Digital transformation has become a watchword for many businesses. In a new era defined by cloud computing and mobile strategies, companies are pursuing new IT tools, and the best use of tools requires a disruption to operational procedures.

CompTIA’s new research explores the different aspects of this corporate evolution. As companies seek success with new products and new customers, there are many areas that must be addressed in order to become a digital organization.

Key Points

Digital transformation is defining the business of the future

Companies today are blending the traditional view of IT as a tactical function with the perspective of technology as a strategic driver. While 43% of companies indicate that technology is an enabler for business process, 39% feel that they are using technology to drive business goals, such as enhancing efficiency or innovation.The decision process for new technology is experiencing major disruption

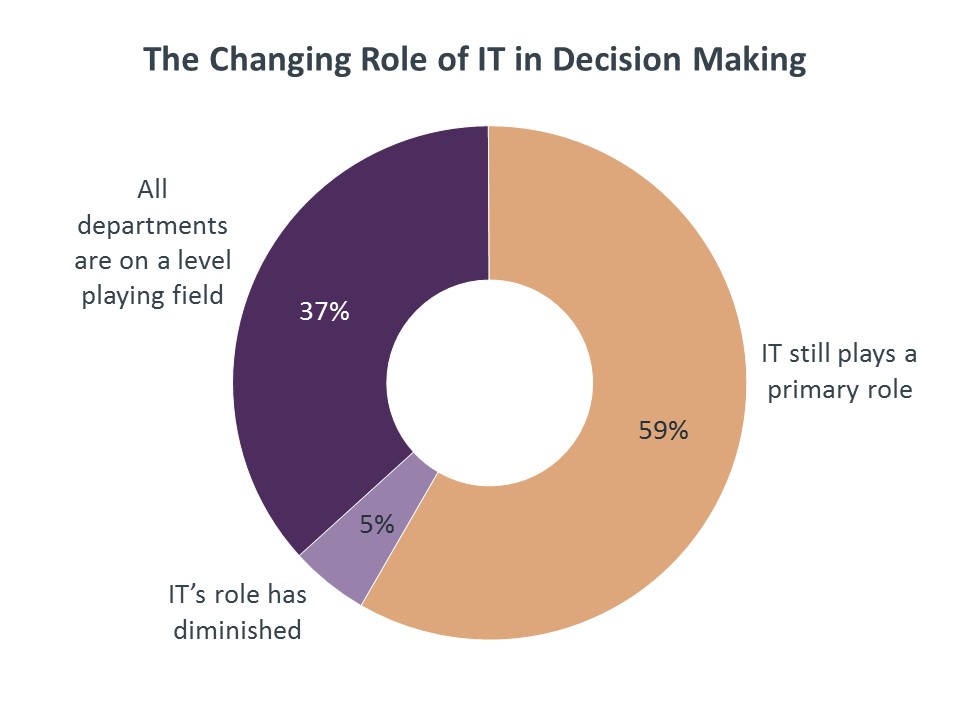

Digital organizations are not just adopting new technology; they are also modifying processes to optimize available tools and models. The decision process for new technology is becoming much more collaborative, though that does not mean IT is fading. Fifty-nine percent of companies say that IT still plays a primary role.IT professionals in digital organizations have a lot on their plate

As IT teams take on dual responsibility for tactics and strategy, they must balance four areas: Infrastructure, Innovation, Integration, and Intelligence. Along with the changes to decision process, this balancing act will bring them closer to business functions and require a better understanding of business demands.Business units in digital organizations still want to partner with IT

Although rogue IT has received tremendous focus in recent years, most businesses are shifting to models that keep IT in the loop. Business units see most technical areas as shared responsibilities, with security and technology discovery being areas where IT is still seen as a primary owner.

Defining Digital Organizations

DIGITAL ORGANIZATIONS: DRIVING BUSINESS OUTCOMES WITH TECHNOLOGY

IDC predicts that by the end of 2017, 70% of the Global 500 will build dedicated teams focused on digital transformation and innovation. Why will these activities be such a high priority? Companies are starting to recognize that new tech trends are leading to a new operational model: the direct contribution of technology to overall business outcomes.

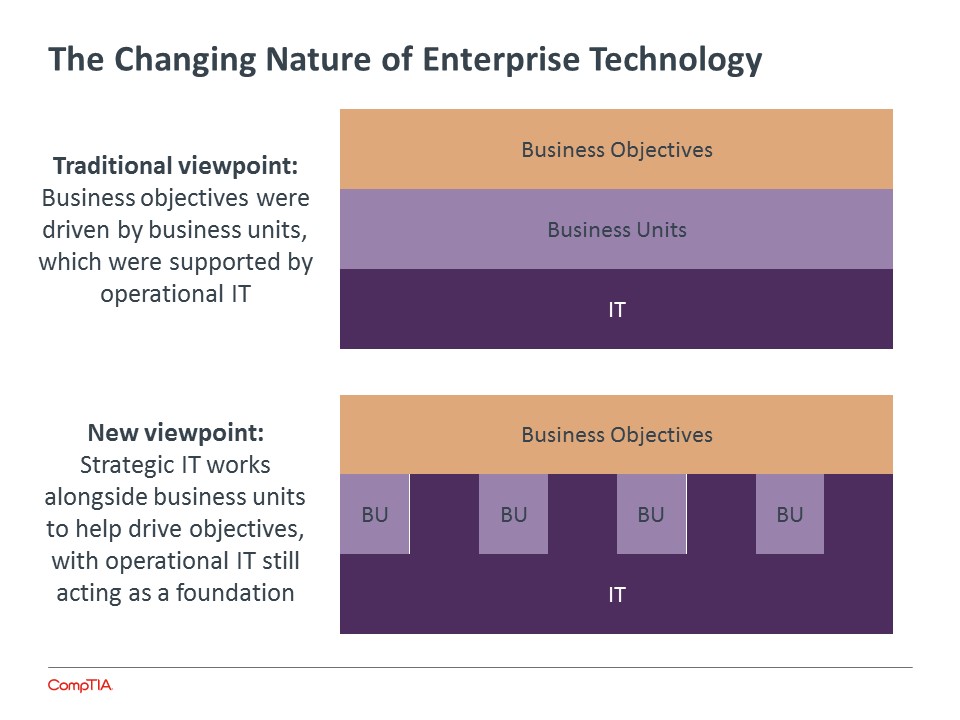

In the past, technology served more of a supporting function. IT equipment and operations served the needs of business units, which in turn drove business results. As such, IT took on qualities of a cost center, where the notion of support was treated as a fixed quantity and providing that support at lower cost was a common goal.

Over time, businesses have moved to a much more strategic approach when it comes to technology. The correct application of digital tools and techniques can enhance employee productivity, provide market insights, or create revenue opportunities. IT has become a direct contributor to business results and must now consider broad corporate demands, especially as various business units are able to drive their own technology initiatives. At the same time, the basic foundation of operational technology must remain in place and remain highly cost-conscious.

Gartner calls this bi-modal IT, but balancing operational IT and strategic IT is often done by a single team. The team may have many pieces—including a piece focused on digital transformation and innovation—but the overall effort must be holistic. The IT function must provide the underlying infrastructure while simultaneously coming alongside business units to help directly drive business outcomes.

CompTIA’s research shows that companies are shifting their mentality to this new reality. Overall agreement with different statements on technology shows a blending of the dual role that IT plays, with the enabling/supporting role still a predominant viewpoint but the strategic role growing significantly:

- 43% Technology enables our business process

- 39% We are using technology to drive business outcomes

- 36% The technology function plays a critical role in strategy

- 34% We are redefining our business thanks to technology

- 30% We have strong collaboration between functions

- 29% Technology simply plays a supporting role for business

- 23% Every project is a technology project

Additionally, while technology is playing a more important role, its impact is still not felt in every corner of an organization—the least common opinion is that every project in a company is by necessity a technology project.

Top Strategic Goals for Organizations

- Enhancing efficiency [48%]

- Innovation [46%]

- Renewing/maintaining key customer accounts [42%]

- Identifying new customer segments [38%]

- Hiring skilled workers [38%]

- Launching new products/services [36%]

As new technologies have entered the picture, a common theme has been the blending of traditional mindsets and cutting-edge thinking. A listing of top strategic goals reflects this blending, with standard objectives such as enhanced efficiency mixed in with newer goals such as innovation and pursuit of new customers. Of course, all of these goals are now being driven and enhanced by technology.

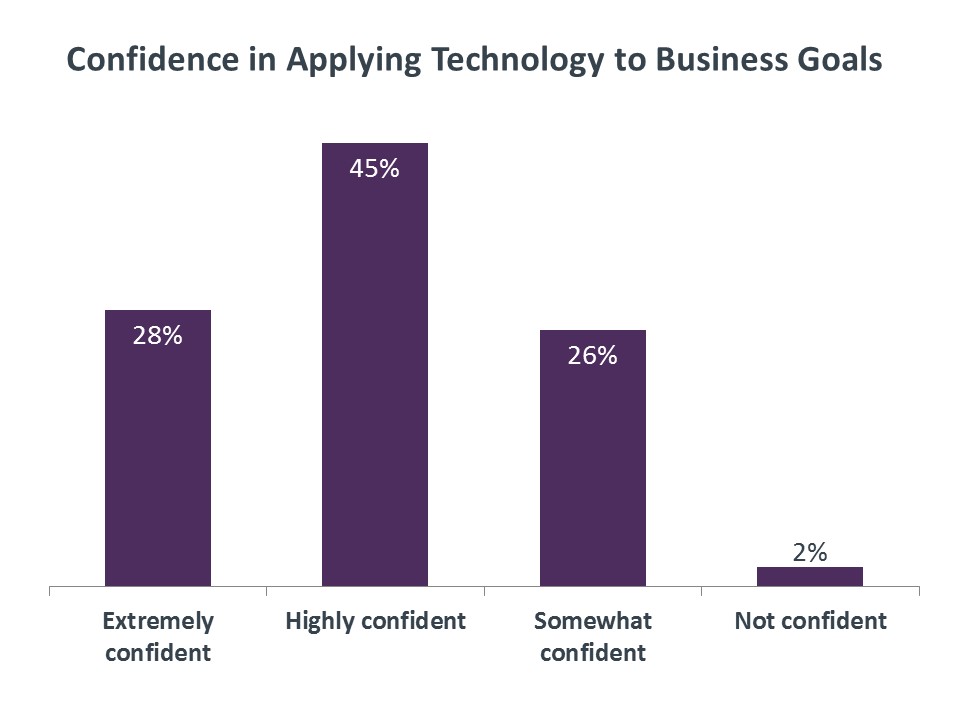

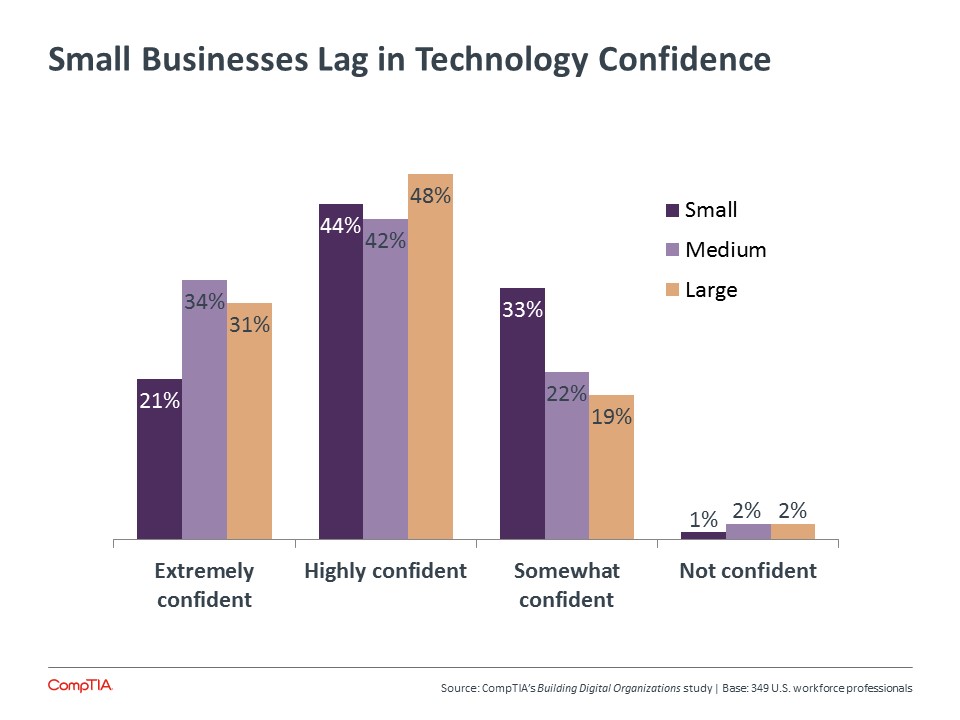

Unfortunately, most companies do not feel fully prepared to enter this new digital era. While IT pros have built confidence over the past year (34% extremely confident in 2016 compared to 24% extremely confident in 2015), this optimism is not fully shared by business function employees (24% extremely confident in 2016) or executives (17% extremely confident in 2016).

The situation is especially critical for small businesses, who tend to put weight on more traditional goals and also feel the least confident in their technical acumen. While large organizations build specialized teams, resource-constrained small firms must explore different models. Digital transformation is vital for future success, and companies of all sizes will need to understand the proficiencies required to become a digital organization.

PROCURING TECHNOLOGY

GETTING STARTED: THE TECHNOLOGY DECISION PROCESS

While the new era of IT is being driven by new technology—in particular cloud computing and mobile devices—digital tools are only one part of digital transformation. The other component is process and policy, and changes in these areas are proving to be more challenging than adoption of new technology.

Naturally, the process of deciding on new technology is one of the first areas of focus for many organizations. This has typically been the domain of IT; obviously business units have had varying degrees of input, but IT has been in the driver’s seat thanks to their specialized expertise.

Now, there are more layers of abstraction surrounding end-user technology, fewer barriers preventing access, and greater tech literacy among business units. The decision process does not necessarily have to funnel thorough IT, and companies are trying to build environments where technology is acquired quickly yet appropriately and all groups have a voice in the decision.

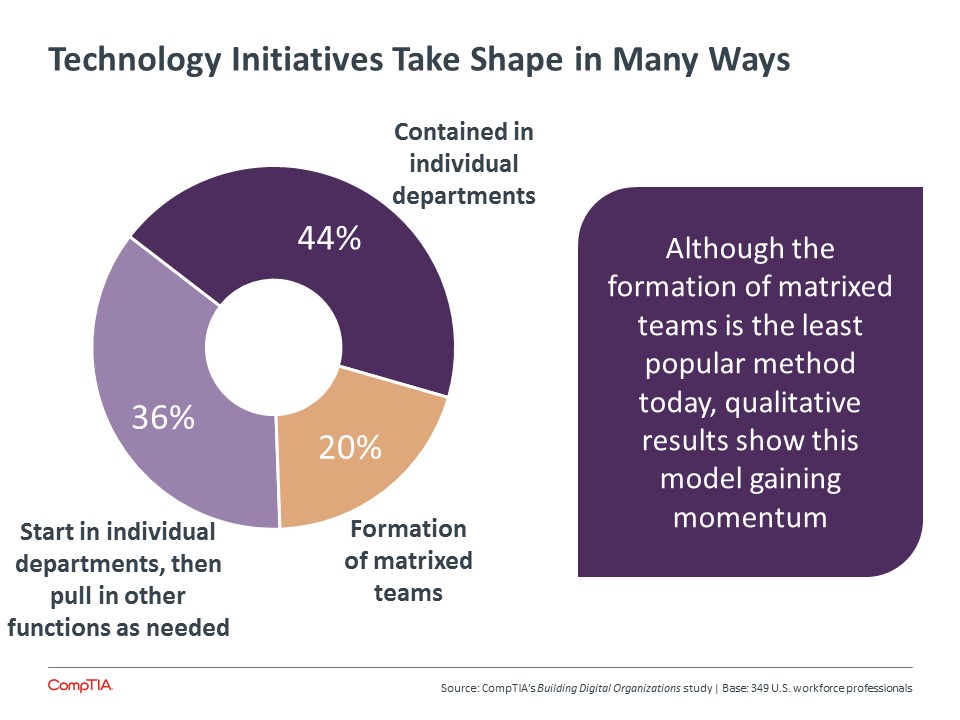

There are four ways in which the technology decision process is changing. First, ideas are coming from different parts of the organization. Half of the companies surveyed see this taking place, especially at medium-sized and large firms where there are different functional departments. Greater exposure to technology, especially in the consumer space, gives non-technical employees new ideas that they would like IT to consider implementing.

Second, the ultimate objective for technology is more business focused. This is not surprising since it matches the overall shift in attitudes toward technology. In fact, the only surprising part may be that just 47% of companies view this as a change in the decision process. Presumably that number will rise as companies embrace strategic IT.

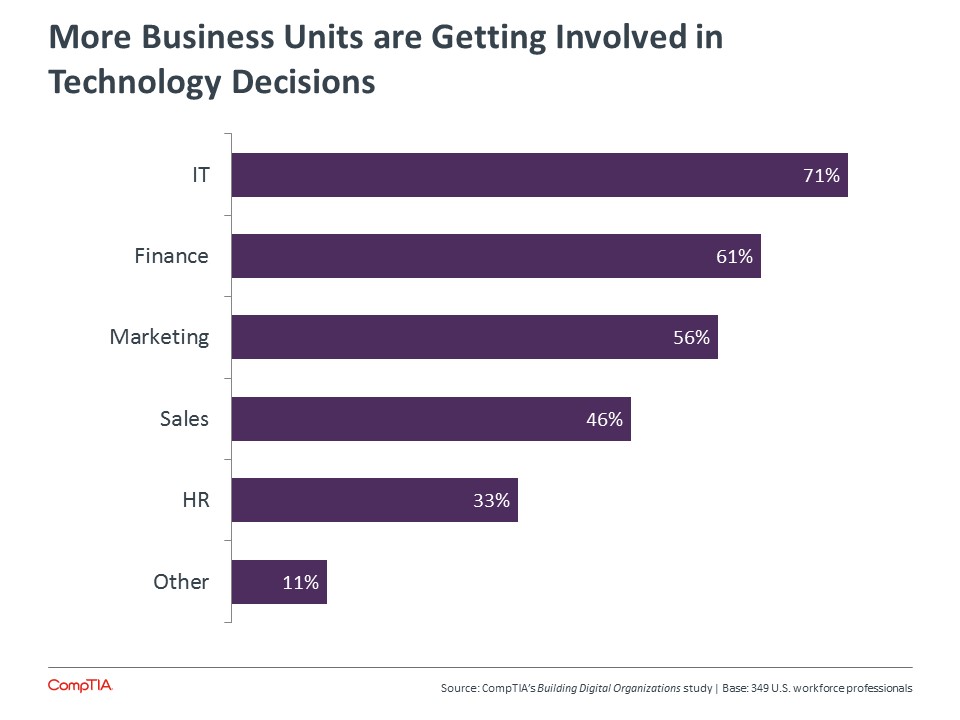

Functional departments are not simply contributing ideas for IT to evaluate; the third change is that they are directly involved in making decisions. Forty-five percent of companies surveyed have more collaborative decision making. IT is still heavily involved, but other groups such as finance, marketing, and sales are becoming more and more influential.

The final change in the decision process takes the collaborative nature a step further: 33% of companies say that a department other than IT has the final say in a technology solution. This is fairly consistent across companies of all sizes, though smaller companies are slightly more likely to see non-IT decision makers. Most commonly, the CEO or owner now holds this responsibility. This is partly because smaller firms have no formal IT function, but it is also because technology is playing a larger role that necessitates top-level approval.

It is important to note that none of these changes are completely black and white. New voices in the process or even new parties giving final approval do not automatically mean that all voices are equal or that IT has lost authority. A simple scenario to imagine is one where a business department is making final approval across a range of choices that IT has previously reviewed. Technical decisions still require the deep experience of IT, even if business units are starting to add some technical skills.

Building a new process for selecting technology is a major effort for many companies, and most firms are still finding the right approach. Through all the churn, the role of the IT function has been somewhat up in the air. Some feared that IT would fade as technical knowledge grew in other areas. However, businesses are clearly finding that IT still has an important guiding role to play, even as business units become more prominent and more independent.

PAYING FOR IT

Shifting budgets are a key part of business units becoming more independent with technology. When the IT function made most of the decisions and was responsible for most of the maintenance, they held most of the technology budget. New models of device provisioning, exacting demands around applications, and rethinking of cost accountability are all causing that budget to become more distributed.

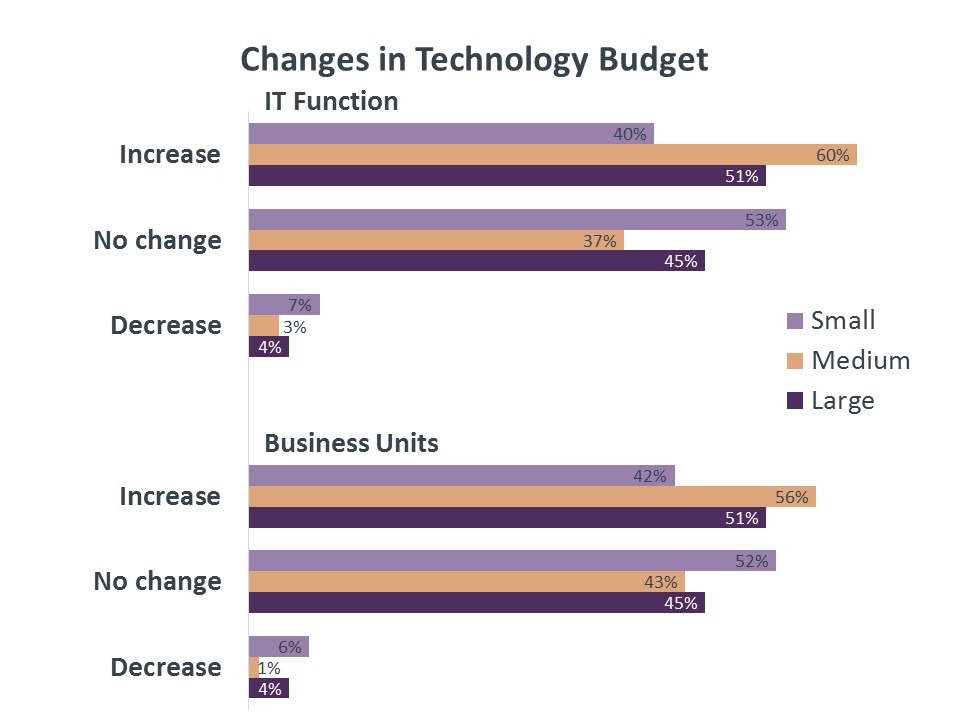

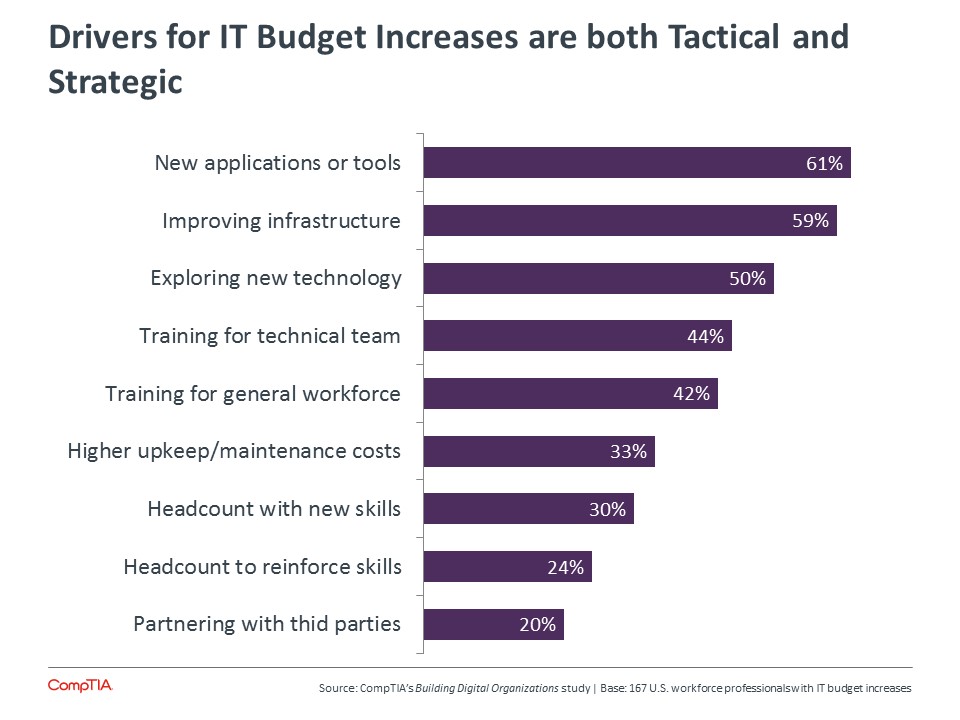

At many companies—especially medium-sized and large organizations—technology budgets are on the rise. This is true for both budgets held by the IT function and the technology portion of budgets held by business units. Headlines often say that IT budgets are shrinking, but this most likely applies to traditional line items related to operational IT. Strategic IT is a new endeavor and may not have perfect year-over-year line item comparisons, but in a broad sense most companies acknowledge that the overall technology budget is growing.

There are certainly exceptions, and those exceptions are mostly concentrated among the smallest firms. These companies are in the tough spot: they need to invest in technology to remain competitive, but they lack the resources to focus on strategic IT and have difficulty moving away from an operational IT model. There is opportunity for consulting around innovation, but small businesses also must accept that there will be new costs involved in modern technology.

Where budgets are increasing for the IT function, there are several areas driving the expansion. The top two drivers highlight the dichotomy IT teams must wrestle with, as 61% of companies cite purchase of new tools as a driver and 59% cite improvements to existing infrastructure.

Technology budget increases for business units are more interesting, though, as they are a primary ingredient for rogue IT. There is certainly a greater degree of independence to be found. Thirty-seven percent of companies with increased tech budget for business units say that the funds are used to procure technology directly, and 9% say that the funds are used to contract with a third party.

However, these are not the primary activities. Fifty-four percent of such companies say that the budget is used to initiate projects with internal IT. Shifting funds to the lines of business makes them more aware of technology tradeoffs rather than simply handing off requirements.

Furthermore, the direct actions may not be as rogue as they appear. As with the decision process, these activities often involve the IT team. In 60% of cases, the IT team gives approval; in 24% of cases, the IT team is consulted, and in 10% of cases, they are at least informed of the decision. Rarely is the IT team left in the dark.

THE ROLE OF IT

A FOUR-WAY BALANCING ACT

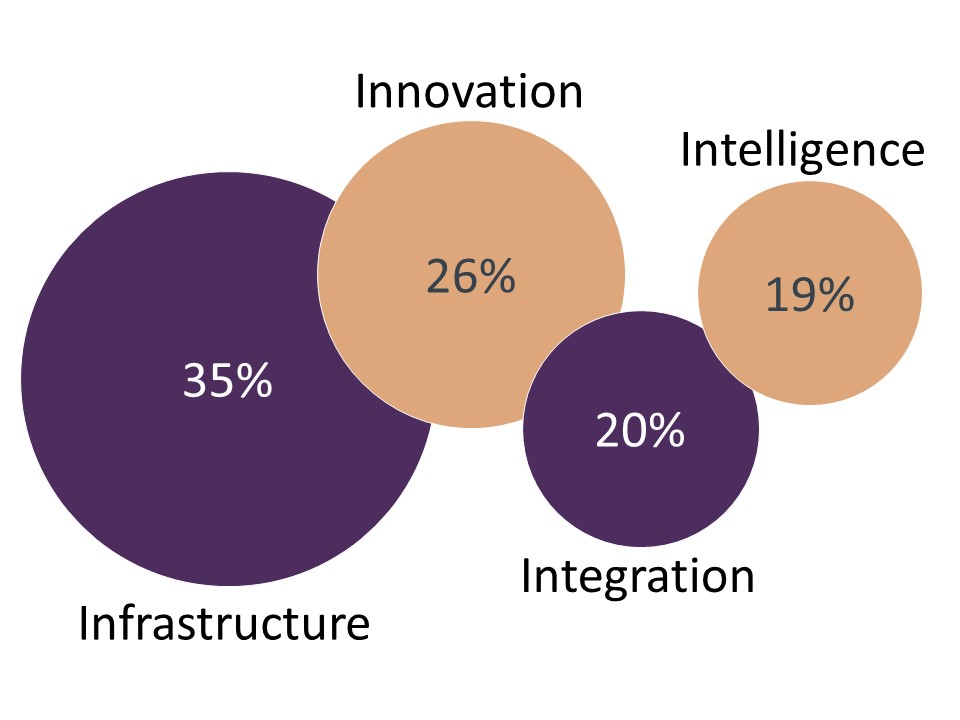

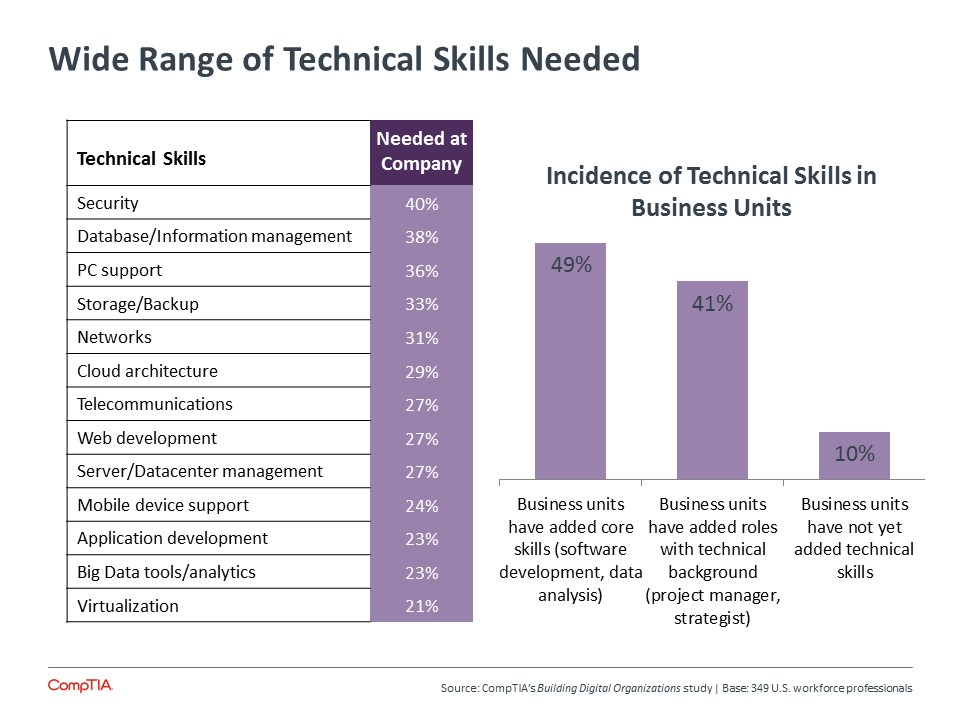

The division between operational IT and strategic IT can be broken down further into four separate components. Constellation Research has suggested that these areas could all fit under the “I” in “IT,” so that rather than broadly managing Information, technical efforts must encompass Infrastructure, Innovation, Integration, and Intelligence. CompTIA took this concept one step further to understand how businesses prioritize these areas.

Infrastructure remains the primary focus, with 35% of companies rating it as the top priority. Infrastructure is the most traditional IT discipline of these four fields, and it also remains a necessary prerequisite to any technical endeavor. The following section describes some changes to infrastructure management due to cloud and mobility.

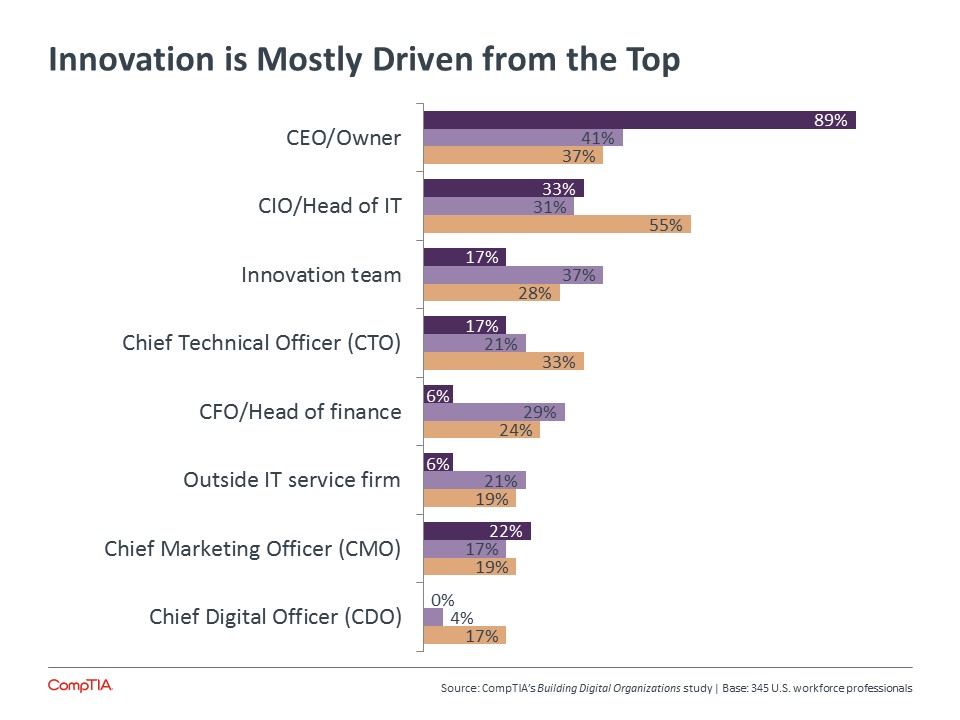

In the area of innovation, there is a bit of a mystery. Only 18% of executives rank this as the top priority (a slight bump from 12% who felt it was the top priority five years ago). When asked who drives innovation, though, 42% of respondents cited the CEO or owner, making that the top option along with the CIO or head of IT. Even more noteworthy, 89% of executives listed the CEO/owner as a driver, by far the most popular option among that group.

Why the difference? It may be that executives don’t feel innovation plays a strong role in their day-to-day activities, but they still want to make sure that the proper workers are focused on new things. It may also be that executives view innovation as a path to other objectives. Either way, even if executives have other daily technology needs, they are pushing a message of innovation to the workers and it has become a high priority.

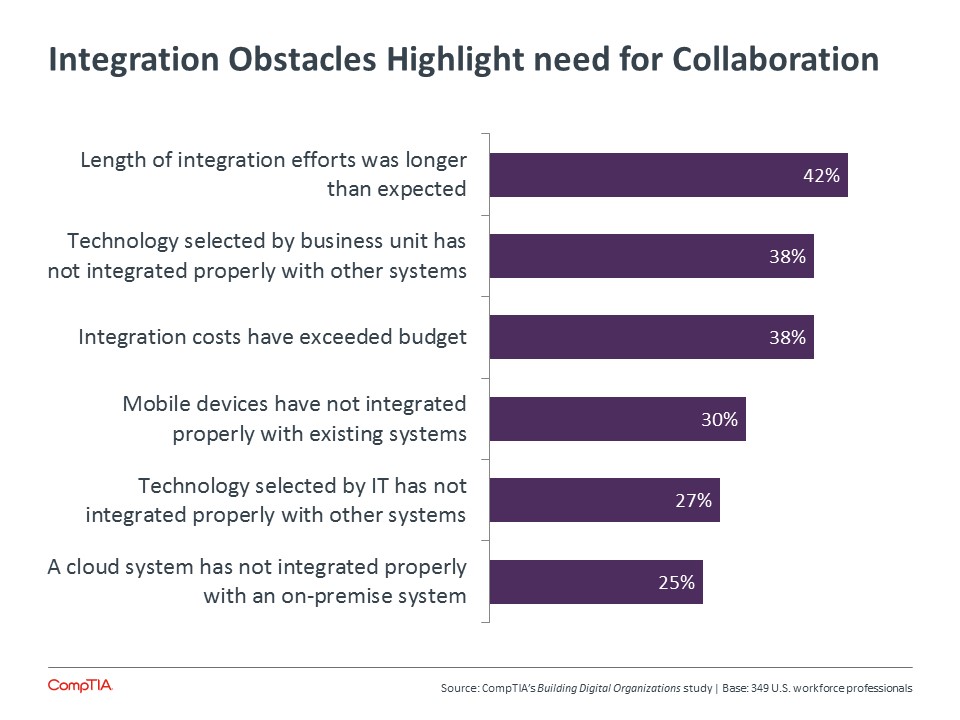

It is surprising that integration doesn’t rank higher. Integration typically represents the lion’s share of an IT project, as making everything work together is a much larger task than simply procuring individual pieces. Yet integration is rated the top priority by only 1 in 5 respondents, regardless of job title.

Integration also seems a little low since it is one of the leading drawbacks to rogue IT. Thirty-eight percent of companies have experienced difficulty integrating technology that has been chosen by a business unit, making that one of the top two integration challenges.

At first glance, intelligence is another area that appears to be ranked low. Although the Big Data trend has faded somewhat behind other hot topics, general data management and data-driven decision making are still major issues for organizations. Certainly at the executive level, intelligence is a concern. After the foundational area of infrastructure, intelligence is the second-highest priority. Unlike innovation, this is an aspect of technology that executives expect to utilize on a daily basis.

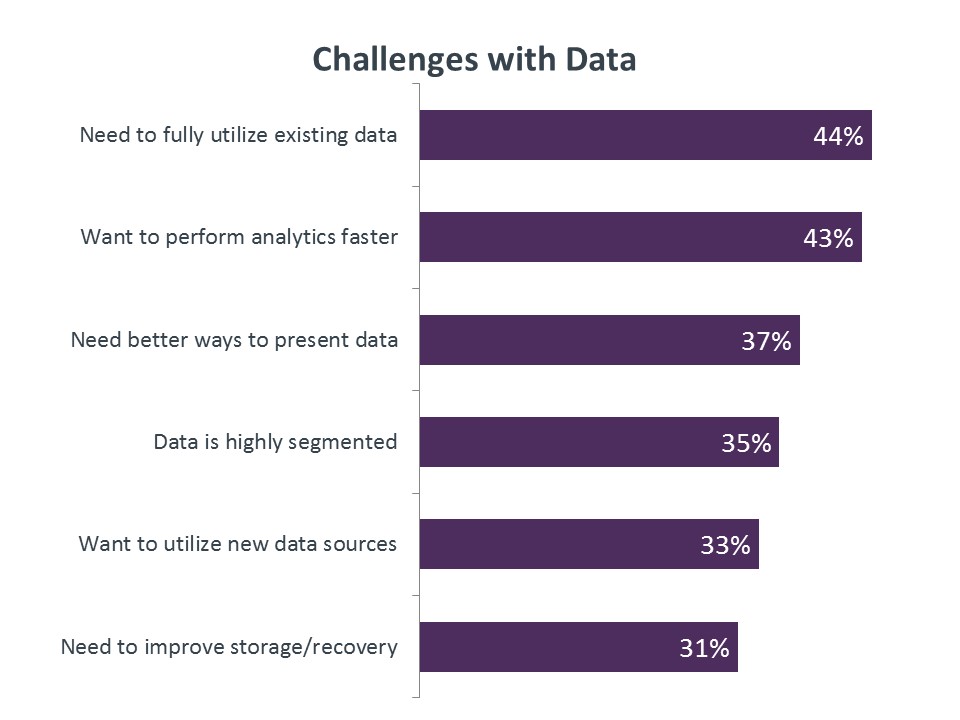

The low ranking for intelligence may not reflect true prioritization as much as lower levels of skill. CompTIA’s 2017 IT Industry Outlook predicted that one of the year’s trends would be the formation of data teams specializing in management, analysis, and visualization. The lack of existing skills has kept companies from fully utilizing their existing data and moving into more advanced data strategies.

New skills are needed for the full range of data challenges, from faster analytics to the inclusion of new forms of data to better storage options. As skills are built and new tools address these different problems, companies will improve the quality of their intelligence, which will likely have ripple effects in the other three areas.

BUILDING NEW BUSINESS SYSTEMS

Strategic IT represents greenfield opportunity for technical staff, but after the strategy has been set there is still tactical work to be done. Building and maintaining business systems is challenging work, especially as cloud and mobility introduce new components and complicate management of the overall architecture.

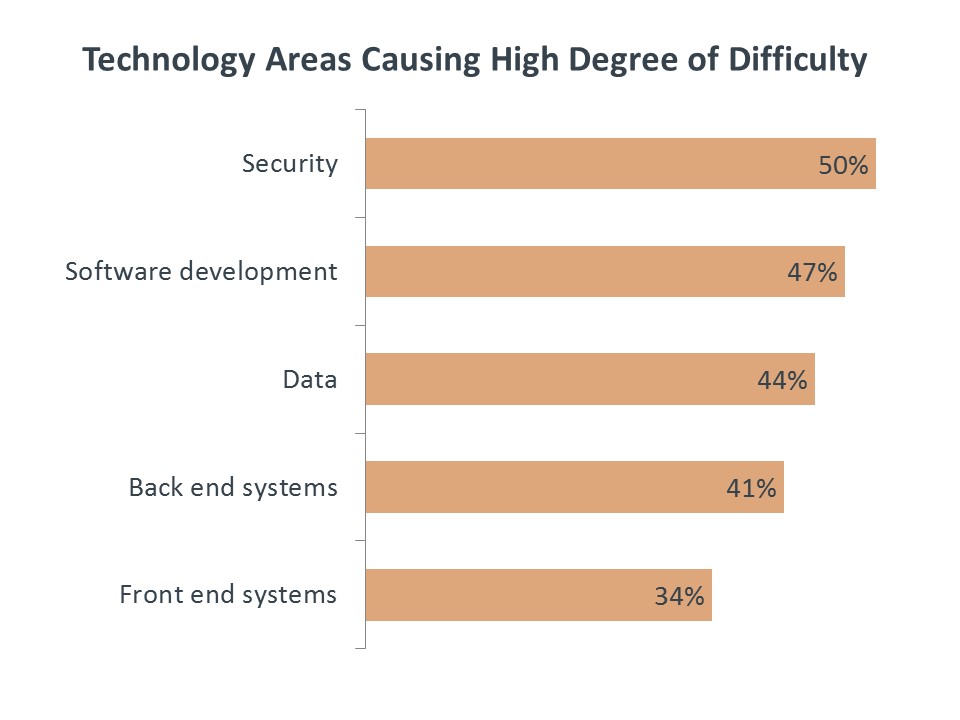

CompTIA’s Functional IT Framework defines four basic domains as the ingredients for business systems: Infrastructure, Development, Security, and Data. These are the four pillars of IT, with different skills and operational styles in each area. For an IT team, each one also brings distinct challenges.

The Infrastructure pillar can be broken down into separate components: back end (such as servers, networks, and storage) and front end (such as PCs, smartphones, and tablets). As described earlier, this is the most traditional IT discipline, and the degree of difficulty is correspondingly low.

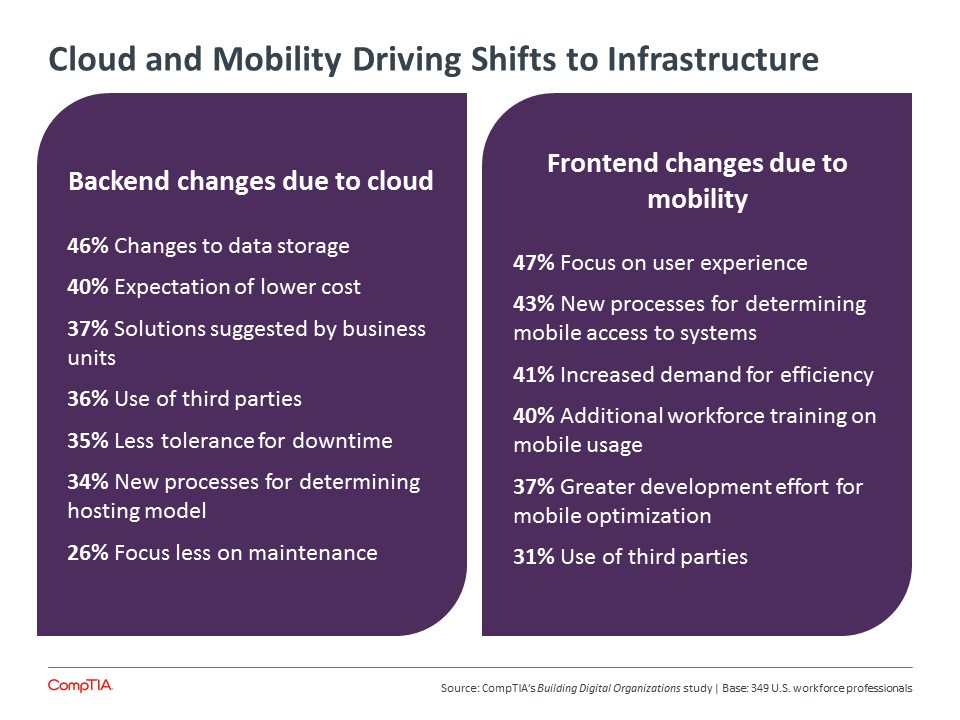

Of course, there are still challenges, especially as these are the areas most directly impacted by cloud and mobility. On the back end, IT workers report that cloud has brought many changes. Chief among these is new storage approaches that help consolidate data for analysis (reported by 46%). Other shifts caused by cloud include expectation of lower costs (40%), solutions suggested by business units (37%), and the use of third parties (36%).

Mobile devices have drastically changed the front end experience for both the general workforce and the technical staff. Popularity in the consumer space has led to demands in the office and new hurdles for IT.

Challenges in Front End Management

- Choosing how to provision/manage devices

- Creating/modifying applications

- Ensuring proper use among employees

- Providing help desk support

- Controlling costs

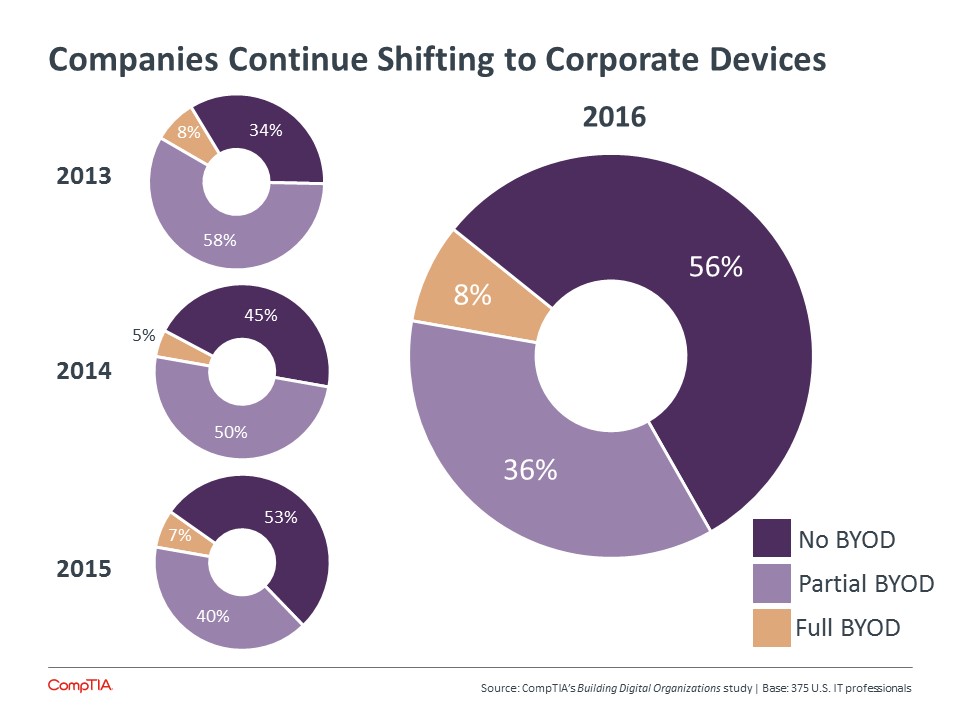

One of the top challenges for front end management remains the way that devices are distributed and supported, but there continues to be momentum towards corporate ownership. For the fourth straight year, the number of companies preferring to control all corporate devices has gone up.

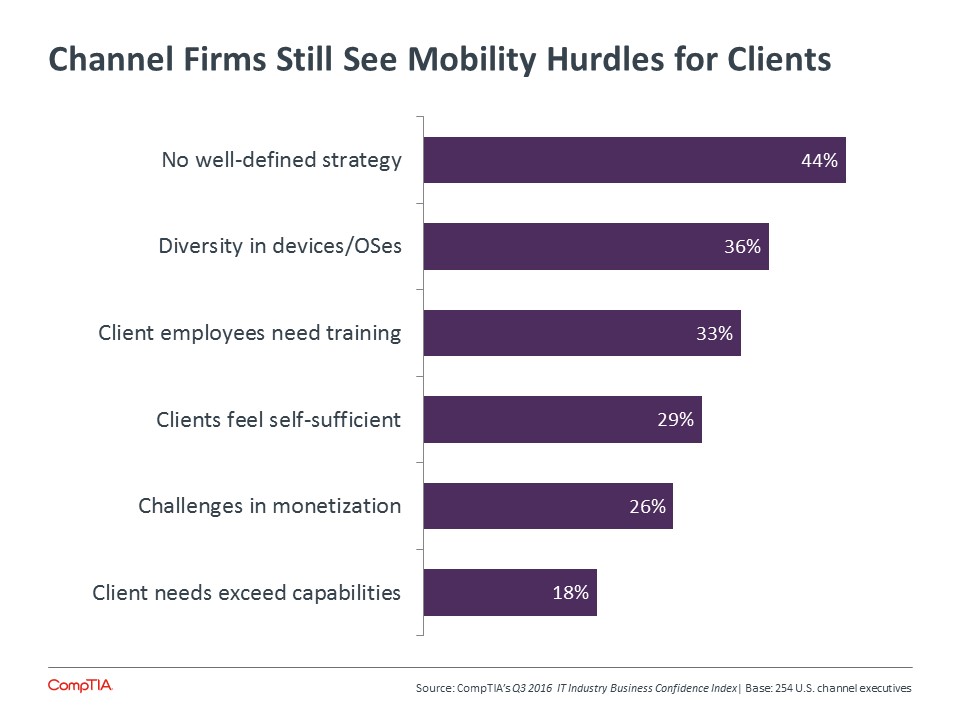

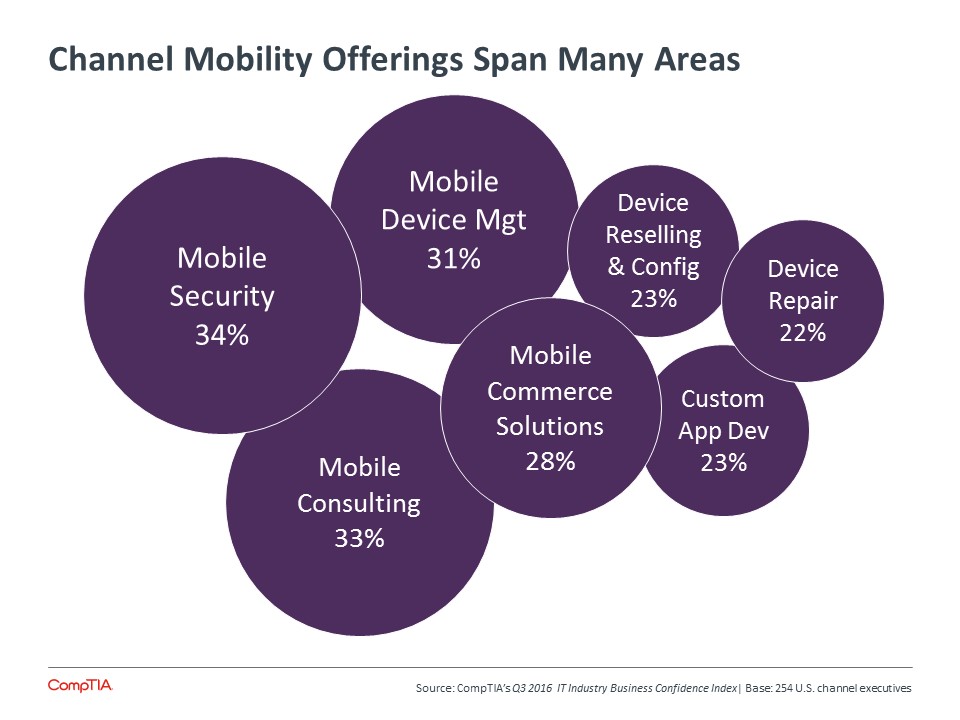

As with cloud computing, mobility opens opportunities for third parties. In data collected for CompTIA’s 3Q 2016 Business Confidence Index, 33% IT channel firms reported that cloud and mobility discussions with clients happened simultaneously to meet a strategic outcome. On the other hand, 34% reported that these discussions were separate. Bringing the discussions together may be a first order of business if that is not happening already; the top challenge for channel firms was customers not having a well-defined mobile strategy.

Moving up the chain, Data is in the middle of the pack when it comes to operational difficulty. The top challenge is determining the appropriate business insights to extract, reported by 44% of respondents. This highlights the need for data scientists and analysts to understand the language and goals of the business and not just solve technical issues.

Software development is quickly becoming a hot area for all companies. One of the things keeping it from the top spot may be that many companies have never explored development, so they can’t claim to be having difficulty with it. Small companies lag larger counterparts in software concerns, which likely corresponds to a lag in development activity. Software is the catalyst for increasing complexity and driving automation, and all companies will need to build or improve development skills to remain competitive.

Finally, Security reigns as the most challenging area for IT pros. Most companies are still working to build a modern approach to security, but many are seeing that breaches are unavoidable. Over half of the respondents say that a major challenge is building contingency plans for possible attacks. In terms of prevention, companies still struggle to strengthen the weakest link: 49% say that educating the workforce on security issues is a major obstacle.

BUSINESS UNIT PERSPECTIVE

THE VIEW FROM THE BUSINESS UNITS

As IT teams find a balance between strategic work and tactical work, business units are figuring out how much technical ownership they want to take on. Adventures in rogue IT have shown business units that there is more to technical solutions than they initially assumed. Just like IT has to learn more about the business side, the business side has to learn more about IT.

The collaborative environment that digital organizations are creating implies shifts in responsibility. Obligations that previously fell to the IT team—and, in doing so, defined that function—are now shared between IT and lines of business. As stated before, this does not reduce the role of IT; it simply opens bandwidth for new strategic work.

From a business unit point of view, most responsibilities are now shared. Three areas stand out as leaning towards one side or the other. First, as previously discussed, the discovery of business insights from the full range of corporate data is viewed as a more business-like activity. This will drive data-related skills in business units and business liaisons in the IT department.

The other two areas, though, are items that business units still view as IT-centric. They require a greater degree of centralization, and the accumulated experience and expertise of the IT team allows for efficient ownership.

Security is a growing concern for several reasons. Abstraction lowers barriers for adoption, so employees are handling more technology than they know how to secure. Additionally, digital disruption is now a massive threat to daily operations and ongoing reputation. Organizations need holistic security measures, and business units feel IT is well suited to oversee those measures.

The second area is the discovery of new technology. Cloud and mobility provide a way for business units to quickly digitize certain functions, but they also create a platform for innovation of unimagined possibilities. IT is better suited to imagining technical solutions with new pieces.

Even in areas where IT remains the responsible party, there is more synergy than ever between different functions. Among the different behaviors IT could adopt to help drive strategy, the leading request from business units is education on technical matters. IT can remain a center of competence while also distributing knowledge so that technology is used safely and efficiently.

The transformation to digital organizations is well underway. New tools, new processes, and new duties for IT will define this revolution and shape businesses for the future.

Appendix

Research Methodology

This quantitative study consisted of an online survey fielded to U.S. workforce professionals during October 2016. A total of 350 businesses based in the United States participated in the survey, yielding an overall margin of sampling error proxy at 95% confidence of +/- 5.3 percentage points. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected Code of Standards.

Read more about Industry Trends.

Download Full PDF

Download Full PDF