About this Research

CompTIA’s 3rd Annual Trends in Enterprise Mobility study was conducted to build on previous CompTIA research in the mobility space and further explore mobility trends, challenges, and opportunities. The objectives of this research are:

- Understand the variables and tradeoffs involved in a company’s decision on provisioning devices

- Ascertain benefits realized from using mobile/remote work solutions

- Identify the challenges in supporting and managing mobile/remote work

- Gauge the need for training and/or standards

The U.S. component of the study consists of five sections, which can be viewed independently or together as chapters of a comprehensive report. Findings from a separate study conducted in the UK are contained in a sixth section.

Section 1: Market Overview

Section 2: Device Strategies

Section 3: Workflow Implications

Section 4: Challenges and Opportunities

Section 5: Qualitative Interviews

Section 6: UK Insights

The research used both quantitative and qualitative methods. For the quantitative portion, U.S. results are the result of an online survey of 400 IT and business executives directly involved in setting or executing mobility policies and processes within their organizations (aka end users). Data collection occurred during March 2014. The margin of sampling error at the 95% confidence level for the results is +/-‐ 5.0 percentage points. Sampling error is larger for subgroups of the data. UK results are the result of an online survey of 250 end users. The margin of sampling error at the 95% confidence level for the results is +/-‐ 6.3 percentage points.

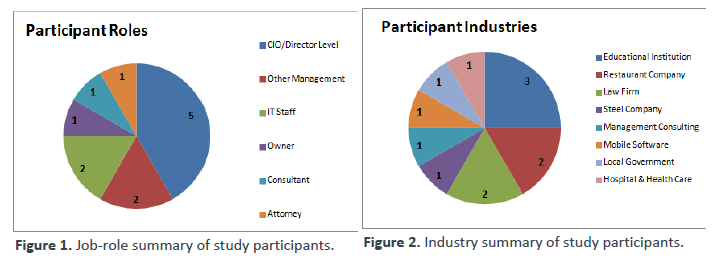

For the qualitative portion, CompTIA worked with the research firm Cascade Insights, who conducted a series of in-‐depth interviews with 12 professionals involved in a technical capacity with mobility initiatives1, primarily at a management or other senior level. Interviewees were selected to represent a variety of industry verticals. Interviews were conducted on a one-‐on-‐one basis over approximately a four-‐week period in April and May, 2014, with an average length of approximately 30 minutes.

As with any survey, sampling error is only one source of possible error. While non-‐sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content contained in this series. Any questions regarding the study should be directed to CompTIA Market Research staff at [email protected].

CompTIA is a member of the Marketing Research Association (MRA) and adheres to the MRA’s Code of Market Research Ethics and Standards.

Section 1:

Market Overview

Key Points

- There are two primary signals that indicate growing maturity in the mobility market: saturation in behavior/mindshare and multiple compelling options for implementation. The overall device market is experiencing net growth as mobile devices become viable computing options, and the range of form factors and operating systems have created healthy diversity.

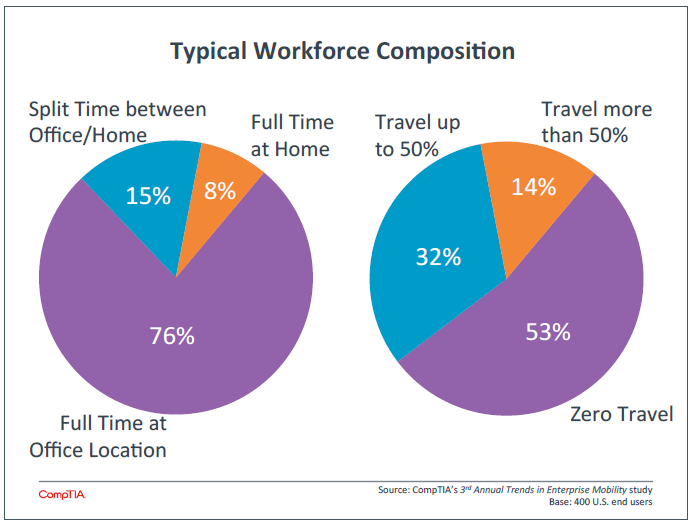

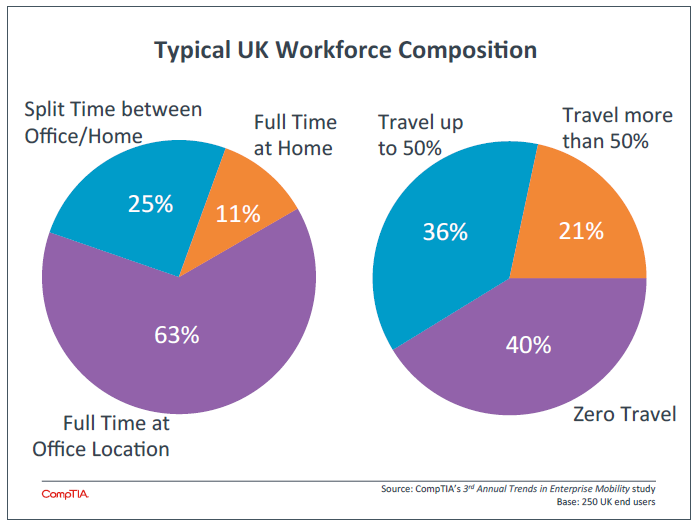

- One of the major drivers of the mobility trend is the growing mobility of the workforce. Companies are seeking more flexibility for employees, but still estimate that 76% of workers are full time at an office location and 53% have no travel. In moving towards a new workforce dynamic, companies will need to change workflows and policies as they adopt new technology.

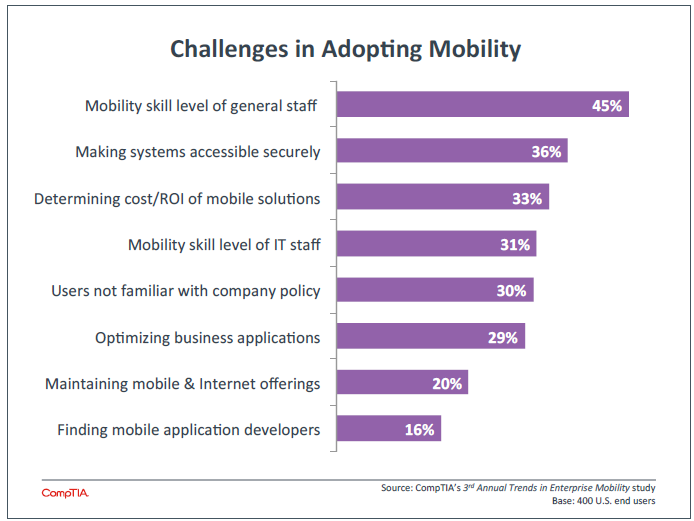

- The mobility skill level of general staff remains the top hurdle to mobile adoption. Although employees are bringing in their own devices or driving device selection through their preferences, many may not have a deep understanding of system settings, encryption capabilities, or new enterprise applications that a business may require.

Taking Stock of Enterprise Mobility

In the past five years, several technology trends have risen to prominence in very rapid fashion and created a major stir in the IT industry. Cloud computing, mobility, and big data are three examples of topics that have been focal points for many discussions, with those discussions mostly revolving around definitions and monetization opportunities. The industry is now experiencing a new stage of adoption, where the pace and scope of change is less revolutionary in scale and the maturity of the market allows companies to explore the true implications of new technology models.

When it comes to mobility, there are two primary signals that indicate maturity in the market: saturation in behavior/mindshare and multiple compelling options for implementation. In both areas, there is a clear shift from basically a single mode of computing to a more dynamic environment.

Much has been made about the demise of the PC thanks to the rise of smartphones and tablets. The primary evidence for this argument is the year-‐over-‐year changes in device shipments. However, examining the raw shipment data and market share numbers presents a slightly different picture. Clearly smartphones and tablets have seen tremendous growth over the past three years, but PCs remain a viable piece of the device market. In fact, IDC predicts that the portable PC market—which includes laptops and ultrabooks but not tablets—will actually grow by 9% between 2013 and 2017.

The overall device market is seeing net growth rather than seeing PCs vanish at the same rate that smartphones and tablets are appearing. The 2013 market share numbers show that all three types of devices (with PCs represented by the combination of desktops and portables) are still major components. Indeed, the 2017 device market does not look markedly different, with smartphones holding 70% of the market, tablets becoming the second most popular device at 17% of the market, and PCs acting as the third leg of the stool with 13% of the market.

While the PC is still a viable factor in the device landscape, it is true that its importance has been diminished. The Ericsson R380 in 2000 was the first device marketed as a smartphone. Prior to that, it is safe to assume that the PC held practically 100% of the device market. Even from 2000 to 2006 (when the iPhone was introduced), smartphones were entering the market but not dominating mindshare as an alternative computing device. The iPhone, along with the iPad in 2010, fostered the concept of standard compute tasks being done apart from a PC. This led to greater diversity than the device market experienced during the PC era. Aside from form factor, this can also be seen in the mix of operating systems on the market.

The situation here is similar to shipment data. The dominant storylines today center on the dynamics between iOS and Android in the mobile space, but across all installed device types Windows desktop systems still dominate the market. StatCounter shows these systems holding 71% global market share as of the end of 2013, with iOS/Android holding 15% market share. The situation has changed dramatically in a short period of time: In 2010, Windows desktop systems accounted for 90% of all installed devices, with iOS/Android sitting at just over 1%.

Mobility Market Stats

According to IDC, the global IT/telecom market generated $3.6 trillion in revenue in 2013, with telecom services making up $1.6 trillion of that total. Within this space, mobility solutions are a significant and growing segment. The following estimates and projections contain some areas of overlap but provide a comprehensive picture of the mobility market:

- IHS estimates that the overall tablet and 3G/4G cellphone market generated $354 billion in 2013, exceeding the total revenue from traditional consumer electronics such as televisions, appliances, and AV equipment ($344 billion).

- Juniper Research projects that consumers will spend $75 billion on mobile apps by 2017, driven largely by in-‐app purchases.

- Addressing both enterprise concerns along with consumer technology, Infonetics Research predicts the mobile client security market to reach $2.9 billion by 2017. New approaches are needed here as attackers discover new ways to infiltrate mobile devices and data.

- Specifically for the enterprise, Gartner expects Mobile Device Management (MDM) to be a $1.6 billion market in 2014. However, Gartner also expects that MDM will give way to Managed Mobility Services (MMS), which expands on the concept of MDM to include aspects such as application management and financial management.

These mobile operating systems are obviously gaining market share thanks to the influx of mobile devices in the market, but there is also a ripple effect in the desktop space contributing to the decline of Windows systems. Mac OSX has risen slightly from 5.7% in 2010 to 6% in 2013, and Chrome systems (which fall under StatCounter’s “Other” category) have also found a niche. The bottom line is that both the day-‐ to-‐day experience for many individuals and the working environment for many organizations are much less homogenous than they were five years ago.

These signals clearly point to an IT disruption that is not merely imminent but has actually arrived. While various market sizing estimates indicate that strong growth will continue in this space, both the companies using mobile solutions and those companies offering support around those solutions need to build plans for today’s reality and put a foundation in place to prepare for tomorrow’s opportunities.

New Tools for a New Workforce

Of all the new technology trends, mobility may be the one that is most closely tied to the phrase “consumerization of IT.” Smartphones and tablets have both firmly established themselves as consumer technology and are coming into businesses as employees make a push to have familiar devices. This in itself is a remarkable aspect of the new era in IT: previously, the premier technology was designed for enterprise use and trickled into the consumer space. This new direction holds several implications that will be explored throughout this report.

Businesses pursing mobility solutions have motivations beyond simply allowing their employees to bring in the devices they want. To start, mobile solutions allow for a mobile workforce. Companies can bring in talent regardless of location, and employees on the go can be better connected to corporate systems.

As much publicity as the mobile workforce gets, it is important to remember that businesses estimate that most of their employees are still currently based in an office location and have no travel as part of their job. This is actually true regardless of the size of the business—small, medium, and large businesses all estimate that between 74% and 81% of their workforce work full time at an office location and between 46% and 58% of the workforce have no travel.

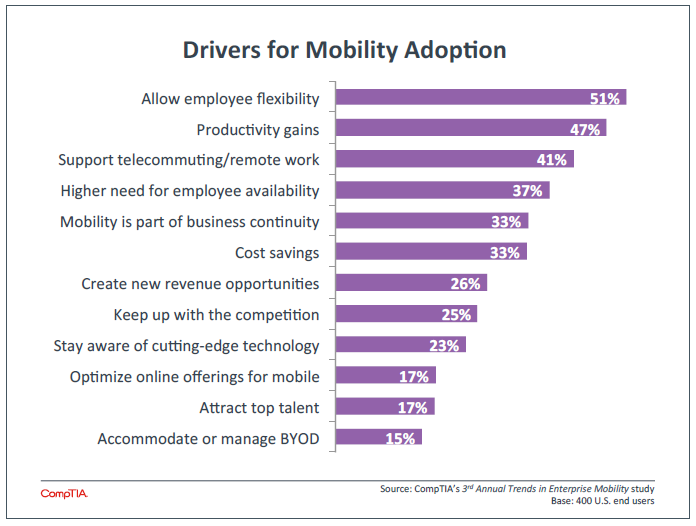

Looking at the typical drivers for mobility adoption, it would appear that many companies might be hoping to explore new operational territory with mobile technology. While employee flexibility and support for remote work can still benefit a workforce that is mostly local, these benefits may be limited if the culture and workflow have not been adapted. Bringing in mobile technology is a good first step, but there must also be changes to management systems and business processes.

Addressing the needs of the workforce may be a driver for mobility, but the workforce itself may not be ready for the technology the company needs to use. As with last year, the top challenge in adopting mobile solutions is the overall skill level of general staff. This seems counterintuitive—if employees are bringing in their own devices or driving device selection through their preferences, shouldn’t they know how to use these devices?

In some areas, the answer is yes. End users are familiar with certain applications and features that they use regularly in their personal life, and that knowledge will translate to a business setting with similar functionality. However, many users likely do not have a deep understanding of system settings, encryption capabilities, or new enterprise applications that a business may require. Companies building mobile solutions (and IT firms assisting with those solutions) must look for ways to raise the skill level of the general workforce, often going beyond one-‐time education at the time of implementation.

Another area where skill gaps can present a challenge is with the IT team. Here, the need is clearly different. Rather than focusing on day-‐to-‐day productivity and efficiency, implementation and support are more critical. While education for general staff may require a more novel approach, building skills for the IT team can likely follow a more traditional path, such as technical training and certification.

According to the job matching firm Burning Glass, open positions with the keyword “mobile” increased 148% from 2010 to 2013. Over the same time period, open positions in the overall IT industry increased 18%. While the overall IT growth rate is healthy across all industries, mobility is certainly one of the trends in highest demand. Examples of jobs with a mobile flavor include:

- Mobile developer

- .Net mobile front end developer

- Java mobile architect

- Business analyst – mobile applications

- Software engineer – mobile applications

- Mobile software development manager

- Mobile product analyst

- UX/UI mobile designer

General Adoption Data

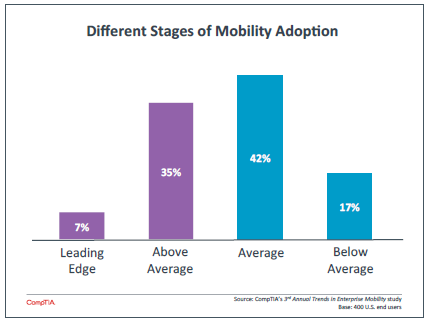

Taking a very broad view of adoption that includes laptops as mobile devices, the vast majority of businesses are engaged in some form of mobility initiative. CompTIA’s study focuses on those companies that claim some amount of mobility adoption, with the adoption pattern following a typical distribution.

There are two primary factors that cause companies to believe they are early adopters of mobility. The first factor is the practice a company has around devices. Fifty percent of early adopters (leading edge or above average adoption) said that their corporate deployment of smartphones was an indicator for early adoption, and 42% felt that their corporate deployment of tablets qualified as such an indicator. In addition, 44% said that they were performing targeted device deployment based on job role, which certainly implies a degree of consideration beyond simple distribution. Interestingly, only 26% said that a new BYOD strategy indicated early adoption, suggesting that many companies may be pushing mobility initiatives without throwing the doors wide open for BYOD.

The second main factor is the use of new mobile apps that tie into business systems, which 48% of the sample claimed as an early adoption indicator. Some companies may be doing their own app development. More often, businesses are incorporating apps from enterprise software vendors. Those could be incumbent vendors that are providing mobile capability or new vendors that are capitalizing on the trends of cloud and mobility. Businesses are clearly seeing that applications are the next layer of mobile ecosystem to consider (see Appendix for more on the mobile ecosystem).

However, fewer companies have progressed beyond the application layer into workflow changes or overall architectural overhauls. Only 41% of firms claimed to have modified workflow to incorporate mobile devices, and just 31% have installed new backend systems to support mobile functionality.

This report focuses on the dual nature of enterprise mobility. Section 2 examines device practices in more detail, covering the stage of mobility adoption that most companies are facing at a tactical level today. Section 3 explores changes to workflow, an approach to mobility that may be seen as more strategic but may also be the best first step for companies to take. Sections 4 and 5 cover the opportunities and challenges at hand, including qualitative data to give a complete picture of end user experience. For solution providers that are planning to address IT in a mobile era, the data and insights will provide context for building the right strategy.

Appendix

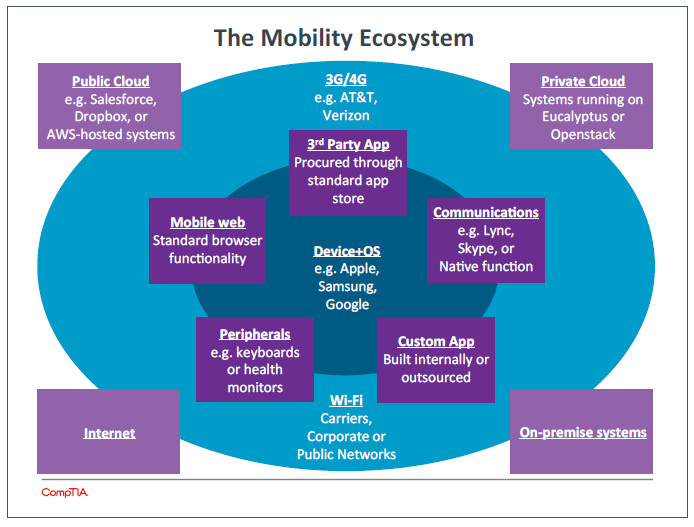

The mobility ecosystem is made of several layers that interact together to create the overall experience. Each of these layers presents new challenges for businesses and requires new levels of skill to ensure smooth and secure operation.

- Devices: This is the layer where most companies currently place their focus, thanks to the changes in form factor and user interface that allow for greater opportunity for both productivity and problems. The operating system is an intrinsic part of the device, and there are many features that distinguish the OS from a traditional PC system.

- Applications and Peripherals: The first layer beyond the device, these actually make the device a useful tool. Applications can come in many flavors—native function on the device, procured through a public app portal, or custom-‐built. The ability to access the Internet also opens the door to the wide range of browser-‐based applications and information. Peripherals are a simpler matter but still represent a compelling segment of the mobility industry.

- Networks: Cellular networks have become fast enough and reliable enough to make on-‐the-‐go computing possible, but they also come with a cost that must be factored into mobility planning. Many companies have Wi-‐Fi networks installed, but these networks may not handle the load imposed by many mobile devices. In addition, companies must consider their policies on the use of public Wi-‐Fi.

- Backend systems: The final pieces of a mobility solution are the systems that house information stores and perform the heaviest computational work. Cloud systems have been vital to the mobile movement, since they provide a new model for accessing information through standard connections. Legacy on-‐premise systems can be used as well, and these may require some amount of reconfiguration in order to be optimized for mobile use.

Section 2:

Device Strategies

Key Points

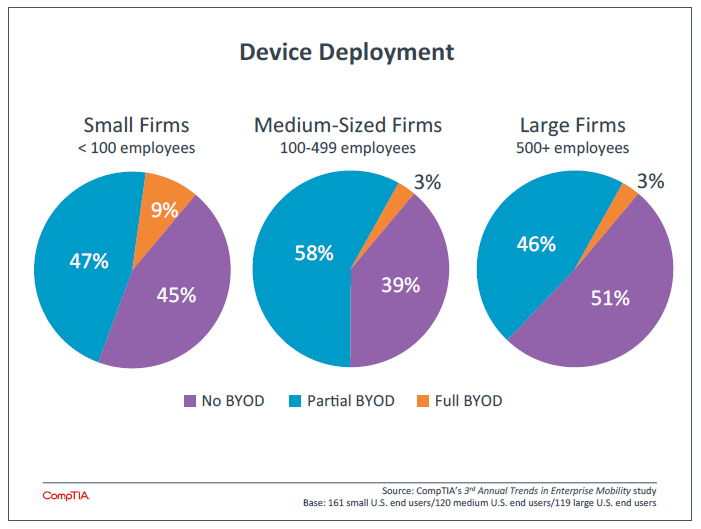

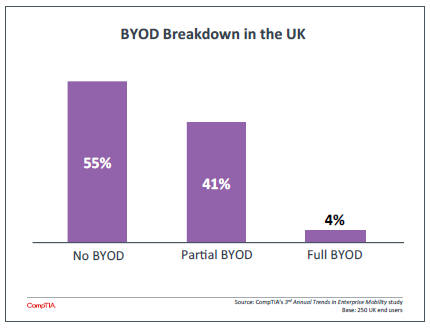

- BYOD is one of the key trends within enterprise mobility, and over half of all companies practice some form of BYOD. The vast majority of these practice partial BYOD, where the company still provides some devices, and many companies may be following a model known as COPE (corporately owned, personally enabled) to help manage device trade-‐offs.

- Even including companies that do not practice BYOD, mobile devices are changing the IT landscape. Among companies that provide devices, 76% provide smartphones and 61% provide tablets, implying that many workers are operating in a three-‐device environment.

- Over 70% of all companies, regardless of BYOD stance, have made some level of investment in order to build out mobility solutions. Obviously mobile devices are an area of investment for any company not practicing full BYOD. Other areas of investment include networks, security, and even laptop or desktop purchasing and support as overall architectures are optimized for mobility.

Deciding How to Handle Devices

While enterprise mobility encompasses much more than simply a device decision (see ecosystem in Section 1 appendix), discussions on device deployment and management have dominated the early stages of mobility adoption. As devices have traditionally been deployed and managed by the company, the notion of employees bringing their own devices creates turmoil for security, support, and workflow. The fact that more and more employees require devices for their work adds to the confusion.

The BYOD phenomenon can carry an implication that businesses no longer deploy devices but instead allow employees the freedom (and responsibility) of choosing and maintaining all their own hardware. As with last year, CompTIA data shows that this is not the prevalent case. Small companies are the most likely to follow this strategy, likely placing a lower priority on security or application consistency and choosing to eliminate the overhead of dealing with devices. This may not be the best tradeoff, and solution providers working with small companies can help assess any security exposure created by such a decision.

Organizations mainly remain split between a partial BYOD strategy and an approach where the company provides all devices. Many companies offering partial BYOD may actually follow a model known as COPE (Corporate Owned, Personally Enabled). This gives businesses the ability to leverage procurement benefits (such as discounts and control over selection) and also gain some management control. At the same time, it still hands some flexibility and responsibility to the employee. Some firms find that use of the COPE model removes the desire to bring their own device for most employees, provided they are able to get a comparable device through the company.

Among companies that provide at least some devices, standardized IT support is the primary driver (cited by 44% of companies). This is a direct contrast to the idea that BYOD can save money by assigning device support responsibility to employees; businesses seem to feel that the efficiency gained through standardized support is well worth the cost.

Security and compliance are other common reasons for businesses to maintain control of devices. This is what drives the largest organizations to be the ones most likely to prohibit BYOD. Unlike the smaller firms, these companies place a higher value on the risks associated with uncontrolled devices and will wait until the tools and techniques for allowing BYOD can provide the same level of confidence they get when they own device management.

On the other hand, those companies that allow BYOD overwhelmingly believe that it benefits the company. Forty-‐six percent of firms allowing partial or full BYOD believe that it increases productivity among employees. This raises a question about the ROI of not just BYOD, but also mobility initiatives in general. Productivity on its own is difficult to measure and is only one factor in a company’s business output. While the CIO, owner, or other decision maker may feel that even access to email is enough justification for allowing mobile devices, this decision may require more scrutiny as the investment gets larger.

Figuring Out Form Factors

The unique quality of mobile devices is, obviously, that they provide a robust computing experience in a compact form factor. This is achieved through the use of cost-‐effective components and unique user interfaces (such as touch), and it has led to speculation on which devices will remain viable for consumers and businesses.

Typical Company-Provided Devices

| 2013 | 2014 |

| 84% laptops | 86% laptops |

| 74% desktops | 77% desktops |

| 69% smartphones | 76% smartphones |

| 48% tablets | 61% tablets |

For business, mobile devices appear to be mostly additive. In CompTIA’s 2013 mobility study, laptops and desktops were the primary devices being deployed by companies, with smartphones close behind. This suggested a situation where many workers had two devices as the normal course of business. This situation has become more clear—while laptop and desktops have held steady as primary devices, smartphones increased substantially to become a definite complement to a workstation.

Tablets appear to be following a similar pattern. These devices have much more potential to be laptop replacements, and consumers seem to be taking this path. The year-‐over-‐year declines in traditional desktop/laptop shipments have mostly been attributed to consumers either replacing their workstation with a tablet or choosing to extend the refresh cycle. For businesses, tablets saw the most dramatic deployment increase among all devices, but this did not come at the expense of laptops or desktops.

When asked specifically about plans to replace PCs with tablets, only 15% of companies said that they expected to replace heavily or to distribute tablets to workers that previously had no computing device. Nineteen percent said that PCs and tablets served completely different functions, and 67% said that a tablet might replace a PC in certain situations (such as travel). Those companies most likely to heavily Typical Company-‐Provided Devices 2013 2014 84% laptops 86% laptops 74% desktops 77% desktops 69% smartphones 76% smartphones 48% tablets 61% tablets 3rd Annual Trends in Enterprise Mobility: Section 2 5 use tablets as a PC replacement were the large enterprises—those companies that are also retaining control over the deployment of devices.

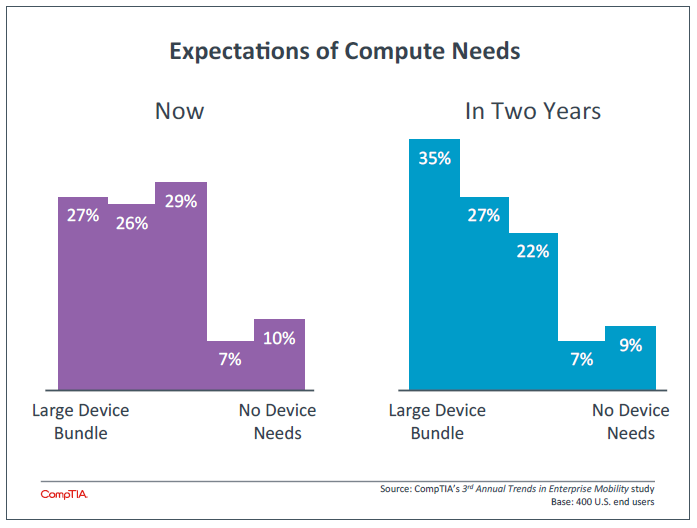

In general, the data is pointing to a three-‐device environment for many workers. The desktop or laptop will perform the heavy lifting, such as creation of content or use of applications requiring the most local compute horsepower. The smartphone will be a constant companion, available for communications functions and also a wide range of light computing tasks. The tablet will sit in the middle, suitable for heavier workloads than the smartphone but lighter and more portable than the PC.

The view that companies take on compute needs confirms this scenario. Rather than selectively matching specific device types to job roles, companies are moving towards each employee having more compute capability. Over the next two years, businesses expect that employees will move from having a simple device setup (such as PC only) to a more comprehensive bundle (such as PC + smartphone + tablet).

Peripherals are an aspect of devices that is often overlooked. While mobile devices—including laptops— do not specifically require peripherals since all the UI is built into the device, the right add-‐ons can greatly enhance productivity in different situations. Monitors, keyboards, and mice are the most popular peripherals. Even among companies that follow full BYOD, the majority provides these items to employees. Projectors and webcams are less common, but are still provided by a significant number of companies. That number may rise as mobile devices are more integrated into workflow and communications.

Counting the Cost

As with any new undertaking, the total cost is a top concern for most firms. Traditionally, technology decisions have been driven by a desire to lower costs. For example, the early days of cloud computing were marked by a feeling that using compute resource as needed rather than paying for unused capacity would have a positive impact on the bottom line. Today’s technology decisions, though, are more complicated as businesses try to use technology more for growth and innovation. As cloud computing has matured, many workloads have been shown to be cost-‐neutral (or even more expensive); companies are still pursuing cloud systems thanks to other benefits such as agility or new business opportunity.

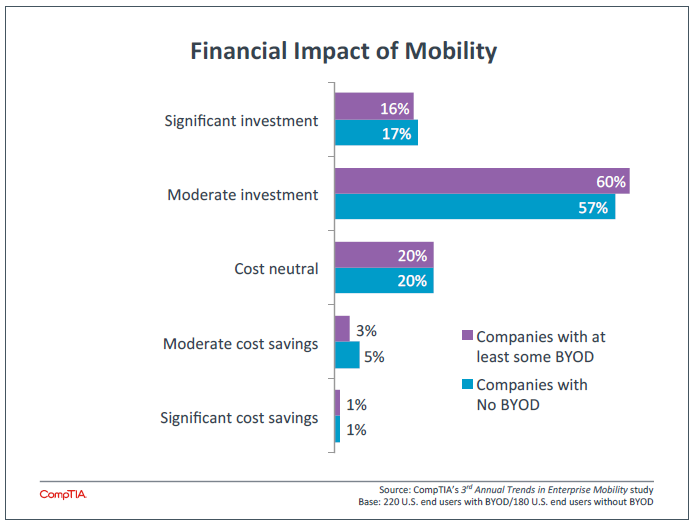

The same scenario exists for mobility. Some proponents of BYOD claim that it lowers cost by removing the management and support overhead from the company. While this may be true in some cases, the general case is that mobility initiatives require some level of investment. Over 70% of all companies, regardless of BYOD stance, have made some level of investment in order to build out mobility solutions.

The areas requiring investment demonstrate the breadth of issues that need to be considered in building out an IT architecture that includes mobility. The top item companies invest in is mobile devices. For companies with full BYOD, this is not an issue, but those companies with partial BYOD are likely purchasing some devices (like smartphones) and then allowing others (like second smartphones or tablets).

Networking is another major area for investment. As with cloud computing, companies are finding that upgrades are needed to support the number of devices and the subsequent traffic. Sixty-‐seven percent of companies that have made investments have targeted Wi-‐Fi networking, and 42% have targeted other network infrastructure such as cables, routers, and switches.

As the notion of a secure perimeter continues to erode, security is becoming an area where companies realize new tools and techniques are needed. Fifty-‐two percent of companies making investments have dealt with security. This could be device-‐specific, such as mobile device management (MDM) or app containerization, or it could be an end-‐to-‐end upgrade that inserts data loss prevention (DLP) at multiple stages of the ecosystem, including on-‐premise datacenters and cloud systems.

A final area of investment that is noteworthy is the investment made in laptop/desktop purchasing (55%) and laptop/desktop support (47%). Along with providing more evidence that workstations are still a vital part of business operations, this suggests that applications and workflow require traditional support as they are reconfigured or optimized for mobile use. Clearly the impact of mobility spreads far beyond mere device selection, and Section 3 dives further into the changes companies are making to their business processes.

Section 3:

Workflow

Implications

Key Points

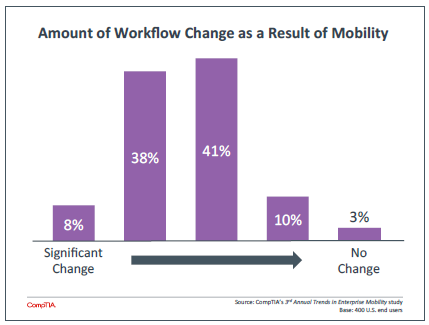

- While device provisioning and management is a high priority in many mobility strategies, workflow changes will eventually be needed for companies to fully utilize the technology. Only 8% of businesses have made significant change to their workflow as a result of mobility, indicating strong potential for change to process and architecture.

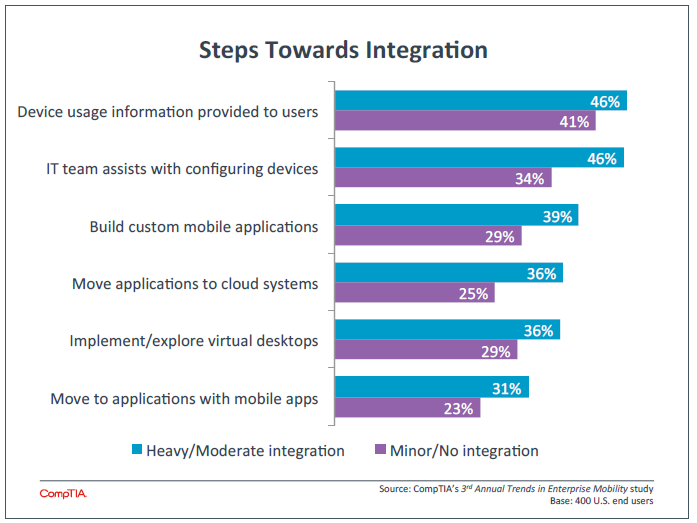

- As businesses take steps to further integrate mobile devices with existing systems and practices, education and device configuration are the most popular steps in building the required technical literacy. Beyond that, companies have a wide range of options as they deal with an ever-‐ increasing level of complexity in IT.

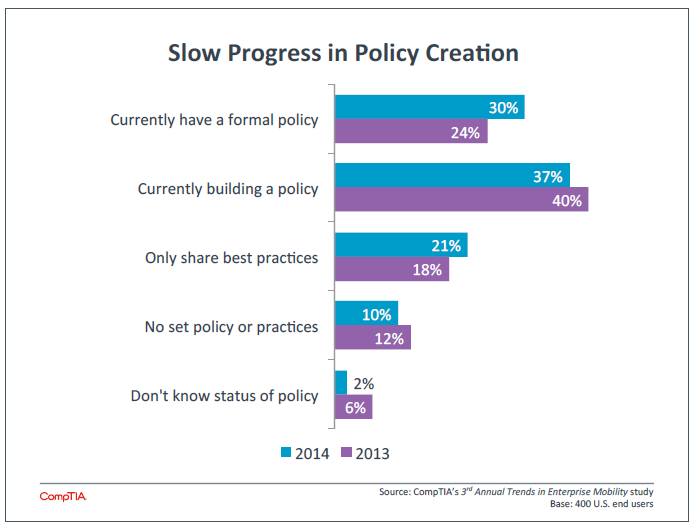

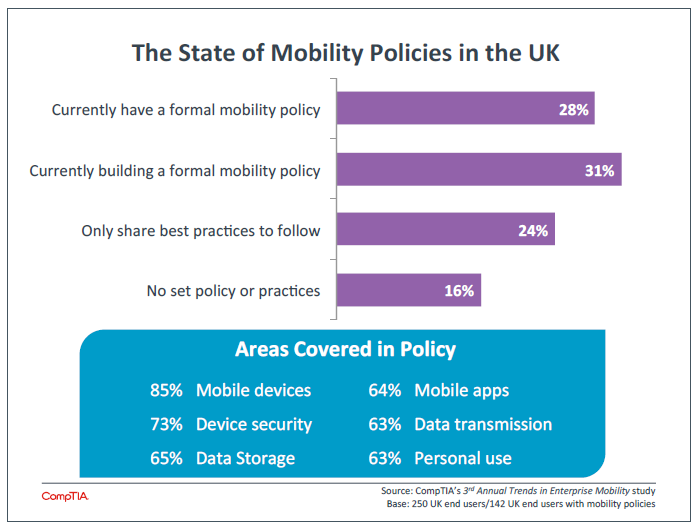

- There has not been significant progress in building formal mobility policies over the past year. Just 30% of companies have such a policy in place. There continues to be good representation from all areas of a business in building policy, but opinions on acceptable behavior with mobile devices indicate that more companies should be setting official guidelines.

With Mobility, Devices are Just the Tip of the Iceberg

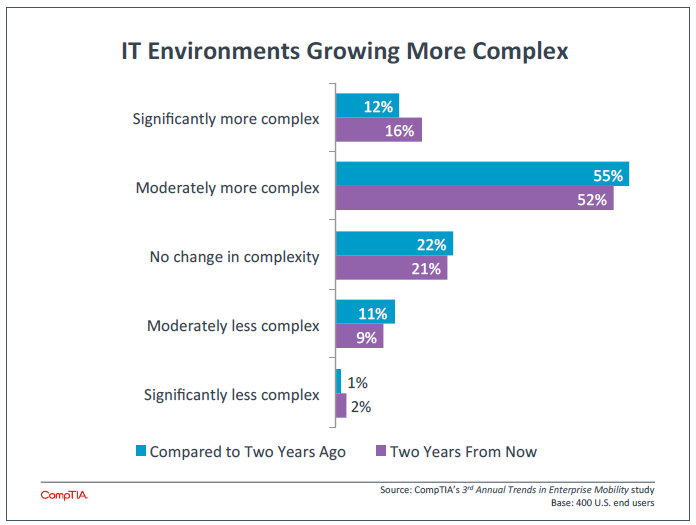

The mobility ecosystem shows that there is far more than just the device strategy to consider. Since the devices are so disruptive as endpoint computing options, the issues surrounding provisioning, managing, and securing devices have been front and center for many companies. Section 2 explored the current trends in device strategies, and it closed with a look at the areas of investment as companies pursue a mobile strategy. The breadth of these areas shows how IT environments are growing in complexity (see Appendix), and the level of investment required suggests that companies need to seriously consider what they are getting in return.

As such, workflow considerations must be a large part of mobility planning. Ideally, a business would decide on optimal workflow based on the technology available, then choose those applications and finally those devices that enable that workflow. In practice, this is complicated by legacy infrastructure and the speed at which employees are pushing for mobile devices.

Still, companies are finding that use of mobile devices provides an opportunity to make overall processes more efficient or even open new ways of doing things. CompTIA’s Trends in Workflow Automation and Communications study found that 72% of companies claim to take a proactive approach to mobility. However, more than half of this group also admits that they do not tie their mobility strategy to their communications strategy, indicating that their planning is perhaps not comprehensive across the entire organization. The number of remaining companies that take a fully proactive approach (35%) matches well with the number of companies that have made above-‐average change to their workflow (46%).

Large companies are slightly ahead of the pack in making workflow changes. Fifty-‐one percent of large companies have made fairly significant workflow changes, compared to 44% of medium-‐sized companies and 42% of small companies. As section 2 described, larger companies are the ones more likely to retain control of the devices used, so they are also better positioned to make workflow changes that utilize the allowed devices.

Along the same lines, larger companies are more likely to have integrated mobile devices into day-‐to-‐ day operations. Fifty-‐six percent of large companies have moderate to heavy integration of mobile devices. This means that mobile devices are used for more than email or light productivity, typically via connection to cloud-‐based business software or utilizing custom-‐built applications. Fifty-‐six percent of medium-‐sized firms have the same level of integration, but the balance is weighted towards moderate integration. For small firms, just 50% claim moderate to heavy integration—not a dramatic difference, but enough to warrant investigation into further steps that could be taken.

In driving towards greater integration, several patterns emerge. First, the primary action being taken today to improve integration is simply one of logistics. Either by providing education to end users or by having the IT team configuring devices, companies are attacking the issue of general literacy with mobile devices. Even though these devices are familiar in consumer settings, further education and setup is needed to attain a high level of productivity in a business setting.

The second takeaway is that integration of mobile devices may require deeper architectural changes. Complex business applications can be difficult to translate to mobile devices for several reasons, including simplification of user interface or accessibility from outside a corporate firewall. Businesses are pursuing avenues such as custom mobile applications or systems that are cloud-‐based and/or mobile friendly in order to better incorporate mobile devices.

Finally, the integration data shows that there is still plenty of opportunity to enhance the use of mobile devices in daily workflow. The incidence rate across the board suggests that few companies have explored all options for mobile integration, and each method holds some promise since no single method is a clear frontrunner. Success in integration, just like success in mobility, depends on overall business objectives and requirements when sorting through options.

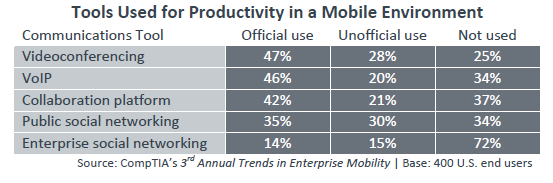

The area of communications provides a fitting example for a process where businesses are pursuing mobile integration. Communication is still a primary function of smartphones, even though they clearly have much broader capabilities. Tablets may not be a first choice for pure voice connections, but they can certainly figure into unified communications schemes involving tools such as video or instant messaging.

The incidence rates for officially provided communications applications or platforms track well with data from other CompTIA studies. For example, 46% for VoIP use may seem somewhat low since that technology is more mature, but CompTIA’s Trends in Workflow Automation and Communications study found that only 28% of companies have deployed VoIP to all employees, with an additional 32% having deployed VoIP to a subset of employees. Adoption of VoIP on mobile platforms at 46% of companies, then, seems reasonable.

Within the data on communications tools, there are the same themes as with general integration. Deploying these tools will likely require some amount of user education. Using VoIP as an example, a company may want communications to occur through an official UC app rather than having employees use their phone’s native calling function, and this may require some training. Where employees are using their own apps rather than official versions, the possibility of greater confusion (and lower productivity) is even higher.

The infrastructure needed for these solutions is often more than just the device and the app. Many companies have specific equipment for video or VoIP solutions, ensuring quality and reliability. Even as communications begin to utilize protocols such as H.265 or WebRTC, reducing the need for specialized back-‐office hardware, networks will need to be robust enough to carry the traffic.

Clearly there is opportunity in the communications space, with each individual solution adopted at 75% of businesses or fewer. This opportunity, though, also introduces a new level of complexity. What is the right mix of tools for business needs? How will the tools work together to achieve the best result? How will the overall solution be managed? These are the questions that must be answered by businesses and the solution providers that deliver IT for their clients.

Putting it In Writing

Building formal policies can help cut through some of the complexity and confusion introduced by the new wave of mobile devices and applications. Companies can explicitly state which tools have been approved for use and will receive the highest level of support, and they can also establish guidelines for using new tools that can potentially offer some benefit.

A second motivation for building a policy is that it will help clarify the business reasons behind decisions. If the IT function is concerned about security and the sales function requires a particular solution to increase growth, the discussion and decision will reveal general priorities that can help guide future outcomes.

The year-‐over-‐year trend on policy creation further confirms that companies are still in a somewhat reactive mode when it comes to mobility. Consistent with other CompTIA data, the 40% of companies who claimed to be building policies in 2013 did not translate to a massive uptick in completed policies in 2014. There is definitely some movement away from not having any policy in place or not knowing the status of a policy, but some of that movement results in more companies that are simply sharing best practices without building formal guidelines.

As with last year, IT staff takes the lead in helping build mobility policy, but there is good representation from all parties. Fifty-‐nine percent of companies report that IT staff are part of policy creation, and IT executives, business executives, and CEOs/owners are part of the exercise at nearly half the sample (45% each). Business staff is less commonly involved (35%), but this group should not be ignored as they can provide some of the best input on day-‐to-‐day usage scenarios.

It is not surprising to find that large companies are the most likely to have built formal policies, but this also means that those companies without BYOD are more likely to have policies than those companies without BYOD (36% vs. 25%). Even a smaller company that is taking a more relaxed approach to device usage by employees may find that building policies helps define interactions in a mobile environment.

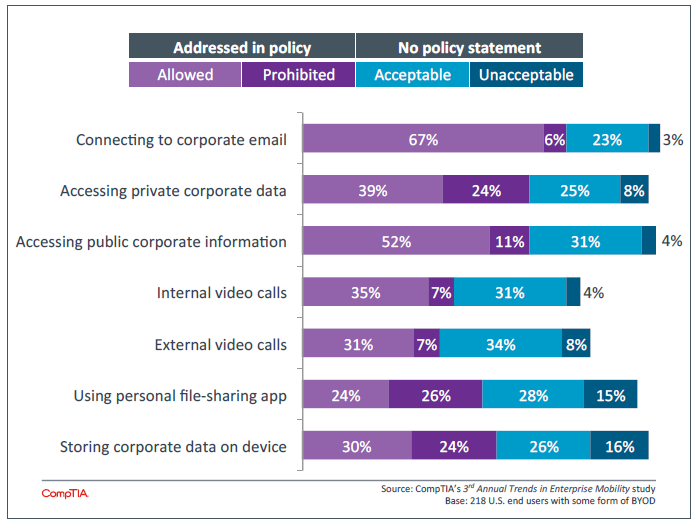

The importance of building policies is evident when examining the approach taken to different activities by companies that allow some form of BYOD. These activities represent the different facets of mobile devices and the broad range of issues that companies should consider in mobility initiatives.

In general, the data shows that companies struggle with addressing usage beyond basic functions. The issue most commonly addressed by policy is email access, and it is allowed in most cases. After that, issues of data are addressed, but these are both less likely to appear in policy and less likely to be allowed if they do appear. Businesses are not yet comfortable with how data is handled on these new endpoint devices.

Data issues also present an argument for the need for policies. Among those companies that do not have a policy, significant numbers feel that use of personal file-‐sharing apps or local storage of corporate data is unacceptable. Without a policy, though, it can be difficult to communicate and enforce this decision.

The approach to video calling provides one last reminder that companies are still working through all the implications and issues of the mobile era. Although it has merited the least amount of consideration, video calling has some unique properties that companies will likely want to review, such as calling etiquette (especially for external calls) or the use of a cellular data plan for video calls (especially if the company pays for the plan).

As businesses continue to explore the ramifications of mobility on their workflow, they will continue to discover best practices. By turning these practices into specific guidelines for their organization, they can be prepared for a future where mobility is a natural part of doing business.

Appendix

Section 4:

Challenges

and

Opportunities

Key Points

- Security is one of the top challenges for companies as they build out mobile solutions. In dealing with new endpoint devices, security professionals have several issues to solve, including the discovery and implementation of new technology, the ability to centrally monitor and control security, and poor security implementation by end users.

- For mobility challenges beyond security, the solution will differ depending on company size. Differences in resource constraints and implementation scope create different needs as companies integrate mobile devices, attempt to build and enforce policy, and efficiently support multiple operating systems.

- Skills gaps are a major issue for companies as they attempt to resolve the many issues related to mobility support. Across several topics related to mobility, fewer than 4 out of 10 companies rate their IT staff as having a high level of skill in any one area. Companies must consider both specific training/certification for their technical staff as well as effective education models for the general population.

Security Leads List of Mobility Challenges

One of the primary themes throughout CompTIA’s research is the growing importance of technology to businesses. Mobility, along with other trends like cloud computing or big data, is creating an environment where technology is so ubiquitous and powerful that it is no longer simply a supporting function as companies pursue their goals; it is the primary method for achieving objectives and creating differentiation.

However, an aggressive pursuit of technology is not a simple undertaking. There are many hurdles to adoption, and security is one of the largest. Businesses consistently rate security as their top IT priority, but this may not always translate into a proactive approach if the company believes that their security is already adequate or if they are more driven to gain the benefits of a new technology.

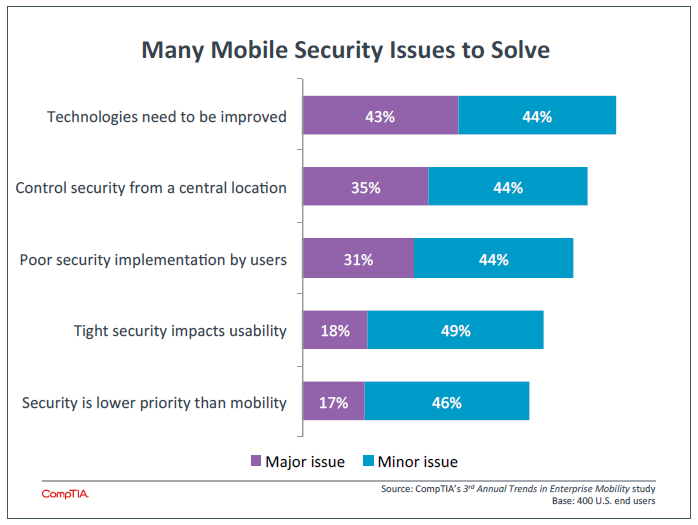

The fact that security is complex compounds the problem, and the host of issues that companies deal with in improving mobile security highlights this complexity. There are three primary issues that make security implementation difficult.

First is the need for new technology. As section 2 described, 52% of companies have made investments in security as part of their mobility strategy, and these investments can range from mobile clients to back-‐office data security improvements. Especially at the device level, existing tools such as mobile device management (MDM) may leave areas of exposure, and attackers will be quick to exploit those areas. Advanced tools that examine the behavior of apps and raise flags for suspicious activity are coming on the market, providing a new layer of defense for security teams to consider.

The second key issue in the area of mobile security is the ability to centrally control and monitor activity. One of the aspects of technology that is changing the most is accessibility—lines of business are procuring their own solutions, sometimes leaving the IT team completely out of the discussion. The problem with this approach is that those lines of business do not have visibility to their company’s overall IT architecture. Without necessarily becoming a controlling bottleneck, IT can still act as a central management function, and they require tools that will enable this.

Finally, security teams are struggling with end users who do not properly implement the necessary security measures. Improved technology and central control will help with this issue, but end user education and policy enforcement are also critical components. As an IT team or solution provider defines their role in mobile security, they should ensure that they are accounting for proper training in their plans and obtaining the ability to take action if users deviate from policy.

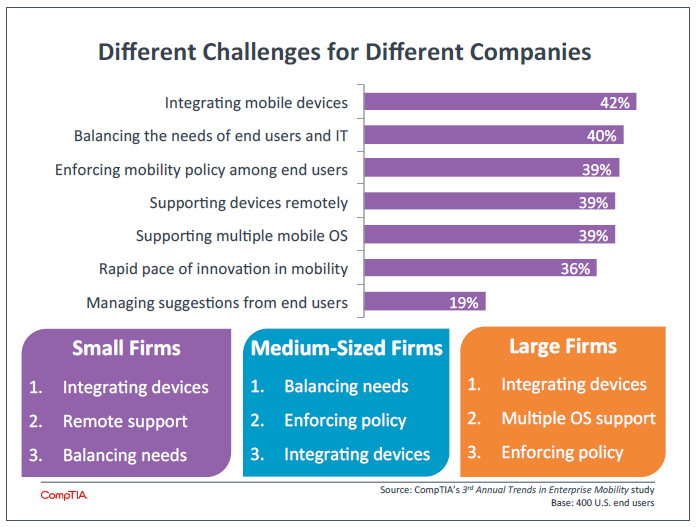

Beyond security, there are a number of other challenges that companies face as they try to build and support mobile solutions that will help them advance their business. In the aggregate, these problems are tightly clustered and appear to be similar in importance. Breaking things down by company size reveals opportunities to tailor the approach based on the situation.

For small companies, the lack of resources is a major factor in addressing mobility. Device integration requires specialized skill that the company may not have in-‐house, and remote support requires a combination of skill, infrastructure, and bandwidth. As mobility is used to give employees flexibility, a small business will move away from a model of the entire team being co-‐located, creating a need for more robust workflow capabilities and support options.

For medium-‐sized firms, the fact that there are more resources to deal with creates a different set of problems. Balancing needs between end users and the IT function is a new problem because a smaller company likely did not have a discrete IT function with specific concerns. Likewise, enforcing policy is a larger issue simply because a policy exists—medium-‐sized firms are 47% more likely to have a policy in place than small businesses as they require a greater degree of control and clarity.

Integrating devices is also the top issue for the largest firms, but here the issue is one of complexity rather than resource constraint. With many more moving parts, integration for a large firm is a much greater undertaking. The same is true for support—while there is sufficient infrastructure for remote support, scaling that infrastructure to handle multiple operating systems is a difficult task.

Becoming a mobile-‐savvy organization is a multifaceted initiative. Those solution providers assisting SMB clients with mobility may find that they themselves do not have the resources to fully address each aspect of mobility, driving a need for partnering. Either by specializing in a given area or by building the ability to coordinate efforts, solution providers can find ways to add value in the mobile space.

Closing the Skills Gap

With so many pieces in the mobility puzzle and so many companies just beginning to explore all the implications of mobility, it is not surprising to see that few companies feel that they have strong mobility skills. Across several topics related to mobility, fewer than 4 out of 10 companies rate their IT staff as having a high level of skill in any one area. The skill level is highest in Wi-‐Fi networks, which have implementation history pre-‐dating smartphones and tablets. Even there, companies may need to closely examine policies around public Wi-‐Fi, as laptops outside an office environment were more likely to use a VPN connection than smartphones and tablets.

Room to Grow

Areas where staff are rated as having "high level of skill"

| 38% | Wi-Fi networks |

| 31% | Cellular networks |

| 26% | Mobile device management |

| 23% | Mobile policy/best practices |

| 22% | Mobile security |

| 20% | Mobile application development |

Beyond networking knowledge, mobile-‐specific skills are growing in maturity at most organizations. Mobile device management most closely ties to both current company direction and previous device management experience, but there are still many complications depending on exactly which flavor of BYOD or COPE a company chooses to embrace. Given the complexity in that decision as well as the different types of functions that are making their way into MDM, it may make sense for companies to isolate some aspects of device management and build competency around those as a first step towards full mobility expertise.

Mobile security and mobile application development are tightly tied together, and the two areas combined represent the most challenging aspect of mobile implementation and integration. Just as mobile devices signal a massive shift in device behavior, mobile apps drastically change the approach to software. Procurement methods, cost structures, and usage styles are all examples of areas where mobile apps differ from traditional software, and with so much disruption the opportunities for security breaches skyrocket. A 2013 report from HP found that 97% of mobile apps contain some sort of privacy issue and 86% of apps lack basic security defenses, thanks to a combination of problems with permissions, OS integration, and cross-‐app interactions.

The tie between app knowledge and security is another reason to separate device management and handle hardware-‐based security issues (such as lost devices) separately. Even if a company does not plan on building custom mobile apps in the near future, they will likely need knowledge of app operations and APIs in order to make the best decisions on security.

Along with deep technical skills needed by the IT team, a business must also consider the appropriate level of skill needed by the general population. As section 1 described, this is the largest hurdle to productive adoption of mobility. Similar to other topics that CompTIA has explored, education formats are critical in raising mobile literacy among general staff.

One-‐time training sessions—delivered during onboarding or when there is a major change in policy—are less effective in building awareness and skills. Many companies are shifting to ongoing sessions, with larger companies taking the lead here and also being the most proactive in providing online modules. Making education relevant to job roles and measuring results can help ensure that employees are getting the information they need to be productive in a mobile environment.

Section 5:

Qualitative

Interviews

Summary of Key Findings

- Key Finding #1: Mobility is seen as a critical force in the IT landscape. Participants revealed that mobility initiatives are both an expected part of IT and an opportunity to deliver high-‐visibility value.

- Key Finding #2: Mobility initiatives tend to begin with one core business need. Interviewees generally identified a single, specific business need as the original central driver of their mobility initiatives.

- Key Finding #3: Mobility produces new variations on familiar challenges. Interviews described business changes that seem revolutionary, but corresponding IT challenges that are more evolutionary.

- Key Finding #4: Unmet demand exists for IT providers to address mobility challenges. Respondents reported an important role in mobility initiatives for third-‐party providers of IT products and services.

- Key Finding #5: Interoperability and standardization are key mobilization goals. Interviewees valued cross-‐platform interoperability among devices and standardization within the mobile environment.

Moving from Management to Maturity with Mobility

As a complement to the data collected by the CompTIA study, the research firm Cascade Insights performed end-‐user interviews to understand how mobility initiatives are playing out in the field. The qualitative results confirm that companies are pursuing aptitude around device policies as the devices provide clear benefits, and they are also discovering new uses for mobility that produce new results but also require new approaches.

Note: What this study refers to collectively as “mobility initiatives” may take a variety of forms, typically including one or more of the following elements:

- Structured deployment of mobile devices such as phones or tablets (or a combination of different types of devices)

- Development or selection of mobile business applications to address high-‐value usage models

- Deployment of mobile device management (MDM) or similar software to govern security, access to resources, deploy and manage applications, etc.

Key Finding #1: Mobility Is Seen as a Critical Force in the IT Landscape

The participants in this study posited that a mobility initiative is an expected part of mainstream IT strategy. Supporting mobile devices and helping to ensure that those devices can participate in the company’s broader information infrastructure was identified as fundamental to IT’s role.

Interviewees reported that users assume they will be able to use their phones and other devices on the network, while also indicating that mobility provides the opportunity for IT to deliver high-‐visibility value to the larger organization.

Finding 1a: Embracing Mobility is Considered a Requirement for IT Organizations

Respondents interviewed for this study indicated that mobility initiatives are assumed to be part of any up-‐to-date IT operation. While the interviewees were explicitly chosen for their involvement with mobility initiatives (which carries some selection bias toward valuing mobile technology), all participants shared this view. At the same time, however, mobile devices were regarded by the respondents in general as an adjunct to other client-‐computing platforms.

“Everything is going mobile. I think the importance of mobile and the extent of its relevance to enterprises was dramatically underestimated by most enterprises, and simply by most analysts also for many years, and maybe even towards today to some extent. It shows no signs of slowing down and everything is getting more and more mobile.” – Head of Sales (Americas), Mobile Software Provider

“There's a lot of people in the field who are using air cards and various connectivity applications for always-‐on VPNs to come back in. All they’re using is one application. They're using a Toughbook, which is a ridiculous amount of money. All of a sudden it's like, ‘oh well, we can get you an iPad, [and] there's an app for exactly what you're doing...’ To a certain extent, yeah, we’re doing that ... but there’s still other applications that the reality of the laptop is still your best, your only option.” – Sr Systems Administrator, Local Government

“We've tried all sorts of things to limit the desktop, but the reality is that the desktop is... not going away.” – Sr Systems Administrator, Local Government

Finding 1b: Resistance to Mobility Initiatives Tends to Fade Quickly

Some skepticism and even resistance to changing the status quo was often reported among management, IT, and end users. Still, mobility initiatives appear to have enough momentum in their own right to overcome those challenges, due to parties recognizing the efficiencies and other value enabled by the use of mobile devices.

“There were people that may have been with the company for 30 years, and maybe they don't have a smartphone themselves but once they saw the capabilities, even the most jaded ones quickly got on board and see what they can do.” – Business Systems Operations and Security Manager, Steel Company

“In the beginning, it's completely overwhelming. It's so brand new to some of the people we bring on board who were used to using pencil and paper and filing away in filing cabinets. Now there's none of that. Zero. It freaked them out in the beginning. They keep trying to go back to their old ways because that's what they're used to, but after a few months and they get used to our system, it's like a breath of fresh air for them. Then they can't even go back to their old system.” – Owner, Restaurant Company

“We have a couple of doctors that are actually starting to come around to the electronic because they’re starting to see the benefits of it and what kind of time savings are there and how much easier it is to go back and check on records that kind of thing. The ones that are coming out of medical school and residency now grew up with the computers, so they understand.” – Director of IT, Hospital & Health Care Provider

Finding 1c: Mobile Technology is Seen as an Easy Fit with Both IT and End Users

Interviewees reported that end users, were, in general, enthusiastic about (or at least receptive to) the use of mobile technology in the context of their work. Respondents indicated that, because most users were already accustomed to the use of mobile technology in their personal lives, the crossover between work and non-‐work environments was intuitive and natural. Study participants also indicated that internal IT resources were ready for mobile initiatives, in terms of attitude and skill sets.

“You can be at home and as long as you have an Internet connection, you can get the files. It's good for work sharing and for flexible work schedules. It's just fantastic and it should take great dividend as we move forward because of the additional access to information.” – Consultant, Management Consulting Firm

“Whenever I want to get something new, I get it and just plug in and I'm good to go. Particularly with the iPad and the iPhone, because everything's in the cloud, there's not a whole lot to move over and sync.” – Attorney, Law Firm

“We have mobile developers on staff that are also web developers. It was a pretty easy transition to take normal website functions and make them mobile.” – Business Systems Operations and Security Manager, Steel Company

Finding 1d: The Need to Manage Devices is Valued, but Not Universally Agreed Upon

While many of the participants in this study indicated that bringing mobile devices under a central device-‐management environment was vital, others insisted that an unmanaged population of devices is the better approach. In some cases, robust MDM software is seen as key to security and regulatory compliance. In other cases—even within some regulated environments—MDM may even be seen as a negative influence, in terms of mission scope as well as end-‐user perceptions. Where MDM is seen as valuable, training in various MDM platforms could provide a competitive advantage among IT service providers.

“I came in two years ago and realized that it was like the Wild Wild West ... I began looking around at some MDMs and settled on AirWatch... Now I can set up iPads in a room for a grade level at one time, so now I don't have to physically plug each iPad into a computer to install profiles.” – Director of Technology, Educational Institution

“One of the things I was looking into was a way to use certificates to authenticate the users against Exchange... I read an article about a couple of the first MDM solutions that were out there. Basically at this point I presented to the executive group that this is happening and these devices are only going to become more popular. We need to get in front of it if we can, so we started the evaluation process of the MDM platforms.” – Sr Systems Administrator, Local Government

“We definitely don’t want to get in the business of managing physicians’ phones, especially if they’re their own phones.” – Director of IT, Hospital & Health Care Provider

“Even though I was very clear in the policy ... we had one guy with the Big Brother freak out, right? He decided to opt out at that point. He doesn't sync his phone, and he just has to remote in through the SSL VPN on the weekend... In honesty, the AirWatch clients and the integration with an iPhone, there are a ton of security settings that, A, we don't touch, but they can very much look like Big Brother, especially if you have GPS tracking turned on.” – CIO, Law Firm

Key Finding #2: Mobility Initiatives Tend to Begin with One Core Business Need

Interviewees generally identified a single, specific business need as the original central driver of their mobility initiatives. While most participants also reported that opportunities to enable additional use cases revealed themselves after the initial implementation, our findings do not suggest that companies initially follow broad sets of goals such as a generalized wish to modernize business practices.

Finding 2a: The Impetus for Mobility Initiatives Travels Top-Down

Full-throated mobility initiatives within the study sample tended to originate from senior management or others in positions of authority. Their motivations took one of the following forms:

- An official strategy to better meet business needs

- The desire for access by influencers to email or other resources from their phones

- The need for order and security to an unofficial population of personal mobile devices being brought into the network

“Part of the success of our program is because it came from an academic authority. Our head of upper school is the one who, basically, pushed this. It can't be successfully pushed from IT, in my opinion.” – Educational Technology Coordinator, Educational Institution

“Basically it started with the CEO... He charged operations with how can we improve our consistency between stores. An obvious way to do that is to do checklists ... so then he charged IT with, ‘Okay, how to we get this to where they can do them electronically?’ ... You needed something you could walk around the restaurant with. It always helps when a project is started by the CEO because it's amazing how you could find funding for it when it's his idea.” – Sr Director of IT, Restaurant Company

Finding 2b: Location-‐Independent Access to Corporate Data Drives Many Mobility Initiatives

Many study respondents reported that supporting sales or other field operations with access to back-end systems was the key driver for the mobility initiatives in their organizations.

“A lot of the engineers are in the field or on the road several days a week and their clients have an issue that comes up or even their coworkers and they need immediate help... If they are in a meeting, they can't answer the call [or] check voicemail, but they can get a text or an e-‐mail.” – Consultant, Management Consulting Firm

“With my tablet I can close the deal quickly and more easily than I can without it... I can generate quotes right there and then email them to the customer... I can communicate back to whoever I need to talk to, maybe my boss, to get authorization for the quote, or maybe the shipping guys to see if they can actually ship the stuff today. But I'm fully plugged into the company, and I can bring all the company’s resources to bear to close my deal, as needed.” – Head of Sales (Americas), Mobile Software Provider

“We had a few of the area directors that have stores that are kind of outliers. They're not in the main metropolitan areas, so we put Skype on their iPads for that so that they can hold manager meetings and not actually have to have everybody in the same location.” – Sr Director of IT, Restaurant Company

Finding 2d: Digitizing Paper-‐Based Processes Can Be a Powerful Motivation for Mobility

Replacing paper-‐based business practices with digital alternatives was often the key motivator for mobility initiatives among this study’s participants. Among these interviewees, most cited the wish to increase efficiency, reduce errors, and enhance effectiveness.

“The business problem we were trying to solve ... was that we had the stores doing basically paper checklists... If someone got sick in one of our restaurants, in order for us to tell if the store had done their job and temped all the food like they're supposed to three times day, it required somebody going to the store and pulling up the paper and looking at that.” – Sr Director of IT, Restaurant Company

“The game changer for us in this case was not just the ease of use and mobility but textbooks. That was the thing that really pushed it over the edge for us... I mean, for fifteen dollars you get ... the exact same textbook that you would pay over a hundred dollars for, and it is a fifth dimension product because it's not just the text on the page and it's not just the graphics. It's interactivity.” – Educational Technology Coordinator, Educational Institution

Finding 2e: Mobile Use Cases Expand Rapidly After Initial Implementation

Many interviewees reported that—once a mobility initiative was underway—additional, unforeseen use cases emerged, sometimes quite rapidly. This dynamic often created significant momentum within their organizations’ mobility strategies.

“We're installing a new POS this week at one of our restaurants... We're going to be able to rip out all these terminals and machines and antiquated POS system from 1980, '70s, whenever they developed these things. I can hang iPads in our walls and that's it... They take advantage of the front camera on the iPad to clock people in through a QR code. One of the things that'll be iPads on the walls and that's all they use is mobile devices and pay at the table on an iPad mini.” – Owner, Restaurant Company

“They're starting to seep in to our everyday life. We have a fish tank that has an iPad that tells you what fish are in the tank, it gives you information.” – Business Systems Operations and Security Manager, Steel Company

Key Finding #3: Mobility Produces New Variations on Familiar Challenges

A recurring theme in the interviews for this research was that, while mobility may create business changes that seem revolutionary, the corresponding IT challenges are more evolutionary.

Participants indicated that concerns over loss protection for physical devices, client management and security, and interoperability were extended by their mobility initiatives, rather than being introduced for the first time. Nevertheless, new variations and considerations are creating the need (and opportunity) to reassess, refine, and strengthen existing approaches to many challenges within participants’ environments.

Finding 3a: Companies Use Network Policy and Employee Rules to Control Portable Devices

The consumer-‐based ancestry of mobile devices equates to end-‐users having more control over how those devices are used than many interviewees reported being comfortable with. In addition, IT organizations within study participants’ companies must address concerns about the potential for loss of highly portable devices (and the corporate data on them). Network policy and corporate procedures may be used to address these concerns.

“We limit what they can do on the iPad, we limit App Store access. We push down base applications that we want installed which includes things that we've built, along with certain items from the App Store... We push down mail configuration, we push down the Wi-‐Fi information. We force passcode lock, those types of things. We make sure that in the event that a device is lost that we can find where it is as well as lock it if we need to.” – Business Systems Operations and Security Manager, Steel Company

“One of the things we did when we first rolled these out, we were kind of hyper vigilant so we had every employee sign something basically stating ... we have video surveillance in all of our restaurants and basically if one of these turns up missing, we'll check the surveillance and if you're the last one that had it, you'll be responsible for paying for it and we'll take it out of your paycheck...” – Sr Director of IT, Restaurant Company

Finding 3b: Fragmentation and Interoperability Are Concerns

Participants in the study indicated that ensuring a coherent environment that spans both the desktop and mobile environments was high on their list of priorities. Many of the interviewees identified solutions based on virtualization and cloud computing as effective approaches to addressing these challenges.

“The PCs won’t go away but they need to work hand-‐in-‐hand with phones and the tablets that we’re going to implement.” – Director of IT, Hospital & Health Care Provider

“We're using Parallels Access to allow users to get back either their desktops or virtual desktop to ... use full Office products and any other Windows that are currently available on an iPad... You're working with the same environment, you're not having to open a totally different desktop to get the work done.” – Business Systems Operations and Security Manager, Steel Company

“All of our client files are stored in Dropbox, and so we've got access to them when we're out of the office as well. Our case management program is ... web-‐based, so we can access it from out of the office and, of course, and email and everything, too. We use them a lot when we're in court, trying to do calendaring and check status of things, pull up documents for viewing in court and that type of thing as well.” – Attorney, Law Firm

Finding 3c: Network Policy and Desktop Management Address Many Mobility Challenges

Participants in the study reported that, in many cases, they have been able to extend their existing tools and techniques from the desktop environment to address challenges for mobile devices in areas such as management and security. Interviewees identified devices and platforms that facilitate such usages as being highly desirable.

“I think that corporate IT departments are guiding their companies towards using Windows tablets if they can because it simplifies life for the IT guys very definitely... Yeah, they have the security, and they have the compatible software, and all that kind of stuff.” – Head of Sales (Americas), Mobile Software Provider

“Basically, the Wi-‐Fi, the network is just connected to [Active Directory], so as long as ... they log in with their user credentials and their certificate, they just get in the Wi-‐Fi. When it asks them for their user name, they put in their Active Directory user name and their Active Directory password and then the wireless authenticates them against their Active Directory credentials, and offers them a certificate to keep on their iPad... From then on, they just open up and they're in.” – Educational Technology Coordinator, Educational Institution

“As far as secure texting and MDM, it’s not going to be a whole lot of heavy lifting... The reason we went with Sophos is because we already had it for anti-‐virus and web filtering... So once the application is on the backend for the IT; it’s just a matter of putting the application on each phone and it syncs up and says okay now I can see the mail server. Then you can ‘control’ the phone. You can’t control what it does, what kind of apps you put on it, but we’re able to wipe our data off the phone, or able to lock it if they lose or they get stolen. That keeps it out of the hands of HIPAA police.” – Director of IT, Hospital & Health Care Provider

Finding 3d: Supporting Mobility Helps Address Issues Elsewhere in the Environment

A number of interviewees indicated that putting solutions in place as part of mobility initiatives gave them the opportunity to implement security-‐related solutions for their environments more generally. Those participants reported that their mobility initiatives highlighted the value of IT solutions for business needs that would have existed with or without the mobility initiatives.

“Everything we do is certificate-‐based so we [have] certificate-‐based authentication for email. We do certificate-‐based authentication for our Wi-‐Fi. Basically we use this mobility, this new mobile platform as a catalyst to readdress a bunch of our access concerns.” – Sr Systems Administrator, Local Government

“I think everybody’s pretty much agreed now that passwords are becoming obsolete. They’re not working very well as a security mechanism, and therefore, you’re going to see tablets, some of them are already moving in this direction, but I think very quickly you’re going to have other forms of security on tablets, biometrics being a very common way to do it, probably.” – Head of Sales (Americas), Mobile Software Provider

Key Finding #4: Demand Exists for IT Providers to Address Mobility Challenges

Respondents in this study reported that assistance from third-‐party providers of IT products and services can play an important part in mobility initiatives. The value of that role was described primarily as an adjunct to internal expertise, acting in concert with the efforts of IT organizations, rather than as a business model of “outsourcing mobility.”

Finding 4a: IT Wants Service Providers to Help Lighten the Load

Many interviewees indicated that IT service providers were (or would be) valuable to them as on-‐demand resources within mobility initiatives, during either rollout or day-‐to-‐day operations. In many cases, the assistance these respondents described was not particularly specialized, but rather support to provide resource scale for company-‐led initiatives.

“What we’re shooting for and there are a lot of applications that basically 100% with the IT overhead where the IT activates the phone, rolls out the phones, controls them, tells you what to do with them. If you install something you have to have a password that kind of thing. The bigger hospitals tend to do that. But [we can’t,] with us only having five or six people in our IT department and not having time to do it, nor the money for the resources.” – Director of IT, Hospital & Health Care Provider

“We are using a combination of tablets as well as ... Chromebooks ... through these value added retailers. They are blessed by Google and we have access to the Google control management console whereas if I go to Fry’s, I don’t... They are doing a couple of things. One they are tagging in with our inventory tags. The second thing they are placing them on our, within our domain which enables us to just literally take them out of the box or out of a cart and turn them on... We don’t have the manpower to provision all these devices.” – Director of Technology, Educational Institution

Finding 4b: Mobility Solution Providers Must Speak Their Customers’ Languages

Interviewees often indicated that, for mobile-‐solution providers to be a good fit within mobility initiatives, those providers had to do more than show expertise with mobility per se. Study participants also alluded to the need for providers of IT services and other solutions to understand key business needs and regulatory issues, have experience with the software environment in use by the customer, and be able to provide solid, independent recommendations. Training of IT service-‐provider personnel could have significant value in this area, particularly with regard to specific regulatory frameworks.

“I think some of [the mobile software providers] I’ve talked to, I probably know more about the HIPAA compliance than they do. Then you talk to some of the other vendors and they have entire departments dedicated to making sure health-‐care facilities are compliant with HIPAA.” – Director of IT, Hospital & Health Care Provider

“Windows Surface Pros have full Office Professional Suite and it just integrates better with how the company functions. I guess they made a commitment a long time ago to stick with Microsoft. I think also because the majority of our clients are in those environments and it just helps to use stuff that they are using.” – Consultant, Management Consulting Firm

“No, they’re absolutely on my radar, I think that’s definitely a feature for the health care. You have to be careful which cloud you choose, but there is a lot of work and push right now going to HIPAA-‐compliant secure cloud, personal cloud, whatever you want to call them. I think a small hospital would benefit from not having to do the backups, not having that overhead in IT to utilize the cloud.” – Director of IT, Hospital & Health Care Provider

“I really want to push it back into the hands of the providers and then the onus is to say, ‘you pick the applications; as long as its HIPAA-‐compliant, we’ll go with it.” – Director of IT, Hospital & Health Care Provider

Finding 4c: Some Customers Are Skeptical of the Value of Generalized External Mobility Support

Many respondents gave negative feedback to the prospect of paying an external organization to provide overall support of the mobile fleet. That support was regarded by many interviewees as unneeded, expensive, and potentially inefficient.

Q: “Do you have any sort of professional support, like a service provider that can help people?” A: “We don't do anything formal like that. On one hand, it would be nice; on the other hand, it seems like kind of a lot of money for a lot of what gets offered.” – Educational Technology Coordinator, Educational Institution

Q: “Do you have a service provider that you pay to support all the iPhones and iPads, or do you do it internally?” A: “I do it all myself ... Which is obviously a huge benefit. We don't have to call somebody every time we need something updated or changed or fixed, just do it right in house.” – Owner, Restaurant Company

“We've got a [support] subscription here if anybody does have any questions about how to do anything, but it's rare that ... I'd probably be scared to look and see the last time anybody got on it, just because everything is so intuitive. ” – Attorney, Law Firm

Finding 4d: Organizations Recognize the Value of External Point Solutions for Mobility

For specific, discrete software and service aspects of their mobility initiatives, participants in this study reported having the opinion that external providers offered significant value. Interviewees also identified open issues that suggest opportunities ripe for IT provider solutions, particularly in the areas of regulatory compliance and optimizing the value of the mobility solution as a whole.

“We are updating our wireless network this summer and we're going to be going with the company called Aerohive. Aerohive is a partner of AirWatch and a partner of Apple or at least endorsed by them and that is going to really help us with our AirWatch implementation.” – Director of Technology, Educational Institution

“We are still working with the company that built our app and adding different things to it. We're adding a communication module to it to where we can push out ... applications to the iPad.” – Sr Director of IT, Restaurant Company

“Right now what we’re trying to do is since we don’t have a full penetration of mobile devices we’re trying to get our hands around how to ... make sure that the phones are doing what we need them to do... It’s a HIPAA violation if they were to text out any kind of patient-‐level data, so we have to make sure we have that secured.” – Director of IT, Hospital & Health Care Provider

Key Finding #5: Interoperability and Standardization Are Key Mobilization Goals