Section 1:

Market Overview

Key Points

- Cloud and mobility have ushered in a new era of enterprise technology. By adding key innovations to existing models, these trends allowed companies to change their approach and redefine the processes for choosing, implementing, and supporting business systems.

- New technologies such as cloud and mobility account for nearly all projected revenue growth in the IT industry. Traditional areas like security, networking, and help desk are still major factors in a $3.7 trillion industry, so the net effect of new technologies is to add options and complexity.

- With more technology options available and more input being added from business units, the typical IT goal of building business systems becomes a greater challenge. However, it is also more critical as businesses use technology to compete in a fast-paced global market.

Welcome to the Cloud/Mobile Era

In 2006, Amazon Web Services released their first offering: Simple Storage Service (S3). In 2007, Apple announced a new device that promised to combine the best qualities of the iPod with revolutionary mobile phone design and Internet capabilities: the iPhone. In the time since, the IT industry has been saturated with information and discussions on cloud and mobility, and that saturation has obscured the disruptive nature of these two trends.

Neither of these early offerings represented a never-before-seen concept. With cloud computing, Amazon built on a foundation of virtualization technology along with the recognized advantages of hosted systems over on-premise systems. The key innovation was the software layer that automated many virtualization tasks and allowed for greater flexibility and speed.

With mobility, the foundation was even more solid. Considering laptops as mobile devices, many companies had been exploring best practices around mobility for several years. Even smartphones were well entrenched as Blackberry had captured significant share among business users. The iPhone accelerated mobility momentum with a groundbreaking user interface and an app ecosystem that redefined the possibilities of mobile computing.

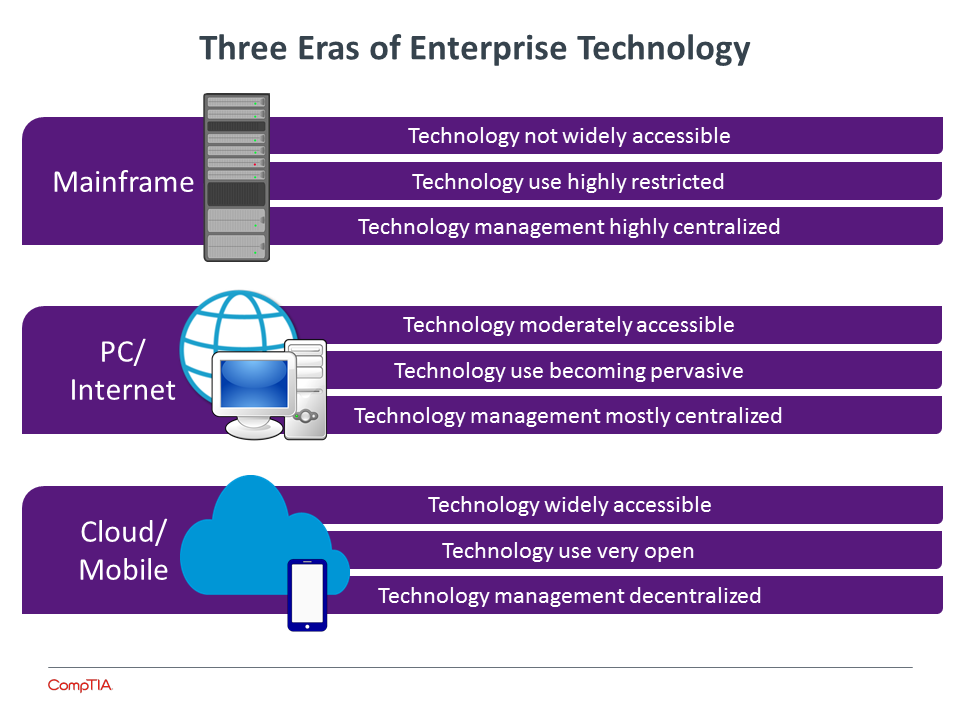

S3 and the iPhone introduced these new elements, and as more companies adopted them and adapted them for their own offerings, the era of cloud and mobility was born. Rather than creating an evolutionary step, cloud and mobility represent a true revolution. CompTIA, IDC, and other industry observers believe that cloud/mobility will be the third wave of enterprise technology, following mainframes and PC/Internet.

The revolution is not confined to the IT department, though. As technology becomes more accessible and more widespread, entire organizations are changing their approach and redefining the processes for choosing, implementing, and supporting business systems. The function of the IT team is certainly changing, whether that team is an internal department, an informal collection of employees, or a third party responsible for technology management. However, there are also changes in inter-departmental dynamics and in the drivers behind technology projects.

After several years of looking at cloud and mobility individually to understand how they were being implemented, CompTIA is taking a step back to assess the bigger picture. Building Digital Organizations explores the transformations taking place in businesses beyond the IT team. It also explores the steps the IT team can take to continue providing value in this new era of enterprise technology.

Growing the IT Pie

Without a doubt, the new trends in technology are the major growth drivers in the IT industry. IDC, which calls this new era of computing the “3rd Platform,” actually predicts that these new technologies will account for 100% of IT spending growth in 2015. With the lines often blurred between different areas in spending projections, there may still be incremental growth in some traditional areas of IT, but revenue for emerging areas has definitely skyrocketed in recent years, with high expectations for 2015:

- $536 billion on wireless data, making that the largest component of telecom spending.

- $484 billion in smartphone/tablet sales. This includes consumer spending, but businesses will certainly account for a healthy share.

- $118 billion on the overall cloud ecosystem, including IaaS, PaaS, and SaaS.

- $125 billion on data-related software, hardware, and services as late adopters pick up data management foundations and early adopters push new forms of analytics.

However, these growth areas are not necessarily replacing traditional components. Consider security as an example. Migrations to cloud systems and use of mobile devices force companies to invest in new security measures, such as DLP and IAM. At the same time, there is still a need for legacy measures such as firewalls and antivirus to remain in place. These areas may even require updates thanks to new technology models being deployed.

Flat spending in traditional areas, then, is still fairly significant in an industry that generated $3.7 trillion in global revenue in 2014. Companies will continue to spend in areas like security, networking, and help desk as they pursue new technology directions and seek greater efficiency and productivity. These macro revenue trends are the first sign that technology planning is has two separate components: operational and strategic.

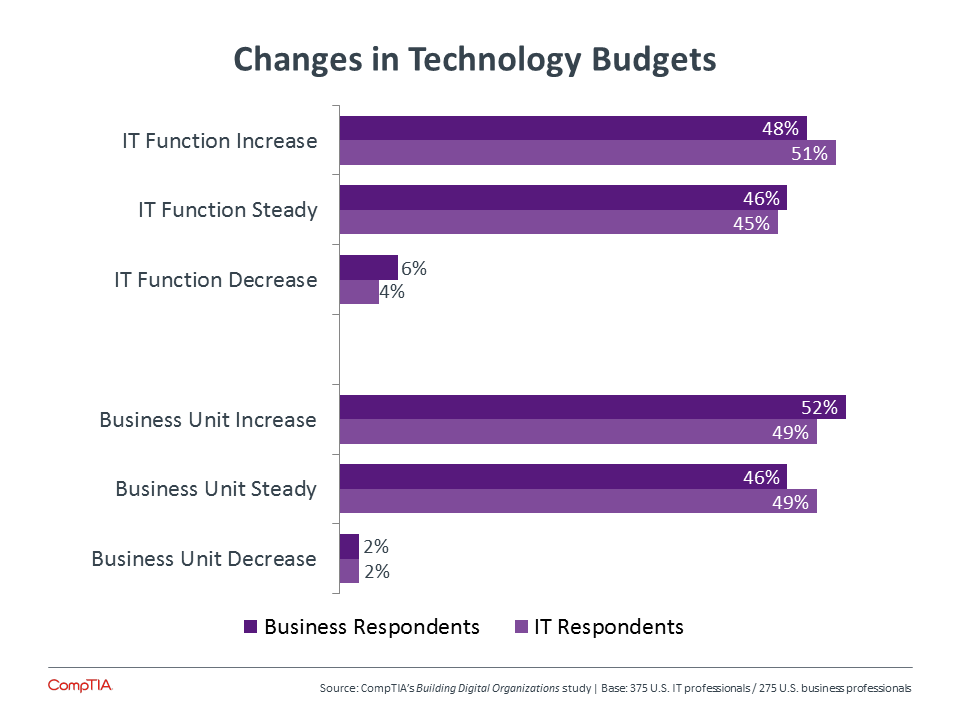

Individual company budgets reflect this trend, and they also show that technology is a growing market. In order to meet both operational and strategic goals, budgets are becoming more distributed. Only 19% of companies report that the IT function still owns the entire technology budget. In most cases, the business units have some of their own funds, whether that is merely discretionary (33%), split evenly with the IT function (20%), the majority of the technology budget (9%), or complete control (19%).

There are obviously differences in budget distribution depending on company size. Small companies (1-99 employees) are less likely to have formal IT functions, so it’s no surprise to see that this is where business units are most likely to hold the full technology budget. Among medium-sized companies (100-499 employees), the most common model is for the business units to have discretionary funds while the IT function holds the majority of the budget. Large enterprises (500+ employees) use a variety of methods, but generally the IT function retains at least half the budget.

While the budgets may be spread across different areas, they all seem healthy. Distributing technology funds to business units has not adversely affected the budget of the IT function, and in nearly half of businesses both sets of budgets are growing. The fact that there is negligible difference between IT respondents and business respondents shows that all groups have good visibility to what is happening across the organization.

Growing budgets do not mean that companies are becoming less cost-conscious, but it is a signal that investments will be made if the business case is viable. With budgets held by different groups, that business case will take different forms depending on who is making the decision. Pitches for technology will often need to go beyond specifications and features to include user experience, innovative potential, and overall integration across separate functional areas.

The New Business Systems

The role of IT within business is complex, but one way of quickly describing the function is that IT exists to build and support business systems. In the early days of IT, these systems required highly specialized skill to build and operate. Only large companies could afford the expensive equipment and the highly skilled staff, and the systems were very self-contained. As PCs and the Internet entered the business world, systems evolved to include a strong backend for centralized computation and storage along with a connected frontend for the broader workforce to utilize technology.

In the age of cloud and mobility, the workforce is more aware than ever of technology options and more equipped to apply those options directly. Workers bring in their own mobile devices, and business units procure their own cloud solutions. The concept of a business system could mean different things to different people. A sales team may think of a CRM application and the various functions and features they need for driving new deals. The IT team will consider the CRM application along with the databases on the back end and all the devices that need to display that application in different settings.

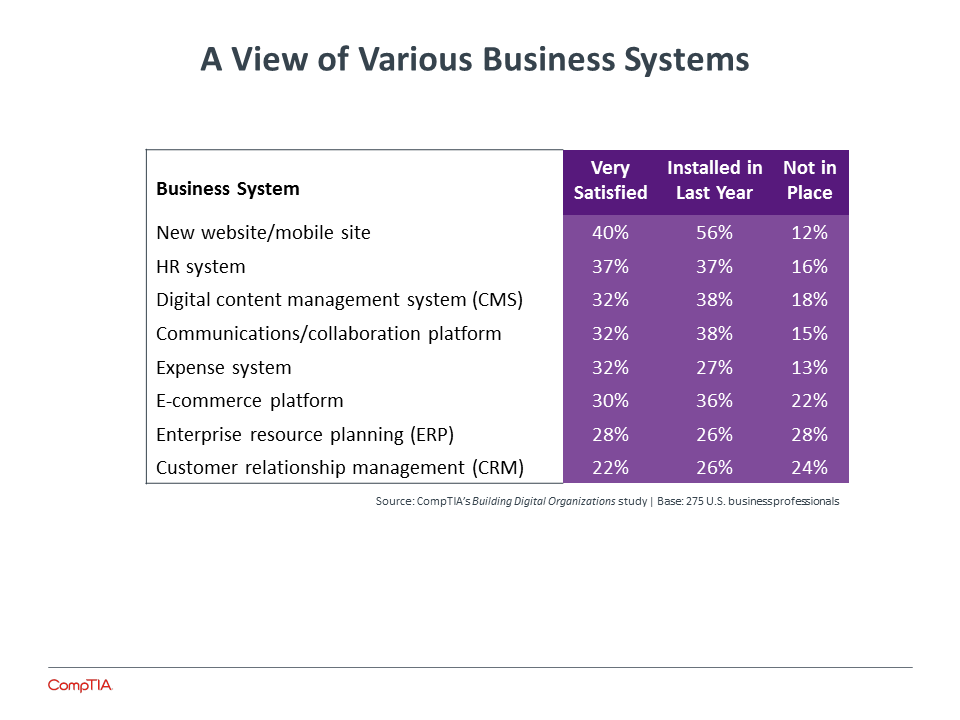

Any application can qualify as a business system, especially as the focus on data grows sharper and companies expect to gain insights from data generated within any application. There are several systems that are commonly recognized across most organizations, including the corporate web presence, communications platforms, and customer relationship management (CRM).

Satisfaction with business systems is currently a function of business operations. Those systems with the lowest satisfaction are the ones with the goal of automating standard business operations and enabling connections between different functions. Systems like CRM or enterprise resource planning (ERP) hold a great deal of potential, and new experiences with technology can make it apparent that this potential is not being met.

This is especially true if these systems are a little long in the tooth. CRM and ERP are the least likely types of system to be installed over the past year, with small companies still holding off on these systems even with cloud-based options. The primary activity over the past year has focused on the portal between a company and the outside world. Websites (including mobile sites), content management, and e-commerce all work together as businesses try to make an impact in the digital space and reach new customers.

More and more, digital systems are becoming the battleground for business competition and the tools for building competitive advantage. By a wide margin, the smallest businesses are the least likely to have certain systems installed. For complex systems such as ERP (not in place at 49% of small businesses), there is probably not a pressing need. The gap still exists, though, in systems that are more critical, such as websites/mobile sites (not in place at 23% of small businesses).

For small and medium-sized businesses to truly become digital organizations and compete with larger enterprises, they will have to explore a greater degree of technical complexity and automation. Many SMBs recognize that they can expand their capabilities thanks to cloud computing, but building large business systems will require a broader, more aggressive approach.

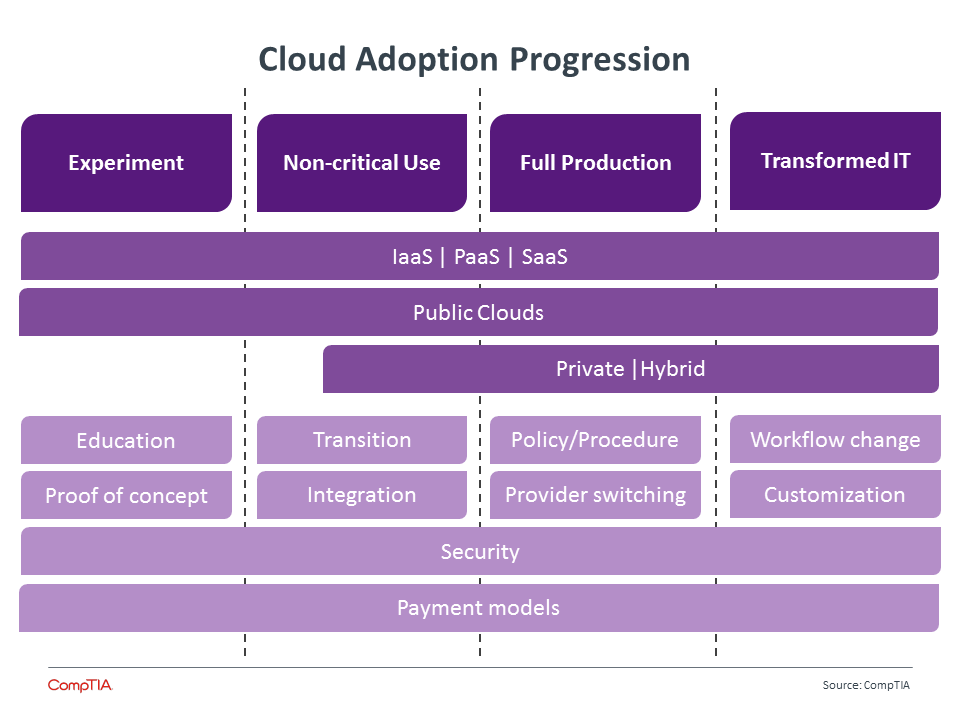

CompTIA’s 5th Annual Trends in Cloud Computing report found that the top applications that have moved into the cloud are business productivity suites and email. While these applications could easily be connected to other pieces of a larger business system, it is more likely that companies in the early stages of adoption are using them stand-alone. Businesses still gain benefits from these types of migrations, but those firms moving into the Transformed IT stage of CompTIA’s cloud adoption progression are comprehensively changing their architecture to allow for greater connection between applications, driving towards fully cloud-enabled business systems.

Similarly, only 8% of companies in CompTIA’s 3rd Annual Trends in Enterprise Mobility study claimed to have made significant changes to workflow as a result of mobility adoption. Email is again a top application for mobile strategies, and that certainly provides employees with new efficiencies in communication. As applications are rebuilt for cloud systems, workflow will also have to be rebuilt to ensure that mobile devices can be used to drive a variety of business operations.

Business transformation is a topic that has been in the spotlight as much as cloud computing and mobility, and there is just as much reason to believe that it is also critical. In order to connect with customers in a global economy or even provide the products and services needed for today’s market, companies will need to transform into digital organizations that effectively use technology to drive forward.

What, then, are the characteristics of a digital organization? How are these business systems built, and how does IT provide value in the new world order? Building Digital Organizations examines these questions, taking the lessons learned in the first stage of cloud/mobile adoption and providing insight for IT departments and solutions providers as a more advanced stage begins.

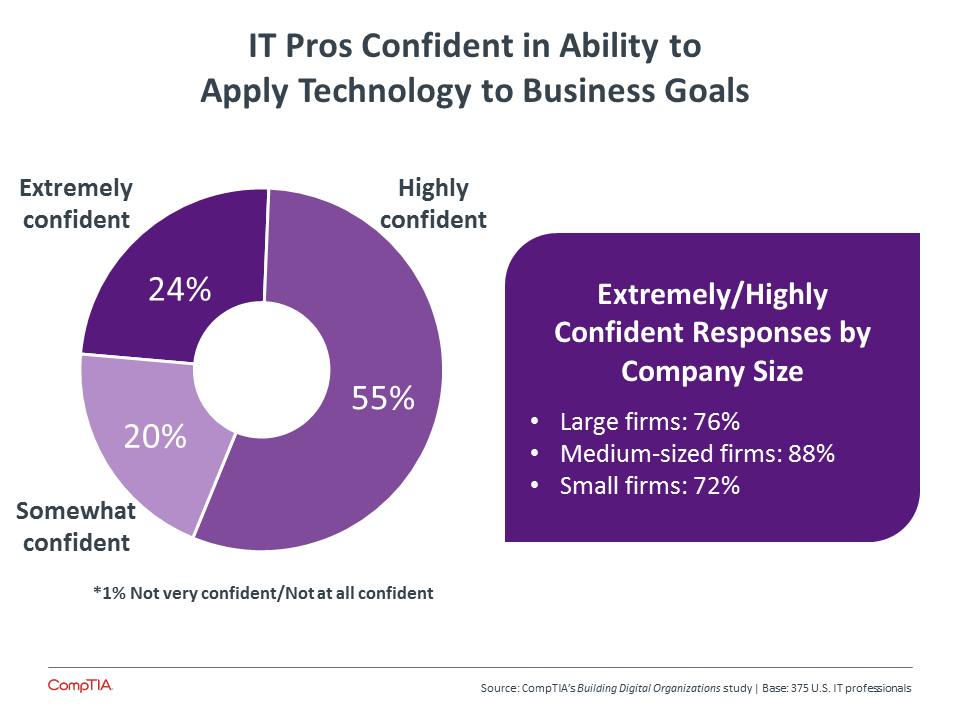

The good news is that IT is up for the challenge. As these new trends have taken hold, there has been some uncertainty about the role that IT will play as delivery models change and business units become more powerful. With the first wave of cloud migrations and mobile device influx behind them, IT professionals are more confident in the value they provide and the ability to deliver service in the new environment.

Appendix

What exactly is a digital organization? The full report aims to answer that question in depth, but a quick glance at a sampling of business processes gives some insight into the ways in which a digital organization is using technology—both old and new—to optimize their workflow and improve efficiency.

Section 2:

Business Model Analysis

Key Points

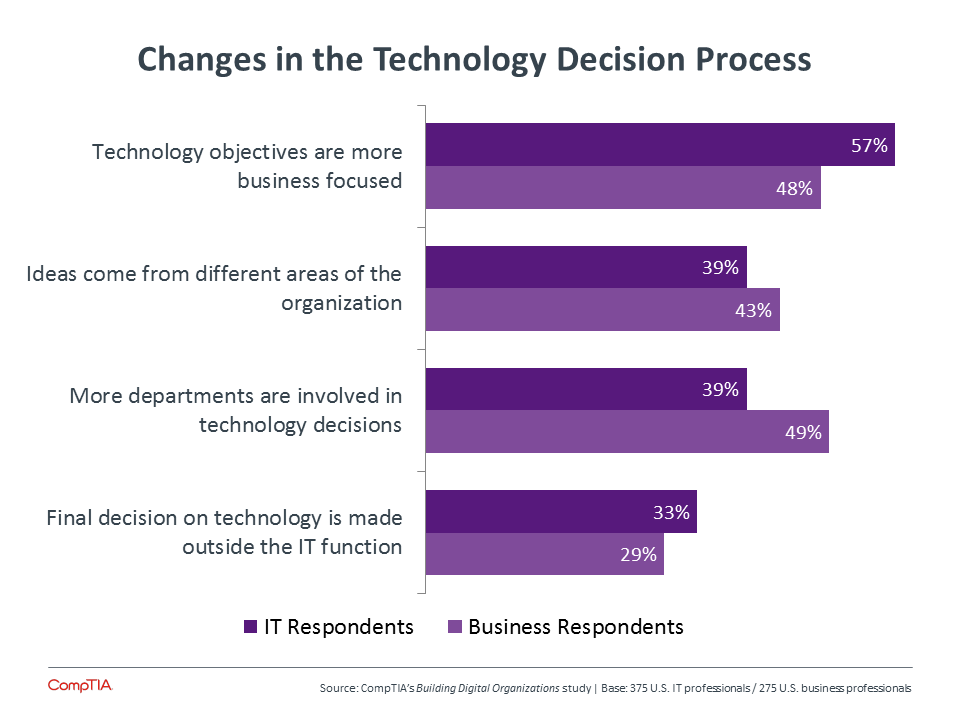

- The decision process for new business systems is the starting point for the changes that a business must make to its internal processes. Rather than the IT function being the command center for technology decisions, the process now focuses more on business objectives, includes different areas of the organization, and often has a different final decision maker.

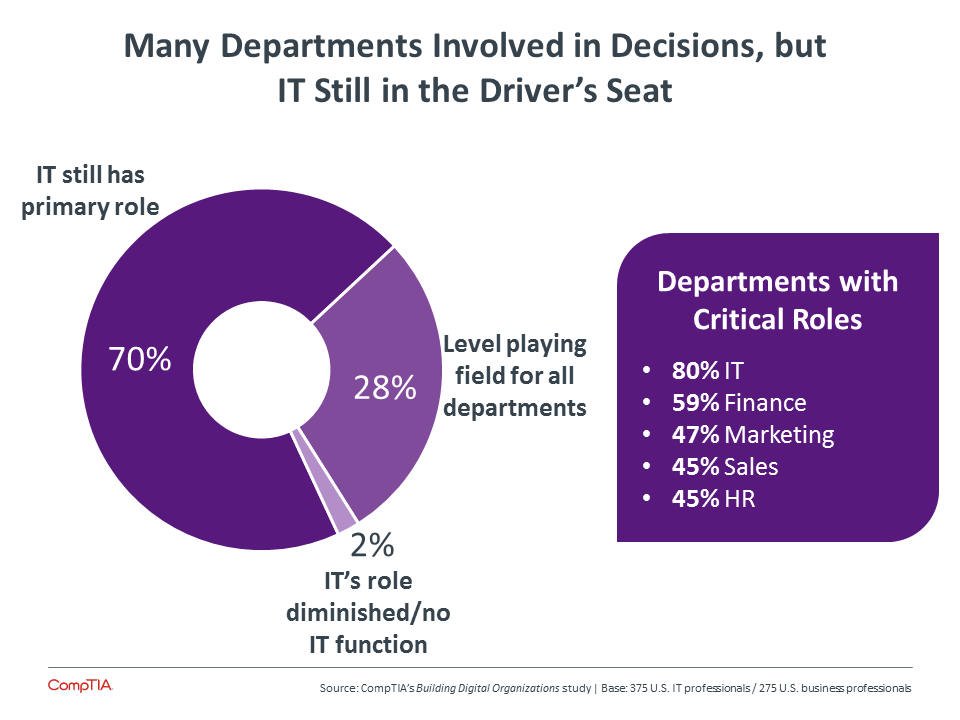

- While there are more voices involved in the decision process, IT is still seen as the primary driver for technology choices. Seven out of ten companies say that IT still has a primary role in the decision process, with finance, marketing, sales, and HR playing larger roles.

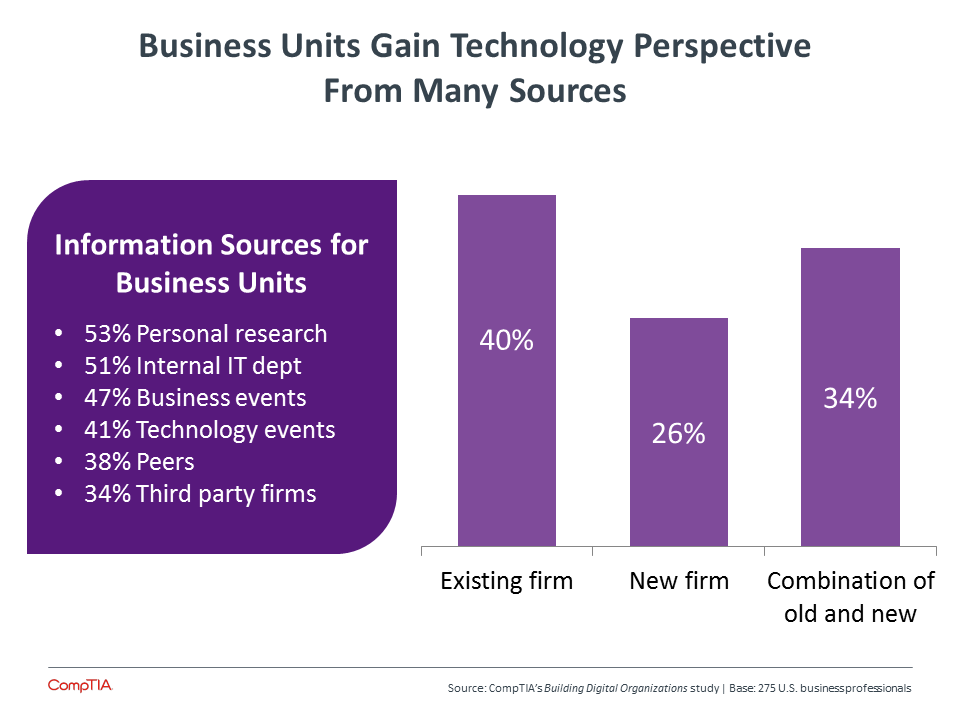

- As business units contribute more to technology decisions, they are seeking input from a variety of sources. Along with knowledge or research internal to the line of business, information comes from business/technology events, peers, and third party firms. Existing technology partners are a common choice, but new firms with new capabilities are also sought out.

A New Way of Making Decisions

As cloud and mobility transform the approach to enterprise technology, the changes go much deeper than application architecture and infrastructure implementation. Digital organizations have new business processes thanks to the propensity of business units to drive technology choices and the responsibility that the IT team must take as a result.

The decision process for new business systems is the starting point for these changes. In the PC/Internet era, the IT team still held the vast majority of the technical knowledge and skill. Because of this, they maintained a high degree of control, selecting systems to match their interpretation of business needs and their knowledge of integration and security.

Today, business units are not only more aware of technology solutions but also more able to procure those solutions. Developers within business units can obtain virtual machines through IaaS providers instead of going through a process to secure internal resources. Other workers can select SaaS applications for their needs, and they can bring in their own mobile devices to access these applications.

Over the past several years, the concept of business units procuring their own technology has become known as “rogue IT” or “shadow IT.” In theory, this allows for greater speed and a better fit to business goals, but it also raises questions around integration and security. As businesses try to get the best of both worlds, they are making changes to the process for deciding on technology.

The most common change is in the objective for new technology. IT has always played a support role—the ultimate objective has always been to support the needs of the business. However, the view on enterprise technology is changing in the cloud/mobile era. Rather than simply enabling goals that the business has already chosen, technology is tightly integrated with the goals. In other words, new goals depend on the proper use of technology as they aggressively move the business into new areas.

There is a notable gap between IT personnel and business personnel in the perception of technology objectives being more business focused. Business personnel likely see new business goals as technology-fueled extensions of their previous activity. IT personnel, on the other hand, likely see the business imperatives in a new light. It’s the difference between “We need email so that we can communicate with each other” and “We need our email to connect to our CRM so that we can have a tighter process for communicating customer information.”

CompTIA’s cloud research has consistently shown that medium-sized businesses are in a unique position for adopting new technology models, and the data on technology objectives continues to affirm this. Six out of ten medium-sized businesses say that there is more of a business focus with technology decisions, compared to 52% of large companies and 49% of small firms.

The other major difference in the technology decision process is that there are more voices involved. This is true as ideas are being generated, discussion is taking place, and the final call is made. For most companies, IT is still seen as the driver for technology. This is true for IT respondents and business respondents, and it can be seen whether talking about the position of IT relative to other departments or the list of departments that play a critical role.

This picture is in flux—in another five years, there may be even greater balance than there is today—but this is a good sign that the role of IT is still highly valued. Some companies may still have IT in a primary position simply because of historical momentum, but others are likely realizing that IT’s expertise in those problem areas of integration and security is critical for ongoing success.

The data around final decisions tells a slightly different story, one that may indicate the shape this process takes over time. With fewer respondents saying that the final decision comes from a new source, the data for now simply acts as an indicator, but it appears that final technology decisions are more frequently being made by the CEO or business owner. This is true even at large enterprises.

Smaller technology investments may not rise to this level of executive approval. As business systems grow more complex, though, they will require greater investment and affect many different departments. There will often be trade-offs required between one department and another. As the decision process evolves, everyone may have a seat at the table, but the final call could be made at the highest levels.

Business Goals from the Business Units

New Criteria for New Systems

- 54% Improve innovation/build new products

- 51% Reach new customers/markets

- 49% Speed up processes and operations

- 40% Improve internal communications

- 40% Lower overall cost

- 37% Gather new types of data

- 29% Improve brand image

If the business units are taking a more active role in technology decisions, what does that mean for the decision process? Obviously, there is the push for technology to better drive business objectives. Since the first mainframes, the goal of IT has always been to enable a business to achieve things that would otherwise be impossible. New technology models allow companies to continue chasing typical pursuits such as cost cutting or increased efficiency, and they also open doors to new products, new customers, and new data.

To match business goals with technology solutions, business units must have the right level of technical knowledge. Most business professionals today are far more aware of technology capabilities than their counterparts from previous decades. Some of this is simply the cumulative effect of IT: as companies have built a strong foundation and integrated technology into their day-to-day operations, employees have become accustomed to the typical tools in use within their organization.

However, consumer technology has greatly accelerated technical savvy among business professionals. In the mainframe era, there was no consumer technology to speak of. In the PC/Internet era, technology moved into the consumer space, and it mostly trickled down from products created for enterprise use. The best technology was built for businesses since they were the ones that could afford it, and eventually it made its way into the consumer market.

One of the hallmarks of the cloud/mobile era is that some of the best technology is being developed for consumers. Smartphones, tablets, and many cloud services were initially designed to focus on user experience and convenience, with security taking somewhat of a back seat. The simplicity built in to these devices and services has driven rapid adoption and quickly raised the technology literacy level.

Given this newfound literacy, it is no surprise to see that the primary source of technology information for business units is their own experience or research. With direct knowledge of the problems they are facing and with the right tools at their fingertips, business professionals are eager to dig a little deeper to find the best solutions for their needs.

Internal IT departments also rate highly as sources of information, giving further proof that the IT team continues to deliver value. In this case, the IT team is shifting into a role as a consultant. As expected, small businesses see this happening far less often than medium-sized or large businesses.

The IT channel is not yet playing a major role in educating business units about available technology. Once again, medium-sized businesses take the lead here, with 41% using third party technology firms for information (compared to 32% of large businesses and 27% of small businesses). With enough resource to think seriously about growth and operations but not enough resource to fully bring everything in house, medium-sized firms are ideal candidates for exploring new forms of partnering.

Following the trend seen in CompTIA’s Enabling SMBs With Technology study, companies are most likely to seek out information from third party firms that already have an established relationship. For the business units, though, this relationship may be an unknown. Compared to the general SMB market, business units across all company sized show a greater tendency towards new firms, either as the single source of information or as a complement to an existing partnership.

There are two takeaways for solution providers. First, be sure that the connection with a company includes the lines of business along with the IT function. The IT function may still be a major driver in technology decisions, but the business units are becoming more critical. Second, be sure that services and skills are up to date. Even if current offerings continue to generate healthy revenue, there is always the possibility for disruption. The current offerings may remain viable, but they will need to be positioned in the context of the changing market.

Section 3:

Challenges

Key Points

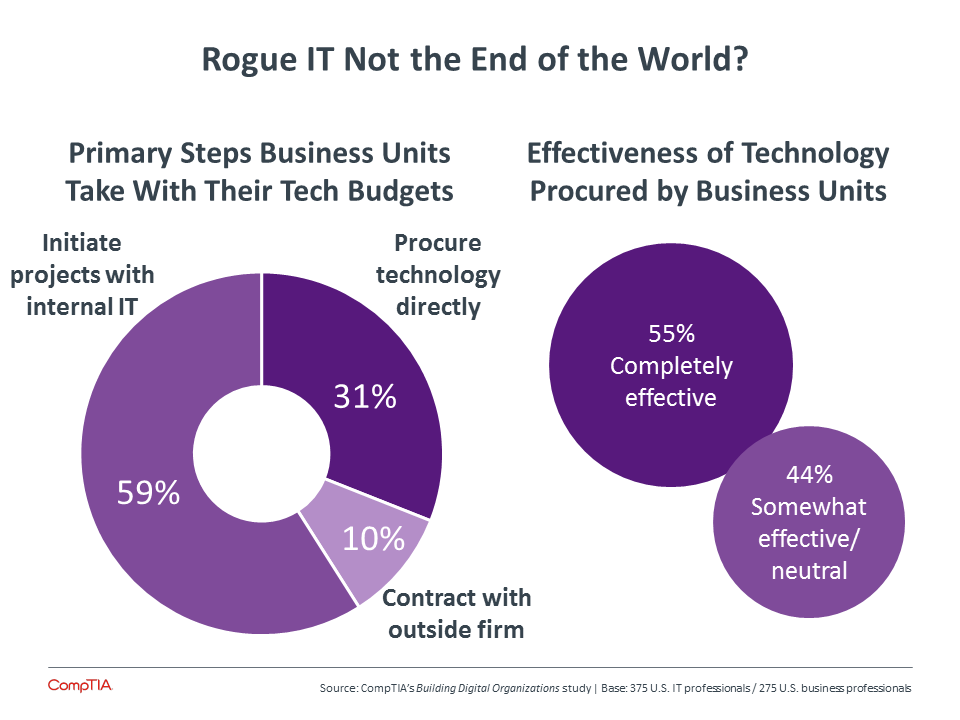

- One of the major challenges in the new technology environment is rogue IT: the selection and implementation of technology by business units with no IT function involvement. However, this trend may not be as rampant as some might think: of business units with their own technology budget, only 41% use that budget to procure technology on their own or start independent projects with outside firms.

- Part of the issue with rogue IT is the perception of the IT function. Here again, the data points to a more positive picture than is often portrayed. Over half of the companies surveyed said that there is a good relationship between the IT function and the business units. There may be more strategic work that IT could do, but there is a desire on the part of the business units to be partners.

- As the IT function implements the technology decisions that have been made, there are new considerations for every part of a business system. On the backend, cloud systems provide new options for application and drive new storage needs. On the frontend, mobile devices allow for more efficiency but require more development effort. Across the entire architecture, data and security have become greater cause for concern than the cloud/mobile pieces.

Going Rogue

Many challenges crop up as the business model for technology solutions changes, and one of the biggest challenges in this new dynamic is the incidence of rogue IT. Business units are knowledgeable enough about technology and enabled enough with their own budges to procure their own solutions. In some cases, this procurement may happen because business units have negative feelings about IT. In most cases, though, they are simply looking for the quickest path to meeting or beating their goals.

There are two major questions when it comes to rogue IT: How much is it happening and what are the effects? On the first question, CompTIA research has seen indicators for rogue IT rise over the past few years. The 5th Annual Trends in Cloud Computing study found that business units handled their own procurement for cloud applications between 18% and 36% of the time (depending on the application). This was a slight increase from the previous year’s numbers.

The data on business unit budgets in the Building Digital Organizations study indicate that rogue IT continues to grow. Four out of ten companies say that the primary action business units take with their own budget is an independent one, whether they are procuring their own technology directly or contracting with an outside firm. While small businesses show a greater tendency for independent outsourcing (which makes sense without an internal IT function), there is no significant difference in the likelihood for independent procurement across company size.

Rogue IT is clearly not rampant, though. As section 2 described, it is still more likely for the IT function to control at least half of the technology budget. Within business units that hold their own tech funds, the most common approach is to engage internal IT teams for projects. This matches findings from previous studies showing that business units typically keep IT involved, even if they are making the final decision.

Keeping IT involved or working with them directly on technology projects are both ways to avoid the major threats associated with rogue IT: integration and security. For as much technical savvy as they may have, business units still will not typically be well versed in these two areas. The early view on rogue IT was that business units might select applications that worked well in a vacuum but caused headaches in the context of the overall company architecture.

It certainly appears that businesses have learned these lessons, based either on missteps they have made themselves or on information they have gathered from early adopters. Even in the relatively short time CompTIA has been examining rogue IT in studies on cloud computing, the complete sidestepping of IT has gone down, and those companies that have done so have experienced the expected issues with integration and security.

In this new study, companies overwhelmingly claim that technology procured by business units is effective. This view is remarkably consistent among IT respondents and business respondents, so the two sides do not appear to be at war over this issue. Instead, it appears that there is some agreement being formed on how technology will be driven and which issues must be considered in the process.

The question on the effects of rogue IT has a partial answer. While companies view these solutions as effective, there is clearly a great deal of work being done to make this happen. Those companies that are pushing into new territory with line of business technology budgets and democratic decision processes are finding success, and companies with more traditional structures will soon follow suit. As they do so, the negative connotations of rogue IT should fall away as teams work together to marry the speed of business unit procurement with the safety of IT oversight.

Business Unit Views on IT

The level of agreement from business units to various statements about the IT function indicates a generally positive relationship.

- 52% “There is a good relationship between the IT function and all business units”

- 44% “The IT function plays a critical support role in our organization.”

- 40% “The IT function plays a critical strategic role in our organization.”

- 32% “The IT function drives our vision for technology.”

- 18% “It can be difficult explaining business problems to the IT function.”

- 18% “The IT function has a tendency to slow things down.”

Perception of IT

Just as rogue IT has some negative connotations, there are some views on the behavior of the IT function that are less than rosy. Many of these views correspond to the thinking that rogue IT is done primarily as a workaround of an IT team that is not moving quickly enough or finding new ways to meet business goals.

However, this concept of the IT function as the “department of no” does not seem to be the majority opinion. The idea has appeared in many industry articles and conference sessions, but its traction may have more to do with its weight as a rallying cry than its actual presence in the workplace. Every business has some degree of inter-departmental frustration and differing priorities, but business units tend to view IT as a valuable partner rather than a hindrance.

While only about half of the business units in the survey agreed with the statement that there is a good relationship between the IT function and the business units, this was the top response chosen and was far more popular than the more negative statements. This is likely a case of abstention—it is reasonable to assume that the 18% agreeing with the negative statements are the segment with negative feelings, and the gap remaining between that segment and the positive statement are simply in neutral territory. Having approximately 8 out of 10 businesses with positive or neutral relationships is still a far cry from a widespread negative viewpoint.

As good as the relationship may be between business units and the IT function, there is room for improvement. Overall, IT is still seen more in a support or tactical role rather than a strategic role, though not by a wide margin. This is particularly true in the SMB segment. In fact, more large businesses view the IT function as strategic (48%) rather than support/tactical (43%).

Medium-sized businesses, on the other hand, are more likely to view the IT function as driving technology vision. Forty-one percent of medium-sized businesses agree with this viewpoint, compared to 35% of large businesses and 24% of small businesses. Large businesses may agree less since they employ a more collaborative approach to technology, but small businesses are in need of someone to drive an innovative vision.

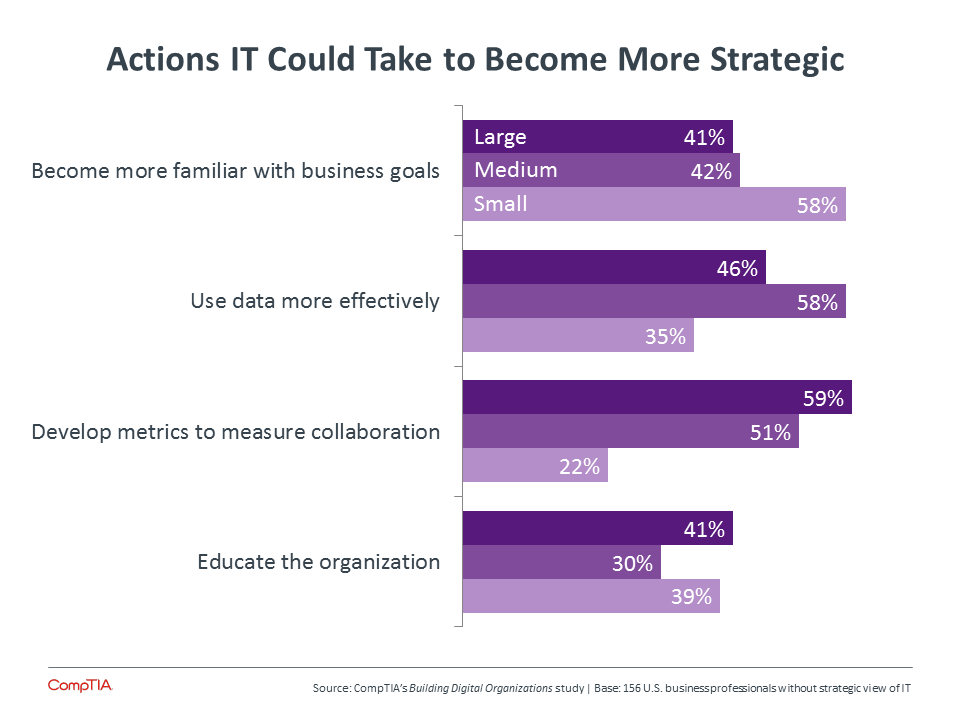

Each company segment has a different preference for the key action IT could take to become more strategic. Small businesses that are using IT providers or internal employees simply to maintain operations are looking for a better understanding of business objectives. Medium-sized businesses that have grown into more complex processes and architectures are looking for a more effective use of data. Large businesses that are highly concerned with efficiency are looking for metrics that quantify the collaboration between the IT function and the business units.

Although education is not at the top of anyone’s list, it is a growing need as technology becomes more complex and integrated with business operations. CompTIA’s 3rd Annual Trends in Enterprise Mobility study found that the top challenge in adopting mobility was the skill level of general staff. Since much of the momentum behind mobility initiatives (especially BYOD) is the adoption in the consumer space, this is surprising at first glance. However, organizations are finding that the requirements for safely using mobile devices in a corporate setting are new even to users with fairly strong mobile device proficiency.

Education, then, bridges the gap between what users think they know about technology and what they really need to know. New user interfaces have driven demands for ease of use and abstraction has made complex functions appear simple, but the expertise IT has built in proper security and smooth integration is highly valuable and should now be shared across the broader organization.

Building Business Systems With New Pieces

Aside from the issue of forming and maintaining strong relationships with the business units, the IT team has its own challenges to deal with internally. The construction and support of business systems has become much more complicated thanks to the wide range of options now available. In addition, certain aspects of these systems have now taken on an enhanced level of importance thanks to the new cloud and mobile components being used.

At the highest level, IT architecture consists of a backend (where applications are hosted and databases crunch numbers) and a frontend (where users interact with the backend and perform day-to-day operations). Cloud computing and mobile devices have transformed both of these aspects, with cloud changing how systems are constructed and mobile devices driving new user experiences and workflows.

The top change that cloud computing is driving within the IT function is the management of storage as systems and data are spread across multiple environments. Storage was the first cloud offering, and there are now many cloud solutions such as databases or analytics services that allow companies to build robust plans beyond simple storage of data. Backup and disaster recovery is a good example of a process that has been re-imagined, especially for companies in the SMB segment that previously had little in the way of BC/DR strategies.

Other changes driven by cloud involve internal expectations. In the early days of adoption, companies viewed cloud as a path to lower costs. Although many companies are now finding cloud to be cost-neutral (while delivering other benefits such as speed and new revenue opportunities), the expectation still lingers, and 61% of IT professionals say that controlling costs is the top challenge in the overall management of backend architecture. Other expectations for lower downtime or a stronger business voice in suggesting technical solutions drive new operational behavior and organizational collaboration for the IT team.

Although only a third of companies say that there is less focus on backend maintenance due to the cloud, this change may have one of the more dramatic effects on the composition of the IT function as it becomes more widespread. The notion of shifting the maintenance burden to cloud providers can be somewhat unnerving for IT professionals currently doing that work, but previous CompTIA research has found that companies are far more likely to redeploy these skills to something more innovative rather than reduce the workforce. As maintenance causes less burden, the IT team is free to pursue those activities that can put them in a more strategic position.

Aside from keeping costs under control, the main challenges with backend systems revolve around the complexity in managing multiple models. The challenges start at the beginning, with simply selecting the correct model (cited as a challenge by 47%). Things remain complex as the process moves on and models are integrated together (43%) and secured (43%). Finally, the entire system must be monitored (42%).

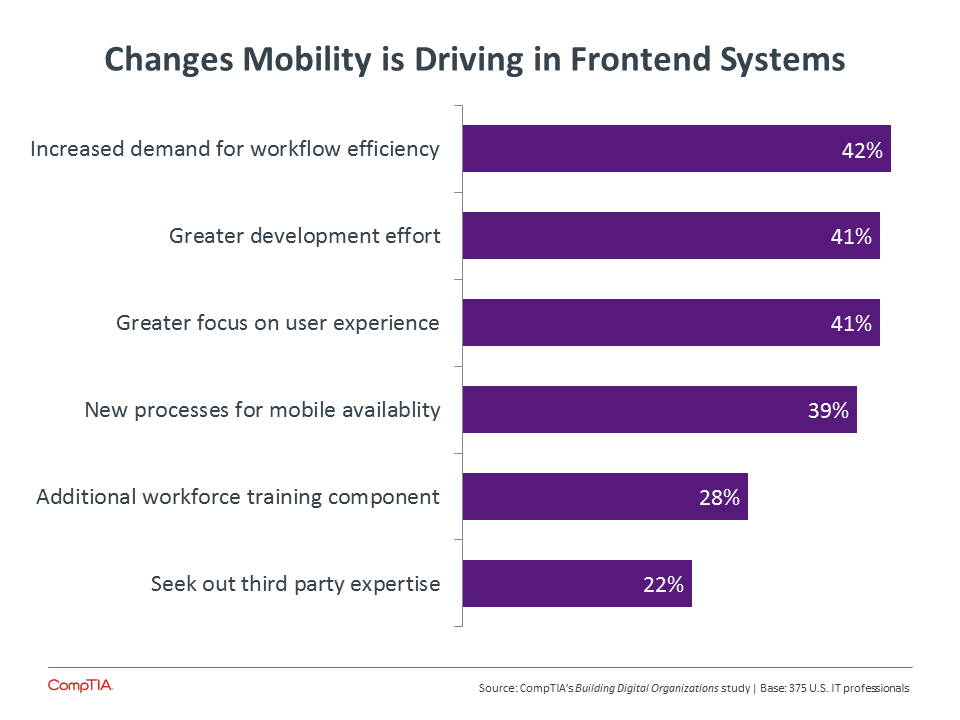

Moving to the frontend, the challenges follow a similar pattern. About half the companies that experience difficulties with frontend systems cite cost control as an issue as they need to support a growing number of devices. This growth also drives complexity, and companies struggle with new applications needed for mobile devices and ensuring that users are properly equipped to put their new devices to good use.

Some of these challenges are directly driving change. The IT team feels greater pressure to deliver on workflow efficiency, and that drives a development effort. Many companies are finding that their traditional desktop development experience does not perfectly translate to mobile app development, and many more are finding that they must start development efforts where there have been none in the past. For other challenges, more change is needed. Although educated users are a major problem, less than one third of companies are adding workforce training to go along with mobility efforts.

Companies are less apt to seek out third party expertise for mobile systems. The consumer familiarity likely causes organizations to believe that the transition will be smooth. However, the new work needed in mobile app development and the gap between user knowledge and training efforts both suggest that third parties will be able to step in where companies need help fully integrating mobile devices.

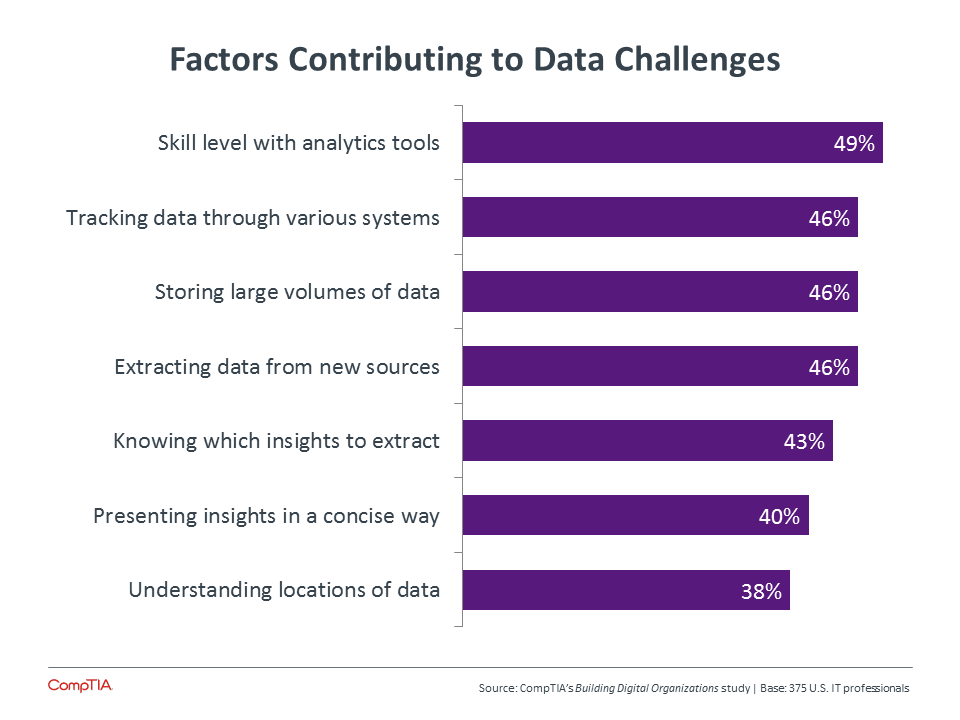

There are two components of business systems that are not directly tied to the main components of cloud and mobility but are indirectly magnified as those components are used. Digital data and cybersecurity have always been parts of IT operations; they have become serious concerns as data flows through multiple models and the entire architecture must be made secure. IT professionals actually rate these two areas of business systems as being more problematic than the primary focus areas of cloud and mobility.

The challenges with data begin with skills. At large organizations, there is a learning curve in dealing with distributed storage or non-relational databases. At smaller firms, the learning curve is even steeper as companies gain skill in more traditional areas such as data warehousing and SQL.

Even with the right knowledge, it can be difficult to know where all the data is. Whether it is moving through new systems, coming from different sources, or living in silos throughout the organization, the data itself now must be managed independently of the application or the location. Companies that previously relied on a secure perimeter for all their data must now examine other methods.

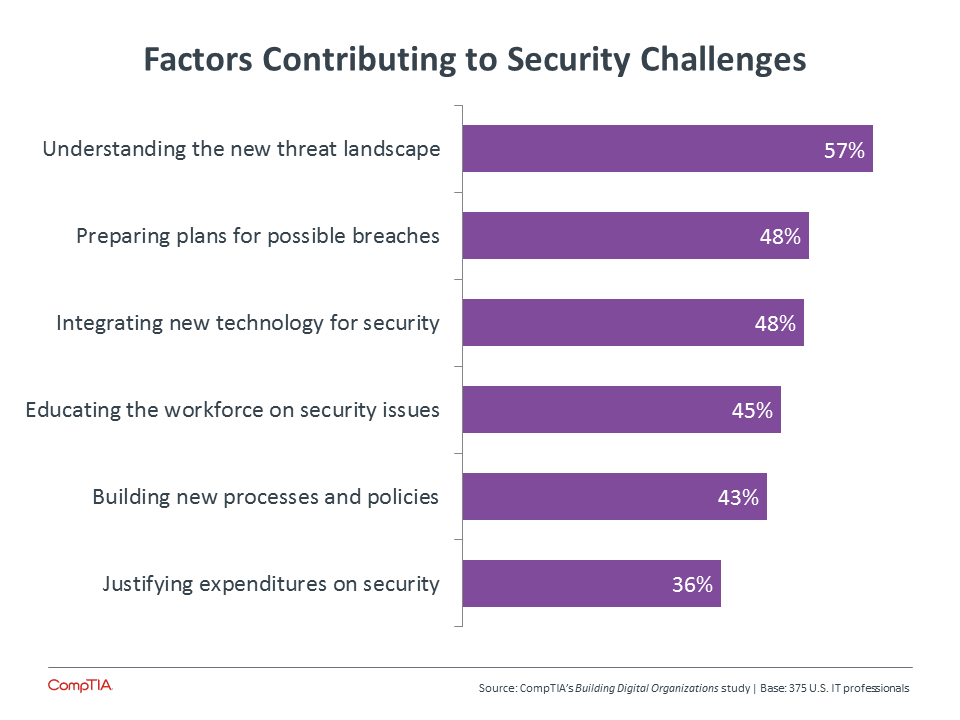

Security, then, becomes the final piece of the puzzle. New threats have emerged as a result of cloud and mobility, and understanding these threats is a top priority for the IT team even as traditional threats continue to be effective.

With the immense value of data and the myriad of new tools available to hackers, one of the biggest changes to a security mindset is preparing for an inevitable breach rather than putting all the effort into prevention. This makes the workload explode and also requires significantly different behaviors. CompTIA’s Trends in IT Security report goes into more depth on new approaches to IT security. It is no simple task, but the challenge now facing IT professionals is to change security and handle data in the age of cloud and mobility while partnering more with business units. These professionals have great opportunity to redefine themselves as they tackle this challenge and provide new value for their organization.

Section 4:

Opportunities

Key Points

- With a positive view on the role of IT in an organization, business units have certain areas where they definitely see IT as the primary owner. Security is an operational concern, even though the approach to security needs to change. Driving new forms of technology is a tactical concern, and business units want IT to be proactive in offering new applications that are suited for the enterprise.

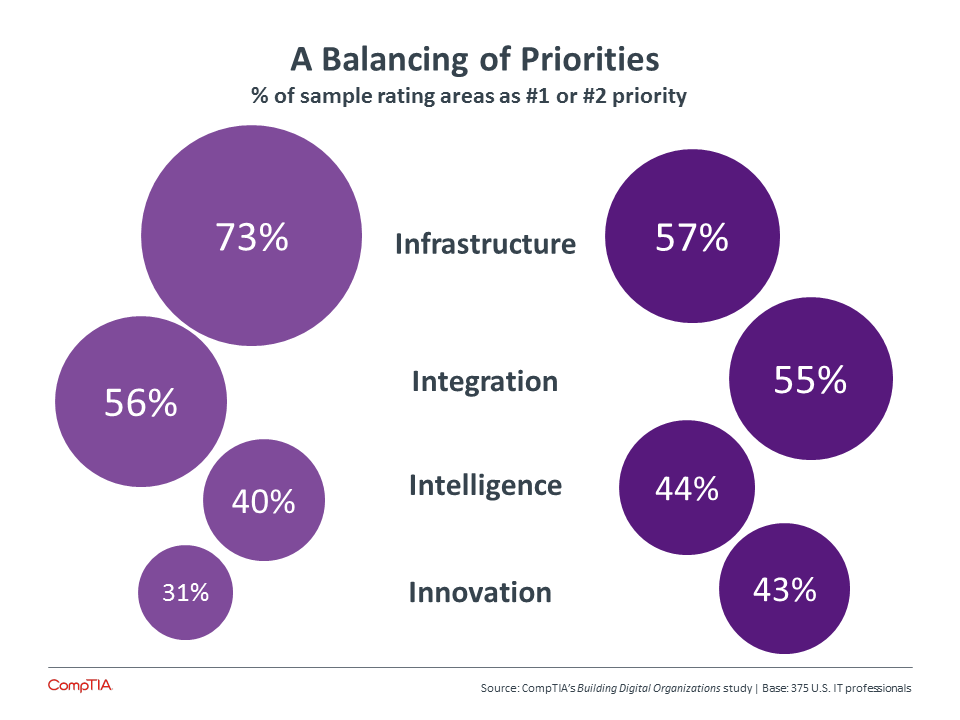

- As business systems and organizations change, the role of IT grows to include four priorities: Infrastructure, Integration, Intelligence, and Innovation. Infrastructure and Integration were the traditional strongholds of the IT department, and they continue to be of high importance in the cloud/mobile era.

- Intelligence and Innovation are more strategic paths for the IT function. There are skills needed here—both technical and business-related—that must be added to an IT function in some way, whether by training, hiring, or partnering.

The Once and Future IT

With cloud and mobility ushering in a new era of enterprise technology, the IT function can take on a new role within a digital organization. As section 1 described, that role has two parts: operational and strategic. The operational piece is the more traditional piece, where IT is responsible for keeping business systems up and running. The strategic piece is newer, requiring a new mindset and new behaviors.

IT is aware that this branching is taking place, and they definitely see it as added responsibility rather than a transition from one mode to the other. Over the past five years, 53% of IT professionals in the survey say that the operational workload has stayed the same, and 44% say that it has increased. Compare that to the strategic workload, where 40% feel there has been no change and 59% say there has been an increase. The operational work is clearly not going away, though the strategic work is quickly becoming more important.

The business side of the organization is helping define what this dual role should look like. Even if business units are not taking over technology decisions en masse, their growing influence in the process means that their view of the IT function should be given serious consideration.

First and foremost, business units see IT as a partner. For most areas of technical activity, business units hold the view that there are shared responsibilities in guaranteeing successful operations. Depending on the topic, this varies slightly between small, medium, and large companies, but in general the feeling is consistent: business units expect to work jointly with IT to solve many technical problems.

There are a couple of exceptions. The first is security, which falls into the operational camp. Business units show a clear preference for IT taking the lead on security issues. This is another data point suggesting that rogue IT will not take over the enterprise. There is recognition that security is vital to an organization’s success and that it must be managed from a center of expertise.

Becoming Better Partners

Business units and the IT function may already have a good relationship, but that doesn’t mean there are no ideas for making things better. The top items that business units would like to see from the IT team both have to do with speaking the same language, whether that means that IT understands the business a little better or that IT helps the business understand their concerns. Business units would also like to see IT be more proactive, looking into suggestions and providing their own innovative insights. The ultimate goal is a straightforward service catalog, relying on a number of different sources to make applications available for easy but safe use.

- 60% Better knowledge of business objectives

- 52% Better communication of IT concerns

- 50% Accept/explore ideas from business units

- 45% Proactive technology recommendations

- 32% Build a catalog of services

The second exception is more strategic. As much as business units may be learning about technology on their own and bringing ideas to the IT team, they would like the IT team to drive the technology vision. By combining their existing knowledge about enterprise security and integration with new insights about the direction of the business, IT is in the best position to explore potential solutions and bring them to the table. This is the type of forward-looking activity that businesses are starting to demand from their technical team.

Moving Beyond a Single Focus

Expanding into this new role will require IT departments and solution providers to broaden their focus. Constellation Research has described this broadening by defining four different personas that modern CIO’s need to adopt:

- Chief Infrastructure Officer

- Chief Integration Officer

- Chief Intelligence Officer

- Chief Innovation Officer

There is a sort of hierarchy to this description. The role of the modern CIO is based on traditional activities, such as choosing the right infrastructure and then integrating the pieces to build a comprehensive architecture. With that in place, the activity becomes more strategic, bringing intelligent insights from the stores of data and planning innovative ways to move the business forward.

At the simplest level, this description implies a four-fold increase in responsibility and workload as the focus shifts from simply Information to Infrastructure/Integration/Intelligence/Innovation. The real increase may be less than that, but it is still significant. The largest organizations demonstrate this through new positions that work alongside the incumbent CIO, such as Chief Technical Officer (CTO) or Chief Digital Officer (CDO). Small and medium-sized businesses often do not have the luxury of expanding the top of the organization, and they must find other ways to pursue these new efforts.

Responses from IT professionals clearly show that all four of these areas are driving behavior. Five years ago, infrastructure was the main focus, followed by integration. Both of these fit within the tradition purview of the IT department. Today, infrastructure has dropped dramatically, with most of the gains going to innovation. The picture now has much more balance between operations and strategy, though operations still carries some historical weight.

This is especially true among small businesses, where cloud and mobility now offer paths to vastly improved infrastructure without huge investments. These firms also see a shift towards more strategic IT behavior, but the natural first step is to build out architecture and set the stage for the exploration of new business possibilities.

Each of these areas has its own specific characteristics. Behaviors are changing because of newly balanced priorities, but they are also changing due to transformations brought on by cloud and mobility.

Infrastructure

This is the area where cloud and mobility have the most direct impact. On the backend, companies are reconsidering their hardware requirements as they analyze the economics of the cloud. Forty-seven percent of companies say that they require specialized hardware to achieve optimal application performance. This is a somewhat traditional mindset, though it will certainly be true of some applications, especially at the enterprise level. With that said, cloud options continue to evolve. Bare metal clouds, where the cloud automation runs on physical machines without a hypervisor level, are an example of cloud solutions aiming to deliver higher performance.

Another 33% of companies say that they do not require specialized hardware, but they keep some hardware on premise for security or cost reasons. Again, this will be application dependent, and companies without strict hardware requirements will have to evaluate their application suite to understand which model best fits each application.

The remaining companies freely use commodity hardware or have a low level of concern with the specifications of their backend equipment. Small companies especially exhibit little concern, making them ideal candidates for cloud-based infrastructure.

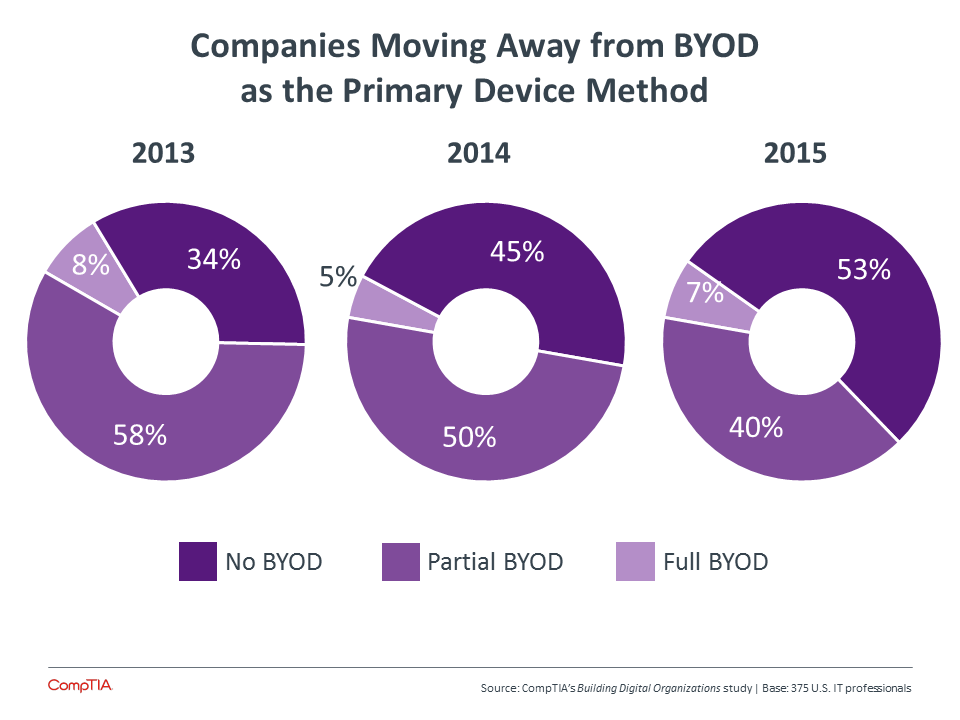

On the front-end, the great focus of the past five years has been how to deal with BYOD. With smartphones and tablets so prevalent in the consumer space, the question posed is often how to manage the BYOD flood, with the assumption that there is no way to stop it. It appears, though, that companies are moving in a different direction.

For the past three years, CompTIA has asked companies to describe their device approach by one of three buckets: 1) Full BYOD, where the company takes no responsibility for devices; 2) Partial BYOD, where the company provides some devices but allows some personal devices to access corporate systems; and 3) No BYOD, where the company provides everything and disallows the connection of personal devices.

There is a clear move towards a policy of no BYOD. Companies are finding that they can pursue mobility initiatives just as well by providing mobile devices, and employees are often happy enough to take a corporate device if it is the same thing they would choose on their own. A small percentage of companies—mostly small firms—elect to completely avoid device distribution. This can reduce the overhead required for device support, but it also raises issues for security and productivity. Many firms are clearly choosing to solve those issues by avoiding BYOD.

Of course, this is simply the stated policy. Ambitious employees will find ways to utilize personal devices and applications even if they are forbidden, so companies must also consider how to detect such usage and correct the behavior beyond merely building the preferred policy.

Integration

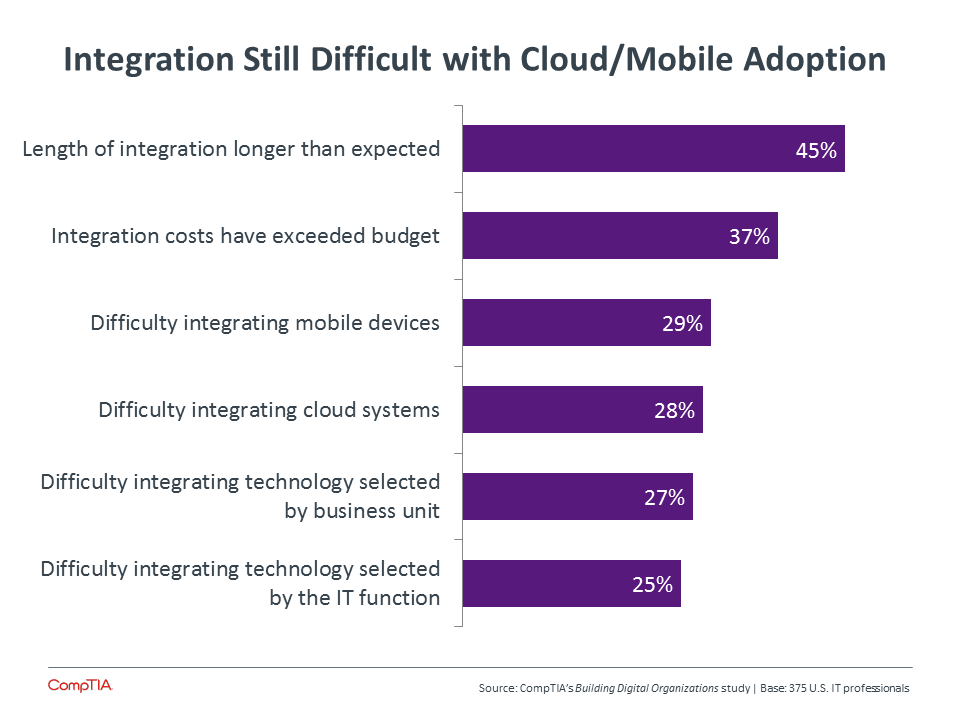

Those that are familiar with IT projects know that integration represents the lion’s share of the budget, both in financial costs and implementation time. Those less familiar with IT projects typically underestimate integration efforts, leading to surprises and scrambling as work gets underway.

As new cloud and mobile solutions are put in place, there is a learning curve for integration. Even among IT professionals, estimates for time and money are falling short as new technology is being implemented. There is not much difference between cloud or mobility, and there is not much different between technology chosen by the business units and technology chosen by the IT team. Integration has always been difficult, and cloud and mobility are impacting the level of effort that is required.

Another effect of cloud and mobility may be that integration is viewed from a broader perspective. Rather than integration applying to the technical work of putting disparate systems together, integration is coming to mean the smooth flow of technology, workflow, and processes to achieve goals. Fifty-seven percent of IT professionals still say that it is important to understand integration at an architectural level to allow the greatest degree of control, but 32% say that they prefer to consider integration at the application level for seamless workflow, and 11% say that they prefer thinking of integration at the business level. Viewing integration at higher levels is more strongly preferred in the SMB segment, where companies are increasingly focusing their limited resources on core competencies rather than technical details.

Intelligence

At first glance, there has only been a small uptick in the prioritization of intelligence among business professionals. This reflects the fact that business intelligence and data analytics have long been practices that companies have used to better understand the market and deliver the best products and services.

Under the covers, though, intelligence is changing as the nature of data is changing. The initial hallmark of Big Data was volume/velocity/variety: huge amounts of unstructured data constantly streaming into an organization and requiring analysis. Other attributes of data (such as veracity and value) have since been added to the definition, but the original description is sufficient to show that the format of data has drastically changed. CompTIA has conducted multiple studies on the topic of Big Data to understand how organizations are reacting to the new types of data.

These three aspects play into the priorities that businesses have as they revamp their intelligence efforts. Considering volume, 48% of companies say that they would like to more fully utilize the data they already have. Many companies are discovering data silos as they audit their internal data for analysis. Different departments have built their own data stores, and companies need to consolidate this data and understand the complete set before embarking on more advanced analytics.

The velocity of data is also an issue, as 44% of companies say that they would like to perform data analytics faster. Often, this will require new tools. For as much focus as Hadoop has gotten as a Big Data platform, its main weakness is in real time processing. Other tools, such as Storm and Spark, are better suited for that task. In addition to tools, there is a significant workflow component needed. Organizations need to define—or re-define—their processes in order to expedite the path from insight to decision.

Finally, variety is impacting data management and analytics, as 38% of companies say that they want to utilize new sources of data. Unstructured data that companies already have, such as documents and images, are certainly part of this equation. Data from social networks has been another major part in recent years. Looking forward, data collected from connected devices in the Internet of Things will continue to provide companies with new possibilities—if they are able to act on that data in intelligent ways.

Innovation

Innovation has become the guideline for companies as they seek to use their technical skills in more strategic ways. This area has seen the largest increase in priority, and it is the basis for the deeper IT/business connection that so many companies are pursuing.

Even deciding where to innovate can require a fresh approach. When choosing top priorities, the most popular objectives are reducing costs (60%) and improving operational efficiency (58%). These are common goals for a business, but they are also more of a means to an end. When applying technology to business problems, there is an opportunity to directly address mainline business targets, such as reaching new customers (44%), managing competitive threats (38%) or pivoting to a new business model (23%).

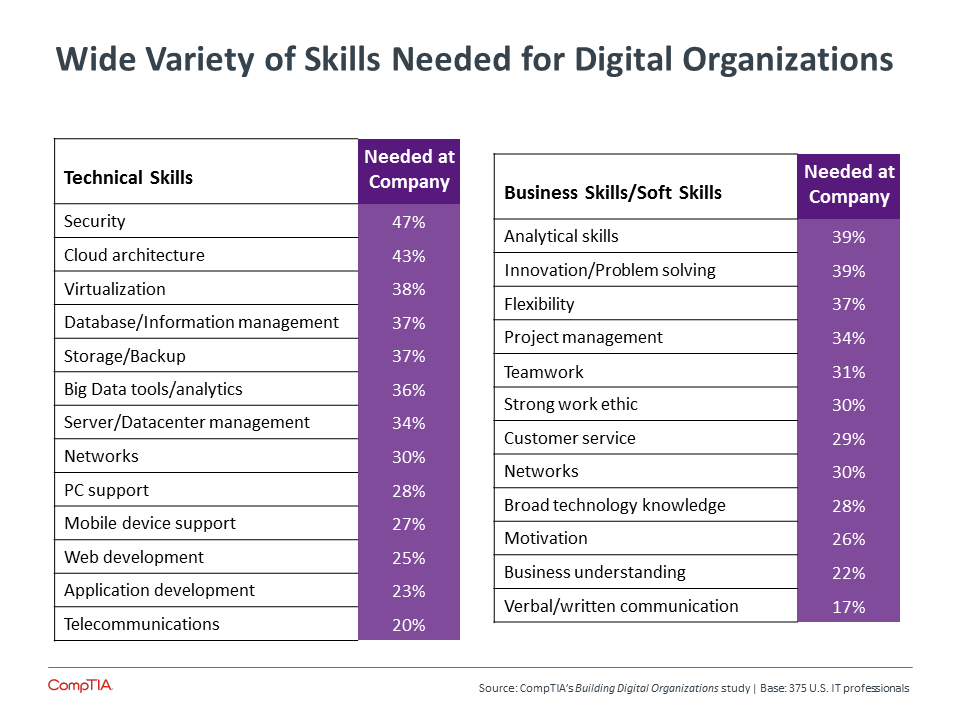

To achieve this innovation and truly become a digital organization, companies need to examine the skills they currently have and make adjustments as needed. Just as the approach to technology now has dual parts of operations and strategy, the workforce needs a dual set of skills. Both technical skills and business skills are needed to turn a company’s vision into reality through technology.

The exact mix of these skills will differ from organization to organization. Larger firms can create this mix with separate teams, some reporting to the CIO and some reporting to the CTO/CDO. Smaller firms must look for individuals that exhibit skills on both sides of the ledger, changing the notion of what it means to be a technical employee.

Either way, the skills are not limited to the technical team. Business units must also consider which skills they need to effectively manage their technology approach and team up with the IT function. Adding to the momentum behind business units and IT becoming effective partners, business units see ways that IT can support the skill-building that they need, including providing education (70%), the use of IT liaisons in business units (56%), or consultation on hiring (31%).

Cloud and mobility have done much more than provide fodder for conferences and industry debates. They have changed the way that enterprise technology is chosen, constructed, and implemented. Digital organizations are on the rise—companies that will effectively use technology throughout the entire business to meet their goals. In this change, IT has a tremendous opportunity to establish a valuable new position for themselves, helping to drive their companies forward in the new era.

Section 5:

Qualitative Interviews

Key Points

- Finding 1: Corporate IT’s power and influence over business is growing (not waning), but multiple business leaders now have a voice in IT’s direction. Business unit leaders certainly have more say in IT decisions. But as cloud, mobile, big data and social waves grow larger, central IT will emerge as a service broker to in-house and third-party IT offerings.

- Finding 2: IT’s transformation into an internal service provider is in its infancy and will require several more years to complete. Business executives and employees want self-service applications, but that requires several stages of IT investment.

- Finding 3: The shift from CapEx to OpEx will gradually even out. Technology and business leaders are discovering that cloud computing isn’t about cost savings. Instead, the conversation is about speed to market and automated maintenance—with lingering concerns over IT management.

- Finding 4: The security conversation is extending from device protection to total data protection. While overall device and infrastructure protection remains important, business and IT leaders are increasingly worried about data protection and customer privacy issues.

- Finding 5: Mobile conversations are extending to the Internet of Things. Business and IT leaders are exploring if or how new IP-connected devices can be monetized, while also exploring the potential cost and management challenges.

- Finding 6: Big Data is on the radar, but data-driven decisions are limited by information silos, a flood of new data sources, and business executive confusion over potential big data opportunities.

- Finding 7: As innovation cycles get shorter and shorter, IT and business must get more and more closely aligned.

Deeper Findings: The New Balancing Act

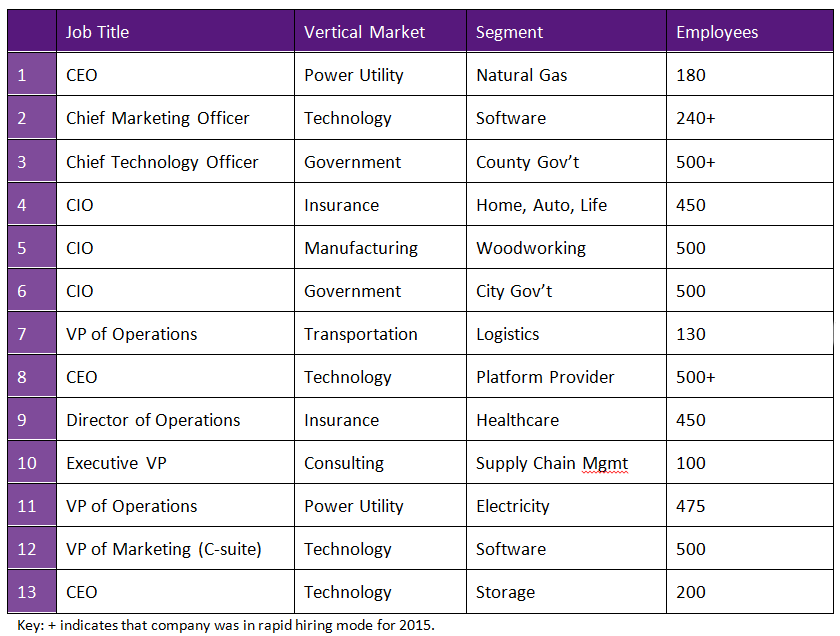

Here, we explore qualitative interviews with end user executives (CEOs, Chief Marketing Officers, CIOs, etc.) within midmarket companies. Our interviews explored (1) the decision-making process for technology and business systems, (2) the perception of the IT function by business units; and (3) the operation of the IT function as systems are built.

Finding 1: Corporate IT’s power and influence over business is growing (not waning), but multiple business leaders now have a voice in IT’s direction.

Business unit leaders—chief marketing officers, chief revenue officers, etc.—certainly have more say in IT decisions these days. But as cloud, mobile, big data, and social waves grow larger, corporate IT is gradually transforming into a central service broker to users and customers.

1a: CIOs remain a central, trusted cog for driving business innovation.

From the infrastructure level to the application level, CIOs are still weaving together platform architectures and applications to move the business forward.

“For true midmarket companies like ours, it’s still our CIO calling the shots. Our CIO is more involved now at so many levels because IT has become so strategic now—especially as IT as a service emerges. If it’s an application discussion of course you’ll have business unit leaders involved. But what our CIO is really creating is a shared services infrastructure—for our employees and customers to consume. At the end of the day, only he can really define what that infrastructure layer and application layer will need.” CEO, Technology Company (Platform Provider).

“Our CIO has a good seat at the executive table, and we’re finally looked as partners with the business to enable our future. Much of that is the result of a journey we are on. We’ve consolidated our data centers and virtualized everything. Over the next few years, we’ll be rolling out automation and self-service capabilities to our users.” VP of Operations, Power Utility (Electric).

“On the one hand, we’re an IT department within local government. But on the other, you can think of us as an IT service provider to our ‘customers’–the school system, the community college, the library system. And all those ‘customers’ have a strong say in the applications we choose and manage for them.” CTO, County Government.

1b: Business leaders have growing influence over IT’s direction—without necessarily dictating the overall IT strategy.

Cloud, mobile and social platforms have empowered business leaders—and inspired them to bring new ideas to their CIOs, without necessarily dictating if or how the new concepts should be implemented.

“We still have a centralized IT budget. Every piece of IT is in it—all the pieces are there. But we break it out by line item for the businesses. Some of the solutions--like infrastructure—clearly touch every user. But others, like customer-facing applications are budgeted more for the sales and marketing departments.” CEO, Power Utility (Gas).

“In some companies, I hear about the marketing or sales department going off and doing a lot [of IT] on their own. With cloud services they can just go off and sign up with a credit card. But then the CIO has to come along and clean up the mess—after the fact. That’s not our approach. We’re lucky to be a trusted advisor to all the departments.” CIO, Manufacturing.

“Depending on the project need, we’ll see money allocated either to centralized IT or to a specific department—like if the HR department needs a new talent management application. In that case the money is allocated for HR—but only IT can spend it for them. We’re still involved in every IT decision—the selection of applications and so on, and then how the money actually gets spent.” CIO, City Government.

1c: In some organizations, corporate IT decisions are increasingly made via ad-hoc committees involving multiple business units.

While CIOs typically make the final call, peer CXOs and business unit leaders have a strong say in how IT systems are aligned to meet corporate goals. Those CXO and business unit voices have even more say if an IT project involves applications (rather than underlying infrastructure).

“Each time we embark on a new IT project we form a committee with key stakeholders. Our director of IT—essentially our CIO—is on every committee because IT is now strategic to every part of our company. And you’ll find our CFO on every IT committee because of the dollars and cents involved. But once we get to the application level, that’s where you begin to see specific business leaders on a committee. We had a committee for our cloud strategy that pulled in our VP of Mass Markets because the applications were customer-facing.” CEO, Power Utility (Gas).

“Our innovation effort includes three teams of business and IT leaders: (1) one to generate ideas; (2) folks who are tasked with finding the right resources internally to address the ideas and opportunities; and (3) a so-called innovation garage to build the prototype solutions. Five people from IT work in the innovation garage. They rotate in and out on 12- to 18-month schedules. When they rotate back into their specific departments, they have greater skills focused on innovation rather than maintenance.” CIO, Insurance Company.

“We have a Strategic IT Workplan that looks out over a seven-year horizon. The real point behind a plan is to get work done. Every year, we adjust IT’s priorities for the next 18 to 24 months. It’s basically a list of all the things each department director—in the business world, that would be each business leader—wants to do. Then we create the plan with the directors and the queue of work. Directors get to make the final call on which IT needs are at the top of their specific priority lists. We do ‘course corrections’ every two weeks. It’s like applying the agile software development approach to your overall IT plan.” CIO, City Government.

1d: Chief marketing officers have an incredibly strong say in customer-facing application selection, but it’s not always the final say in application choices.

As all businesses increasingly shift to digital models, chief marketing officers are striving to find, engage, delight and monetize customers. That process requires new data management tools and customer-facing applications. In some rare cases, CMOs now control their own IT budgets with complete autonomy. But for the most part, a CMO’s digital decisions require continued collaboration with central IT—as well as final sign-off from a CIO.

“IT still holds and manages the technology budget here. And I think that’s the approach in the majority of midmarket shops. Shadow IT [the rise of cloud applications that were not approved by central IT] taught midmarket companies some important lessons about security, privacy and runaway costs. I do hear about marketing leaders or sales leaders holding some IT budget in some companies but we haven’t gone that route. I suspect maybe 10 percent to maybe 20 percent of midmarket companies have shifted their IT budgets outside of the IT department. But it’s early in that trend. ” CIO, Manufacturing.

Within our own company and across the midmarket, I’ve never been in a meeting where a Chief Marketing Officer was making all of the decisions on IT—not even if it involves a specific application for marketing. Yes, the CMO has growing say in customer-facing applications. And that makes sense in the digital age. But even there, you still have to really focus on security, access, privacy and compliance issues. To ignore your experts on those topics—your CIO, your CTO or our compliance officer—would be foolish.” CEO, Technology Company.

“The basic infrastructure responsibilities remain with our CIO reporting into our CFO. But I see a pretty dramatic shift where the CMO is accountable for customer-facing experiences. I have my own six-person team focused on this—a visual designer, two front-end developers, two back-end developers and me. I can’t take a number and wait in line for project engineering or IT to get back to me. I needed autonomy when it comes to my own IT budget and my application development decisions. And I have that autonomy. My IT budget is a line item in my overall marketing budget—and I control it.” Chief Marketing Officer, Technology Company.

Finding 2: The transformation of IT into an internal service provider is in its infancy and will require several more years to complete.

Midmarket CIOs are increasingly committed to deploying self-service systems for their employees and customers.

2a: The first step to self-service typically includes converged data centers that are virtualized.

Next, CIOs are seeking to roll out automation and self-service tools that allow employees to select and activate applications on-demand.

“In some ways this is all about the hybrid cloud trend. It’s not only about using some public cloud resources while virtualizing your own data centers. On-premises, you also need dynamic provisioning of servers and applications. We’ll do that this year for our developers and longer-term we’ll offer application-level dynamic provisioning to our employees.” VP of Operations, Power Utility (Electric).

“Our big focus the past few years was completing a $100 million federally backed fiber network. Now that we have that infrastructure in place, we can really focus on how we’ll deliver more self-service applications to our users and citizens.” CTO, County Government.

“The first step toward IT becoming a service provider involved converging the infrastructure—servers, storage and networking in one system that gets virtualized. Then, we focused on orchestration and automation—and providing a service catalog for employees to pick and choose the IT services they want to activate. The big challenge? Most midmarket companies don’t have the time to maintain their own service catalog.” CEO, Technology Company.

2b: Continual enhancements through business and IT alignment are taking hold, but it’s not quite a “DevOps” mindset just yet.

Constant communication between IT leaders and business leaders is starting to trigger faster decisions and more innovation. But true DevOps (formalized communications, collaboration and automation) for new software deployments hasn’t really taken hold yet in the midmarket.

“When it comes to innovation, some of the new approaches come from us in IT but some come from the business. A lot of it comes down to collaboration. A business unit may have a germ of an idea and then ask us what IT solutions will enable or enhance a concept.” CIO, Manufacturing.

“Take something like IT infrastructure and the innovations around that. Our sales folks want to make sure any new infrastructure has great support for remote access. Our supply chain and risk management people want to make sure that infrastructure is reliable and robust. They all have a voice in the process of shaping the infrastructure needs. But our director of IT—essentially our CIO—has to deliver on those specifications.” CEO, Power Utility (Gas).

Finding 3: The shift from CapEx to OpEx will gradually even out. (Translation: Technology and business leaders are discovering that cloud computing isn’t about cost savings.)

During the early days of cloud computing, some business and technology leaders expected to experience cost savings. The idea was to shift some IT budget from “expensive” CapEx (lump sum) hardware and software to “less expensive” OpEx (pay-over-time) cloud services. But midmarket businesses now say cloud computing is rarely about cost savings. Instead, it’s about flexibility and speed to market. Moreover, it’s about a hybrid world where on-premises workloads can be extended to the public cloud when it makes business and financial sense.

3a: When analyzing the cloud’s perceived value, the speed to market conversation must also include automated maintenance and management tools.

Customers know they can turn public cloud services on and off very rapidly. But they’re also starting to value the fact that cloud providers maintain specific pieces of the IT stack (IaaS, PaaS and/or SaaS).

“When we really price out cloud computing, we discovered it’s ultimately the same cost or more expensive than traditional IT purchases. But that doesn’t mean cloud computing is somehow bad. It’s really about shifting the responsibility of delivery and maintenance to the cloud provider. Those are high-value outcomes if your IT staff doesn’t have the time or expertise to focus on a specific application or service.” CIO, Manufacturing Company.

“After Hurricane Sandy hit us in New York, we really had to ask ourselves: How can users get to the data we’re restoring? Virtual desktop infrastructure tied to cloud computing became the solution. This was all about time-to-recovery: Getting everybody back online as quickly as possible even if local offices or towns were dark. If you could at least get a powered laptop to a WiFi connection, you could get to our cloud. We gained a lot of respect from our business leaders when we made that happen.” Director of Operations, Healthcare Provider.

3b: Hidden cloud costs remain a concern across business and IT.

Basic per-user or compute cloud costs are well understood. But midmarket companies are worried about hidden or overlooked costs tied to managing hybrid clouds or bursting heavy on-premises workloads out to the public cloud.

“The ‘debate’ about extending from on-premises to the cloud has largely gone away in our company. We see the value of the cloud. Now it’s all about finding the best value—the commodity hardware with the right software above that. For the most part we really like that OpEx model but we focus heavily on metering to really watch prices—especially when business units burst more cycles into the cloud. That can be a hidden gotcha.” Executive VP, Business Consulting (Supply Chain Mgmt.)

“Most of current IT infrastructure is on-premises and leased and the renewal is 2019—so we have a time-sensitive cloud mandate. CRM, HR and some other applications are out in the cloud for us and we’ll adopt even more—but mostly in a hybrid way. My big concern involves the cost of managing hybrid services. Plus, the tools for managing a hybrid environment are in their infancy. I worry about whether I’m making the move too early—but we have that lease renewal concern bearing down on us.” VP of Operations, Transportation.

Finding 4: The security conversation is extending from device protection to total data protection.

While overall device and infrastructure protection remains important, business and IT leaders are increasingly worried about data protection and privacy issues. Much of the concern stems from high-profile cyberattacks and data breaches across such verticals as retail, healthcare, and financial services.

4a. Business leaders want security and compliance status reports.

Even so, that doesn’t mean business leaders want to “own” the security conversation.

“Each IT project now involves a deep level of discovery around compliance, security, and privacy. Business leaders want a general overview on security but they generally don’t want all the deep details. So you come back to the business leaders with some broad strokes about the security of a particular platform or service. A multi-tenant, public cloud solution may look really tempting. But then our internal risk department may spot an area of concern or weakness, raise it with business leaders, and they’ll instead opt for a single tenant private cloud model.” Executive VP, Consulting Firm.

“Once you’ve stepped from a small business mindset into the midmarket, you’ve shifted your IT security stance into a far more comprehensive approach. The CFO or CEO has pointed to a specific individual or department and said: “You’re responsible for protecting our assets—our people, our customer data and our IT systems.” CEO, Technology Company.

4b. Security is becoming an industry-wide conversation without corporate borders.

Proper data protection now requires coordinated initiatives across multiple industries and government organizations.

“Cybersecurity is certainly front-of-mind. Even companies with nine-digit security budgets [i.e., $100 million or more] are getting breached. I see a market shift toward more automation—where some standardized tools at least block threats from the base level. Next, I expect to see far more cross-industry coordination between the FBI, the security industry, government agencies and vertical markets.” CIO, City Government.

Finding 5: Mobile conversations are extending to the Internet of Things.

The current mobile conversation—across business and IT—increasingly involves the Internet of Things (IoT). Specifically, business and IT leaders are exploring if or how new IP-connected devices can be monetized. That exploratory research also seeks to pinpoint hidden costs and management challenges.

5a: BYOD and Mobile Device Management (MDM) debates have largely subsided.

The older BYOD and mobile device management (MDM) conversations still occur. But those challenges are increasingly addressed by (1) formalized business policies/processes and (2) standardized MDM device management tools.

“MDM was a hot-button but it has moved beyond that with enterprise mobility management and overall app development. We’ll be taking a look at really well thought-out mobile apps that aren’t just scaled down desktop apps. The app development paradigm will likely need to change as the Internet of Things takes off. Instead of phones, tablets and notebooks, the conversation will shift to sensors and machine-to-machine computing.” CIO, Manufacturing.

5b: The Internet of Things offers immediate business opportunities.

While cloud and mobile (smartphone, tablet) computing took several years to emerge, the Internet of Things wave appears to be building even more quickly.

“Our IT team is already involved in a lot of connected vehicle projects for law enforcement and school district buses, so for us the Internet of Things is already real. For our business leaders, it opens up a whole new range of privacy, security, management and monetization questions and answers.” CEO, Technology Industry.

“The next step for IT, from my perspective, is when the Internet of Things takes off. By the way, the car is a ‘thing,’ and it's a pretty big and important ‘thing’ for us. Consumers of that data, whether they're insurance companies or others, are going to need some standards to emerge. We have no desire to only have insight into cars that happen to have the Apple operating system, or cars that run the Microsoft operating system. Instead, we want to insure everybody. So we're going to have to work through that.” CIO, Insurance Company.

Finding 6: Big Data is on the radar, but data-driven business decisions are limited by information silos and a flood of new data sources.

Midmarket companies are exploring predictive analytics to optimize current product offerings or to spot new market opportunities. Sales leaders and chief marketing officers (CMOs) are particularly attuned to big data—seeking new ways to monetize unstructured and structured information.

6a: IT and business leaders together must address new data silo concerns.

Data-driven decisions are difficult to make because so much information is scattered across relational databases, email, CRM systems, social media and more.

“Increasingly the big data conversation is shifting to information integration. How do I get all of our existing technology silos integrated? And how do new silos like social media factor into that effort? Things get even more complex when you consider how much new data is being created by mobile users. As a technology marketer, I need my CIO to solve the data silo problem.” VP of Marketing, Technology Company (Software).

“We’re now in a world where employees want to make real-time decisions based on real-time information. Some of that information is going to be structured data from something like a CRM system. But much of it also might be unstructured data or maybe even batched data out in Hadoop. Data scientists may want to analyze all that data right now. But only our CIO can ultimately link it all together—through the right infrastructure—to make that happen.” CEO, Technology Company (Storage).

“Our customer support is already data-driven in nature. Our call center technology leans heavily on our phone systems, reporting, and analytics. But we’re certainly trying to figure out how to work social media customer conversations into our support strategy and data strategy.” CEO, Power Utility (Gas).

6b: Despite potential hurdles, midmarket organizations are testing new approaches to data management and analysis.