employees in a business function is not enormous, but it still tracks with the current view of non-‐technical employees becoming more tech savvy and pushing for technology that will help them meet objectives. Of course, the smallest businesses will not have formal IT departments, but this is still an area to watch for third party firms that play the IT role for their small customers.

Finally, the age of a business plays a role in their satisfaction with technology. The sweet spot seems to be those companies that have been in business between 5 and 9 years. These firms have built enough of a foundation to pursue the technology they need, and they are not overly encumbered by past decisions or investments. Younger firms tend to be more resource constrained, and older firms tend to have infrastructure pieces in place that may hinder flexibility.

As firms consider their current position, they are also thinking about how they will take the steps to improve that position in the future. A small group of SMBs (12%) are basically a blank slate, working to figure out their business needs and then build the strategy for meeting those needs. Another 46% feel that they are well positioned with a vision and strategy for execution. This group is skewed towards medium-‐sized business, and there are doubtless still some opportunities for presenting new ideas that may not have been considered.

The best opportunity, though, lies with the 43% of SMBs that claim to have some ideas for where they would like to go, but are unsure of the strategy for achieving those goals. These companies already have the piece that they are best suited to bring to the table—ideas for transforming their business and taking it to the next level. The piece they need is the technology that will take them there, and the connection between those two pieces is the primary challenge that must be addressed.

Appendix

Section 2:

Usage Patterns

Key Points

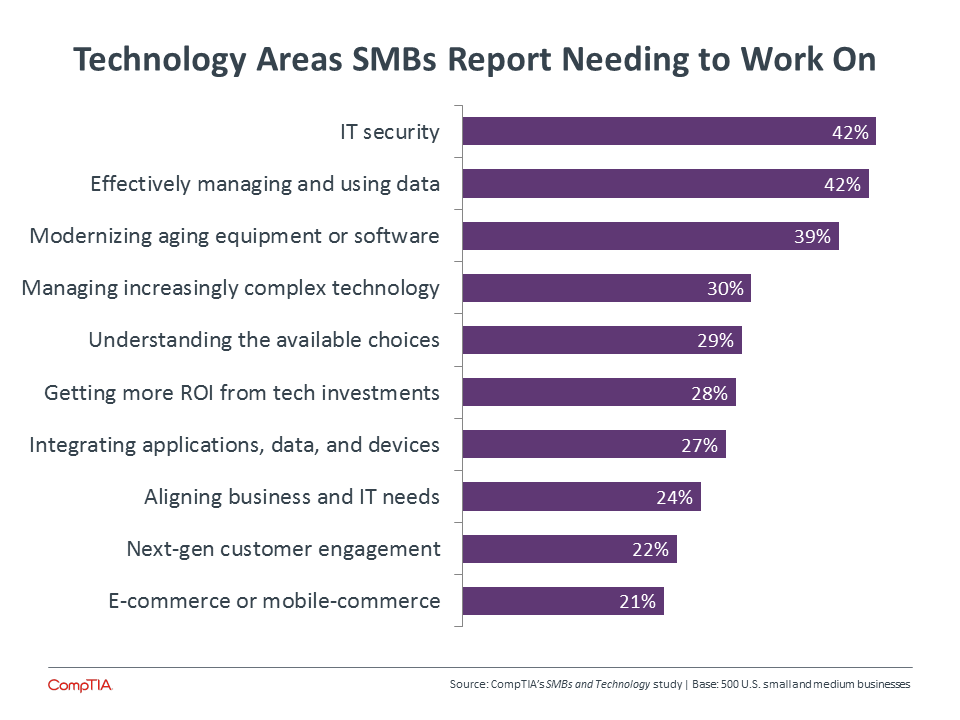

- As the technology landscape grows broader and more complex, SMBs are seeing a range of technology issues that they need help with, led by IT security (42% cite as an area for improvement), data management (42%), and modernizing architecture (39%). Work in these areas will require not only new technology, but also new workforce education and new processes.

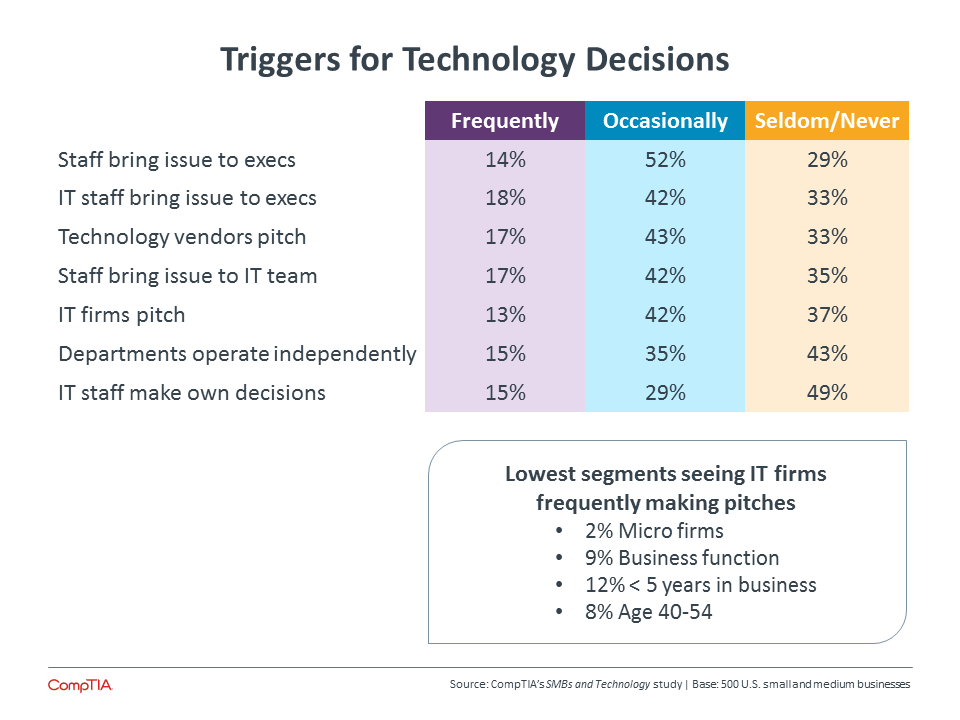

- There are many different triggers for technology decisions at SMBs, with executives or business owners typically seen as the decision-‐makers. A relatively low number of firms typically see IT companies making technology pitches, and there is opportunity to create a businesses discussion around technology at the smallest and youngest firms.

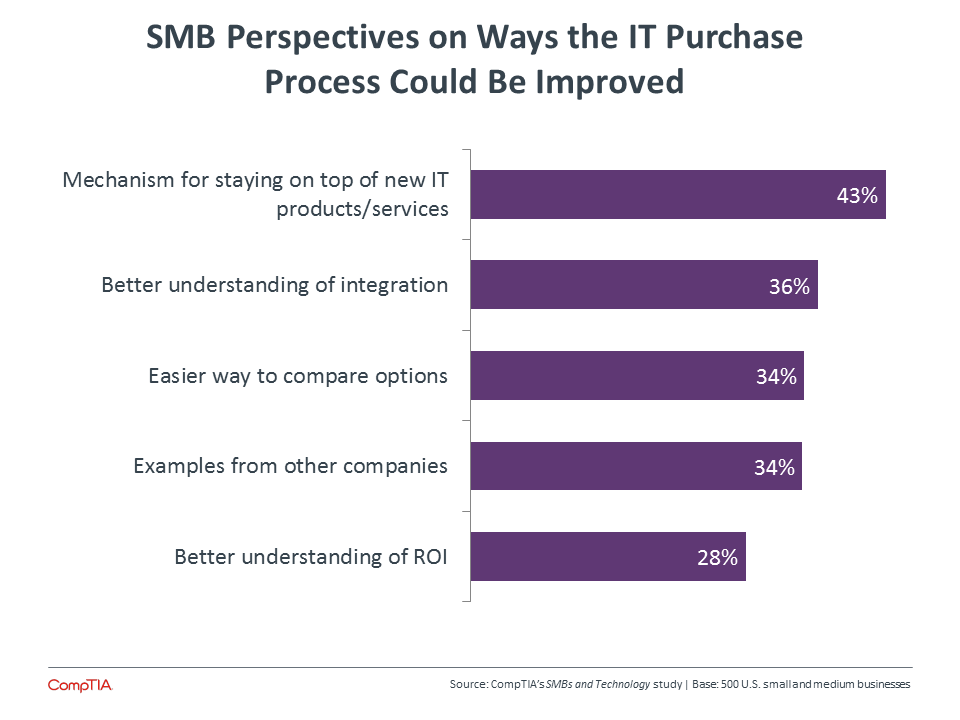

- Although pitches from IT firms are not the primary way technology decisions have been made in the past, 66% of SMBs say they are somewhat likely or very likely to seek outside help or expertise as they consider new strategic uses of technology. Outside firms can bring improvements to the technology decision process, such as education on the wide range of services and products available or a better understanding of how everything integrates together.

Digging Into SMB Tech Issues

As small and medium businesses consider their technology strategies for the future, the ultimate goal is to build systems that help move the business forward. The challenge is that building these systems and integrating them with each other and with a company workflow is more complicated than ever, thanks to a wider range of options and a dynamic environment.

While many IT projects are narrowly focused on a single application or workflow component, the notion of building new business systems carries an implication of overarching themes, and these themes stand out as the top areas of concern for SMBs. There is a common thread among these themes: they are all topics that have likely been lower priorities for smaller businesses but which now play an increased role in IT operations.

Security is quickly becoming a top priority for all businesses as breaches occur more frequently and carry more serious repercussions. Small businesses are not immune to attacks simply because their data sets are smaller. Cyberattacks have a growing variety of motivations, and data from Symantec shows that attacks on the smallest firms (where defenses are weak) occur just as often as attacks on the largest enterprises (where the data may be more valuable). Furthermore, the impact to an SMB is proportionally larger—the October 2014 Global Report on the Cost of Cyber Crime conducted by the Ponemon Institute found that the per capita cost of a breach for the smallest businesses was significantly higher than at the largest firms—$1,601 vs. $437.

Keeping data safe is just one aspect of data handling that is cause for concern among SMBs. As businesses undergo digital transformation, data turns into a more critical asset. The Big Data movement has also raised interest in using data for analysis and decision-‐making, and even when the data sets are not massive there are tools and techniques required for performing good analytics. Many small businesses have never managed data as a primary resource, and they must take steps towards consolidating data silos, handling rapidly growing data collections, and establishing strong business continuity/disaster recovery plans.

The final item causing major concern for SMBs is their infrastructure. The smaller the firm, the less infrastructure there is in place. In the early days of cloud computing, this slowed adoption since small or micro businesses did not see a return in migrating small installations to the cloud. The thinking has shifted, as these firms begin to understand that cloud systems can give them expanded options at a reasonable price. As current pieces of infrastructure move towards the end of their life cycle, SMBs need to understand how to choose the best mix of cloud systems and on-‐premise systems, and that will lead to the challenge of managing a complex architecture.

Sifting through complexity is clearly the next overall challenge after the top three problem areas. Education on available options, calculating ROI, and integration of disparate pieces are all activities that SMBs need help with as they try to simplify a complicated landscape. Not only do SMBs need to figure out which pieces can help make their current operations more efficient, but they also need to figure out how to add new pieces that help drive the business forward.

The use of technology to actually transform business occupies the final three spots on the list of SMB tech concerns. As Section 1 describes, many SMBs feel that they have ideas for the direction they would like to take their business. What they need is help in understanding how technology can make that vision a reality.

There are three primary ingredients that go into any technology solution: the hardware or software that make up the solution, the people involved to use or maintain the solution, and the process by which the solution fits into a business workflow. Among these three, SMBs rate people and technology nearly the same in terms of needing improvement, with process improvements a trailing priority.

The emphasis on people highlights the need for education. An obvious place for education is with any technical team that may exist that would own responsibility for installing or maintaining the application. However, education is also needed among the general workforce, as technology solutions become more user-‐accessible and the endpoints (such as mobile devices) become more powerful. Such education will both ensure proper usage and reduce security risk.

Although process is not rated as highly as the other two components, it is an area that needs just as much attention. CompTIA’s research in the cloud space has shown that as companies move deeper with cloud adoption, they need to modify process and workflow in order to fully transform their business. As the technology solutions become more complex, SMBs will face the same challenge.

The Technology Process at SMBs

When considering how SMBs deal with technology, it is important to understand how they use their limited resources to make decisions and procure what they need.

The most common triggers for beginning a technology purchase process involve issues being brought directly to executives. At firms large enough to have a formal IT department, that group is largely responsible for bringing forward new concepts. At smaller firms, these issues come from all departments in the organization. The bottom line is that these decisions are brought to business executives and owners, where the final call is made. In larger companies, there is a movement towards greater interaction between technology and business; in smaller companies, this interaction naturally takes place.

With this interaction in place, the gap that many SMBs face is the correct knowledge and application of technology. The suggestions that are brought forward will often be more tactical than strategic in nature, and there is little bandwidth for considering the many ways in which a new strategy could create a widespread advantage. This is where a third party can be very useful, but pitches from outside firms are one of the least common triggers. In addition, the traditional selling pattern for outside firms is bypassing certain segments, and there is opportunity to engage these segments in order to build strategic technical plans.

SMBs are quite open to the idea of outside help. Sixty-‐six percent of firms say they are somewhat likely or very likely to seek outside help or expertise as they consider new strategic uses of technology. Among those segments that are not frequently pitched by IT firms, there is varying sentiment about using third parties. Twenty-‐nine percent of micro firms say they are somewhat likely or very likely to seek outside help, compared to 65% of employees in a business function, 51% of firms in business for less than five years, and 57% of respondents ages 40-‐54. IT firms that are targeting these segments may have a receptive audience or may have some work to do in selling the value proposition.

The major challenge in making an outside relationship work is the finances. Two thirds of SMBs spend less than $100,000 annually on technology, with 29% spending $10,000 or less. With this raw dollar amount not being very high, it is difficult for an outside firm to draw in enough revenue. There is a silver lining, though—two thirds of SMBs are also planning increases to their technology budget, with 30% projecting an increase of 10% or more over the next year. Using technology in a new way could drive that total even higher—47% of SMBs say that they would be willing to increase their overall technology budget if presented with an innovative solution that could enable new business processes. Money may be tight, but the right offering could result in a valuable partnership.

Appendix

Section 3:

Channel Dynamics

Key Points

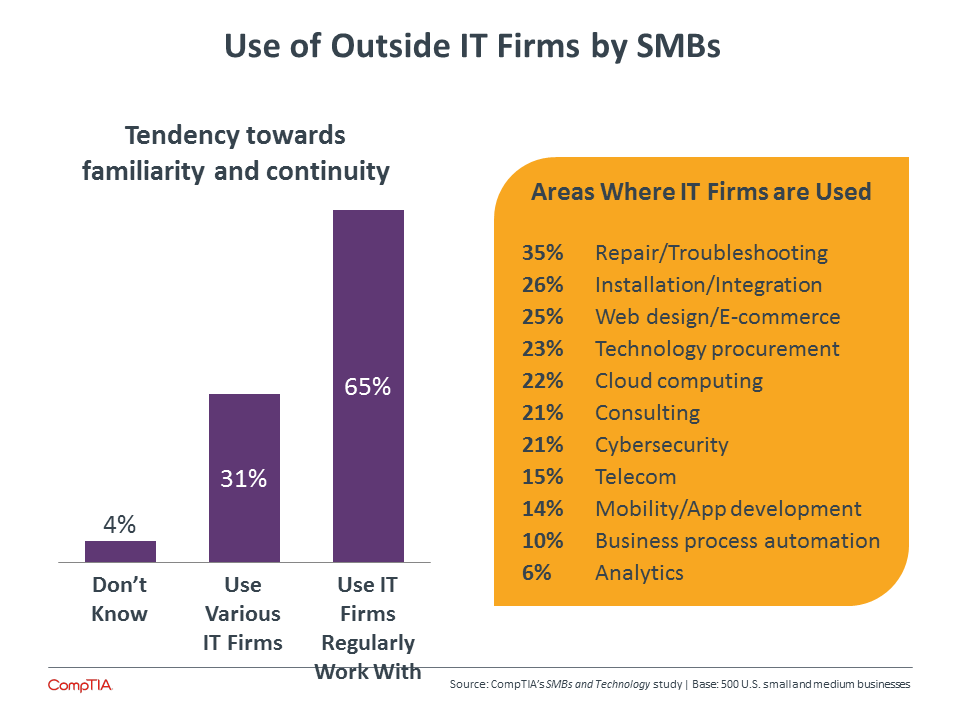

- Without an abundance of resources to devote to vetting outside firms, SMBs have a tendency to work with the firms they already know. Sixty-‐five percent of SMBs say that they continue to work with firms they have worked with in the past. However, this mix may shift as companies move their technology needs beyond repair and integration and into new areas such as mobile app development or business process automation.

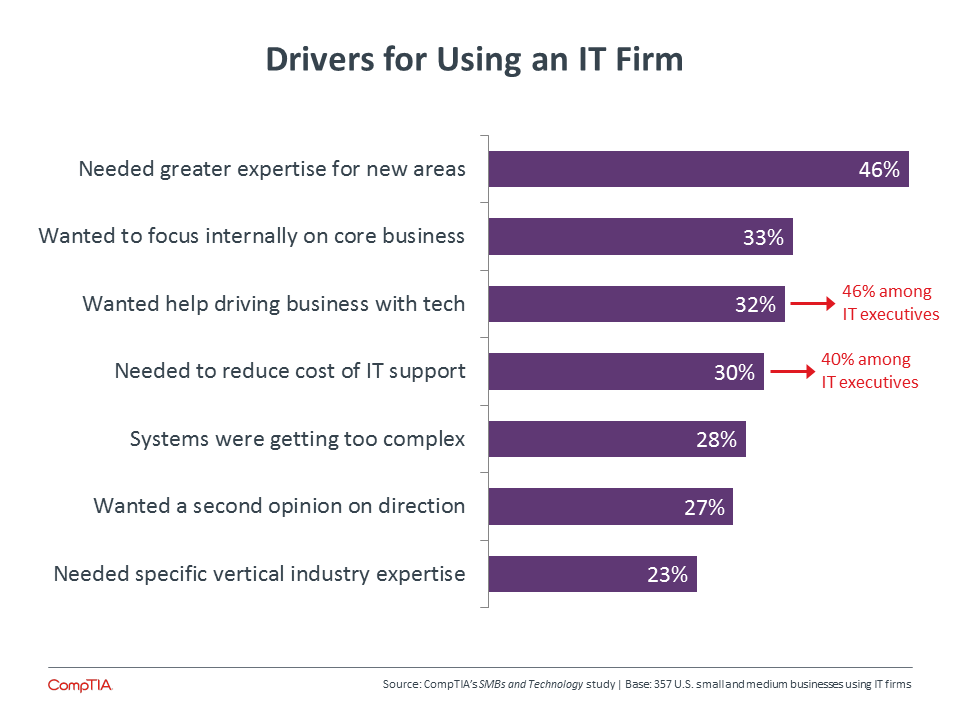

- The biggest driver for using an outside IT firm is the need for greater technical expertise, cited by nearly half of all SMBs. Other factors are important too, such as driving the business with technology (cited by 46% of IT executives) and the need to reduce the cost of IT support (cited by 40% of IT executives).

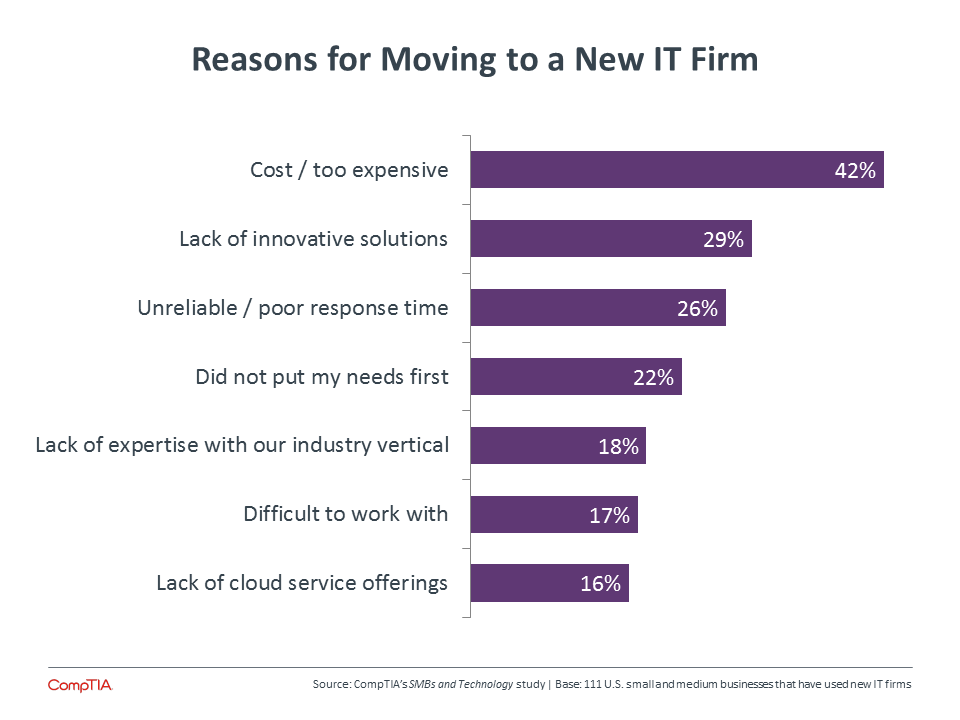

- Although cost has declined somewhat as a primary concern among businesses of all sizes, it remains slightly more critical in the SMB space. Forty-‐two percent of SMBs say that they moved to a new IT firm because of cost, making it the biggest factor in deciding to make a switch. The second biggest factor was the need for innovative solutions, showing the need for IT firms to push into new areas.

Use of Third Party IT Firms

Many small and medium businesses have no IT department, choosing to handle technology issues internally using employees who may be tech savvy but actually hold other jobs such as sales or accounting. Other companies, especially those on the medium-‐sized end of the spectrum, will build a formal IT function as infrastructure demands grow.

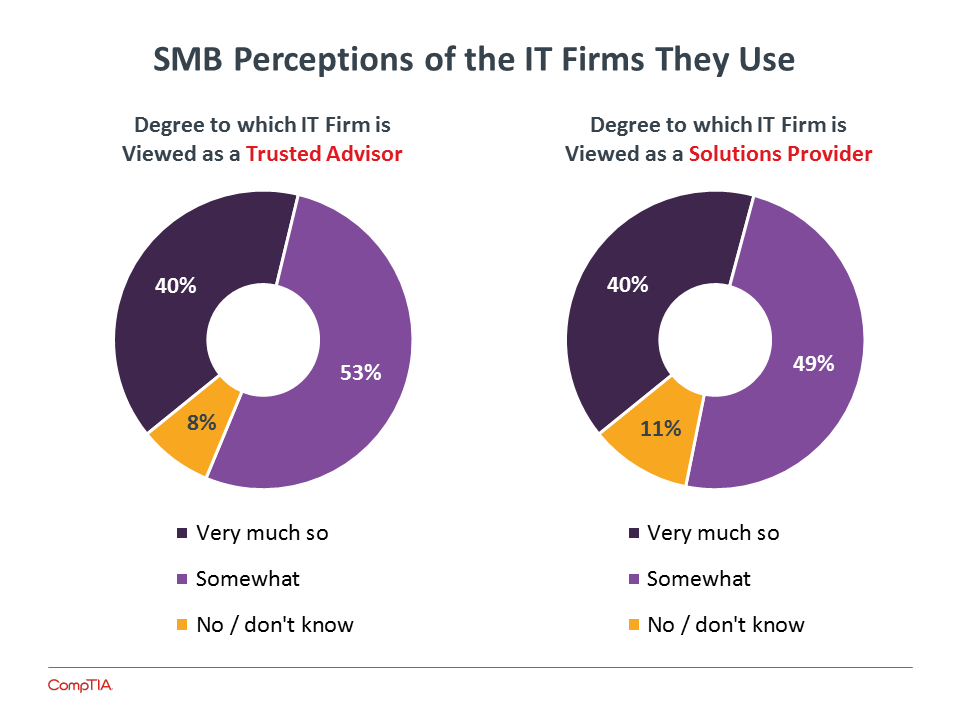

For all these companies, third party IT firms can provide value in providing and managing technology to meet strategic objectives. With smaller clients, an IT firm may act as the overall IT function, needing to both handle tactical plans and drive strategic vision. With larger clients, the role may be more complementary, with opportunities to apply technology in innovative ways for new business results.

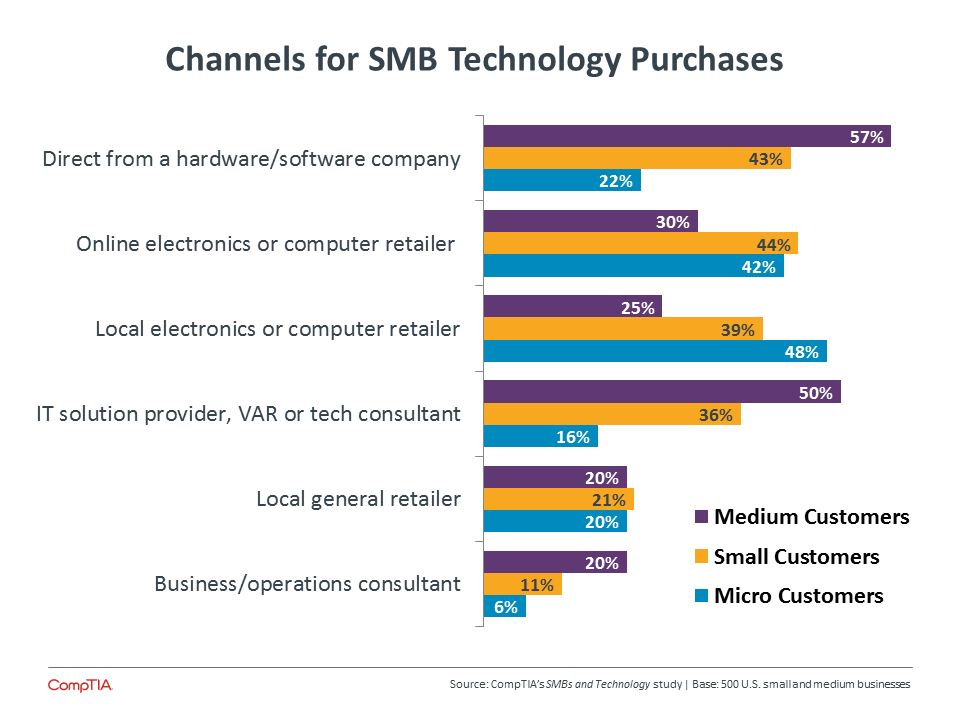

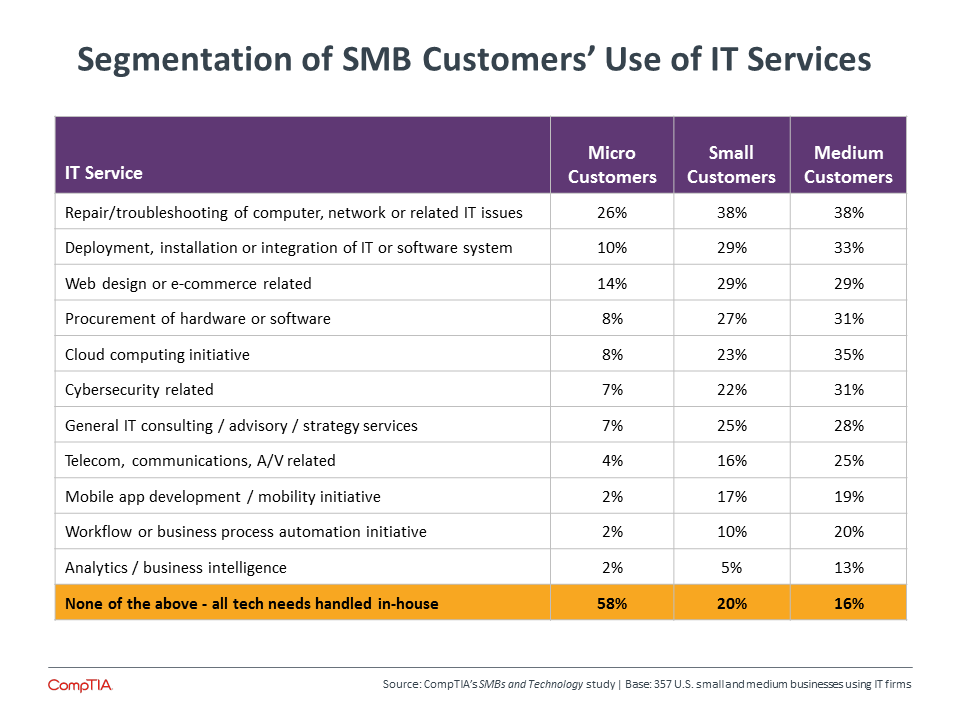

Moving into a more strategic role will be a step forward for many VARs and MSPs currently working with SMBs. Over 70% of SMBs used an outside IT firm at least occasionally over the past 12 months. In most cases, this has been a firm (or firms) that they use regularly, demonstrating an established relationship. That relationship is likely one that has been formed around specific tasks or projects. The list of areas where IT firms have been used is mostly filled with traditional and tactical IT activities, led by repair/troubleshooting and installation/integration.

Other areas on the list indicate possibilities for starting more strategic conversations. Web design may refer to simple management or upkeep of a standard web presence, but this could be expanded into a broader digital transformation where products and services reach a new audience thanks to online and mobile efforts. Cloud computing has become a catch-‐all term that also covers regular hosted datacenter services, but even those services can lead into the multi-‐cloud architecture than many businesses of all sizes are now pursuing. Analytics is one of the least common areas for an outside firm to manage, but a heavier reliance on data for decision-‐making may force many SMBs to explore new options.

In general, new options are exactly what SMBs are looking for as they consider using outside IT firms. While it is not surprising to see that medium-‐sized firms are the most likely to cite this as a driver (50%), it is noteworthy that micro firms are the second most likely (47%). Medium-‐sized firms have a well-‐ established business strategy and want to ensure future growth, and micro firms include many startup firms that are working to establish their businesses in the same way and ensure future viability. Other drivers continue to reinforce the dual nature of technology in today’s business environment, from taking on routine tasks so that an SMB can focus internal resources on core operations to driving the business forward using the technology models that are available today.

Working Through Issues

Maintaining a relationship with clients is challenging in any environment. Today, when technology is creating such dramatic shifts in the way IT and even business are managed, the challenges multiply. “Consumerization of IT” can mean many different things, but for MSPs it means that their clients are becoming more aware of technology capabilities and more sensitive to the places where their business is not taking full advantage.

Reviewing the IT activities where SMBs use outside IT help, the satisfaction scores indicate that many companies can imagine improvements to their current level of IT support. Less than one-‐third of all companies using outside help for some type of IT issue claimed to be “very satisfied” with the IT firm’s work on that issue (See Appendix for additional insights on customer satisfaction with IT services). Interestingly enough, the highest satisfaction came in the area of analytics. There may be few SMBs currently seeking this type of assistance, but those IT firms with the right skills are making an impact.

Looking at those areas where customers are “partly satisfied” or “dissatisfied,” there are several technical areas where IT firms should consider placing more emphasis or building more expertise.

- 24% of SMBs cite this level of satisfaction with telecom efforts. As the telecom industry and IT industry continue to merge, clients are looking for firms that understand the traditional issues associated with communications but also understand how to make communications happen over an IP network.

- 25% of SMBs cite this level of satisfaction with web design or e-‐commerce efforts. As both consumer behavior and B2B transactions become more digitized, it is essential to have a strong digital strategy.

- 27% of SMBs cite this level of satisfaction with workflow automation. Cloud systems and mobile devices are opening new doors for higher levels of automation, which can reduce overhead spent on routine tasks. SMBs may be pushing for greater automation as they build their cloud/mobile foundation.

There is one area in particular that stands out from the pack, though: 44% of SMBs cite lower levels of satisfaction with mobile app development efforts. Weak mobile app development may actually contribute to dissatisfaction with all the other areas that give SMBs heartache. With mobile devices as the new computing frontend for the workforce, many companies are realizing that successful integration goes well beyond the device management decision. Success in many areas—including telecom, e-‐commerce, and automation—will depend on having some level of custom development work. This is new ground for both end users and solution providers, and there will be much to learn as both sides pursue success in the era of mobility.

Of course, technology is not the only part of the equation for satisfied customers. There are several reasons that SMBs have made a switch from their regular tech firm, and these potential shortcomings are good for IT firms to examine as they manage marketing, customer service, and internal operations.

Cost can be somewhat of a red herring—every company would like to reduce costs, but most also realize that you get what you pay for. Especially considering the data from Section 2 showing that SMBs are willing to invest more for innovations that enable better business results, driving to the lowest cost solution may not truly be something that solution providers should aim for. With that said, cloud systems are changing the economics of IT, and many solutions could experience disruption to profit margins.

Beyond cost, the lack of innovative solutions is the top driver for switching IT firms. This ties directly to the desire for innovation that connects available technology to new business opportunities. To meet this need, IT firms will have to move beyond the managed services model, even as many firms are still working to make a managed services transition. The next transition involves moving from the management of isolated pieces of IT to management of the overall structure, then proactively driving technology decisions that are aligned with business needs. This is the same transition that many IT departments at larger firms are going through, so there is plenty of learning happening across the entire industry.

For all the hesitation that micro-‐sized firms tend to exhibit when dealing with technology, they are the ones who are most adamant about needing innovation. Fifty-‐seven percent of micro firms cite lack of innovation as a driver for switch IT providers, placing it above cost considerations for these companies. The budgets may be more limited, but the potential for growth (especially among startups) makes micro firms an interesting customer base.

Micro firms may show the strongest desire for innovation, but similar desire exists across the entire SMB spectrum. For solution providers, there is a great deal of opportunity but also a great many challenges that exist in building a new business model that simplifies technology, creates value, and ultimately drives new business for their SMB clients.

Appendix

Verbatim Comments from SMB Customers for Ways IT Firms Can Improve:

Service Related

- Availability / 24x7 support

- Better communications

- Advisors need to be more communicative

- Be more proactive

- Faster response time

- Respond to our issues in a more timely manner

- Meet project deadlines

- Prompt and courteous replies

- Consistency in people

- More training

Verbatim Comments from SMB Customers for Ways IT Firms Can Improve:

Business / Strategic / Technology Related

- Listening to what we need

- Understand our business

- Technical guidance

- Make system more user-‐friendly

- Customizing to our needs

- Cloud services

- Innovation

- Better integration ideas for different areas [of our business]

- Life-‐cycle management based on previous purchases

- Lower costs

- Not trying to sell us things we don't need

- Meet project cost estimates

- Reliability

About this Research

CompTIA’s Enabling SMBs with Technology study provides insights into the ways that the small and medium business segment uses technology and interacts with outside firms provided technology solutions. The study consists of three sections, which can be viewed independently or together as chapters of a comprehensive report.

Section 1: Market Overview

Section 2: Usage Patterns

Section 3: Channel Dynamics

This quantitative study consisted of an online survey fielded to small and medium business executives and professionals during December 2014. A total of 500 small and medium businesses based in the United States participated in the survey, yielding an overall margin of sampling error at 95% confidence of +/- 4.5 percentage points. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-‐sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA is a member of the Marketing Research Association (MRA) and adheres to the MRA’s Code of Market Research Ethics and Standards.

Download Full PDF

Download Full PDF